September 17th, 2025 | 07:15 CEST

Gold explodes to USD 3,700 – What is next? Time to bet on Barrick Mining, Newmont, Dryden Gold and BASF

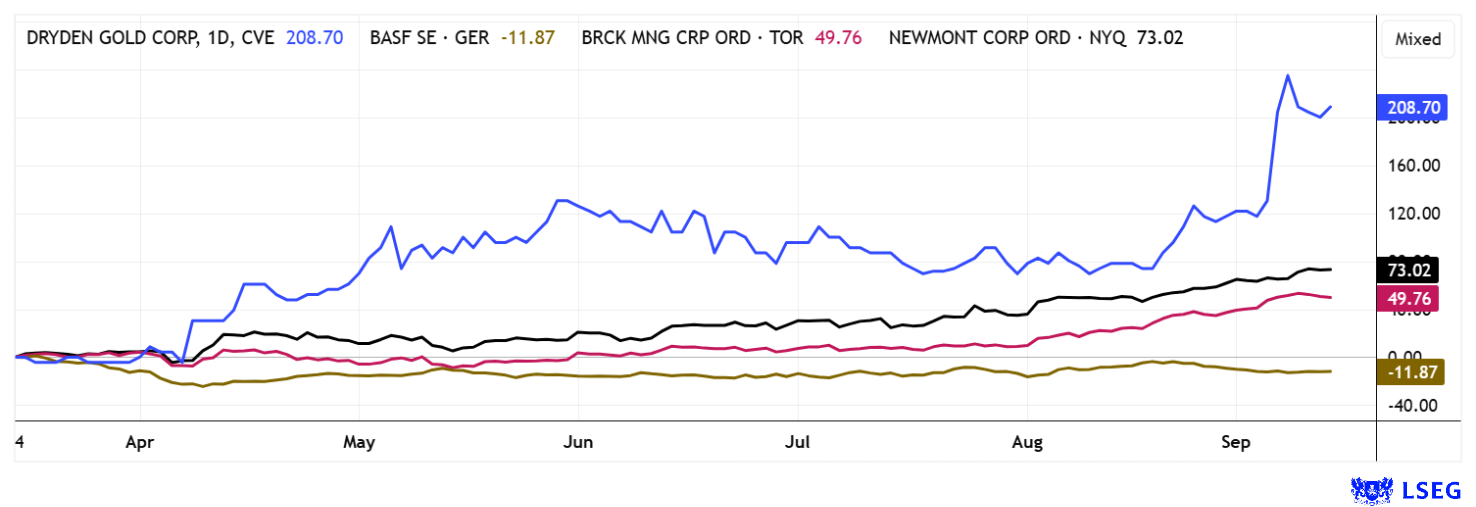

The gold price is currently being driven primarily by expectations of falling US interest rates, a weaker US dollar, high geopolitical uncertainty, and strong purchases by central banks. The latter added around 1,045 tons of gold to their reserves in 2024, one of the highest levels in recent years. Major US investment banks have consistently raised their price targets: Goldman Sachs expects around USD 3,700 per ounce by the end of 2025, JPMorgan sees an average of about USD 3,675 in Q4, and UBS even forecasts up to USD 3,800. In very optimistic scenarios, prices of over USD 4,000 are already being discussed in industry. How are gold giants Barrick and Newmont performing in this environment? In the short term, they have been significantly outperformed by Dryden Gold, which has recently doubled in value. Investors should now drastically increase their exposure to precious metals, as they have been overinvested in AI, high tech, and defense for months. Here are a few ideas.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BARRICK MINING CORPORATION | CA06849F1080 , NEWMONT CORP. DL 1_60 | US6516391066 , DRYDEN GOLD CORP | CA26245V1013 , BASF SE NA O.N. | DE000BASF111

Table of contents:

"[...] One focus will be on deposits near the surface. These would be good arguments for a quick production decision using the low-cost heap leaching method. [...]" Brodie Sutherland, CEO, Tocvan Ventures

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Barrick and Newmont – Time to reap the rewards

Barrick Mining and Newmont shares have already gained significantly since the turn of the year, rising by 50 to 85%. If the price of gold continues to rise, the rally could even continue. However, despite high cash flows, things will not get any easier for either company. In order to meet investors' heightened expectations, new properties must be developed. Barrick Mining is working on Reko-Diq in Pakistan and finally plans to make progress in Mali. But challenges remain: the political situation in Balochistan is fragile, and conflicts and local resistance to foreign investors pose risks to the schedule and security. High cash flow at mid-year could now be used to accelerate exploration programs. Barrick is currently attracting attention with its favorable valuation and higher growth expectations: its 2026 P/E ratio is only 11.2, well below industry average, and analysts on the LSEG platform see around 30% upside potential.

Newmont shines with massive liquidity, an equity ratio of over 50%, and broad international diversification from the Newcrest acquisition, enabling production increases and robust cash flow. Pre-tax profit of just under USD 10 billion is expected in 2025. Although the 2026 P/E ratio of 14.4 is slightly higher than that of Barrick, the stock has already risen by over 85% this year. In the short term, Newmont offers the more stable outlook for risk-averse investors, while Barrick presents the more attractive growth story. In the big picture, both stocks can enter the harvest phase, and investors can hope for an increase in earnings forecasts. On top of that, there is a constant dividend of 2.5% per annum.

Dryden Gold - Spectacular drilling results make Gold Rock shine

Things are moving much faster at Canadian explorer Dryden Gold. The Company is making headlines with new drilling results from the Gold Rock Camp in Ontario, positioning itself as one of the most exciting gold explorers in North America. In September, Dryden reported its most significant drill intercept to date from the so-called Gap Hole, which intersected 9 stacked gold mineralized structures over a length of 540 meters. Particularly impressive is a high-grade section with 55.34 g/t gold over 3.50 meters, including 379.00 g/t over 0.50 meters in the Jubilee hanging wall. This discovery highlights that Dryden Gold hosts a significantly larger and more robust gold system than previously assumed, with open-pit potential still very much on the table.

Previous drilling at Elora has already yielded spectacular results, such as 301.67 g/t gold over 3.90 meters and visible gold in several parallel structures over a kilometer in length. The geology is reminiscent of legendary deposits such as Red Lake. The Gap Hole now confirms the hypothesis: the Gold Rock target area is a largely exposed mineralization system with multiple geological control factors such as shear zones, folds, and en-echelon structures. This diversity opens up new opportunities for high-grade extensions.

Initial tests in the Big Master system, near the historic mine of the same name, also demonstrate further potential. Here, a near-surface zone grading 0.93 g/t over 9.00 meters was intersected and mineralization was extended along strike. This indicates that the area contains a series of parallel structures that have been little explored to date. Historical production near Laurentian gives the team additional optimism, as many of the identified structures appear to be related to old mining zones. Thanks to state-of-the-art exploration techniques, Dryden Gold can now precisely locate and further develop these zones. The Company controls approximately 70,000 hectares in a stable mining district with excellent infrastructure, low-cost energy supplies, and strong relationships with indigenous communities. Partners such as Centerra Gold and Alamos Gold underscore the strategic importance of the projects. With an additional CAD 5.8 million secured for drilling in 2025, the next steps are solidly financed. The goal is to deliver an initial resource estimate, supported by the potential for further discoveries.

For investors, this means that Dryden Gold combines first-class geology with stable conditions, an expanding land package, and spectacular drilling results. The stock has already gained over 200% in recent months, and the story is likely to continue to delight investors due to the favorable outlook in parallel with the gold price. Buy!

BASF – Little golden glow in Ludwigshafen

Far removed from the gold market, the chemical industry in Germany is not exactly shining brightly. Due to ongoing geopolitical conflicts, rising customs duties, and declining export prospects, things are no longer looking so good for the industry leader BASF. Energy costs are a particular problem, as gas-dependent production has led to an additional burden of a good 50% per annum since 2022. An industrial group must first be able to absorb this through its margins.

Not entirely surprisingly, BASF recently issued a profit warning for 2025: Adjusted EBITDA was lowered from EUR 8.0 - 8.4 billion to EUR 7.3 - 7.7 billion, mainly due to the weaker global economic environment. Net profit already fell from EUR 430 million to EUR 80 million in Q2. While the Agricultural Solutions segment performed well with 21% volume growth, basic chemicals and industrial solutions weighed on earnings. Energy prices and CO₂ taxes remain a constant cost driver, keeping margin pressure high. Although BASF continues to expect stabilization through cost-cutting programs, the environment remains uncertain. The share price has recently shown a slight recovery from its low of EUR 38 and is recommended as a "Buy" by 15 analysts on the LSEG platform. Experts see an average potential of up to EUR 52, with BASF trading at just under EUR 44 yesterday. Technical analysts see long-term support in the EUR 38 to 41 range. The dividend of around 6% is a stabilizing factor, but investors should keep an eye on the strong margin pressure and geopolitical risks, which could lead to a decline in the payout in the future.

In the first half of the year, the stock market favored technology and defense stocks in particular. In some cases, these stocks generated triple-digit returns. For several weeks now, however, precious metals have been causing a stir. This brings the blue chips, Barrick Mining and Newmont, to the fore. Not yet so well known, but no less successful due to recent discoveries, is Dryden Gold, a promising addition for risk-conscious investors.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.