September 19th, 2023 | 08:05 CEST

Hydrogen on sale! Here is the alternative: BYD, Altech Advanced Materials, BASF, Volkswagen

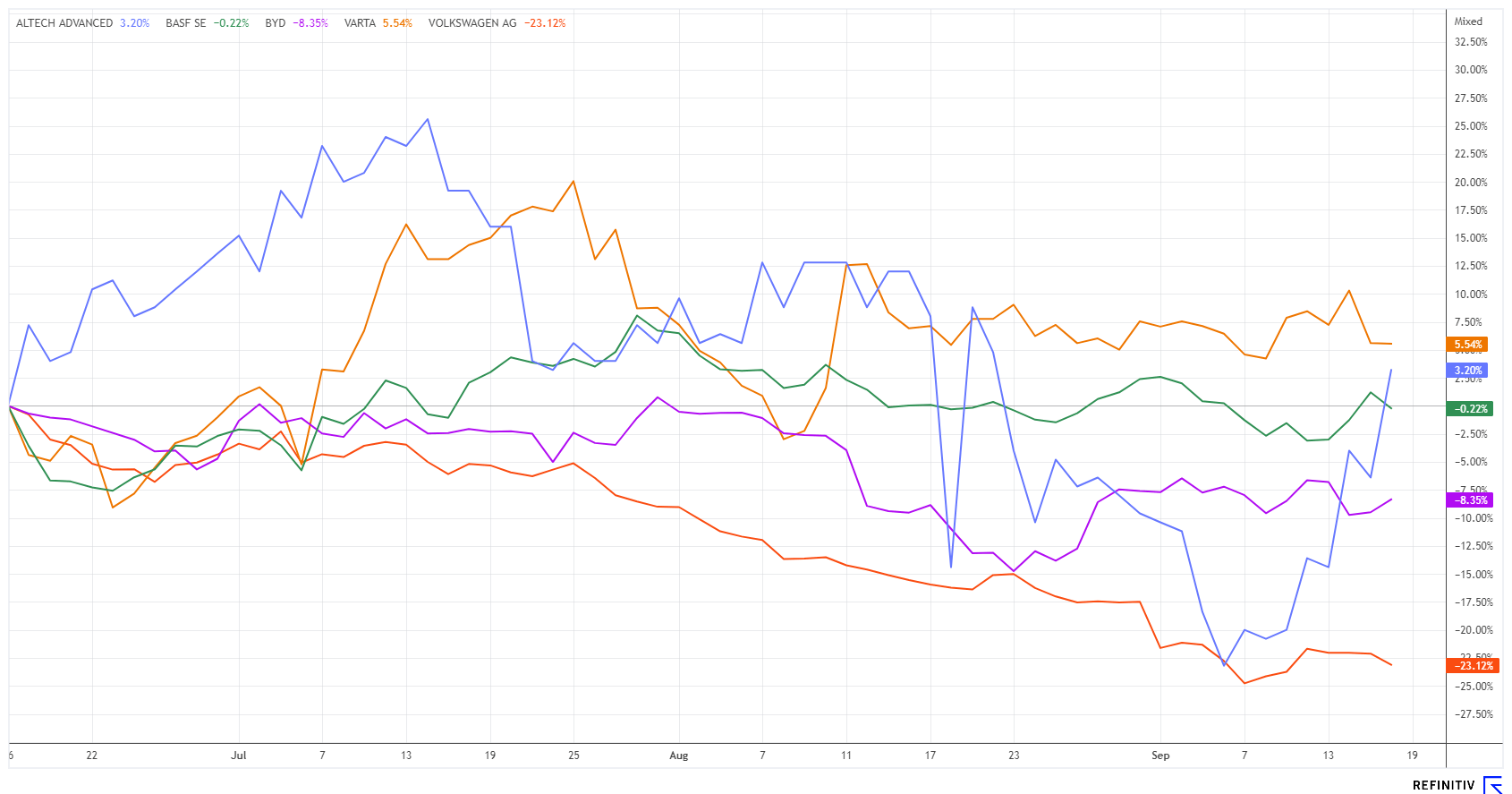

While the IAA Mobility ended with satisfied faces, it did not bring good vibes to local automotive stocks. More than 500,000 visitors attended to be convinced of innovations for a climate-friendly future. Half of the 750 exhibitors came from abroad, and 109 nations were represented. However, those who went with the expectation of finding major breakthroughs were disappointed. The familiar lithium-ion battery still dominates with over 95% usage. Industrially viable alternatives, however, are already in the development stage. Those who think ahead are opting for modern battery concepts.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , ALTECH ADV.MAT. NA O.N. | DE000A31C3Y4 , BASF SE NA O.N. | DE000BASF111 , VOLKSWAGEN AG VZO O.N. | DE0007664039

Table of contents:

"[...] Boron is one of the most versatile elements in the whole world! Everyone reading this text regularly uses hundreds of products that depend on boron. [...]" Tim Daniels, CEO, Erin Ventures

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD - How to steal the show from VW

The fact that German automakers are losing ground internationally has become a constant topic in the media. The local industry was too late to focus on e-mobility, and now the lost time is almost impossible to make up. In fact, the consequences for the sector, with its approximately 1.5 million employees, could be disastrous.

High raw material and energy prices and a relatively strong dependence on suppliers from abroad were also recently evident in the floods in Slovenia. Important transmission components could not be delivered because the plant there sank in the floods of the century. The assembly lines of some VW models were at a standstill for several days. Meanwhile, Chinese manufacturers presented themselves at the IAA as innovative and inexpensive. With price discounts of up to 25% compared to similar European models, it has also raised alarm bells at the EU Competition Commission. They are investigating the subsidy policies of Chinese competitors and threatening punitive tariffs. BYD showcased 7 new models at the IAA Mobility and is actively working on establishing new dealership networks in Europe. For independent sales professionals, it doesn't matter which car they sell; the main thing is to make a profit.

BYD's figures for the first half of the year were convincing. Net income was the equivalent of around EUR 1.46 billion, representing a jump of around 200% compared to last year. That sounds like growth because sales are growing steadily at about 20% p.a., and profits are rising even faster. A 2024 P/E of 19 is thus not too expensive and sends the stock up 6.8% in a 12-month comparison. Its German counterpart, Volkswagen, is now already 27.5% underwater.

Altech Advanced Materials - Leading the way with the latest ideas

The Heidelberg-based holding company Altech Advanced Materials AG (AAM) may already have the game changers for the mobility revolution in its pocket. Although it still needs growth capital and some time for further research, it is already on the trail of future solutions in some aspects. Last year, the investment company was already able to position itself as a specialist in innovative battery technologies. Now, together with its Australian parent company, it is moving into project implementation in the eastern German state of Brandenburg.

In addition to a cooperation with the Fraunhofer Institute, AAM has produced two interesting investments on a joint venture basis, namely the project companies Silumina Anodes™ and CERENERGY®, both of which are pursuing interesting battery concepts. They are targeting the growth markets for stationary energy storage and, in a broader view, e-mobility. They want to develop coated anodes for the battery market, making the important lithium ions more durable. The latter is a capital-intensive area that can only be mastered with strong partners. However, series production of a completely new solid-state battery for grid storage is on the agenda for the next few years. In the current year, building permission has already been granted for the Schwarze Pumpe site in Lusatia. CEO Uwe Ahrens is betting on the southeast of Brandenburg, where he believes a new "hotspot" for the development of state-of-the-art batteries is emerging.

The Heidelberg-based company has been in demand among investors for months as a possible solution for the climate and mobility revolution. Since its initial listing, the share price has risen by over 600% and is currently consolidating at a high level. In addition to two capital increases, the Company recently placed convertible bonds that can now be exchanged for shares. As a result, the liquidity of the booming stock is rising rapidly, and there are no longer any recent erratic price adjustments. The investment projects are currently valued at around EUR 35 million. If research continues to provide good news, the journey north should be able to continue quickly.

CEO Uwe Ahrens will present "LIVE" at the upcoming International Investment Forum on October 10, 2023, at 5:30 pm CEST. Click here to register.

BASF SE - Where is the trigger?

BASF also continues to expand its battery interests. In Michigan, it plans to produce cathode materials from recycled metals that will be used in lithium-ion battery cells made by its collaborative partner Nanotech Energy, the two companies announced last week. Nanotech Energy is a California-based supplier of graphene-based energy storage products. BASF is the global market leader for cathode material and has recently been looking very closely at recycling concepts. Because in just a few years, the first units will have reached the end of their useful life. This is a major problem for the automotive industry because, according to European legislation, so-called "electronic waste" must be taken back by the dealer. However, most manufacturers currently have no idea how the recycling of millions of units can be managed logistically.

With the recent drop in the share price, BASF shares, as a highly cyclical stock, reflect the German industrial cycle quite well. Local location factors are not very attractive for energy-intensive industries, which is why the Company is setting its course for new production sites abroad. Analyst houses such as Bernstein and JPMorgan have reacted to the low prices and raised their price targets to EUR 57 and EUR 58, respectively. On the other hand, UBS reiterated its "Sell" recommendation yesterday with a target price of EUR 40. The Ludwigshafen-based company is currently trading at EUR 45.30. With a 2024 P/E ratio of 9.8 and a payout of over 7%, the share does not seem overvalued.

The stock market has recently been prone to some price corrections. This mainly affects industrial stocks, which reflect the current weak economic trend. In contrast to hydrogen, however, the battery sector is attracting investor interest. BASF, BYD and Altech Advanced Materials are good candidates for a long-term innovation-focused portfolio.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.