March 21st, 2023 | 08:39 CET

Goodbye banks - the Greentech rally is on: Shares of BYD, Canadian North, Mercedes Group and BMW are in focus!

Blunt, clear text - that is what the Intergovernmental Panel on Climate Change had promised, in case governments still did not get it. The latest "State of the World Report" is clear. Hesitation is a thing of the past. The message: action is needed now and must be taken worldwide. This is the conclusion of the so-called synthesis report of the Intergovernmental Panel on Climate Change (IPCC), which was presented yesterday in Interlaken, Switzerland. Leading scientists have spent the past week wrestling with more than 650 government representatives to lay things out as transparently as possible. The conclusion is quickly formulated: Full throttle for the Greentech industry!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , CANADIAN NORTH RESOURCES INC | CA1364271017 , MERCEDES-BENZ GROUP AG | DE0007100000

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD - The next flagships roll onto the market

99-year-old US investor and friend of Warren Buffett Charly Munger keeps falling in love with the BYD share: "The Chinese electric carmaker is a remarkable company that is way ahead of US carmaker Tesla, at least in China," he said on the sidelines of an investor conference in early 2023. The original USD 500 million investment by Berkshire Hathaway in 2008 peaked at USD 8 billion, as the value of the BYD share has risen more than 600% in the last decade alone.

Currently, BYD can again come up with new products. At the end of March, they will launch the champion version of the flagship Han and Tang models with retail prices starting at 210,000 yuan or just under USD 30,440. This is a new blow for Tesla Inc., which had to lower prices twice in China to maintain its market share. Nevertheless, BYD no longer has it so easy in China, the competition in its own country is catching up, and VW can also gain new market shares.

For these reasons, investment bank Morgan Stanley recently lowered its price target for BYD shares while raising the ratings of its two counterparts and start-ups, Li Auto and XPeng. The experts cited Tesla's renewed price cuts on the Chinese mainland market as the reason, as vehicle sales are currently faltering while margins are being lowered. This could have a significant negative impact on earnings, analysts said. However, the cross-section at Refinitiv Eikon still sees the 12-month price target at around CNY 362, or the equivalent of EUR 49. Thus, the BYD share still has about 100% potential at the current level.

Canadian North Resources - New discoveries in battery metals

Commodity companies can contribute to environmental and climate protection through environmentally friendly extraction processes. Despite all the public criticism of mining, metals are needed in the Greentech industry to get the energy turnaround up and running. The battery metals copper, lithium and cobalt are important prerequisites for implementing climate targets because they are the main components of current energy storage technologies.

Exploration company Canadian North Resources Inc (CNRI) has identified extensive granitic pegmatites in the 253.8 sq km Ferguson Lake area that may contain lithium-bearing minerals. The potential for lithium minerals has never been explored in this area, but that will change in 2023. "We are exploring the granitic pegmatites in the large Ferguson Lake Project area for their potential to host lithium minerals," recently announced President and CEO Dr Kaihui Yang. The area is located in the southern part of Nunavut within the Northern Canadian Shield, which has world-class potential for critical minerals such as nickel, copper, PGM, diamonds, lithium, uranium and rare earths.

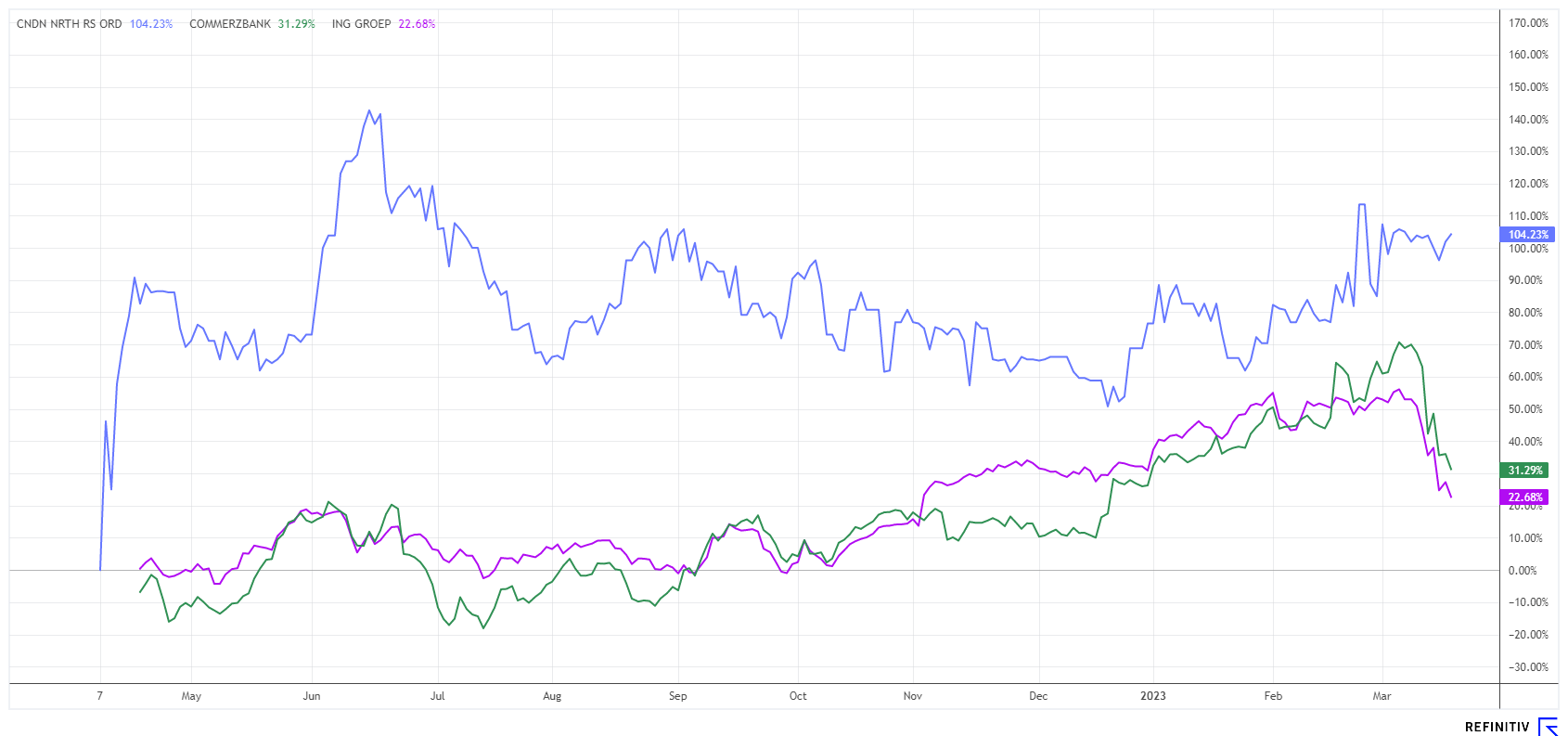

Canadian North Resources Inc. is well positioned to meet the needs of the Greentech industry as it focuses on critical metals for clean energy generation equipment, electric vehicle construction and advanced energy storage. An N43-101 standard resource assessment has already been completed, and the model suggests significant potential for future expansion. CNRI shares have shown strength so far, gaining a good 40% since the beginning of the year. In the current geopolitical environment, the odds favour a further rise.

Mercedes Group and BMW - Another trump card up their sleeves

The ban on internal combustion vehicles in the EU is still on shaky ground. How electric we will drive in the future can hardly be predicted at present. For the German premium manufacturers BMW and Mercedes, however, one thing is already clear: the electric car is not the only right way, as documented by current sustainability analyses. Nevertheless, practically all the major automakers have declared their support for the electric car, albeit with varying degrees of clarity.

BMW and Mercedes are no exception, even if the Bavarians are keeping the biggest back door open and are far from rejecting the internal combustion engine. Business with the new X series has recently been far too successful for that, and the same applies to the Mercedes ML and G models. The popular SUV series is selling around the globe with very good margins. So why go along with the politically driven departure so easily? After all, the 10 to 15-year model cycles will outlive many a political constellation in Berlin.

From 2027, a completely new platform will be available for the models that can accommodate all drive concepts. In the case of BMW, this means gasoline, diesel and battery, and even the fuel cell will play a greater role for the Bavarians in the future. Mercedes has officially renounced the internal combustion engine in response to public pressure and wants to have almost completed the changeover by the end of the 2020s. However, when the electric target was formulated in Stuttgart, the Company took precise precautions: The plan to go exclusively electric applies only where market conditions permit. In plain language, the market will decide in the future, not politics. **In China and the US, currently the most important markets for German automakers, the internal combustion engine does not yet have a dictated expiration date.

The Greentech trend remains strong as many governments worldwide continue to expand their investments in environmentally friendly technologies. This is giving technology leaders a good order book and increasing the need for critical raw materials. Mercedes Group, BMW and BYD are convincing as broad-based automotive stocks, and Canadian North Resources could score as one of the future suppliers in the medium term.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.