September 30th, 2025 | 07:10 CEST

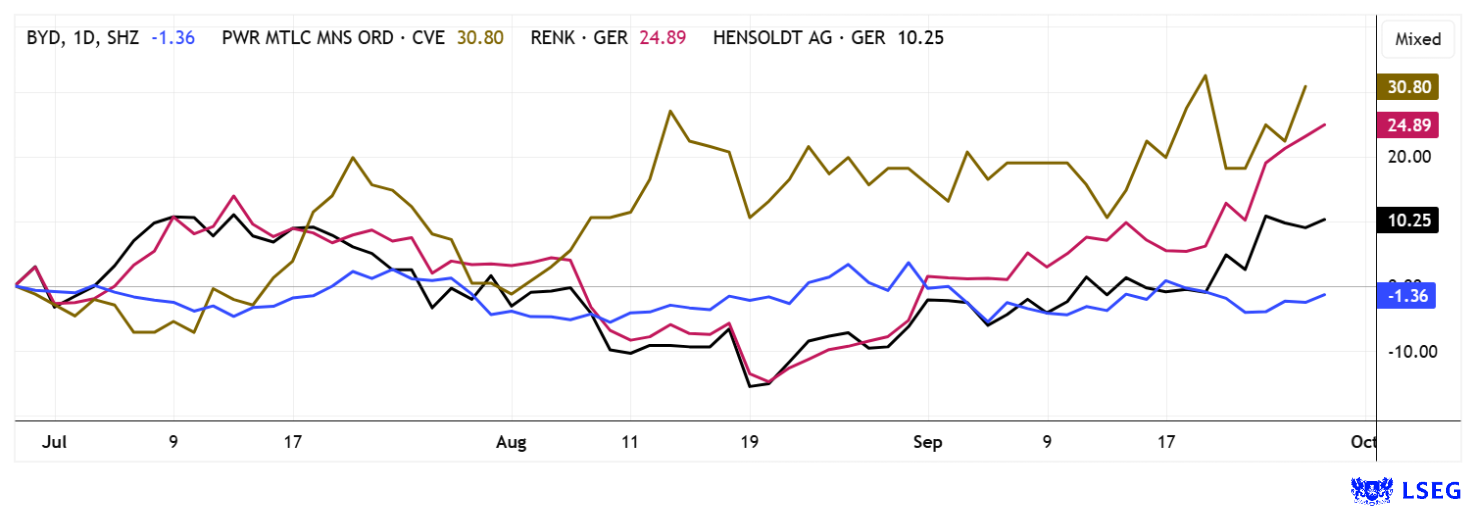

Gold boom boosts critical metals! Another 100% with Power Metallic, BYD, Hensoldt and RENK

The geopolitical situation continues to escalate, but the stock markets continue to boom! Trade conflicts, sanctions, and military tensions dominate the headlines, but behind the front lines of a new Cold War, another competition has long been raging: the battle for access to critical metals. Without copper, lithium, nickel, cobalt, or rare earths, not only would the e-mobility revolution come to a standstill, but defense technologies, digitalization, and the energy transition would also grind to a halt. Supply chains are coming under increasing pressure from geopolitical power games, and the battle for resources is becoming a key strategic factor in a multipolar world order. For Western industrialized nations, security of supply is becoming a matter of survival, and for investors, this is creating new opportunities. Anyone looking for tomorrow's winners today should keep a close eye on the global raw materials poker game.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

POWER METALLIC MINES INC. | CA73929R1055 , BYD CO. LTD H YC 1 | CNE100000296 , HENSOLDT AG INH O.N. | DE000HAG0005 , RENK AG O.N. | DE000RENK730

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD – Conquering Europe

One major consumer of a wide variety of metals is BYD, the export-strong Chinese market leader in e-mobility. The Company currently holds around 8 to 9% market share in Europe in countries such as Spain, Italy, and the UK, but continues to struggle in the leading market of Germany with fewer than 3,000 new registrations in 2024. However, the strategy of rapid market entry via third countries is working very well, and EU import tariffs will soon no longer be an issue. In addition to plants in Hungary and Turkey with a planned capacity of around 500,000 vehicles per year, BYD is now also considering setting up its own European battery factory in order to reduce its dependence on China and minimize EU tariffs. In the short term, the focus could be more on plug-in hybrids, which are exempt from customs duties and are gaining popularity among European customers.

At the IAA Mobility, BYD presented its model offensive and announced its intention to manufacture across Europe by 2026. While demand is skyrocketing in southern Europe, Germany remains a stumbling block: too many models, an immature dealer network, and residual value problems due to high registration numbers in rental car and company fleets. BYD is responding by pushing ahead with the expansion of its dealer network, focusing on better residual value programs, and laying the foundation for "Built in EU" with European production in Hungary. Despite the exit of major investor Berkshire Hathaway, which realized profits of over 1,000% after 17 years, BYD remains on a strong growth course. With over 4.3 million vehicles sold worldwide, market share rising in Europe, and a clear industrial plan, the challenge remains to strike a balance between volume and profitability. Germany will determine whether BYD makes the leap from "importer" to "European manufacturer." The China image is likely to remain, but it is questionable whether Germans will remain loyal to the brand in the face of persistent inflation.

BYD is no longer a newcomer in Europe, but is on its way to becoming a serious challenger to Volkswagen, Stellantis & Co. Those who invest now are betting on a manufacturer with global scale, a rapid model pipeline, and growing production in the EU. The stock has corrected 35% from its high of EUR 17.70, and analysts on the LSEG platform expect a 12-month price target of CNY 136, equivalent to EUR 16.30 – a potential gain of 50%.

Power Metallic Mines – North America reduces dependence on China

Power Metallic Mines from Canada is causing quite a stir amid global commodity turmoil. The energetic CEO Terry Lynch is vigorously driving expansion forward, relying on a clear growth strategy. The Company recently secured a total of 313 additional concessions from the well-known Li-FT Power in the vicinity of the Nisk project in Québec. Li-FT received CAD 700,000 in cash, six million shares and a 0.5% smelting royalty in return, while Power Metallic significantly strengthened its land position and secured long-term options. This is a promising deal at a time when North America is increasingly relying on its own supply chains for nickel, copper, platinum group metals, and gold in light of declining dependence on Asia. Political stability and government support programs are also providing tailwinds for commodity explorers in Québec, one of the most dynamic mining regions in the world.

In parallel, Power Metallic has now reported results from its 2025 summer exploration program, which impressively underscore the substance of the project. A total of 34 drill holes were completed over a total length of 17,250 meters, accompanied by underground electromagnetic surveys. The Lion Zone in particular delivered top results: Hole PML-25-020 returned a total of 22.66 meters with 4.57% copper equivalent, including 6.05 meters with a whopping 9.70%. Hole PML-25-015, in turn, returned 28 meters at 4.28% CuEq, including a high-grade passage of 3.4 meters at 15.45% CuEq. These results demonstrate not only the continuity of the mineralization system, but also the potential for resource expansion. In addition, exploration was conducted in the Tiger Zone and the newly acquired Li-FT area, with initial laboratory analyses still pending. The Nisk deposit also remained part of the drilling program, while state-of-the-art VTEM measurements identified new conductors. In the Lion Zone, a specially constructed drill road infrastructure now enables year-round operation. Furthermore, Power Metallic was able to secure additional land rights in strategically located areas in Québec through a government bidding round - a clear move to expand its project pipeline.

After an impressive rally in 2024, Power Metallic is now back in the spotlight. The Canadian company remains in focus due to its role in securing North American supply chains, and now, alongside a significantly expanded land position, substantial drilling results have been delivered. The PNPN stock has gained new technical momentum after breaking above the CAD 1.50 level. Investors should not hesitate any longer!

CEO Terry Lynch was recently on a roadshow in Germany and will also present an investor update at the 16th International Investment Forum (IIF) on October 8 at 1:30 pm.

Hensoldt and RENK – The threat remains

A quick technical look at Hensoldt and RENK. After a good three months of consolidation, defense stocks are now poised for a new rally. Order intake is exploding after Russia apparently did not shy away from NATO countries. Constant provocations at the border and in the Baltic Sea are forcing Western budget administrators to increase military spending. This is further boosting the few manufacturers and even creating further investor purchases in a totally overheated market. Hensoldt reached a new all-time high yesterday at EUR 109.50. RENK is also rapidly approaching its record high of EUR 86.20. With a performance of over 275%, RENK has performed almost as well as Rheinmetall in 12 months. What remains is the historically high valuation of the entire sector. But that no longer bothers investors. What counts is positioning against a third world war, which is becoming more likely every day.

Demand for raw materials from politically stable regions is reaching new highs, and North America is increasingly becoming the focus of strategic investors. In both the US and Canada, this is paving the way for a new raw materials offensive. For industry giants such as BYD, RENK, and Hensoldt, reliable supply chains for critical metals are no longer just a competitive factor but a matter of survival. This is exactly where Power Metallic comes in, positioning itself as a potential key player in supply security with a promising premium property in Canada.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.