October 10th, 2023 | 07:10 CEST

Hydrogen before the rebound! Nel, First Hydrogen and ThyssenKrupp Nucera in focus

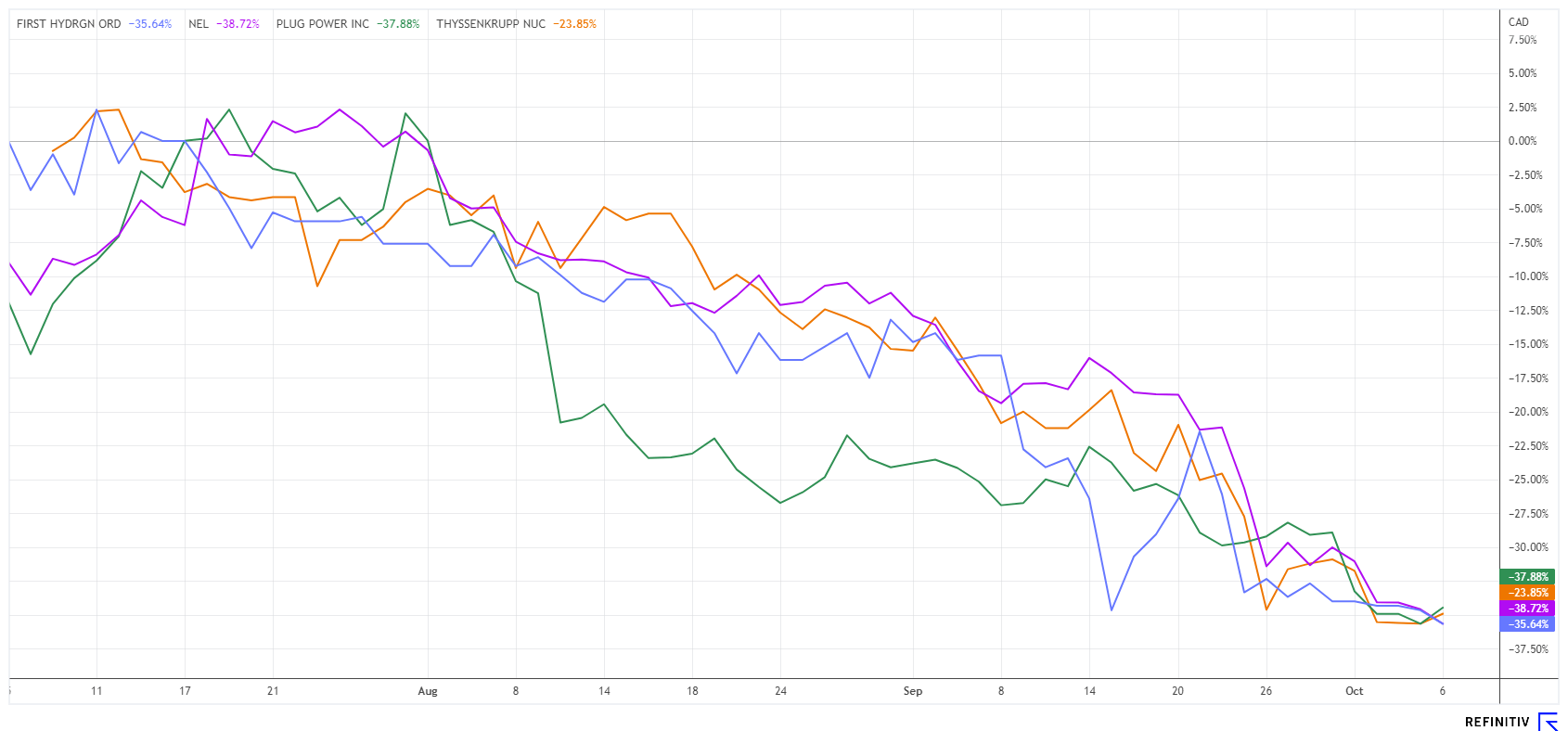

The stock market environment is currently not characterized by a festive mood. Many conflicts and political uncertainties dominate the minds. Even hydrogen stocks have not been spared major price corrections for investors. However, investors with a healthy long-term focus should look a few years ahead. After all, climate change and alternative energies will have difficulty bypassing the hydrogen issue. Public initiatives will increase, if not today, then tomorrow. Even today, however, the entire sector is available for purchase at a high discount. First Hydrogen is very innovative, and there are good rebound opportunities for Nel and ThyssenKrupp. We do the math.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

First Hydrogen Corp. | CA32057N1042 , NEL ASA NK-_20 | NO0010081235 , THYSSENKRUPP AG O.N. | DE0007500001 , THYSSENKRUPP NUCERA AG & CO KGAA | DE000NCA0001

Table of contents:

"[...] We can convert buses and trucks to be completely climate neutral. In doing so, we take a modular and incremental approach. That means we can work with all current vehicle types and respond to new technology and innovation [...]" Dirk Graszt, CEO, Clean Logistics SE

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA - First rebound attempt

Witnessing what is currently happening with the Norwegian hydrogen pioneer Nel ASA is a tragedy. While the Company's half-year figures were in line with expectations, the capital market has revised its outlook for capital-intensive industries sharply downwards. For the past 12 months, the refinancing level has doubled, meaning corporate loans are no longer available at 3%, but rather 6 to 8% has become the norm. In the hydrogen sector, investments will have to be made for years to come in order to create an economical alternative to other forms of energy. Currently, the production of green hydrogen is only plausible with an adequate supply of renewable energy from sources like water, wind, or solar installations. However, the production cost is still far too high compared to gas, oil or coal.

We have been following the Nel share for a long time and had last recommended an exit at EUR 1.25. The then conspicuously high price-to-sales ratio has now been reduced from 12 to a factor of 6 based on 2024, but at the same time, the first earnings expectation has been postponed to 2026. Investors have reacted negatively, sending the share price down by a further 50% to EUR 0.63. The 9-month figures will be released on October 25, and a small hope for a rebound could arise by then. However, volatility in the share is likely to remain very high. Analytically, the title remains expensive. The experts at Credit Suisse rate it "Underperform", with a price target of EUR 0.70. Speculators should keep an eye on the momentum.

First Hydrogen - LIVE today at the International Investment Forum

No longer a stranger to the industry, Canadian company First Hydrogen has been delivering numerous innovations to the H2 mobility market for several years. In addition to building a hydrogen-powered light-duty truck, the Company is also involved in hydrogen production. First Hydrogen has clearly set its sights on establishing green hydrogen as an energy source in transportation. Of course, this requires the appropriate production capacities and the right partners for large-scale industrial implementation of the plans.

**Hydrogen-as-a-Service" is the keyword, referring to closed H2 cycles that include both the development of corresponding vehicles and the complete software and hardware for efficient operation. This summer, the Company has already signed a contract for a feasibility study for the development of a 35 MW plant for the production of green hydrogen and the construction of a vehicle assembly plant in Quebec.

In September, First Hydrogen achieved another milestone. The fleet management company Rivus provided a positive evaluation of the trials with First Hydrogen's hydrogen-powered fuel cell vehicle compared to similar battery-electric and diesel vehicles. All vehicles were used and tested in the same operating cycles. The report provides an independent first impression and tests significant relative advantages in vehicle efficiency at different load factors. With this vote, First Hydrogen is attracting interest from home shopping and parcel delivery companies seeking advanced solutions due to cost pressures and public sustainability requirements. In a recent study, Global Market Insights projects that the parcel delivery vehicle market will reach USD 210 billion by 2032. Here, First Hydrogen is set to claim a share of this market.

First Hydrogen's stock did not fully escape the correction in the H2 sector, but recently, sales have been on the rise again, and the share price climbed 17% within a few days. Today at 4:30 pm, Robert Campbell, CEO of the energy division, steps in front of the camera at the 8th International Investment Forum. Investors are eager to hear the latest developments. Click here to register.

ThyssenKrupp - The new plans for subsidiary Nucera

The rumor mill is bubbling at the Duisburg steel giant. Allegedly, the Czech billionaire Daniel Kretinsky wants to get in. As has become known in media circles, intensive talks have already been held, and half of the steel division is on the agenda. The billionaire is not seeking a controlling interest but would give the cash-strapped MDAX-listed group a helping hand in the area of low-cost energy. Time is pressing because ThyssenKrupp must finalize its long-standing restructuring as quickly as possible under pressure from rising refinancing costs.

What the longtime CEO Martina Merz could not finalize seems to be on the priority list of the new Thyssenkrupp CEO, Miguel Lopez. The Group must be reorganized to secure the future of its 96,000 employees. The Company recently received a billion-dollar grant from the EU to convert steel production to hydrogen. The task now is to find a solution for the other divisions. Marine Systems is also reportedly on the sales list. At the hydrogen subsidiary Nucera, there are also strategic considerations. Nucera, the large-diameter bearing manufacturer Rothe Erde and the plant engineering company Uhde & Polysius are to be combined under the name "Decarbon Technologies". This will create maximum efficiencies in the area of future technologies and put the Group in a robust position, explained the current CEO at the last company presentation.

Analysts on the Refinitiv Eikon platform believe ThyssenKrupp's stock has a medium-term price target of EUR 9.60, but their recommendations are still predominantly "neutral". For the subsidiary Nucera, which is freshly listed at EUR 20, the medium price target is still EUR 28.50, but the current price has slid to EUR 17.50. Analytically, it appears that the parent company offers more price potential, as experts, on average, see a 2025 P/E ratio of only 5.9 for ThyssenKrupp.

The hydrogen sector has seen ups and downs in the stock market. Dynamic stocks such as First Hydrogen, Nel ASA and ThyssenKrupp Nucera remain in focus. As always, timing accounts for much of the expected performance. Good diversification also creates greater portfolio security.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.