July 18th, 2023 | 07:55 CEST

Hydrogen makes headlines: Plug Power, ThyssenKrupp Nucera, Desert Gold, Nikola - Huge price swings!

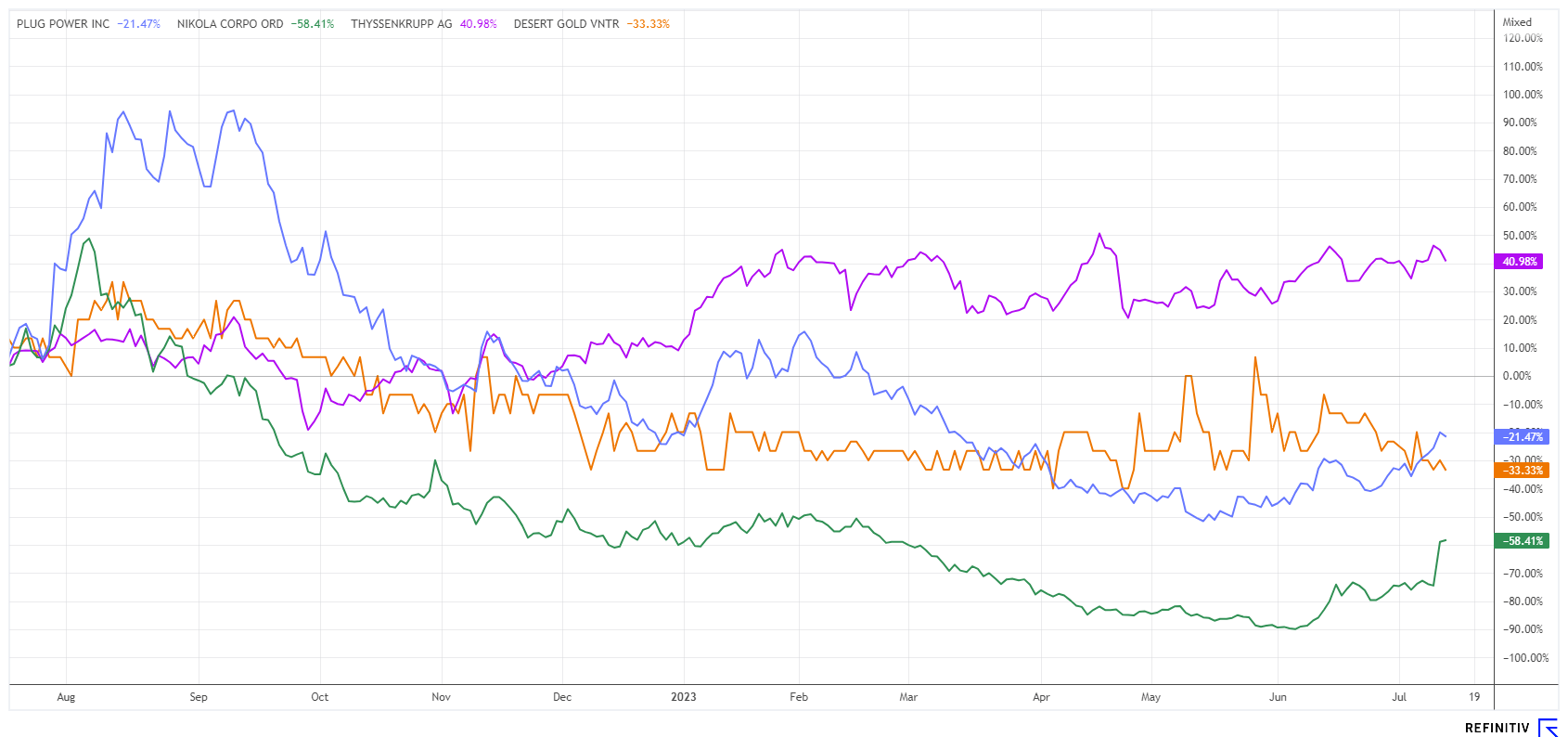

Gains of over 100% in a single day, such occurrences are rare on the NASDAQ. The stock in question is no stranger: Nikola Motors. Currently, it is mainly the investment commitments for hydrogen projects that are causing investor excitement. In the case of Nikola, it was certainly also a short squeeze, as over 100 million shares had been sold short in recent months. Last Friday, the stock initially surged another 50% on historical volume, but this gain dropped to just 0.3% by closing. High risks, but where are the opportunities?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , THYSSENKRUPP NUCERA AG & CO KGAA | DE000NCA0001 , DESERT GOLD VENTURES | CA25039N4084 , NIKOLA CORP. | US6541101050

Table of contents:

"[...] We quickly learned that the tailings are high-grade, often as high as 20 grams of gold per tonne; because they are produced by artisanal miners, local miners who use outdated technology for gold production. [...]" Ryan Jackson, CEO, Newlox Gold Ventures Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

ThyssenKrupp Nucera - The EU orders are coming in

Now it is back, the great hope for higher prices. Since the hydrogen mega-bust in 2021, it has become quiet around the entire sector, with the protagonists discounted by up to 85%. But now the reports about large orders are piling up, which are mainly awarded by public institutions. In Europe, the EU ETS Innovation Fund has been launched. It is one of the world's largest financing programs for the introduction of innovative tech technologies, especially promising climate projects.

Funded by revenues from the auctioning of CO2 allowances from the EU Emissions Trading Scheme, two large-scale award campaigns have already been launched from Brussels in 2023. They are aimed at the submission of proposals from private industry. Grants of EUR 1.1 to 1.8 billion are enticing, which will be awarded in the short term for up to 16 projects. With estimated revenues of around EUR 40 billion by 2030, the innovation fund aims to launch solutions to decarbonize European industry.

Following a successful stock market launch of hydrogen specialist ThyssenKrupp Nucera, all eyes are now waiting for the release of the billion-euro subsidies for "green steel", the production of which the German government has been promoting wholeheartedly for months. This major project would require electrolysers in the double-digit GW range. Nucera has prospects for this blockbuster order but, so far, is well in the running with other projects. It already has a 2-GW electrolysis plant for Saudi Arabia in its quiver, and another 200 MW capacity is expected to be called up by the construction of a hydrogen plant for Shell in the port of Rotterdam. The share continues to spark joy after the IPO. After a placement price of EUR 20, over EUR 23 was on the price board at the beginning of the week.

Plug Power and Nikola Motors - Gigantic price swings

According to experts, the movement in the hydrogen sector is only just beginning. According to a current study by the investment bank Goldman Sachs, a market volume of around USD 10 trillion is expected by 2050. Due to the bullish statements by analysts, a great deal of investment capital is now flowing into the up-and-coming sector again. The movements in Plug Power and Nikola Motors have been noticeable recently.

Plug Power, the US market leader, has lost more than 85% since 2021. But now the tide is turning because, in the last 2 weeks alone, the stock has started a 40% recovery rally. The mood is improving because after recent rather restrained analyst comments, there was now a buy recommendation from Northland Securities with a price target of USD 22. But a real turnaround needs time because the 12-month consensus of the 31 experts at Refinitiv Eikon still stands at a low USD 15.60.

The share of Nikola Motors, on the other hand, is a powerful force at work. Like a rocket, the value shot from USD 1.25 to over USD 2.50 in just 4 trading days, a smooth doubling. The reason was good fundamental news from California. At the Company's Coolidge site, the production of electric trucks is being converted to hydrogen power. The US government also provided subsidies of USD 41.9 million for the construction of H2 filling stations. Last but not least, the stock benefited from a very high level of short selling, which put many shorties on the spot after the price explosion.

But beware: 392 million shares were traded on Friday, which is almost as much as the company has in total free float (550 million). An indication of strong trading activity and cover buying. This creates an artificial bull market, which can quickly reverse. By the close of trading, all daily gains in the stock had already been eliminated. It should be noted that Nikola is still a start-up and has yet to deliver a production-ready hydrogen-powered vehicle. At least they are said to have now reached an agreement with BayoTech to promote a reliable hydrogen supply for zero-emission commercial fuel cell electric vehicle fleets. Let's see how viable this story is for further share price gains!

Desert Gold Ventures - Takeover fantasy in Mali

With rising gold and silver prices, the precious metals market reported a positive turnaround in early July. After lows of USD 1,820 and USD 20.20 in March, gold and silver returned to spot prices of USD 1,960 and USD 24.88, respectively. Many chart experts are now predicting rising precious metal prices for the summer and fall. The momentum seems to have returned. Fundamental reasons abound, as inflation remains stubborn, and on the debt side, the US spent a whole USD 8 trillion in one month after suspending the legal debt limit. Here, important expenditures had probably been postponed for months. The US dollar also reached new lows against the euro at 1.1230.

In times of great uncertainties and demonetization, precious metal investments offer themselves as admixtures. Those who want to diversify to Africa will find an interesting opportunity with the Canadian explorer Desert Gold Ventures (DAU). The Company is looking for precious metal deposits in Senegal-Mali-Shear-Zone (SMSZ). The 440 sq km property is close to known mining operations of Barrick, B2 Gold and Allied Gold. They are all looking for mine expansions, as the large-scale area can boast near-ground mineralization of 1 to 3 grams of gold per ton. Allied has already declared 10 million ounces and will soon be relisted as a billion-dollar company. Desert Gold recently hired exploration expert Doug Engdahl as a director, indicating increased drilling activity in the second half of the year.

With a market cap of just shy of CAD 10 million, Desert Gold Ventures is a bargain for the cash-flow-strapped majors in the region. For now, the majors are more likely to watch how exploration work develops. Should a major find be forthcoming, however, they are likely to look quickly for a stake or even a takeover. However, if the gold price continues to rise, speed is of the essence, as junior prices are historically low.

Strong subsidy pushes are driving the hydrogen sector, but short-term volatility remains high. That is because high government debt burdens are pushing up capital market interest rates and alimenting continued high inflation, putting precious metals investments on the map. Investing in junior explorers involves high risks but is done at a multi-year valuation low.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.