April 14th, 2025 | 08:00 CEST

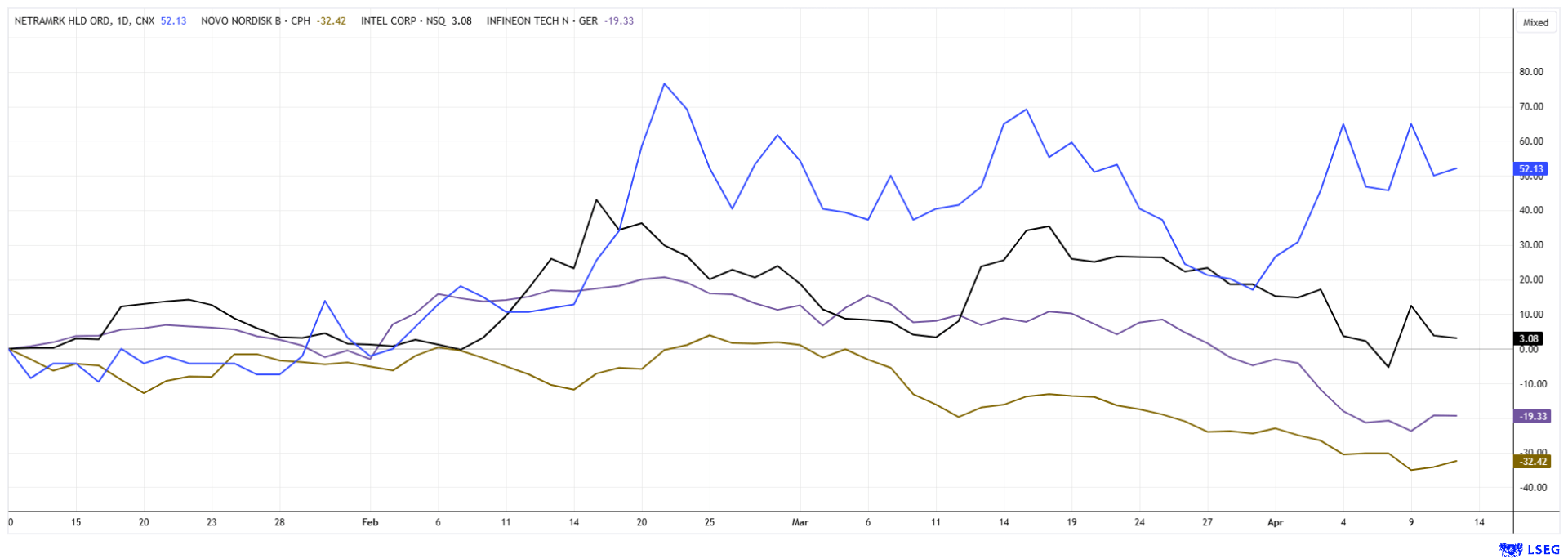

Growth despite tariffs: It is all about using artificial intelligence! Novo Nordisk, NetraMark Holdings, Infineon, and Intel

The tariff policy of the Trump administration is casting a long shadow over the global economy, with ifo Institute President Clemens Fuest warning it could even trigger a new global recession. Only a handful of companies can currently afford to relax - those that manufacture entirely within the US and serve mainly domestic markets. However, the economy is highly interconnected, the recently favored globalization has ensured that. The wheel is currently turning backwards, and "local sourcing" is the new buzzword. History has shown that protectionism rarely leads to positive outcomes. It is important for investors to look closely at which policymakers truly have an understanding of economic issues without ideological distortions. Identifying these trends can lead to discovering high-potential stocks. The search is not easy, but we are here to provide support wherever possible.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NOVO NORDISK A/S | DK0062498333 , NETRAMARK HOLDINGS INC | CA64119M1059 , INFINEON TECH.AG NA O.N. | DE0006231004 , INTEL CORP. DL-_001 | US4581401001

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Novo Nordisk – Hard hit and under pressure

Novo Nordisk's stock has experienced a significant sell-off in the last 6 months, with a decline of 48%. The new drug CagriSema only achieved an average weight reduction of 22.7% in a Phase III study, which was below the expected 25% and did not exceed the efficacy of the competitor product Zepbound from Eli Lilly. Supply shortages of the obesity drug Wegovy due to difficulties at a partner also raised concerns about the Company's ability to meet high demand. Meanwhile, Eli Lilly has gained significant market share with its drugs Mounjaro and Zepbound, increasing competition in the lucrative weight loss market. Announcements by the US government that it would impose import tariffs on medicines have created additional uncertainties for international pharmaceutical companies such as Novo Nordisk.

Meanwhile, Novo Nordisk is in the process of repositioning itself. The Danes are increasingly relying on artificial intelligence to accelerate and optimize drug development. In October 2024, the Company announced an expansion of its partnership with the US health tech company Valo Health. This collaboration aims to develop up to 20 new drug candidates targeting obesity, type 2 diabetes, and cardiovascular diseases using AI and real patient data. Valo stands to receive up to USD 4.6 billion in milestone payments if the projects can be completed quickly. In addition, Novo Nordisk is investing in AI partnerships in India to automate processes such as document summarization and quality control. Despite recent setbacks, 20 out of 28 analysts still rate Novo Nordisk shares as a "Buy". At a current price of DKK 420 and a low 2025 P/E ratio of 15.5, there is an average price target of DKK 756 - representing upside potential of around 80%. Buy!

NetraMark Holdings – Making the best use of artificial intelligence

NetraMark Holdings Inc. (AIAI) is also very strong in the AI sector. The Canadian company has focused on optimizing the clinical trial process. Among many other applications, big data and artificial intelligence (AI) applications are also revolutionizing the clinical phases of drug approval by accelerating processes, reducing costs, and significantly increasing the success rate. AI can analyze large amounts of data from electronic health records, genomic data, and patient registries to identify suitable clinical trial participants faster and more accurately. This significantly reduces recruitment time and improves accuracy.

Generative Artificial Intelligence (Gen AI) is now an accepted practice for making clinical trials more efficient and accurate. The results so far indicate a quantum leap because the NetraAI 2.0 platform addresses the interface between efficacy and feasibility. Recent studies show that the market for artificial intelligence in clinical research is currently experiencing dynamic growth. NetraMark has recently entered into a major global partnership with the well-known contract research organization Worldwide Clinical Trials, which is integrating NetraAI into a wide range of clinical trials. This collaboration is expected to significantly increase the adoption of NetraMark's technology across multiple therapeutic areas, particularly in neuroscience and oncology.

NetraMark will host a conference call for its shareholders tomorrow, April 15, at 10:00 pm ET to provide an update on the Company's recent strategic developments, commercial progress, regulatory initiatives, and next growth phase. It will be led by CEO George Achilleos. It will focus on the Company's growing commercial presence, its approach to interacting with regulatory authorities, and the operational strategy that continues to drive innovation in the area of patient-centered clinical trial design. Here is the direct dial-in.

"Our company is in an exciting period of growth and transformation," said George Achilleos. "We have taken important steps to scale our technology. This call is an opportunity for us to share our vision, highlight our progress, and engage directly with our shareholders."

The uncertainty caused by Donald Trump has so far left NetraMark unaffected. The price is hovering between CAD 1.40 and 1.46 and is up a good 40% from the beginning of the year. This brings the market value to around CAD 113 million. A strong vote of confidence from investors - presumably, the rally is just beginning.

Lyndsay Malchuk interviews

George Achilleos, CEO of NetraMark

Infineon and Intel caught in the Tariff Crossfire – Where to produce, Where to sell?

For investors, it is becoming increasingly challenging to navigate the landscape. Geopolitical conflicts are brewing everywhere, alliances are disintegrating, and suddenly, every country is isolated in the international community. The two chip manufacturers, Infineon and Intel, have weathered turbulent times, and their share prices have corrected significantly. Although they manufacture sought-after products, some of their target markets are subject to supply restrictions or even sanctions. Both companies have been trying for years to diversify and establish new locations to reduce their dependence on politically sensitive supply chains.

Infineon, as a European company, is not directly bound by US regulations, but many products are based on US technology or patents, which means that secondary sanctions could apply. China is an important market, accounting for over 30% of sales, which is why export restrictions would indirectly affect Infineon. However, Infineon also imports some of its production from Asia. If these are used in US markets, tariffs could increase prices or negatively impact margins. This is why Infineon is also investing in the US, for example, in a new plant in Texas. The Munich-based company stands to benefit from America's push to secure its supply chains. Intel, however, has been restricted since the 2022 US policy changes from exporting certain advanced chips to China - especially those intended for AI applications. This affects major customers like Huawei, but chip designs developed with US software or technology are also subject to these restrictions. Intel is building new plants in the US, including in Arizona and Ohio, and is thus indirectly benefiting from government subsidies and protectionist measures. However, Intel also faces rising costs when sourcing from Asia, as imported parts or machinery may be subject to punitive tariffs. It is doubtful whether all revenue and profit risks have already been priced into the current scenario.

With the advances in AI-powered analysis, personalized drug trials could be developed in the future to enable targeted therapeutic approaches tailored to specific patient groups. At the same time, AI has the potential to make the entire approval process more efficient and transparent. NetraMark Holdings is on the verge of establishing itself as one of the first leading AI innovators in the clinical approval phases – an extremely exciting development! The stock held up well in the recent Trump correction.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.