October 5th, 2023 | 08:50 CEST

Hydrogen - further caution. Gold - strong buy! Nel, Plug and Nucera in the sell-off, consider increasing Globex Mining!

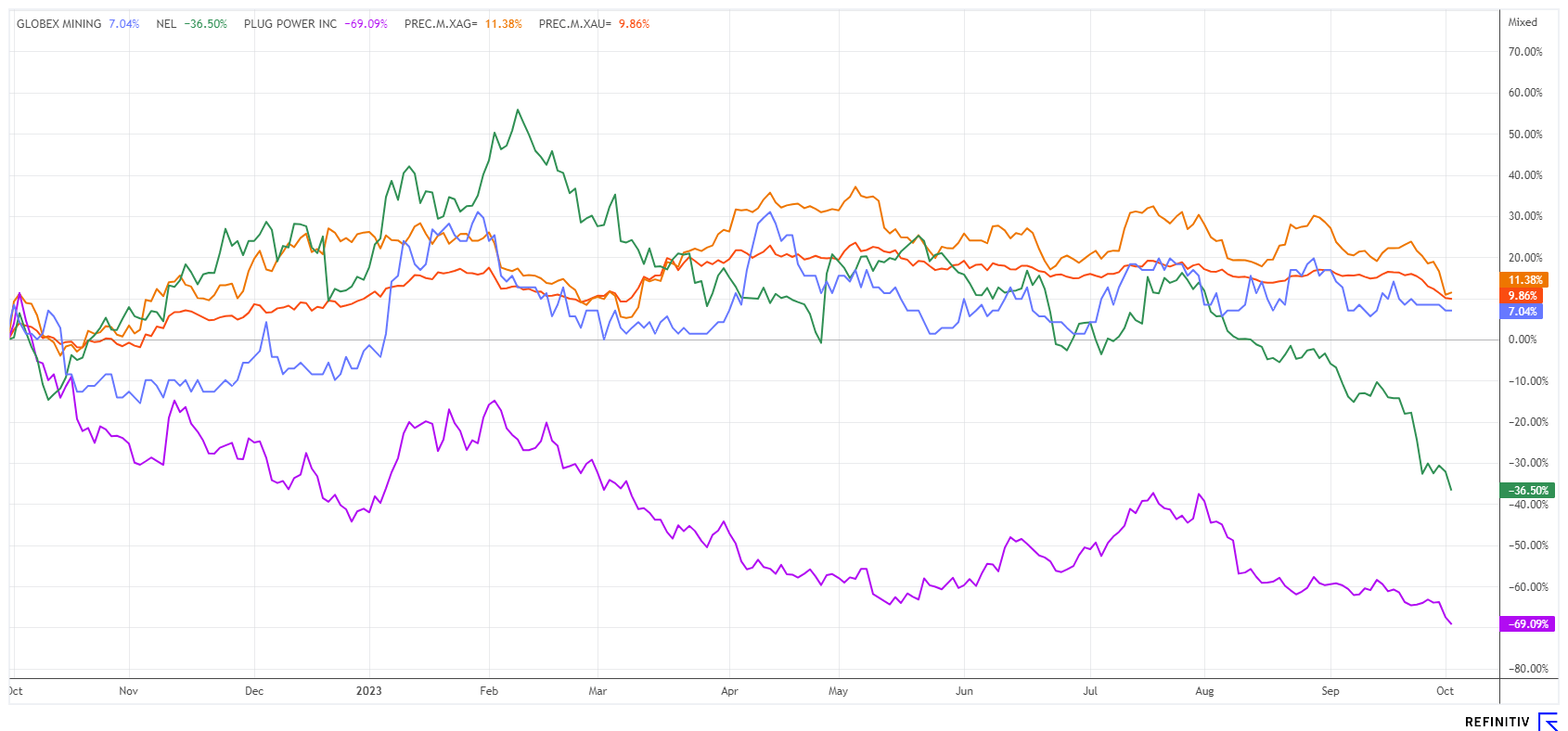

The year 2023 will go down in the history books as the anti-bull market for hydrogen stocks. Because of political declarations of intent, they were the most sought-after stocks on the stock market in 2019 and 2021. However, instead of public and private initiatives, hydrogen is becoming a specialized solution. Electrolysis, which is costly, makes sense where there is enough green energy and surplus available from the grid. In Europe, however, there is more of an energy problem, and expensive hydrogen cannot offer economic solutions. Investors are therefore rethinking and selling the still costly stocks. Mining and mining stocks have also fallen in 2023, but gold and strategic metals have an undeniable demand. Taking a look at Globex Mining could be worthwhile at this point. Here are some ideas for the active investor.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020 , GLOBEX MINING ENTPRS INC. | CA3799005093 , THYSSENKRUPP NUCERA AG & CO KGAA | DE000NCA0001

Table of contents:

"[...] We knew the world was rapidly electrifying and urbanising and needing significant amounts of copper to do so. [...]" Nick Mather, CEO, SolGold PLC

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Globex Mining - Like a rock in the surf

Those who have been watching the precious metals market for a while notice distinctive cycles. The global capital market is now experiencing profit-taking due to ever-rising interest rates, and gold and silver are also trending downward due to liquidity creation. The US M1 money supply has fallen since late 2022, setting the pace globally. It is historically noticeable that precious metals always fall when there is a liquidity withdrawal in the markets. The bond market, which is now correcting daily, is costing capital accumulators around the globe a great deal of money. This is because just 24 months ago, interest rates of 1 to 3% were still considered extremely attractive, but now billions in losses are weighing on the portfolios of banks and insurance companies, which always have to invest a certain percentage of their funds in government bonds. At 4.81%, the 10-year US yield rose to a 16-year high yesterday - the situation is serious!

Those who now think of safety will remember the Canadian stock Globex Mining (GMX). For decades, CEO and founder Jack Stoch has been searching for interesting precious and industrial metal properties, especially in resource-rich Canada. His calculation is rational because with gold and silver spot prices far too low and demand for industrial metals rising, he kills two birds with one stone. If the global economy is running at full speed, he can sell the mining rights for strategic metals; if, on the other hand, there are signs of a recession, as is currently the case, a global correction in the valuation of shares and real estate could attract a larger group of buyers to gold and silver projects.

The investment portfolio now consists of 232 properties, with recent news from Kiboko Gold regarding an upcoming resource estimate and Toma Gold making initial payments for the promising Gwillim Project in Quebec. GMX's interest revolves around precious metals, but important industrial metals are usually a worthwhile addition because of their strategic importance. Global efforts to reduce dependence on commodity countries like China and Russia in the energy transition play into Jack Stoch's hands. Several of his properties are always in the focus of interested parties.

The fully diluted 57.7 million shares add up to a current market value of CAD 44.4 million. CAD 25 million equivalent in cash on hand and realizable shares alone shows how grossly undervalued Globex Mining is. When mines go into production, GMX receives valuable recurring smelting royalties on the metals found. There are also option premiums for drilling licenses issued. A "commodity savings account" does not get any better than Globex Mining. Caution: If precious metals are in demand again, 100% price potential is possible within a few weeks! The last rally of this kind was in April 2022.

Nel ASA and Plug Power - An analytical debacle

Conspicuous sell-offs are evident at Nel ASA and Plug Power. While most analysts have recently rowed back significantly on Nel ASA, the price targets for Plug Power are still, on average, at USD 16.30, i.e. around 150% above the current price. Why the experts do not adjust their expectations downward may remain a mystery because the value is still listed with a lush price-to-sales ratio of 3.5. The Company from Latham (USA) plans to report profits only from 2026 onwards. CEO Andy Marsh should be careful with his forecasts after the sharp accusations from shareholders, as the courts are unlikely to let him get away with it a second time after the recently dismissed class actions. From 2019 to 2021, he fooled the capital markets with sunny outlooks; they were way out of line with operational possibilities and boosted the share price by over 1000% between 2019 and 2020. **Since then, the stock has crashed by over 90%, with Nel experiencing a 78% loss. It has been a debacle for the hydrogen community in the stock market.

However, after an extensive correction, it's now worth taking a closer look at the battered stocks.. Nel ASA will report on its third quarter on October 25, and Plug Power will follow on November 9. Uncertainty is likely to prevail for longer due to the ambitious interest rate environment for highly valued growth stocks. From a chart perspective, Nel first has to climb back up to the EUR 0.85 mark, while there are buy signals again for Plug Power from EUR 8.70 onwards. For those willing to make an initial entry, buying at prices of EUR 0.67 for Nel ASA and EUR 6.15 for Plug Power near the 4-year lows could potentially provide a decent return with a holding period of 2 to 3 years.

ThyssenKrupp Nucera - Celebrated IPO falls through

The widely celebrated German IPO of the year, "ThyssenKrupp Nucera", started out as a beacon of hope for the European hydrogen sector. Unfortunately, the previous shareholder, ThyssenKrupp, exhausted all valuation possibilities and placed it at the upper end of what is acceptable. For those who did not realize their subscription gains quickly, the stock is now trading at EUR 17.70, nearly 12% below its IPO price.

Meanwhile, the parent company ThyssenKrupp is already pursuing new strategic intentions. From October, the hydrogen subsidiary Nucera, the large-diameter bearing manufacturer Rothe Erde, which is important for the wind power sector, and the plant engineering companies Uhde and Polysius are to be combined under the name Decarbon Technologies. The new ThyssenKrupp CEO, Miguel Lopez, wants to make the faltering industrial group more profitable and focus more strongly on green technologies. "With Decarbon Technologies, we are bringing a new quality to our offensive," was the word from Duisburg. Whether this means a rosy future for the stock market newcomer Nucera remains questionable. Analysts on the Refinitiv Eikon platform believe that the share has a medium-term price of EUR 28.50, and most rate it a "buy". After all, the Company has been operating in the profit zone since 2020, a rarity in the industry. Keep watch!

Investing in the supposed growth sector of hydrogen first went wrong in the short term. Global profit-taking and especially rising refinancing costs are causing trouble for the NASDAQ. The latest H2 IPO, Nucera, has now also landed in the red. On the other hand, there are opportunities in the precious metals sector. Here, Globex Mining can celebrate its good positioning and perform in positive territory despite sideways trending commodity markets.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.