June 16th, 2025 | 07:25 CEST

Gold rush 2025: Why Desert Gold Ventures Inc. is now on the brink of a historic revaluation!

Imagine this: A company is sitting on a gold treasure trove of over 1.1 million ounces – and is valued by the market as if this treasure were worthless. While the gold price has soared to a record high of over USD 3,442 per troy ounce, shares in Desert Gold Ventures Inc. (WKN: A14X09 | ISIN: CA25039N4084 | TSXV: DAU) are currently still trading at rock-bottom prices. But that could change radically in the near future. The escalation of the conflict between Iran and Israel is driving the price of the precious metal to rise, which in turn is boosting the appeal of gold companies. The countdown to a revaluation is on – and savvy investors should take a close look now!

time to read: 2 minutes

|

Author:

Mario Hose

ISIN:

DESERT GOLD VENTURES | CA25039N4084

Table of contents:

"[...] We knew the world was rapidly electrifying and urbanising and needing significant amounts of copper to do so. [...]" Nick Mather, CEO, SolGold PLC

Author

Mario Hose

Born and raised in Hannover, Lower Saxony follows social and economic developments around the globe. As a passionate entrepreneur and columnist he explains and compares the most diverse business models as well as markets for interested stock traders.

Tag cloud

Shares cloud

Gold in the ground – and huge upside potential beyond

Desert Gold Ventures Inc. controls an impressive 440 km² of gold properties in Mali, West Africa – right next door to industry giants such as Allied Gold, B2Gold, and Barrick Mining. What makes this property unique is that the gold deposits are not only close to surface and therefore particularly economical, but the Company is also about to publish a preliminary economic assessment (PEA). This initial economic assessment could be the starting signal for the announced gold production on the promising site.

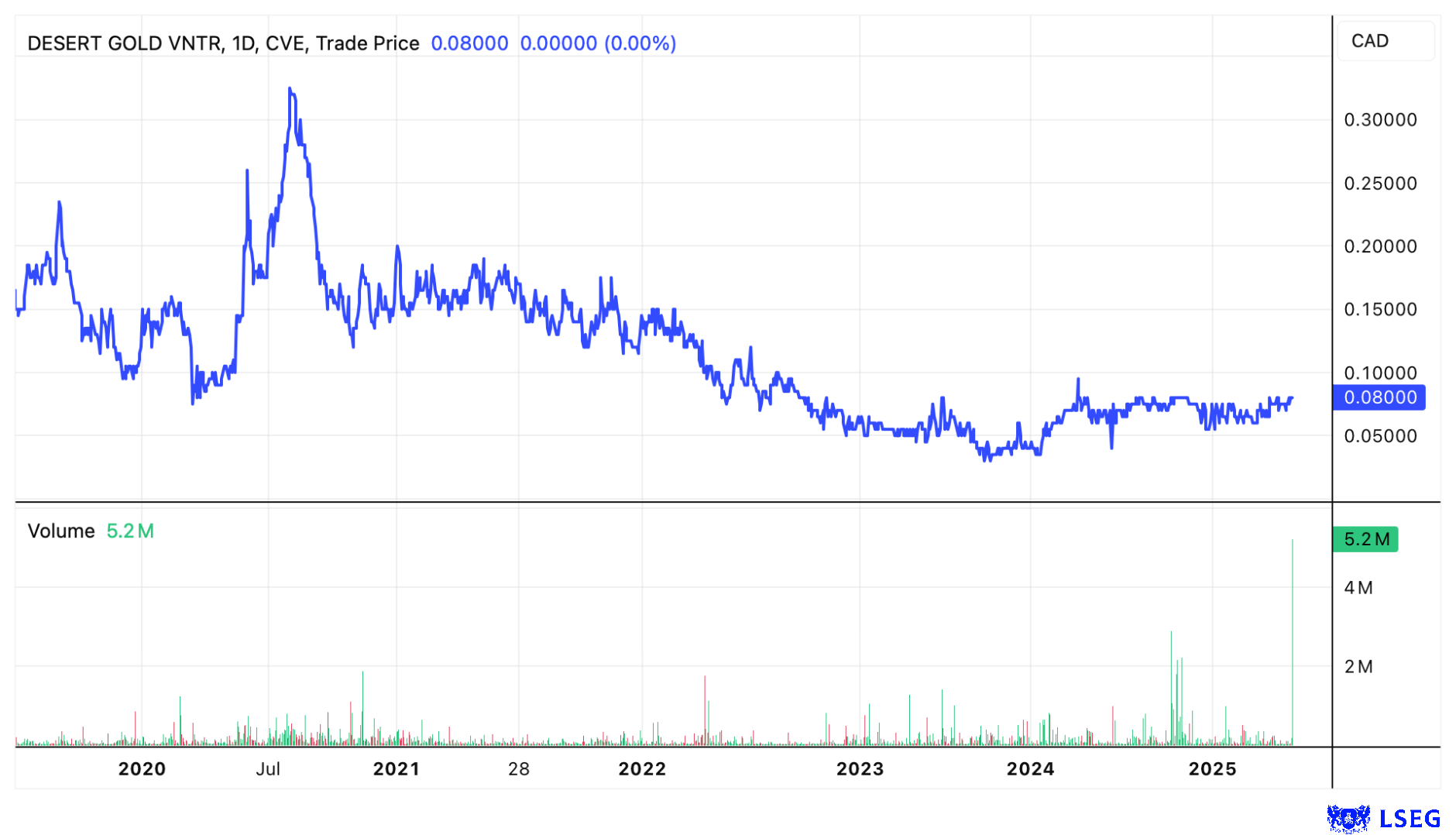

Renowned GBC analyst Matthias Greiffenberger has analyzed the situation in detail in a recent research report. He sets the target price at EUR 0.29 (approximately CAD 0.425) – a multiple of the current stock market price of around EUR 0.05 (CAD 0.08). The full report is available here: GBC Research Report.

Gold price explodes – and Desert Gold shares could follow

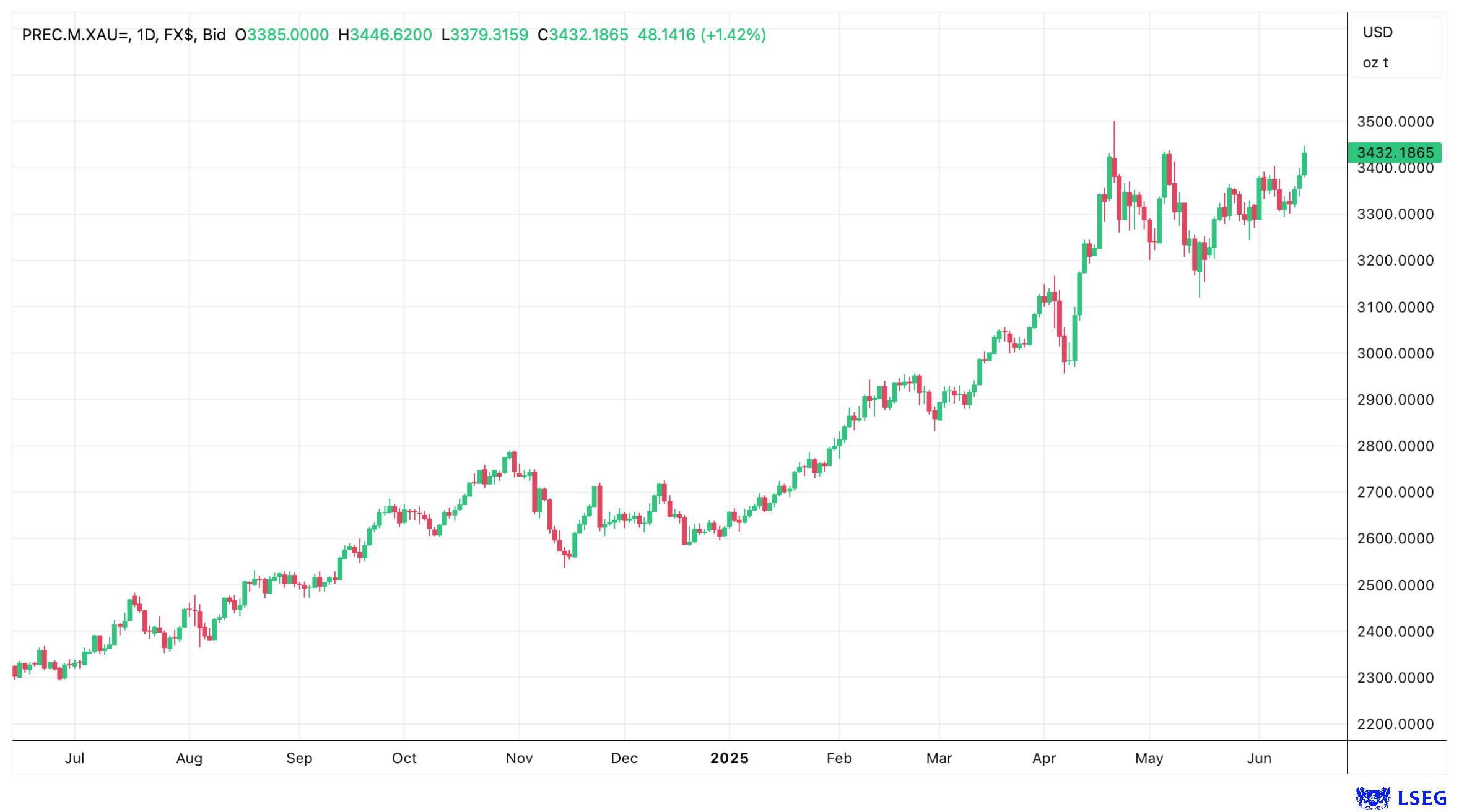

The timing for entry could hardly be better. Due to escalating tensions between Iran and Israel, the price of gold has reached record levels. At over USD 3,442 per troy ounce, the precious metal is trading close to its all-time high – and a jump above USD 3,500 seems only a matter of time. In uncertain times, investors traditionally flock to the "safe haven" of gold. Companies such as Desert Gold Ventures benefit twice over: from the rising value of their gold deposits and growing investor interest.

Trading activity is already rising rapidly. On Friday, over 5 million Desert Gold shares changed hands in Canada – at a price that is still far below analysts' targets. The market capitalization is currently just around USD 11 million, which means that the market values each ounce of gold proven in the ground at just USD 10. In comparison, the current gold price is over USD 3,442. This is a discrepancy that is unlikely to last long.

Conclusion: The next gold high-flyer?

The signs point to a revaluation: The PEA publication is the next big trigger to kick-start production and reveal the value of the project. The monumental rise in the gold price is acting as a turbocharger. With an extremely low valuation, massive confirmed deposits and a neighborhood of well-known producers, Desert Gold Ventures Inc. (WKN: A14X09 | ISIN: CA25039N4084 | TSXV: DAU) offers a highly exciting risk/reward profile for risk-tolerant investors.

Those who want to profit from this gold rush should act now. Once the PEA is published and production begins, the share price could skyrocket toward analysts' targets – potentially reaching multiples of its current level. Get in now before the market wakes up!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.