April 16th, 2025 | 07:55 CEST

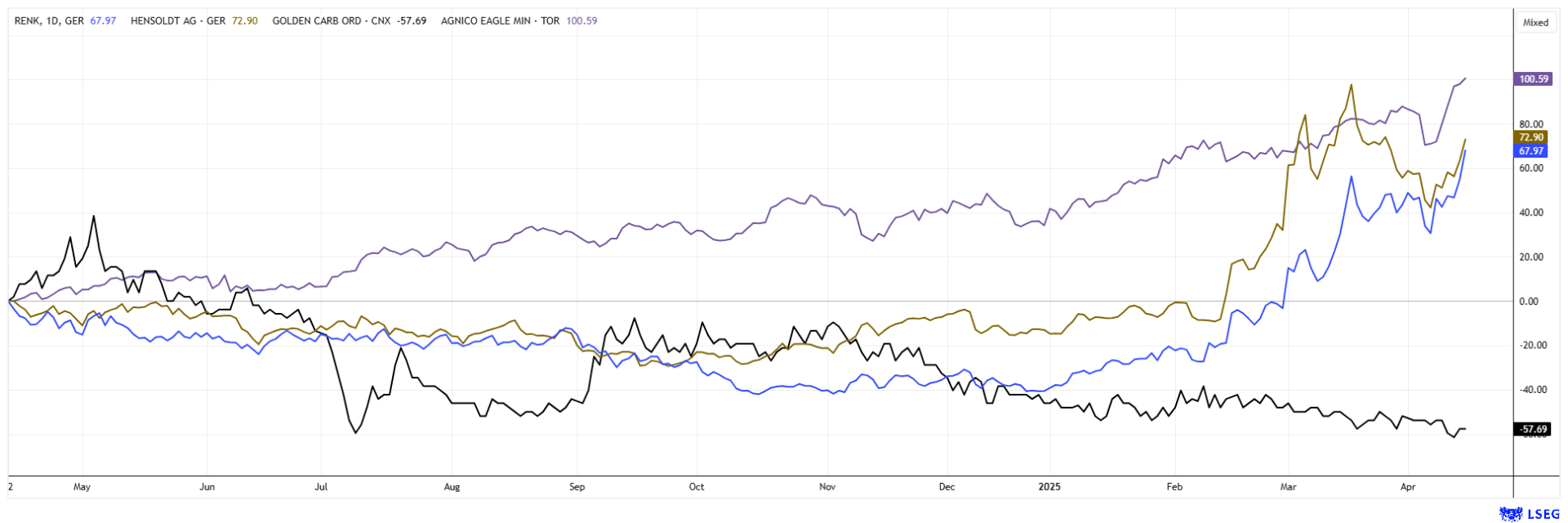

Gold in focus, Defense accelerates again – Agnico Eagle, Golden Cariboo, Hensoldt, and RENK in focus

The daily theatrics are hard to beat. US President Donald Trump is engaging in slapstick and snubbing long-standing trading partners. In his own country, he leaves no stone unturned in his efforts to counterbalance the nearly USD 36 trillion national debt through savings and additional revenues. This creates great uncertainty in the stock markets and causes economic institutes to calculate more precisely whether, instead of growth, a recession may be looming. But perhaps it is all just a test to force political partners to the table. However, the threat of inflation means that precious metals remain in focus. Unresolved geopolitical conflicts also continue to drive defense machinery forward. Here, a volume in the triple-digit billion range is expected, which will result in revenue in the coming years. The train is running at full steam!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

AGNICO EAGLE MINES LTD. | CA0084741085 , GOLDEN CARIBOO RESOURCES LTD | CA3808134025 , HENSOLDT AG INH O.N. | DE000HAG0005 , RENK AG O.N. | DE000RENK730

Table of contents:

"[...] The processes in Namibia are predictable and the country itself is very safe. [...]" Heye Daun, President and CEO, Osino Resources Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Agnico Eagle – In gold we trust!

Daily new highs make the gold price a beloved stock ticker. The biggest beneficiaries of creeping inflation are the producers, who mine at costs between USD 850 and 1,450 and are currently able to sell at more than USD 3,200. A warm shower that is boosting the balance sheets. When investors are asked about their favorite gold stocks, the names Barrick Gold, Newmont, and Agnico Eagle are often mentioned. In the case of Agnico-Eagle, all signs point to growth. In the last 12 months, the stock has gained a whopping 82%. Agnico Eagle is a Canadian-based gold mining company and is currently the third-largest gold producer in the world. The Company mines in Canada, Australia, Finland, and Mexico and has several high-quality exploration and development projects. This allows the Canadians to minimize political and regulatory risks that often arise in other countries. The Company was founded in 1957 and has paid a cash dividend to its shareholders every year since 1983. The stock is currently the most stable performer among all gold stocks.

In 2024, the Toronto-based company achieved a record result. Gold production amounted to 3.49 million ounces at an operating cost of production of USD 885. All-in sustaining costs (AISC) amounted to USD 1,239 and cash flow from operating activities reached USD 3.96 billion. Between 2025 and 2027, 3.3 to 3.5 million ounces of gold are expected to continue to be mined. Yesterday, the Agnico Eagle share price reached a new high of around EUR 105. The stock is a stable portfolio anchor with solid long-term growth!

Golden Cariboo – A promising property

The Cariboo Gold Rush of the 1860s was one of the most significant mass migrations in Canadian history and played a central role in the development of the province of British Columbia. Large amounts of gold were discovered at Williams Creek in the Cariboo region, and the town of Barkerville sprang up in the middle of nowhere. It quickly became the booming center of the gold rush, with hotels, theaters, saloons, and even a printing press. At the time, it was the largest city west of Chicago and north of San Francisco. To reach the remote goldfields, the colonial government under Governor James Douglas built the Cariboo Road – a 600 km technical masterpiece through the mountains. Barkerville was rebuilt after a fire in 1868 and is now a National Historic Site commemorating the Gold Rush.

But even today, British Columbia is still an important location for gold mining, with active mines such as Brucejack and Red Chris, which are producing high-grade deposits. The exploration company Golden Cariboo (GCC) has already revealed its goals in its name, with a focus on the Quesnelle property. The property is contiguous with Osisko's and trends along the Spanish and Eureka thrust faults and covers a whopping 94,889 hectares of land. Results are now available from drill hole QGQ24-21 at the Halo Zone. It intersected a zone of strong, consistent gold mineralization, including multiple occurrences of visible gold from 257 meters depth. This makes the current drill hole the ninth consecutive hole with visible gold since the initial discovery of the Halo Zone in July 2024.

President and CEO Frank Callaghan states: "Building on the success of last year's extraordinary discovery on our Quesnelle gold-quartz mine property, the entire team could not wait to resume drilling in 2025. To start with another discovery of visible gold is nothing short of exciting."

In March, a second tranche of financing totaling CAD 1.2 million was completed, with the placement still outstanding. The Golden Cariboo share (GCC) is currently trading at around CAD 0.11, bringing the 70.23 million shares to a total value of CAD 7.8 million. With expensive spot gold and strong drill results backing it, the share price should rise rapidly!

Hensoldt and RENK – Never more in demand than today

Rarely have there been stock market phases in which traders could call "long only" for a specific sector. In addition to gold stocks, this has been the defense sector for several months. Stocks that were previously priced at single-digit P/E ratios are now benefiting from NATO's rearmament plans, including the mobilization of taxpayers' money to finance these orders. Hensoldt has doubled in value since the end of January, rising from just under EUR 40 to EUR 80.75, although Trump's tariff rant pushed the price back down to EUR 55. Yesterday, the Company's shares peaked again at EUR 68.70, with investor interest unabated. Looking at the analysts on the LSEG platform, average 12-month price targets of EUR 58.10 are being called. Only 5 of 12 analysts are still giving the thumbs up. Caution!

The median price expectation of the Augsburg-based transmission specialist RENK is EUR 47.90. This was already clearly exceeded yesterday, with prices reaching EUR 51.99. Based on 2025 estimates, RENK has now reached a P/E ratio of 35, while the price-to-sales ratio stands at 3.5. From a rational perspective, both stocks should rather be sold. Nevertheless, large sums of money are apparently flowing into the newly ESG-compliant defense stocks. National security has now become a sustainable investment topic. Overall, it is a fundamental tightrope walk on the volcano - especially if wars were ever settled. But momentum is always right, or as they say: "The trend is your friend".

**Larger turbulences like those of the past four weeks are unlikely to occur again soon. However, the days of low volatility are likely over. There are too many imponderables and instabilities affecting stock market prices. Investors are seeking salvation in the now overpriced defense stocks. The first booster stage has now been ignited in gold. The rally is likely to soon reach the juniors like Golden Cariboo.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.