September 6th, 2023 | 10:00 CEST

Hydrogen losing, oil stocks gaining: Plug Power, Shell and Cashflow Monster Saturn Oil + Gas

Hydrogen is considered the future, but is it too early for pure-play stocks to enter? Companies like Plug Power and Nel are expected to continue posting substantial losses for the foreseeable future. Both are valued in the billions, and both will likely have to carry out a capital increase before they reach break-even. By contrast, oil companies are earning brilliantly. Shell prioritizes margin over revenue, which is winning over analysts. Similarly, Cashflow Monster Saturn Oil & Gas is receiving praise from analysts. Their performance in the second quarter was slightly above analysts' expectations. Will the Canadians soon pay a monster dividend?

time to read: 4 minutes

|

Author:

Fabian Lorenz

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , Shell PLC | GB00BP6MXD84 , Saturn Oil + Gas Inc. | CA80412L8832

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Saturn Oil & Gas: Monster Cash Flow - Monster Dividend?

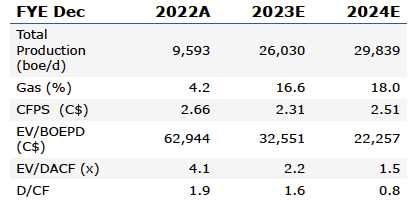

With an operating cash flow per share of CAD 2.31 at a stock price of around CAD 2.70, it becomes evident that Saturn Oil & Gas is one of the most exciting international stocks. Through clever takeovers, the Canadians have become a serious oil producer within a few years. As a result, this year also saw the uplisting from the TSX Venture to the Toronto Stock Exchange ("TSX"), attracting more institutional investors. Most recently, major investor GMT Capital increased its stake in Saturn Oil & Gas to 24.91%. Operationally, shareholders can look forward to a strong performance this year. Saturn Oil & Gas surpassed Canaccord Genuity's estimates in the second quarter, and analysts believe the Company offers tremendous value at the current price level. Therefore, experts believe the stock can more than double.

Production reached a record 25,988 BOE per day (BOE = Barrel of Oil Equivalent, including gas shares) in the second quarter, slightly above Canaccord analysts' estimates of 25,123 BOE/D. It should be noted that due to the forest fires in some regions of Canada, production at oil fields also had to be interrupted in some cases. However, this and the declining oil price could not change the fact that Saturn is earning splendidly. Sales in the second quarter rose to CAD 176.0 million**. That compares to CAD 82.2 million in the year-ago quarter and CAD 131.4 million in the first quarter of 2023. On the earnings side, adjusted EBITDA climbed from CAD 18.0 million to a strong CAD 92.9 million. Operating cash flow reached a solid CAD 67.0 million, or CAD 0.48 per share, which was also slightly above the analysts' estimate of CAD 0.47.

The positive development should continue in the second half of the year. Analysts expect full-year operating cash flow to be CAD 291 million, or CAD 2.31 per share, in 2023, rising to CAD 348 million, or CAD 2.51 per share, in 2024. Saturn is valued at approximately CAD 380 million at a current share price of CAD 2.70. Cash flows are currently being used to reduce debt. But with this momentum, there should also be an attractive dividend soon. Institutional investors will certainly be pushing for that. Incidentally, Canaccord's price target for Saturn Oil & Gas is CAD 6.50. Compared to other mid-sized oil producers such as Crew Energy, InPlay Oil or Pine Cliff Energy, the stock is too cheap.

Shell: Halves profit but raises dividend

Shell is undoubtedly one of the industry giants. Despite a second-quarter profit drop of about 50% compared to the same period last year, the stock remains a favorite among analysts. This may be due in part to the fact that the oil giant is set to launch a new share buyback program worth around USD 2.5 billion. In addition, the quarterly dividend was raised from USD 0.25 to USD 0.331.

Recent analyst comments have all been positive. Deutsche Bank has the highest price target at GBP 32.68. While Shell's net profit missed the consensus estimate, Deutsche Bank analysts had expected even less. Therefore, the stock is a "buy." RBC rates the Shell stock as "Outperform". The analysts like the new management's strategy of putting margin before sales. Their price target is GBP 27. JPMorgan also sees the opportunity for price gains in Shell. The analysts recommend the stock with "Overweight" and a price target of GBP 27.50. Although they reduced their earnings estimates for the full year 2023 and had also expected a more significant share buyback program, Shell is still attractively valued. Shell shares are currently trading at GBP 24.85.

Plug Power and Nel: Valuation in the billions and losses weigh down

There is no question that hydrogen will play an important role in the future energy market. Among the industry's pure-plays are Plug Power and Nel. Both are showing decent growth in the current year, but investors are having little joy with the shares. That is because both companies are facing significant challenges on the path to profitability. At Nel, the net loss in the second quarter was higher than sales. At Plug Power, things do not look much better. Nevertheless, both are valued in the billions. However, both will likely need to conduct a capital increase until they reach break-even. After all, relying solely on borrowed capital until they break even is unlikely to work in the current interest rate environment.

Without oil, it will not work for the foreseeable future. Investors should continue to capitalize on this sector's high cash flows and dividends. Shell is considered a fundamental investment in the sector. Saturn Oil & Gas is arguably one of the most exciting oil stocks. The Company is currently a growth company at value assessment. Even before the announcement of a dividend strategy, the value is expected to rise. Nel and Plug Power are not compelling at the moment.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.