November 13th, 2023 | 07:30 CET

Green Energy in Focus - Varta, Siemens Energy, Power Nickel and Nordex - Find the next 100% gainer now!

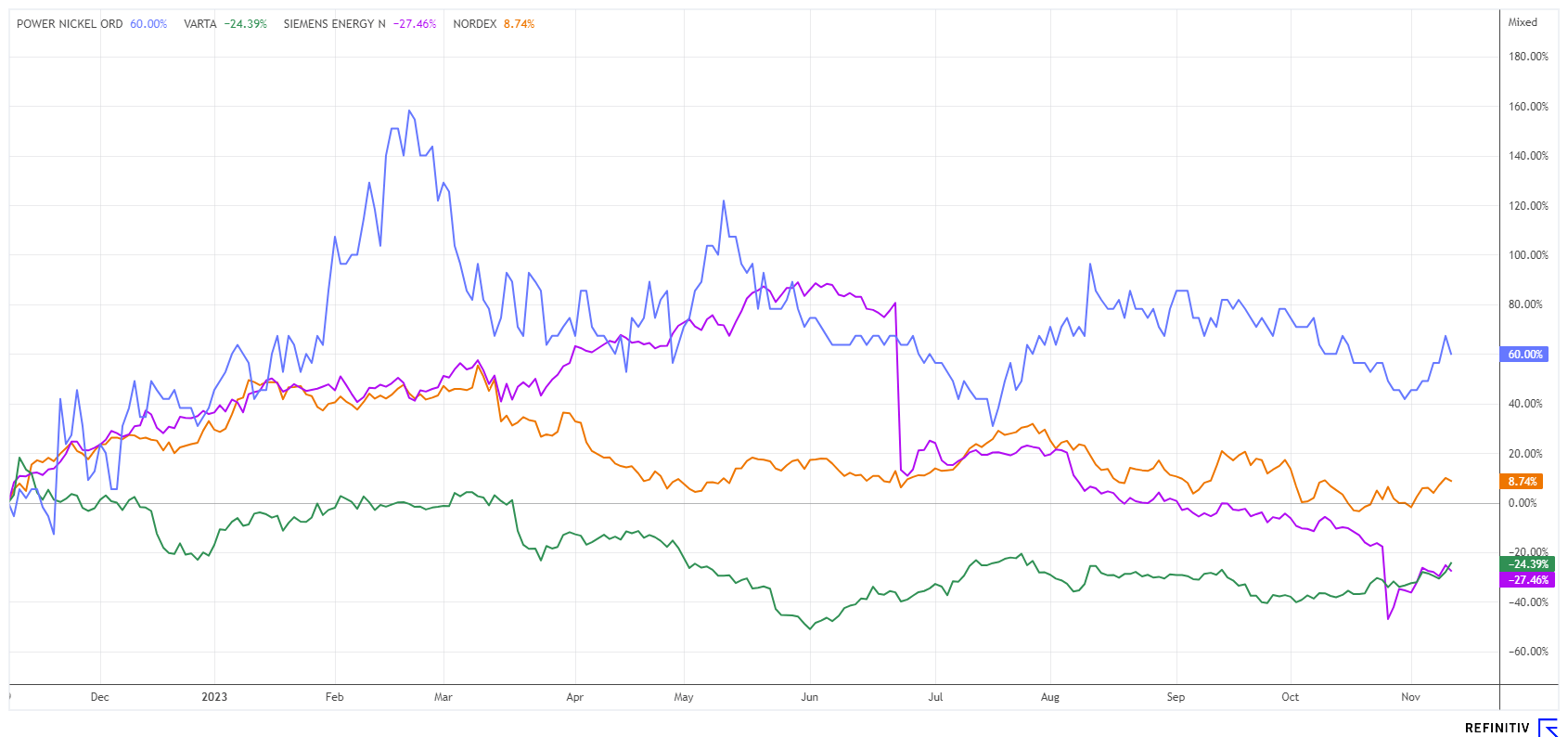

That was a significant turnaround. While the DAX 40 index stood at 14,650 points at the end of October, it started its year-end rally at the beginning of November. On Friday, the index even broke back above the crucial 15,300 mark. There are now technical resistances to watch for upward movement. In the Greentech sector, there was good news from the corporate side: Varta is optimistic about the next quarter, and Siemens Energy is up 40% in 5 trading days. The Power Nickel share has been strong all year, and what about Nordex? All these stocks have the potential for a 100% gain – the question is, which one will take off first?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

VARTA AG O.N. | DE000A0TGJ55 , SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0 , Power Nickel Inc. | CA7393011092 , NORDEX SE O.N. | DE000A0D6554

Table of contents:

"[...] China has become the manufacturing capital of the World, and because of its infrastructure, expertise and capabilities, Silkroad Nickel has strategically positioned itself to partner with Chinese companies in the Stainless Steel and EV industries [...]" Jerre Foo, Corporate Development Executive, Silkroad Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Varta - Light at the end of the tunnel for the first time

After a decent third quarter, the struggling battery group Varta is looking to the future with hope. Three quarters under restructuring pressure are now behind them, and many investors are optimistic that the Ellwangen-based company will get back on track. In the years 2019 to 2021, it went from a level of around EUR 25 to an astonishing EUR 175. The Company benefited from the then-booming wireless headphones equipped with lithium-ion button cells. The stock market even paid high valuation premiums compared to other industrial stocks. Since 2022, however, there has been a noticeable slowdown in growth in consumer electronics, which has plunged Varta deep into crisis. The bread and butter business with household batteries and home storage systems could not compensate for the poor performance in the microcell segment. The share price plummeted by a staggering 90%.

After several profit warnings, the SDAX-listed company from Ellwangen reported preliminary quarterly figures on Friday, which were met with a visibly bombed-out share price. From July to September, the Company achieved sales of a good EUR 215 million, 10% more than in the weak prior-year period. Adjusted EBITDA returned to a reasonable EUR 29.4 million after being in the red a year earlier. Although the annual forecast was not raised, it was confirmed. Revenue of around EUR 820 million is expected to be generated. At the same time, the new CEO, Markus Hackstein, anticipates the operating result to be between EUR 40 and 60 million. The share price gained almost 15% over the week. The holdings accumulated recently in the range of EUR 18 to 20 are now embarking on their long-term recovery path. The predominantly skeptical analyst firms have yet to be persuaded to take a positive view.

Power Nickel - With full coffers into the next year

Given the West's increasingly threatening dependence on critical raw materials from geopolitically unstable countries, resource-rich North America is going on the offensive. Canada, in particular, is known for its wealth of resources and positive attitude towards mining. This encourages private companies to purchase the relevant land management rights and start exploration. Due to the abundance of companies searching for critical raw materials, it is important to analyze the geological conditions and the economic viability of the projects in detail.

In the current energy and climate transition, there is a high demand for battery metals, which are only available in increasingly inaccessible areas of the world. This penalty does not apply to Canadian explorer Power Nickel's flagship NISK nickel project in Quebec. With mineralization for nickel, copper, cobalt, palladium and platinum, NISK covers almost all the critical future metals in one property. The project hosts high-grade Class 1 nickel with prospective intercepts, including 18.5 meters of 2.00% nickel equivalent (NiEQ) and 26.6 meters of 1.98% NiEQ.

For the capital increase announced in October, the Company has attracted well-known investor groups around Rob McEwan and the Lynch family, who fully subscribed to the first CAD 2 million tranche. The funds can be used to continue drilling until 2024. The first NI 43-101 resource estimate is due to be published in November. The share is exciting and costs only CAD 0.22 in the current challenging environment for smaller stocks. The first-class project is still valued at a low CAD 30 million, a valuation that could change rapidly with favorable news.

Siemens Energy versus Nordex - Which Greentech star is still fun?

The last three months have not been a bed of roses for Siemens Energy and Nordex shareholders. Both Greentech stocks experienced significant setbacks. On the one hand, investor sentiment shifted regarding the perceived explosive growth of manufacturers of alternative energy generation systems. On the other hand, Siemens Energy, in particular, is grappling with internal issues related to the recently acquired wind division Gamesa.

Extreme quality deficiencies and delays are forcing Siemens Energy to make extraordinary write-downs of around EUR 4.5 billion. Given its current market capitalization of EUR 7.5 billion, this is a crisis of the century for the Munich-based company, as the Siemens spin-off has been a highly regarded technology partner worldwide in recent years. Now, the Company has to draw on guarantees of up to EUR 15 billion to cope with the current crisis. The guarantors are the federal government with EUR 8 billion, banks with EUR 2 billion and the former parent company Siemens with EUR 5 billion. Siemens still holds a 25.1% stake in the former energy technology division but intends to divest its share in the long term. In order to raise further liquidity, a block of shares in the Indian sister company Siemens Ltd. is to be taken over by the parent company.

Both Nordex and Siemens Energy will report on the past quarter this week. The Hamburg-based company is only expected to report a small loss of around 2 cents per share, while estimates for Siemens Energy range up to a loss of just under EUR 1 per share. The EUR 10 mark is an important resistance level for both stocks. While Nordex hopes to hold this support, in the case of Siemens Energy, it would be a first rebound after the 75% drop since May. Exciting!

Greentech stocks were among the losers in the second half of 2023 due to high expectations since the start of the year when governments announced large subsidy pots. Private investments in wind and hydrogen, on the other hand, are few and far between. Power Nickel shares have a clear advantage over manufacturers of costly industrial plants such as Siemens Energy and Nordex, as the Canadians could soon become a major nickel producer.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.