July 11th, 2023 | 06:55 CEST

Hydrogen ahead of e-mobility! Nucera rises, Tesla falls - What are First Hydrogen, Nel and Plug Power doing?

The complete renewal of the energy landscape is gobbling up trillions. While the EU wants to spend at least EUR 300 billion over the next 10 years on e-mobility, wind and solar power, there are now already many private investors jumping on the bandwagon. Joe Biden's Inflation Act includes, in addition to some social issues, the energetic renewal of the superpower USA, which has been purely fossil-fuel driven for decades. In the hydrogen sector, the profitable H2 subsidiary ThyssenKrupp Nucera has ventured into the market. With a capitalization of EUR 2.7 billion, a clean start has been made. It will be interesting to see how strongly the parent company ThyssenKrupp can profit from the revaluation of its subsidiary. We analyze the opportunities in the volatile hydrogen sector.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

THYSSENKRUPP NUCERA AG & CO KGAA | DE000NCA0001 , TESLA INC. DL -_001 | US88160R1014 , First Hydrogen Corp. | CA32057N1042 , NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] We are committed to stay as the number one Canadian and global leader in the Hydrogen-On-Demand diesel technology [...]" Jim Payne, CEO, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nucera IPO successful - But where do we go from here?

The latest IPO on the German stock market must be described as extremely successful because, despite a cautious placement at EUR 20 per share, the share price rose to EUR 25.90 yesterday morning. Only then did profit-taking set in, causing the share price to fall back to EUR 23.60. The 30.3 million shares, including the over-allotment option, were placed with investors. Existing shareholders include ThyssenKrupp, with a former 66% stake and the Italian partner De Nora with 24%. According to earlier statements, the proceeds will be used to expand the alkaline water electrolysis business for the climate-neutral production of hydrogen. This is fully in line with the "REPowerEU plan" from Brussels**.

Since the generally positive mood is promising, the over-allotment option will likely be exercised in full. This means that around 24% of the capital stock will end up in free float. The Essen-based industrial group intends to retain a majority stake in its subsidiary long-term, while the Italian minority shareholder De Nora wants to continue its long-standing technology partnership with the Company. The analysts at Baader believe that the TK Nucera share can rise by up to 50%. In the meantime, other major shareholders, such as the Saudi Arabian sovereign wealth fund PIM and BNP's Greentech fund, have also stepped in. Acting CEO Werner Ponikwar stands out with a symbolic subscription order worth around EUR 29,000, and parent company ThyssenKrupp announced that it now holds 50.2% of the shares following the capital increase. For all parties involved, the successful IPO feels like a balmy summer breeze, and perhaps the heavily sold-off H2 sector will now receive a corresponding tailwind again.

First Hydrogen - The production of green hydrogen is on the agenda

The EU wants to invest about EUR 25 billion in hydrogen in the next 10 years. To this end, the Commission has drafted the concept of a "Hydrogen Accelerator" to promote the use of renewable hydrogen. With the so-called "REPowerEU Plan", the EU hopes to deliver an important building block for saving the climate. At the same time, Joe Biden is launching his Inflation Act, a signal to the private sector to finally step on the gas when it comes to renewable energies and hydrogen in particular.

The Canadian company First Hydrogen is fully on the gas pedal because, in addition to building a hydrogen-powered light truck, it is now also taking care of fuel production. First Hydrogen has set itself the goal of establishing hydrogen as an energy source in the transportation sector. The Company has already clearly positioned itself in the market with its "Hydrogen-as-a-Service" model during the COVID pandemic. In the future, it intends to cover the entire value chain, from the development of zero-emission vehicles to the distribution of green hydrogen.

An agreement has been signed with Sacré-Davey Engineering to conduct a feasibility study for the development of a 35 MW green hydrogen production plant and vehicle assembly plant in Shawinigan, Quebec. Sacré-Davey has experience in producing and storing hydrogen gas through various means. The objective of the feasibility study is to provide a market analysis, a technical review (proof of concept), and an analysis of grid and water constraints and necessary environmental permits. The overarching theme of the study is the common goal of creating a zero-emission hydrogen ecosystem, which may be considered unique in Canada to date. The production facility will use advanced electrolysis to power the Company's hydrogen fuel cell electric vehicles (FCEVs) and support other hydrogen-powered vehicles and applications in the Montreal-Quebec City region. The Company's planned FCEV assembly plant will be designed to produce 25,000 vehicles annually at full capacity and will be a major contributor to green technology job creation in the region.

According to recent studies, the market for green hydrogen is expected to soar from USD 676 million in 2022 to approximately USD 7.3 billion in 2030. First Hydrogen (FHYD) shares have gained a good 30% since the end of April. The extremely successful debut of Germany's ThyssenKrupp Nucera last week should provide renewed momentum for the entire sector. First Hydrogen has first-mover status in Canada and is highly dynamic in implementing new projects.

Nel and Plug Power - Overpriced compared to Nucera

Sufficient numerical material for an analytical opinion is provided by the initial listing of ThyssenKrupp Nucera. For within the sector, there are large valuation differences. While the German protagonist is listed after the IPO with a 2023 price/sales ratio of only 3, Plug Power and Nel ASA have values of 5 and 10, respectively. TK Nucera is expected to generate revenues of around EUR 600 to 700 million in 2023/24 and would be number 2 worldwide in the industrial hydrogen business behind Plug Power. Nel ASA has been the talk of the town as a European first mover but is now visually moving down to 3rd place.

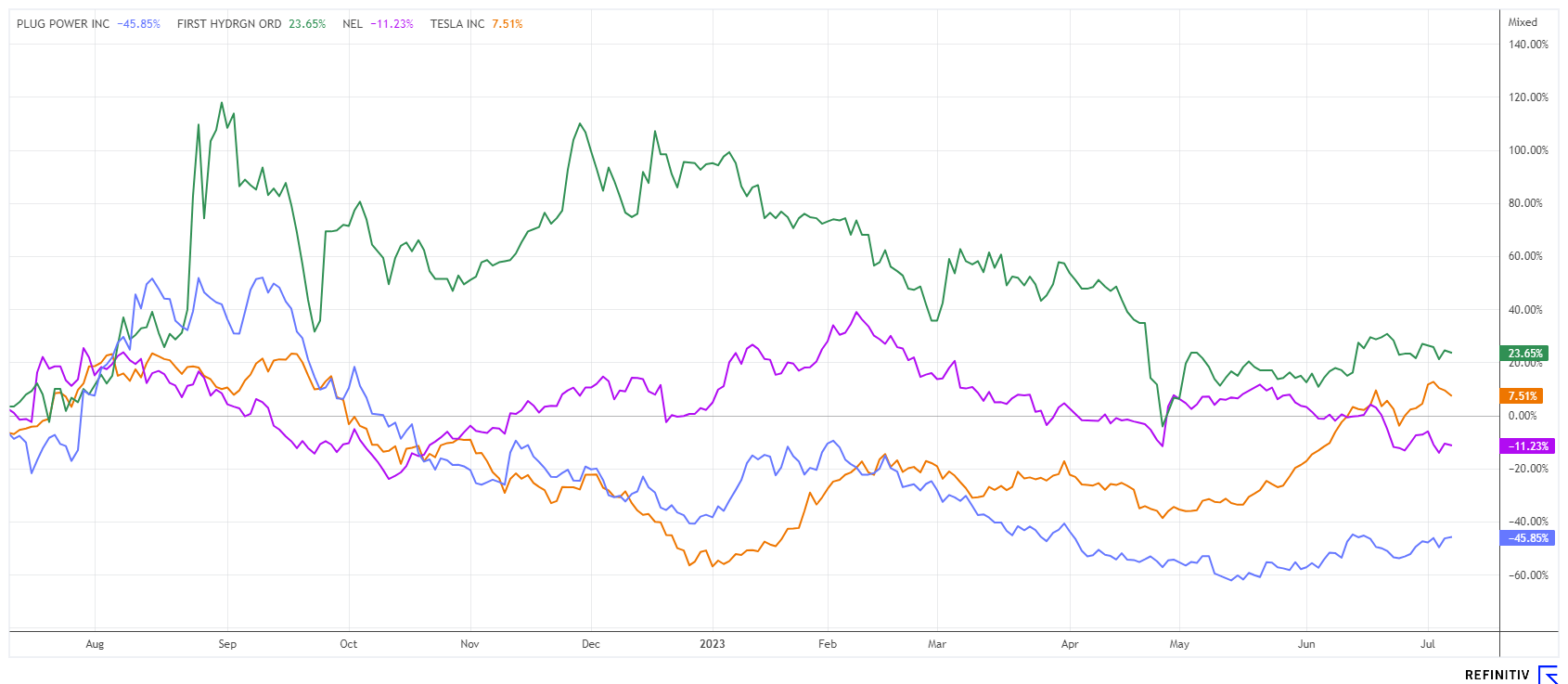

Purely technically, it would be important for Nel ASA to maintain the EUR 1.00 mark. The value is currently at a 3-year low. With a sales increase of approx. 70% per year, the Norwegians would like to become profitable from 2026. ThyssenKrupp Nucera is already profitable. At Plug Power, lawsuits by independent shareholders are underway due to management's misleading outlook, which put the former stock market star under heavy pressure. Here, too, the chart is only 20% above the 3-year low. The share's high in 2020 was over EUR 60, a bitter loss of 83%. Despite its high valuation, ThyssenKrupp Nucera could breathe new life into the stumbling sector.

The hydrogen sector has a new stock market member: ThyssenKrupp Nucera. The extent to which the newcomer can help the sold-off sector get back on its feet remains to be seen. All in all, H2 investments are anything but cheap. Only First Hydrogen offers a lot of fantasy for a fairly low valuation of EUR 145 million and is taking on one project after another.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.