April 29th, 2025 | 07:10 CEST

Gold rush 2.0: Desert Gold could become the next takeover target in West Africa

In uncertain times, gold is again gaining attention as a safe haven. While the price of gold continues to climb to new record highs, exploration companies with substantial resources offer attractive potential – especially in established gold regions such as West Africa. Desert Gold Ventures, a Canadian gold explorer, is well positioned here. With a 440 sq km project in Mali, surrounded by large producing mines, and already confirmed and inferred resources of around 1.1 million ounces, the Company could emerge as a surprise candidate. But what makes Desert Gold special? We take a look at the facts.

time to read: 3 minutes

|

Author:

Armin Schulz

ISIN:

DESERT GOLD VENTURES | CA25039N4084

Table of contents:

"[...] Troilus has the potential to be an entire gold belt. All of our work to date points to this, and each drill hole makes the picture we have of the Troilus project much clearer. [...]" Justin Reid, President and CEO, Troilus Gold Corp.

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

Strategic location: Nestled in a world-class gold belt

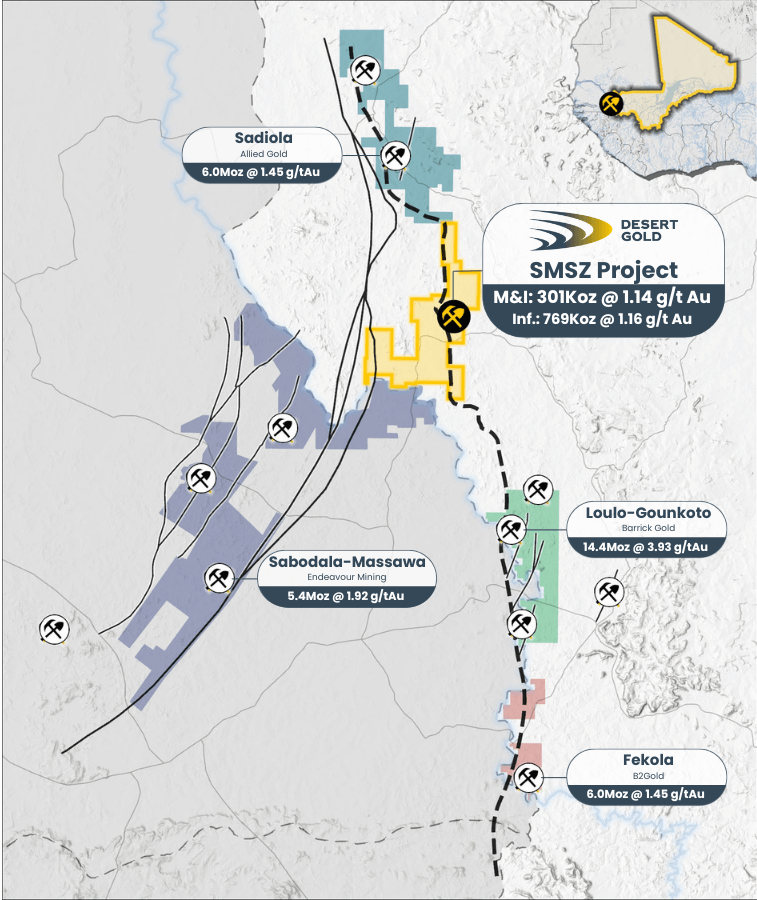

Desert Gold's flagship project, the Senegal-Mali Shear Zone Project (SMSZ Project), is located in the heart of the "Kenieba Window" – one of the world's most prolific gold regions. Direct neighbors include mining giants such as Barrick Gold with its Loulo-Gounkoto mine, B2Gold with the Fekola mine, and Allied Gold's Sadiola mine, which together produce several million ounces. This proximity to established operations is no coincidence, as geological structures such as the Senegal-Mali Shear Zone run through the area and provide ideal conditions for gold deposits.

Newly discovered historical data and new drilling indicate that the SMSZ project could host similarly promising veins as its neighbors. "Overall, this new data confirms our belief that the SMSZ project has significant exploration potential yet to be discovered," said CEO Jared Scharf. For investors, this means that Desert Gold is operating in an already validated environment, which is a key advantage over explorers in undeveloped regions.

Resource growth: Historical data highlights potential

The Company's confirmed and inferred resources total 1.1 million ounces of gold. But that is just the beginning. Recent historical drill data from a former Australian explorer has enabled Desert Gold to identify an additional 479,000 ounces that were not included in previous models. Particularly noteworthy are the Mogoyafara South and Linnguekoto West zones, where drilling has yielded some spectacular results, including 3.4 g/t gold over 12 m.

"The latest drilling and prospecting data improve our understanding of the Mogoyafara South deposit and suggest that further drilling is likely to result in an expansion of the gold zones," said Scharf. Up to 30,000 m of drilling is planned for 2025 to expand existing resources and explore new target areas. Analysts estimate that total resources could rise to over 2 million ounces in the medium term – a jump that would put Desert Gold in the circle of potential takeover targets.

Cost efficiency: Heap leach technology as a game changer

In addition to the quantity of resources, their efficient utilization plays a key role. The Company is currently evaluating the possibilities of gold production using a cost-effective heap leach method for a feasibility study (PEA) that is in progress. Initial estimates indicate a potential annual production of 200,000 ounces of gold. The planned processing capacity would be 20,000 to 30,000 tons of ore per month.

Once production starts, Mali's location advantages will come into play. With estimated total costs of only USD 700–800 per ounce, the project could be highly profitable given current gold prices. Heap leach technology offers clear advantages over conventional methods, both economically and ecologically. Eliminating costly steps such as fine grinding or chemical processing in stirred tanks significantly reduces operating expenses. At the same time, reduced water consumption and the recycling of process fluids minimize the environmental impact. If the study confirms the calculations, the transition from the exploration to the production phase could occur quickly.

Experienced team: Insiders show confidence

Another plus point is the composition of the shareholders. Around 80% of the shares are held by executives and strategic investors, including prominent names such as commodities expert Ross Beaty. This speaks for the confidence in the management, and at the same time, the few nervous shareholders dampen speculation-driven price jumps. For months, the share price has been trending in a narrow corridor between CAD 0.055 and CAD 0.08, waiting for news that will serve as a catalyst for an upward movement. The share is currently trading at CAD 0.07. Analysts at GBC rate the share as a "Buy" and have issued a price target of CAD 0.425.

Challenges: Political conditions in focus

Of course, Mali as a location harbors risks. The military council that has been in power since 2021 has presented a revised mining code that provides for higher taxes and state participation. Only Barrick Gold is directly affected by the disputes. However, there are signs of easing tensions. According to insiders, recent talks between the government and mine operators have been constructive. In addition, companies such as Desert Gold are benefiting from Mali's efforts to secure foreign investment in the raw materials sector.

Desert Gold combines several promising ingredients. A strategic location in an established gold belt, growing resources through systematic exploration, and an experienced team that itself holds a significant stake in the Company. The upcoming PEA and further drilling could mark a turning point in 2025, especially if the political environment stabilizes. For investors looking for long-term upside potential, the Company offers an interesting opportunity to get in early on a promising gold explorer. After all, the next takeover bid in West Africa could be just one drilling campaign away.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.