August 14th, 2023 | 07:05 CEST

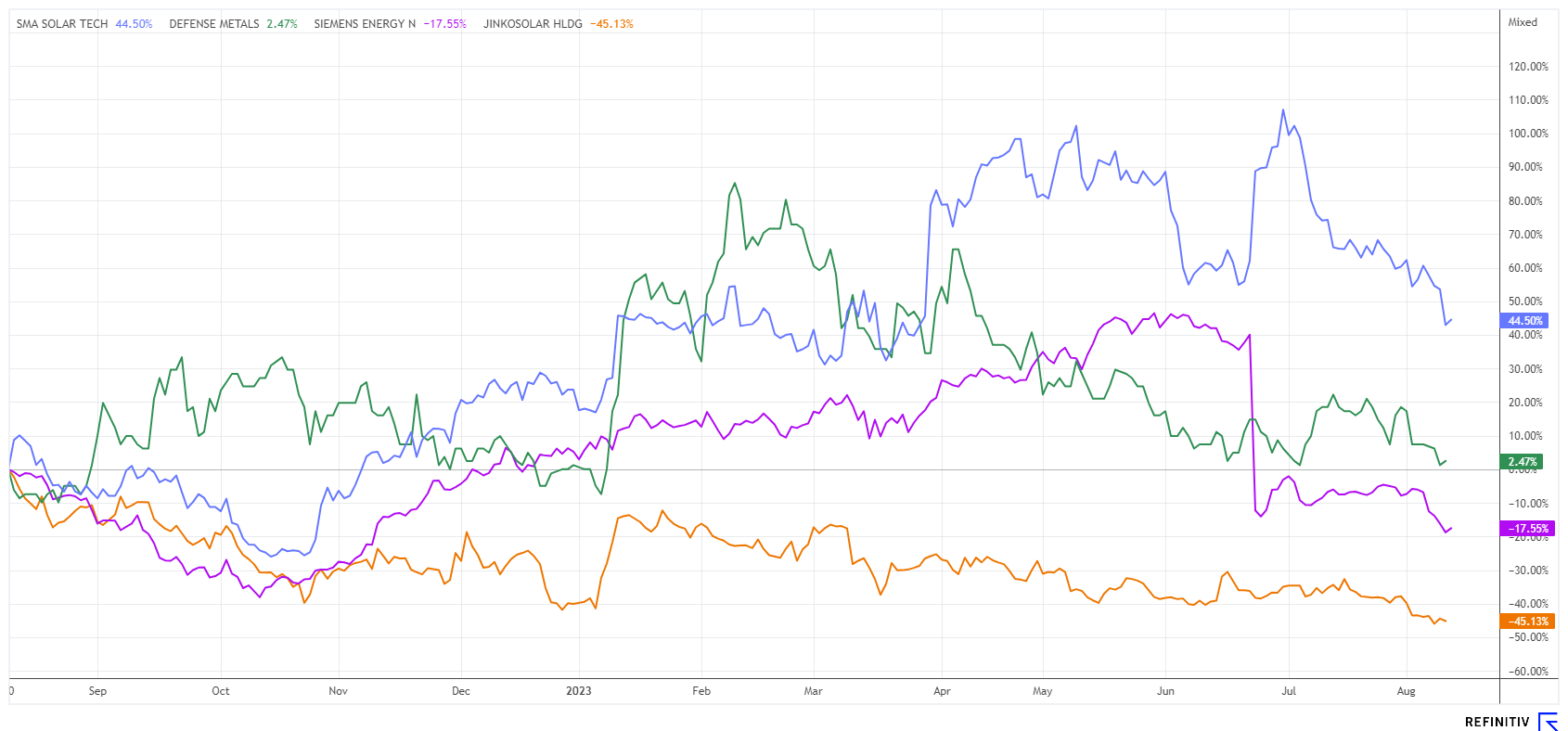

Greentech rally restarts again! Siemens Energy, Defense Metals, SMA and JinkoSolar - critical metals are in demand

Greentech stocks have been a hot topic since the Inflation Reduction Act (IRA) by the Joe Biden Administration. That is because, besides the EU, the US now also wants to step on the gas pedal significantly. It is all about investing in the future of climate protection. This primarily involves technologies for alternative energy generation, such as solar or wind power plants. Under the IRA, US investments in the future will be subject to a tax bonus. For industry, the key point remains the availability of strategically important metals, as they are as rare as they are highly sought after. Where are the opportunities for investors?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0 , DEFENSE METALS CORP. | CA2446331035 , SMA SOLAR TECHNOL.AG | DE000A0DJ6J9 , JINKOSOLAR ADR/4 DL-00002 | US47759T1007

Table of contents:

"[...] Recovery rates of more than 90% rare earths are another piece of the puzzle on the way to the economic viability of our project. [...]" Craig Taylor, CEO, Defense Metals

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Siemens Energy - Problems upon problems in the wind sector

Siemens Energy is currently not to be envied. The spinoff of the energy division from the Siemens Group went through in September 2020 with prices around EUR 22. Temporarily the paper even rose to EUR 34. Thus, the spinoff of Siemens Energy was one of many building blocks of the radical restructuring that outgoing Siemens CEO Joe Kaeser had prescribed for the industrial conglomerate in 2021. Several independent companies with a clear focus have emerged from the traditional company over the past 10 years.

Siemens Energy is seen on the stock market as a pioneer of the energy turnaround. The original focus on gas turbines has been consistently supplemented in the last 2 years by the involvement in the Spanish wind turbine manufacturer Gamesa. There have recently been massive quality problems, bringing the new group a loss of EUR 4.5 billion after full integration in 2022. Even though it was reported at the end of last week that the quality problems with onshore wind turbines had now been resolved, the Munich-based company will still have many months to labour over the restructuring of the subsidiary. Nevertheless, there are now signs of a positive turnaround.

On the stock market, investors immediately smelled fresh spring air and pushed the share price up by 5% after the press conference. However, some analysts do not see the future so bright. JP Morgan downgrades to "Neutral" and lowers the price target from EUR 23 to EUR 18. **Deutsche Bank also sees no more potential than EUR 18, and the consensus from 20 studies at Refinitiv Eikon stands at EUR 19.60. That is still a 42% premium to the current price of EUR 13.85.

Defense Metals - Rare earths from Canada

The new Critical Raw Materials List of the US Department of Energy has just been published. The battery raw materials copper, nickel, graphite, lithium and cobalt are considered particularly critical. The situation is even more difficult with rare earths. These are a group of 17 metals that are essential for many high-tech applications such as e-mobility, electronics and renewable energies.

Defense Metals (DEFN), a Canadian exploration company, owns the 4,262-hectare Wicheeda Rare Earth Project and is touted as one of the future producers of rare earths. A preliminary feasibility study has now been commissioned from consulting firms Hatch Ltd. and SRK Consulting. SRK is acting as the overall coordinator for the preparation of the NI 43-101 report. Hatch Ltd. will focus on the concentration and hydrometallurgical processes and the capital and operating cost levels for rare earth elements (REE). Finally, One-eighty Consulting Group will be responsible for environmental studies, permitting, and social and community impacts. SRK was already involved in the preliminary economic assessment in 2022, and the new analysis can now build on lessons learned to create an optimal development plan for the Wicheeda project.

The investment required to get production up and running is estimated at USD 640 million, which puts the break-even period from the start of production at about 5 years. It is not too expensive an investment because at least the strategic dependence on China will be reduced. The DEFN stock is currently gaining attention as a long-term producer of critical metals. With about 255.78 million shares outstanding, the market value is currently about CAD 54 million. Far too cheap, considering the smouldering procurement problems of Western industries.

SMA Solar or JinkoSolar - Who is analytically cheaper?

The two technology companies, SMA Solar and JinkoSolar, work in the same sector but on entirely different components. SMA Solar is an expert in inverters and energy storage systems for private households and companies. The tense situation on the world market improved step by step recently. As a manufacturer, SMA can once again deliver in significantly higher quantities; this is especially true for storage solutions and products for e-mobility.

The Company, based in Niestetal (Hesse), recently reported excellent half-year figures. Revenues increased by 65% from around EUR 472 million to EUR 779 million, which was at the upper end of the published range. The operating result (EBITDA) also increased significantly from EUR 15.9 to 125.3 million, with a pleasing margin of 16%. The reasons for the positive development were higher sales due to improved material supply on the supplier side and the associated fixed cost degression. "With our new gigawatt factory, we will create an additional 20 GW of capacity and more than 200 new jobs from 2025," said CEO Dr. Jürgen Reinert. The share price briefly jumped to EUR 88 but quickly declined again to around EUR 74 as most of the outlook disappointed. With a 2023 P/S ratio of 1.5 and a P/E ratio of 16.8, the SMA Solar share is fairly valued. Analysts on the Refinitiv Eikon platform expect prices to reach EUR 106.50 in 12 months. We consider this estimate to be very ambitious.

Solar panel expert JinkoSolar reported major overcapacity and price pressure at the end of the second quarter. According to Bloomberg calculations, Chinese manufacturers currently have the capacity to produce over 650 GW of solar modules per year, while another 336 GW have been announced or are under construction. However, the global market will "only" amount to installations of 344 GW this year. This will increase inventories, which will automatically cause market prices to fall. For buyers of modules, this is good news. For Jinko shareholders, it is a selling criterion. On a 12-month view, the share has already lost 50%. Important chart support is found around EUR 25. With a 2024 P/E ratio of 10.8, the stock is not too expensive. Technically, however, the stock is visibly battered.

The Greentech industry promises high growth rates and enjoys political support. Those who aim to improve the climate, at least on paper, can invest in technology stocks related to the energy transition. However, valuations are sometimes very high, leading to sharp price corrections if targets are not achieved.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.