November 3rd, 2023 | 07:30 CET

Hydrogen is back: Nel ASA, Plug Power with 50% potential. What are Shell and Saturn Oil + Gas up to?

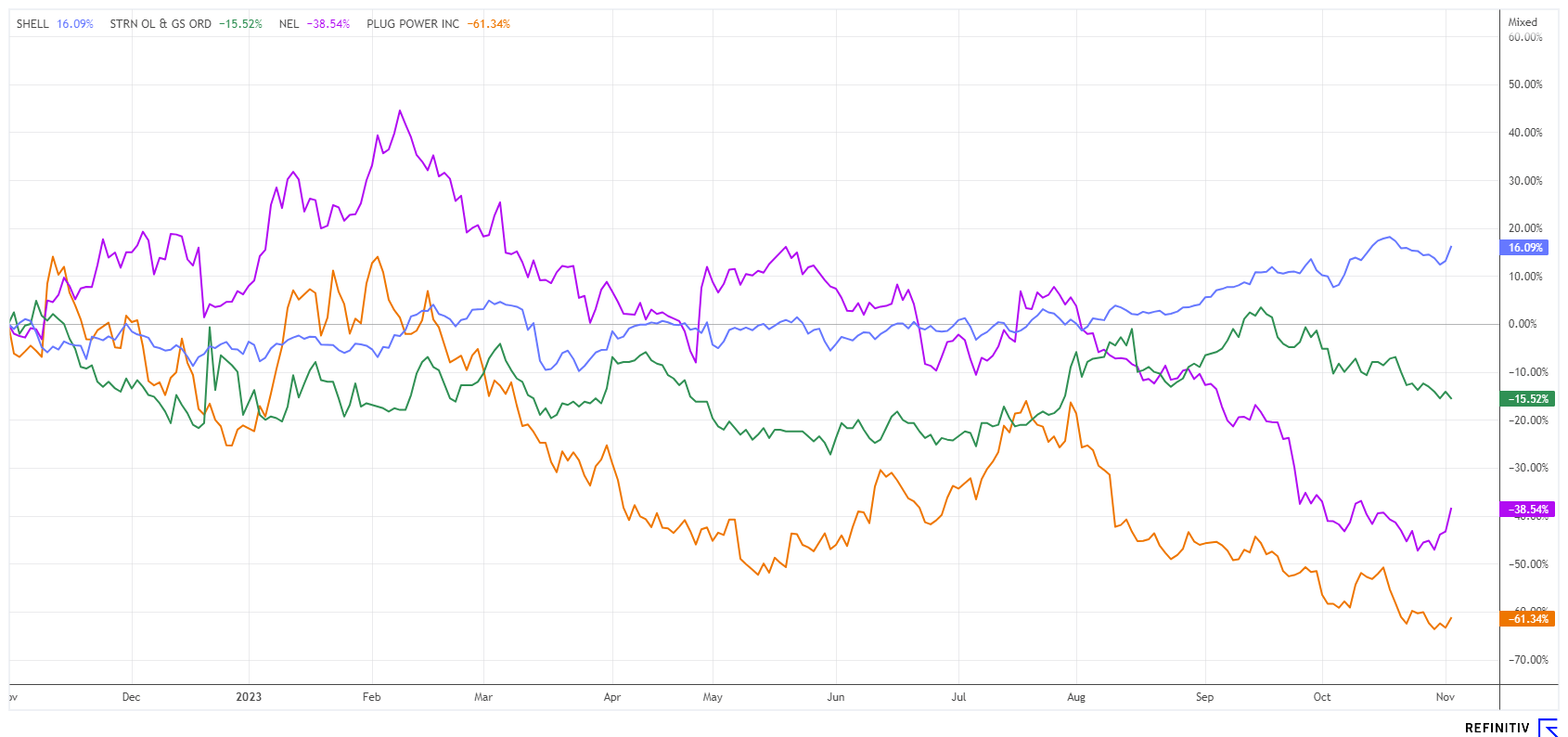

Things have moved quickly. Last week, the DAX 40 index scratched the 14,600-point mark, but yesterday, it was close to the 15,200 hurdle in heavy trading. This is a dream situation from a chart point of view, as the market was able to bid farewell to the short scenario with the central banks taking a breather and presented an ecstatic rebound. Hydrogen stocks Nel ASA and Plug Power, which had been beaten up for a long time, made strong gains yesterday, while oil stocks Shell and Saturn Oil & Gas consolidated at a high level. How long will the hydrogen rebound last, and what is next for the energy sector? We do the math.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020 , Saturn Oil + Gas Inc. | CA80412L8832 , Shell PLC | GB00BP6MXD84

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Shell - Sparkling profits and another share buyback

There were four upgrades for Shell shares yesterday after the Dutch-British oil giant reported a jump in sales and profits. In the third quarter just ended, the oil and gas multinational benefited from higher refinery margins and rising oil prices. Profit adjusted for special effects rose to USD 6.22 billion, slightly below expectations. However, the new share buyback program of USD 3.5 billion, which will be completed in the third quarter, came as a surprise.

With an estimated USD 344 billion in sales, the Company is now expected to generate a profit of USD 28.9 billion for the year, or USD 4.46 per share. As the quarter went well overall, Goldman Sachs, UBS, Jefferies and RBC raised their ratings to "Buy" or "Outperform" with corresponding price targets of 2,800 to 3,100 British pence. According to the experts on the Refinitiv Eikon platform, this translates into a target share price of EUR 36.75 over a 12-month horizon. If oil and gas prices remain at the current high level due to the crisis, we believe this target can be achieved without any problems. In a historical context, the price records from 2001 would then be reached again. It will be exciting to see if this really works out, but analytically, there is nothing to prevent an appreciation with a current P/E ratio of 7.2.

Saturn Oil & Gas - A fabulously low valuation

Saturn Oil & Gas will not be reporting its Q3 figures for a few days still. The spring fires in Alberta have indeed necessitated a few adjustments, but the Canadian oil producer is likely to have made good use of the high spot prices in recent weeks to increase its forward sales somewhat. Due to the integration of the Ridgeback assets, production in 2023 will now reach an astonishing 24,000 BOE (Barrels of Oil Equivalent). The newly developed production areas in the Oxbow region have shown promising initial production figures, once again confirming the good exploration performance of the drilling team. The development program launched in June 2023, which targets light oil from the productive Spearfish Formation, was continued in the third quarter. It will be interesting to see the initial results.

Even if the share price is currently falling somewhat due to the lack of news, investors should be prepared for a full-year operating profit of around CAD 430 million (adjusted EBITDA), with free cash flow estimated at CAD 145 million. Net debt will then reach around CAD 455 million by the end of the year, but perhaps business will improve again in the final spurt, as management's calculation is based on an average WTI price of CAD 80. Since the beginning of the Middle East crisis, however, the price has fluctuated between USD 81 and USD 89, which yields higher net margins in day-to-day business and puts more money in the coffers.

After an interim rally to over CAD 3.00 in September, the share price is currently consolidating at around CAD 2.50. This brings the 138.6 million shares to a market value of CAD 347 million. The analysts at Echelon estimate the adjusted cash flow per share for 2024 to be CAD 2.65. A Saturn share is currently valued with a Price-to-Cashflow (PCF) ratio of 0.9 based on 2024 estimates. In a broader context, the enterprise value corresponds to approximately two times the adjusted operating profit (EBITDA) for 2024. It is a wonder because such a cheap oil stock cannot be found in North America, given the industry's standard multiple is about 4.8 x EBITDA.**Consequently, the share price should at least double next year, according to the experts at Echelon. Take advantage of low quotations to buy in or add to your holdings.

Hydrogen is back - Now Nel ASA and Plug Power for 50%

That was an audible cannon shot. Like a phoenix rising from the ashes, the battered hydrogen stocks Nel ASA and Plug Power surged with almost double-digit gains. They had been sold off for months, and now the buybacks have begun. Although the quarterly figures recently received a mixed reception, the market had already prepared itself for falling profits. Nevertheless, Nel's 121% increase in sales was expected to be somewhat higher, with unexpected production delays being cited as the reason, as some large orders did not arrive on the books in time. Nevertheless, the Company has a convincing cash position of EUR 321 million, which can be used to pre-finance another 8 quarters of operations. A capital increase at this low level would certainly not be well received.

The market will have to be patient with industry competitor Plug Power. Their Q3 figures are expected on November 9. Perhaps the hydrogen experts from New York can even exceed analysts' estimates of minus USD 0.306 per share. In that case, yesterday's initial movement from the annual low of EUR 5.23 to EUR 5.87 would be quite understandable. **Those investors considering buying back shares at this level should be aware that a technical signal will only emerge at prices above EUR 7.80. Until then, however, there is still 50% potential for courageous traders.

After months of sell-offs on the DAX, NASDAQ & Co., the stock market started to rally at the beginning of November. Yesterday's losers are now the winners, driven by speculation and tailwinds from the dovish central banks. None of this can hide the fact that Europe is heading for a recession, but as we all know, the stock market looks nine months ahead. Nel ASA and Plug Power remain speculatively interesting, while Shell and Saturn Oil & Gas are attractive due to their low valuation.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.