November 6th, 2023 | 07:10 CET

GreenTech shares are on the rise! Siemens Energy, Altech Advanced Materials, Nordex and JinkoSolar under scrutiny

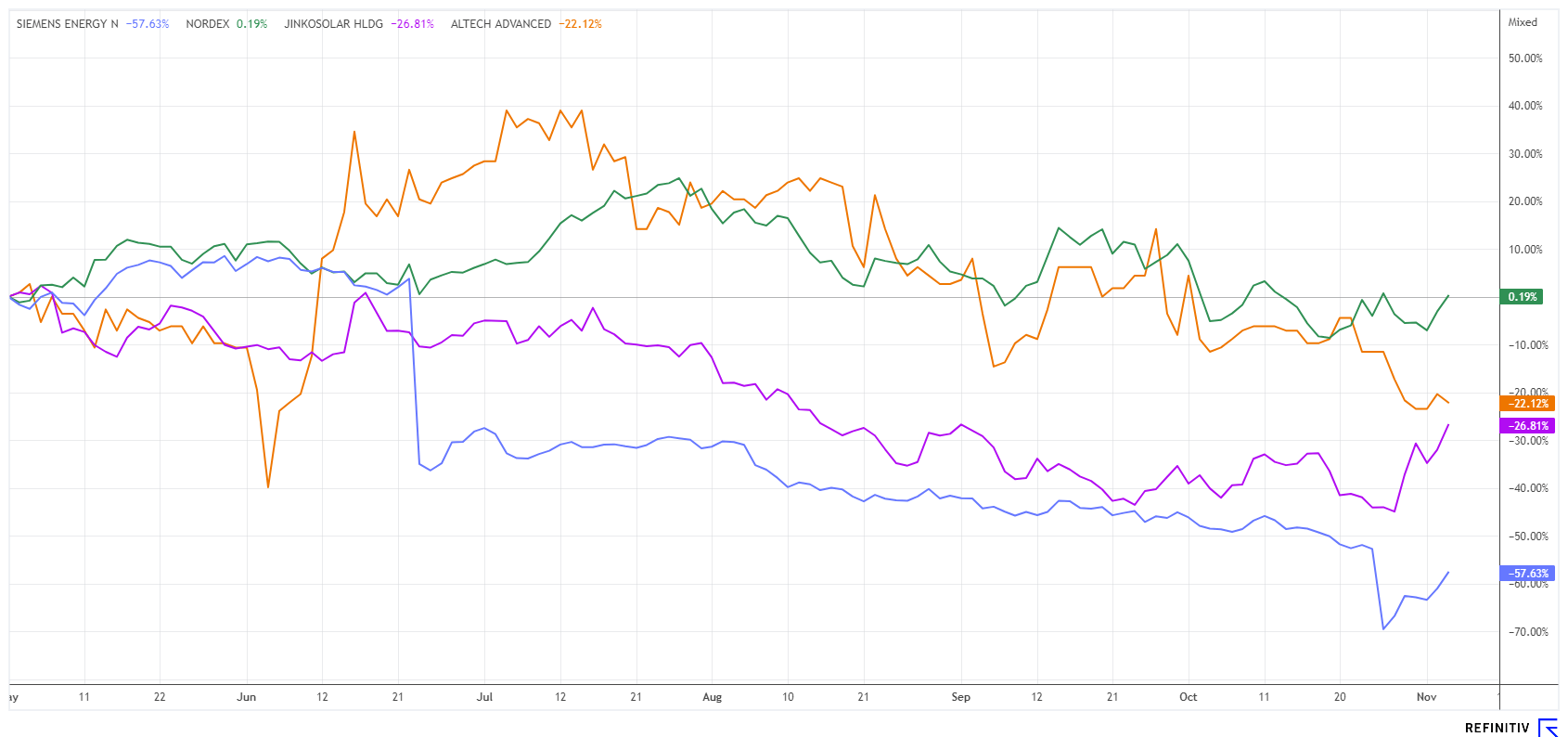

After months of selling off, Greentech shares are making a comeback. By late fall, popular hydrogen and solar stocks had lost between 50% and 85% of their share prices from the boom times of 2020/21. Now, everything points to a rebound. Battery innovator Altech Advanced Materials is also coming up with good news. If everything goes according to plan, lithium-ion technology could soon see a dramatic increase in efficiency. We take a look at the bombed-out sector and where the opportunities lie for investors.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0 , ALTECH ADV.MAT. NA O.N. | DE000A31C3Y4 , NORDEX SE O.N. | DE000A0D6554 , JINKOSOLAR ADR/4 DL-00002 | US47759T1007

Table of contents:

"[...] Boron is one of the most versatile elements in the whole world! Everyone reading this text regularly uses hundreds of products that depend on boron. [...]" Tim Daniels, CEO, Erin Ventures

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Siemens Energy - Price slump offers good entry zone

Siemens Energy's Q4 reporting date this year promises to be extremely exciting. The Greentech high-flyer share was able to advance to EUR 24.80 until the end of May, boosted by the investment plans of the Berlin traffic light. Then, the problems at the Spanish subsidiary Gamesa became increasingly transparent, and in June, the first announcements were made about a pending EUR 4.5 billion write-down due to significant quality defects.

Despite management's swift commitment and the announcement of a drastic quality offensive, the share price came under increasing pressure until the end of October. Rumors of an impending financing gap circulated and pushed the price down to EUR 6.45 at high volumes. Some analysts considered the fall in the share price to be exaggerated, especially given the importance of the energy technology group for the energy transition. An EUR 8 billion guarantee from Berlin was also quickly on the agenda, and the share price started to rise again. Most recently, it increased by a remarkable 50% in just four trading days.

From an analytical point of view, Siemens Energy will end the fiscal year ending September 30 with a loss of just under EUR 5 billion or a minus of EUR 5.14 per share. According to the experts on the Refinitiv Eikon platform, earnings per share should rise again to EUR 0.37 and EUR 1.19 in the next two years. If these analyses hold true, the share would be valued at a P/E ratio of 7.5 based on 2025 estimates. With a market value of just under EUR 35 billion, the price/sales ratio is only 0.2. With a medium-term horizon, feel free to pick up a few shares; the downside risk is now manageable.

Altech Advanced Materials - Good prospects for CERENERGY®

The Frankfurt-based holding company Altech Advanced Materials has good news to report. This Greentech stock has also lost a good 30% since July without any visible reason. Research and development efforts are ongoing and require substantial funding, which the Company has now raised in full through several successive capital increases and the placement of a convertible bond. After full payment of the deposit, the new 4.237 million shares from the last capital increase with WKN A32C3Z are expected to be admitted to trading with the preparation of a securities prospectus. If BaFin approves the prospectus - which can be assumed - around 7 million shares would then be in circulation together with the old shares.

Last week, there was an update on the CERENERGY® project. The ongoing feasibility study now estimates an annual production capacity for the new storage facilities of up to 120 MWh. As a result of technical design optimization in collaboration with the joint venture partner Fraunhofer IKTS and the participating subcontractors and further tests, the plant output could be increased by 20% without the need for additional investment. The feasibility study for the realization of the production plant is in progress and is to be published in the coming months.

Altech is positioning itself with good initial parameters in the field of energy storage and e-mobility. The innovations on show are a clear component of the politically desired energy transition, as the CERENERGY® sodium chloride solid-state battery is ideally suited for stationary intermediate storage operation. All the necessary materials can be sourced from Europe, minimizing dependencies in the supply chain. Taking into account total costs and daily charging cycles, solid-state technology promises a cost advantage of around 50% compared to conventional lithium-ion batteries. Altech is currently producing the industrial prototype of the new 60kWh battery pack together with Fraunhofer.

The Altech share has consolidated somewhat in the last 6 months. New shares will be coming onto the market soon, which will significantly increase the liquidity of free shares. With more trading and attention, the share's challenging fungibility will soon be history. Due to the high market capitalization, institutional investors may now start appearing on the radar.

Nordex versus JinkoSolar - Wind or solar cell?

Two other Greentech stocks are currently causing a sensation. In the case of Nordex, several margin warnings are weighing on the share price, which has fallen from a good EUR 15 to below EUR 10. Market participants are now looking ahead to November 14, as analysts have calculated a net profit of EUR 0.01 for the first time. Of course, this small upward swing cannot compensate for the poor start to the year, but at least the operating turnaround should be achieved in the current year. And by next year, earnings per share of 0.18 EUR could be in the books. From an analytical point of view, however, it will only become really interesting in 2025, as earnings of nearly EUR 0.70 are expected - that is at least a low double-digit P/E ratio from today's perspective.

In JinkoSolar's case, the Q3 report is already history. The solar panel specialist earned CNY 24.21, equivalent to over EUR 3, in the quarter, and for the full year, it is expected to be around CNY 81. Currently, 4 out of 7 analysts have a buy recommendation. Assuming consistent earnings, JinkoSolar is currently valued at a long-term P/E ratio of around 4. Calculated on sales, this results in a low P/S ratio of 0.65. It is rare to find the Chinese technology stock at such an attractive valuation, and momentum is also pointing upward. Collect!

There is movement in the Greentech sector. E-mobility, alternative energy generation and electricity storage remain the permanent climate protection topics. This means that Siemens Energy, Nordex, JinkoSolar and Altech Advanced Materials are part of a long-term megatrend. After a strong consolidation, all stocks now appear promising again.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.