June 10th, 2025 | 07:15 CEST

Gold or Defense – Where to take action now? Rheinmetall, RENK, and Leonardo require caution, AJN Resources on the launchpad!

Russia's war of aggression against Ukraine shows no signs of ending. Despite all political efforts on both sides of the Atlantic, the Russian commander is continuing his bombardment of his neighboring country. NATO sees many reasons in the aggressor's behavior to significantly increase its military capabilities. This is causing further investor money to flow into defense stocks, but valuations are now very ambitious. However, in their search for security, investors are also increasingly buying gold, which could rise to as high as USD 3,490 per ounce in 2025. Low production costs are bringing low-cost projects in Africa into focus. AJN Resources has just refinanced and is repositioning itself in Ethiopia. How can investors diversify wisely?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , RENK AG O.N. | DE000RENK730 , LEONARDO S.P.A. EO 4_40 | IT0003856405 , AJN RESOURCES INC. O.N. | CA00149L1058

Table of contents:

"[...] We can make a big increase in value with little capital. [...]" David Mason, Managing Director, CEO, NewPeak Metals Ltd.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

AJN Resources – Gold in East Africa in focus

Gold has already reached prices of USD 3,490 in 2025, while silver is climbing to new highs every day, most recently touching the USD 36.75 mark. This is putting pressure on producers and explorers. Due to ongoing high inflation, rising long-term interest rates, and concerns about financial stability, precious metal investments are becoming increasingly attractive. Central banks are also playing along. China is gradually selling US bonds due to ongoing trade disputes with Donald Trump and increasing its gold reserves. The central banks of India, Russia, Switzerland, Poland, and Turkey are following suit and, according to the World Gold Council, purchased a total of 1,045 tons of the yellow metal in 2024. The trend looks set to continue in 2025.

Canadian explorer AJN Resources is heavily diversified in Africa. The experienced management team led by CEO and President Klaus Eckhof has put lithium in the Congo on hold for the time being and is now focusing on gold projects in East Africa. These include a 70% stake in the Dabel Gold Project, which covers an area of 672 sq km. It is located 250 km south of the 4.5 million ounce deposit in Lega Dembi, Ethiopia, in the Adola Gold Belt, Ethiopia's largest gold mine. Just 100 km from Lega Dembi, AJN resumed its acquisition activities at the end of May and acquired a 70% interest in the 42.8 sq km Okote gold project. The seller of this attractive area was Godu General Trading S.C. As early as 2019, MIDROC had already completed 13,761 meters of drilling, yielding mineralization at various lengths with grades ranging from 1.6 to 8.7 grams per ton. AJN now intends to validate these historical drill results as quickly as possible. The historical drilling covered a strike length of 2,400 meters, with the highest concentration of drill holes extending over an area of 1,000 x 400 meters in the northern part of the drilled zone. AJN will prepare a NI 43-101 report and a mineral resource estimate during the due diligence phase, with a potential of several million ounces of gold expected.

AJN Resources is undergoing an interesting refocusing with significant potential through its involvement in Ethiopia and Kenya. At the end of May, the Company raised CAD 500,000 through a capital increase at CAD 0.12 per share. With a market capitalization of just CAD 5 million, the Company is extremely undervalued. This makes AJN Resources a compelling option for future discoveries and corresponding value increases, especially in the current environment. The shares are tradable on almost all German stock exchanges in addition to Canada.

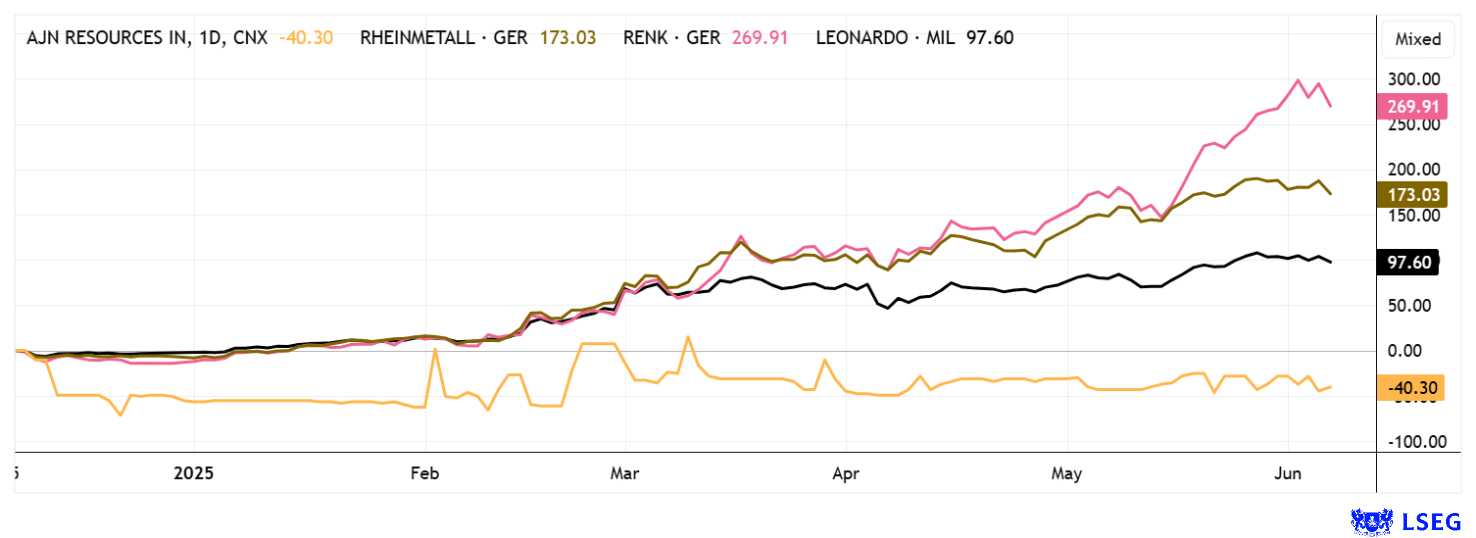

Rheinmetall – A business model for generations

Gold is not the only thing promising dream returns. Over the past 12 months, Rheinmetall shares have defined what a real "rally" means. Boosted by government announcements to increase investment budgets for defense equipment to around 5% of GDP, the defense technology supplier achieved a performance of over 230%. Since the beginning of 2022, the share price has even increased twentyfold. Such a performance has rarely been seen in Germany. Looking at the current market value of almost EUR 100 billion, temporary overvaluations can be identified. It seems investors are already willing to pay today for operational developments extending to 2030.

According to analysts on the LSEG platform, the Rhineland defense company's revenue will increase by a factor of 3.5 to over EUR 32 billion over the next five years. From a current P/E ratio of 60, the earnings valuation is then expected to fall to 18. This assumes, of course, that all announced defense budgets will clear the legislative hurdles and thus arrive in the sector on time. Rheinmetall must work on its capacities, which also costs time, money, and, above all, skilled workers. Given the high valuation of EUR 85 billion, experts doubt this will all go smoothly. 15 of 19 analysts have raised their price targets to an average of EUR 1,875. This price was already reached last week at EUR 1,950. Consider reducing part of your position and set a stop at EUR 1,650 in case the sector experiences a significant correction.

RENK and Leonardo – Quick profits to be had

The situation is similar for peer group companies RENK and Leonardo. The Augsburg-based RENK Group only went public in 2024 at EUR 16 and reached dream targets of EUR 86 last week - more than 300% in less than 18 months. The major French bank BNP reacted quickly and downgraded the stock to "Underperform." However, the price target was raised from EUR 46 to EUR 72. At the end of the first quarter, the Company reported a remarkable order backlog of EUR 5.5 billion and a project pipeline of EUR 12 to 13 billion. These figures support the increased revenue target of EUR 2.5 to 3.0 billion by 2030. With all due respect, even based on these top forecasts through 2030, the price-to-sales ratio is already at a factor of 3 today! The fair value is likely to be around EUR 55, at least according to analysts on the LSEG platform. The supplier of propulsion technology for military vehicles and naval vessels could, therefore, still see further declines in its share price.

The Italian industrial group Leonardo S.p.A. is not really any cheaper. With a market value of around EUR 30 billion, the share price has more than doubled in the last 12 months. The current revenue estimate for 2025 stands at EUR 18.9 billion, but earnings per share are expected to rise to only EUR 1.77. This puts the P/E ratio at a high 30, based on projected annual revenue growth of around 10%. At this level, a share price of approximately EUR 52 already appears to fully reflect future expectations. Caution is advised!

After extensive revaluations in defense stocks, a rotation to other segments could occur in the coming weeks. Gold and silver stocks currently look attractive. While producers are already on the move, there is still little activity among juniors. However, historical experience shows that microcaps only really take off in the second wave. Speculative investors should, therefore, position themselves in advance.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.