June 1st, 2023 | 09:00 CEST

Heating chaos in Berlin! Palantir, Defense Metals, Borussia Dortmund - Do governments use artificial intelligence like ChatGPT?

Artificial intelligence (AI) is a key driver for the digital transformation of our society. Some technologies have been around for over 50 years but advances in computing power and the availability of big data and new algorithms have led to breakthroughs in AI in recent years. Even if AI is only slowly becoming present in our everyday lives, new applications are likely to bring enormous changes in the future. Decision-making processes, for example, can be strongly supported digitally since today's computers can sift through hundreds of years of knowledge within a few seconds. But does this necessarily mean that the quality of results will also increase?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

PALANTIR TECHNOLOGIES INC | US69608A1088 , DEFENSE METALS CORP. | CA2446331035 , BORUSSIA DORTMUND | DE0005493092

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Palantir Technologies - Sensitive data for governments

Palantir Technologies Inc. is a US provider of software and services specializing in the analysis of big data. In addition to Big Data, the investment community has recently become interested in the secret algorithms the Company uses to sift through large amounts of data and interpret analogies in such a way that strategic planning processes are subsequently supported. Governments commission scientific analyses of observable behaviour patterns in the population, trends in society or geopolitical developments in order to be able to use them strategically in decision-making processes.

Palantir Technologies and the Ministry of Digital Transformation of Ukraine have now announced a partnership that will enable the Company's technologies to support the defence and reconstruction of the country following the invasion by Russia. A recent memorandum of understanding clears the way for collaboration in critical areas such as cataloguing and assessing damage to buildings and infrastructure and using software to optimize reconstruction efforts.

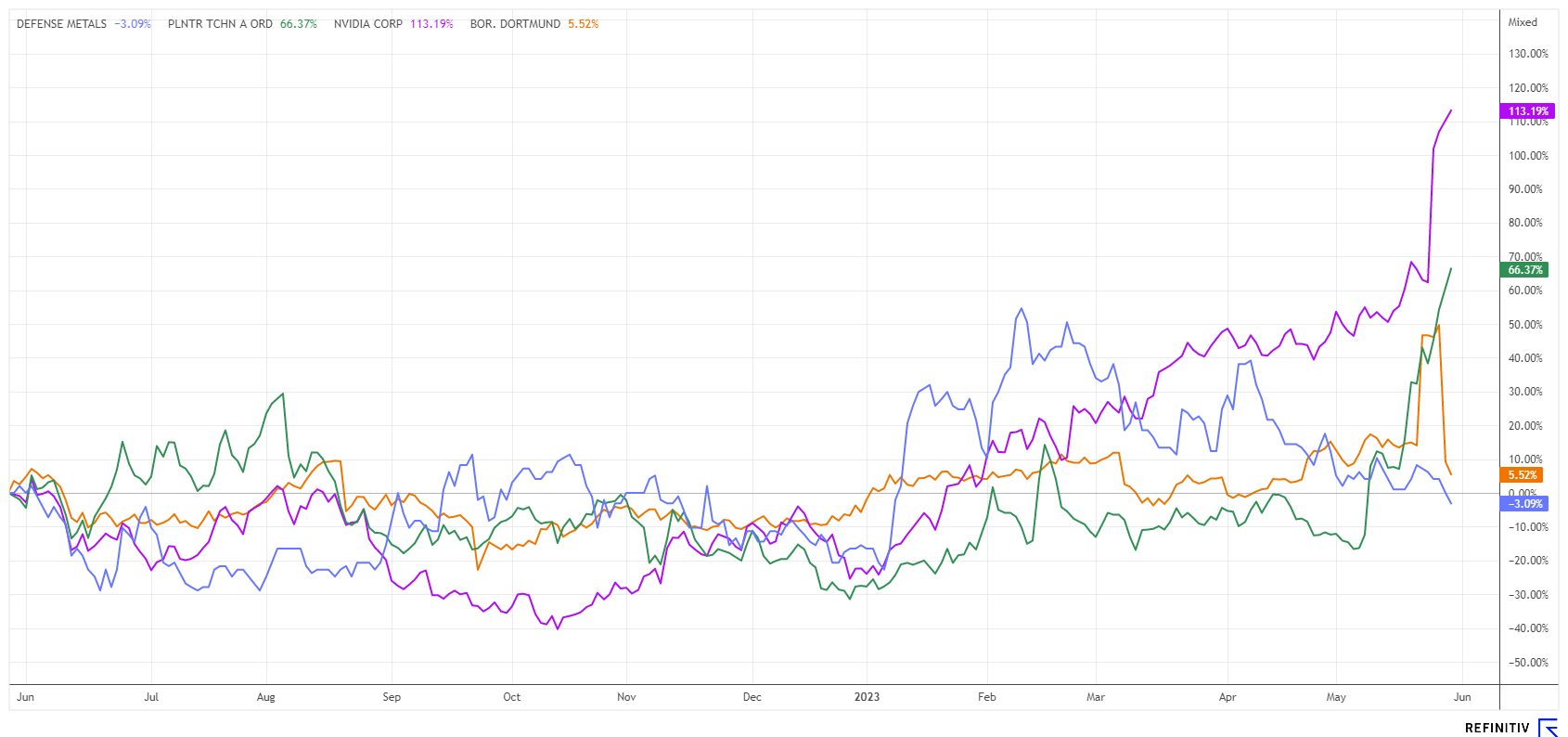

The focus is on improving digital capabilities for government services serving Ukraine's defence and reconstruction, promoting digital innovation and Ukraine's future reintegration into international markets. It will support the country in its goal to become a digital leader in Europe. In cooperation with the Ukrainian Armed Forces, Palantir will contribute to the exchange of data and experiences that support the implementation of world-leading technologies. Alex Karp, CEO at Palantir, was the first Western CEO to visit President Zelenskyy in Ukraine after the outbreak of war. Founded in 2004, the Company's first customers included federal agencies such as the United States Intelligence Community (USIC). PLTR shares are one of the most-watched stocks in the AI megatrend, up 65% over 12 months. With a market cap of USD 28.8 billion, expected revenues in 2024 of about USD 2.6 billion are valued at a factor of 11. The stock is in demand, but anything but cheap.

Defense Metals - Big investors invest in strategic metals

Those who do not want to make access to strategic metals entirely dependent on their relationship with China must go in search of new properties in the Western Hemisphere, as the Middle Kingdom is currently the majority owner of these elements. With the simmering conflicts in Russia and Western interference in Taiwan, there could be an abrupt halt to exports of critical rare earths. They are essential for producing energy equipment and other high-tech products for the modernization of our society.

North America and Europe have recognized the current challenge and have added important metals to the list of critical materials. Thus, the political pressure is there to develop new properties. The British Columbia-based exploration company Defense Metals (DEFN) owns the Wicheeda Rare Earth project and is traded as one of the future producers. Institutional investor RCF Opportunities Fund II contributed CAD 6.6 million in the latest placement, receiving 25,552,380 common shares, representing approximately 9.9% of the outstanding shares. A total of CAD 12.5 million was raised, and Discovery Group expert John Robins, who acts as a strategic advisor to the Company, also participated significantly in the capital increase. Craig Taylor, CEO of Defense Metals, commented, "We are very pleased to welcome RCF Opportunities Fund II as a major shareholder. We believe the Wicheeda Light Rare Earth Elements Project is the best rare earth project in Canada and one of the best developing REE projects in the world."

Good news for Defense Metals because the next operational steps up to 2024 are well financed. DEFN shares are currently hovering just around the placement price of CAD 0.26, valuing the REE property at around CAD 63 million. The latest PEA study calculated a net present value of CAD 517 million, which creates a lot of imagination for interested investors.

Borussia Dortmund - The AI bots tended to be right

It was a big bet, and it went wrong. Those who bet on Borussia Dortmund to win the championship could still get good odds with the poor start to the season. But regardless of whether you placed an 8 to 1 or 1.2 to 1 bet in favour of BVB on Saturday, your stake went down the drain. The BVB share price, which had gained a good 80% since the beginning of the year until last Friday, also crashed.

For the Dortmunders, FC Bayern's 33rd championship is a disaster. Once again, they came close, but the odds were not in their favour in their own stadium against the 8th-placed FSV Mainz. If you had asked the well-known AI platform ChatGPT last week about the outcome of the Bundesliga, the result would have been over 70% in favour of FC Bayern because here, it considers historical data up until the year 2021.

The Borussia Dortmund share now goes into the summer break with a 30% price loss, correcting from around EUR 5.9 to EUR 4.1. The club is currently valued at around EUR 473 million on the stock exchange. After 3 years in a row with operating losses of between EUR 84 and 101 million, analysts on the Refinitiv Eikon platform expect at least a balanced result in 2023. In the final euphoria, the business with merchandising and fan articles should also enable a small profit. The share is a bet on BVB's future titles, so the investor cycle should start again after the summer break. Before that, consolidation is the order of the day.

Data is as much in demand these days as strategic metals. Those who want to be at the forefront of the high-tech or Greentech industry need both: access to raw materials and the necessary information about trends in legislation and public opinion. Artificial intelligence can help, but in certain situations, it will also fail. Palantir has run wide, Borussia Dortmund is back down to earth, and Defense Metals remains a top pick for the Strategic Metals sector.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.