July 28th, 2025 | 07:25 CEST

Gold and silver rally in 2025 – Panic buying ahead! Silver North, BYD, and VW in the fast lane!

Silver has long since ceased to be gold's little brother! Over the past 12 months, silver has clearly outperformed its big brother, rising 38% compared to a 27% increase in gold. This is due to several factors. Firstly, there are only around 240 active silver mines worldwide, compared to 1,350 gold mines. In recent years, silver has established itself as an industrial metal, as it is in high demand in high-tech, e-mobility, defense, and medical applications. This means that less and less of the coveted metal is left for the investment market, and physical stocks on the futures markets are also declining steadily. The time has therefore come to allocate some of your portfolio to silver, the little brother of gold, which has performed well. Silver explorers and developers offer the greatest leverage. Here are a few ideas.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

SILVER NORTH RESOURCES LTD | CA8280611010 , BYD CO. LTD H YC 1 | CNE100000296 , VOLKSWAGEN AG VZO O.N. | DE0007664039

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Silver – A strategic metal new to the investor's list

Silver plays a central role in the production of electric vehicles (EVs), primarily because of its excellent electrical conductivity, which is the best of all metals. Today, an average electric vehicle contains about 25 to 50 grams of silver, and premium and high-performance models can contain up to 80 grams. The demand for silver is thus significantly higher than for combustion engines, which require around 15 to 28 grams. Much of the silver in EVs is found in electrical contacts, switches, relays, and control units, but primarily in power electronics and inverter modules that regulate the flow of electricity between the battery and the motor. Battery management systems and integrated control units also rely on silver-based contacts to minimize heat generation and maximize efficiency. With the increasing digitalization of EVs, such as through autonomous driving, infotainment systems, or driver assistance functions, the demand for silver-containing circuit boards and sensors is also rising. The trend toward electromobility, therefore, has a direct impact on industrial demand for silver. According to estimates by the Silver Institute, silver demand in the transportation sector alone is expected to double by 2030. This makes silver not just a precious metal or traditional raw material, but a strategic metal of the future.

Silver North – A sought-after commodity from the Yukon

There is plenty of silver in the Yukon region of North America. Savvy investors looking for returns are turning their attention to Silver North's (SNAG) Tim and Haldane projects. The Haldane project borders Hecla Mining's property and is considered underexplored. So far, only 27 drill holes have been completed, but some of these have shown very high silver grades of over 300 grams per tonne. The Tim property, located 72 km west of Watson Lake and 19 km from Coeur Mining's Silvertip mine, is easily accessible by road and has anomalous silver-lead-zinc values. It is considered promising for so-called CRD deposits, such as those found at the Silvertip site. In 2024, Coeur Mining, as a partner, carried out an initial six-part drilling program, the results of which are still pending. Under an option agreement, Coeur can gradually secure up to 80% of Tim's capital in exchange for its extensive geological and technical expertise.

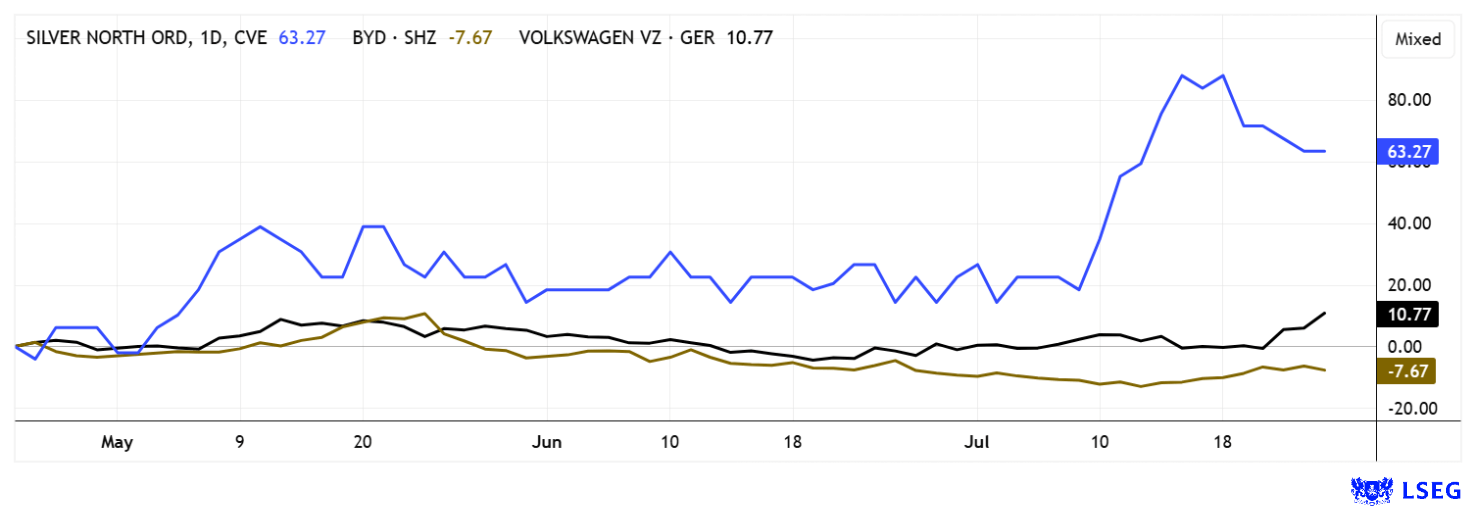

Thanks to its robust infrastructure, the current upturn in industrial activity, and the general sentiment toward silver, Silver North is currently attracting considerable attention. This is reflected in SNAG's share price, which has doubled since April 2025. The reason for this is a robust shareholder structure and good access to the capital market. With the prospect of approximately CAD 2.6 million in new equity, the sails are set for the second half of the year. With a market value of only CAD 13 million, investors should not hesitate for long.

BYD – Sales of electric models are stalling

Despite a stock market rally, Chinese electric vehicle manufacturer BYD is in trouble. Over 340,000 vehicles are sitting unsold in warehouses, mainly in Europe. A rarely aggressive expansion policy led to overproduction, and now BYD is forcing sales with massive price cuts, dragging the entire industry into ruinous competition. Dealers are offering high discounts on so-called "zero-kilometer" vehicles with registered previous owners, new branches are already closing, and production lines are being cut back across the group.

Analysts are now sounding the alarm because, despite all the euphoria surrounding the market leader, the scenario is increasingly reminiscent of the Evergrande real estate disaster. Although the Company is not officially reporting any losses, hidden debts to suppliers are weighing on its results. In addition, the low capacity utilization of many Chinese manufacturers, averaging less than 50%, makes a market shakeout likely. This could present an opportunity for European automakers: those who focus on quality, sustainability, and safety should benefit from the weakness. BYD shares have fallen by around 25% since their high, bringing the market capitalization back to well below EUR 100 billion. If BYD achieves its ambitious growth targets, the 2026 P/E ratio would be very low at 11, but the risks remain considerable. A comeback or the next big Chinese disaster?

VW – The figures triggered a jump in the chart

Perhaps it is the VW Group that will bring BYD to its knees. Volkswagen reported a significant decline in net profit to EUR 2.29 billion in Q2 2025, down by nearly a third compared with the previous year. The main reasons were massive US tariffs of EUR 1.2 billion, sales declines in the US, and weak results for the premium brands Audi and Porsche. Audi lost two-thirds of its operating profit, while Porsche earned almost 90% less in the car business than in 2024. The operating margin fell dramatically to 4.7%, with only a 3% decline in sales and a slight increase in deliveries. The impact of tariffs is fully transparent here, with demand for expensive models falling. High restructuring costs and lower-margin electric vehicles were additional burdens. Audi now plans to cut 7,500 jobs, and Porsche at least 1,900. Across the group, approximately 35,000 jobs are expected to be cut by 2030, with 4,000 having already been implemented. Nevertheless, CEO Oliver Blume sees progress in the electric vehicle business: VW was able to expand its market share in Europe to 28%, and full order books are making management cautiously optimistic. VW shares regained the EUR 100 mark on Friday. This could be the starting signal for an extensive turnaround rally! As a reminder, VW has a 2025 P/E ratio of 3.8 and pays a dividend of almost 6%.

Gold and silver have recently shown signs of a breakout. This is expected to boost Silver North's projects in the Yukon and is likely to lead to further gains for the stock. While BYD is currently experiencing a structural crisis, VW is slowly making its way back up.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.