December 11th, 2023 | 07:30 CET

Gold and Silver in 2024 - Breakout or Crash? Blackrock Silver, TUI and Lufthansa should show their colors now!

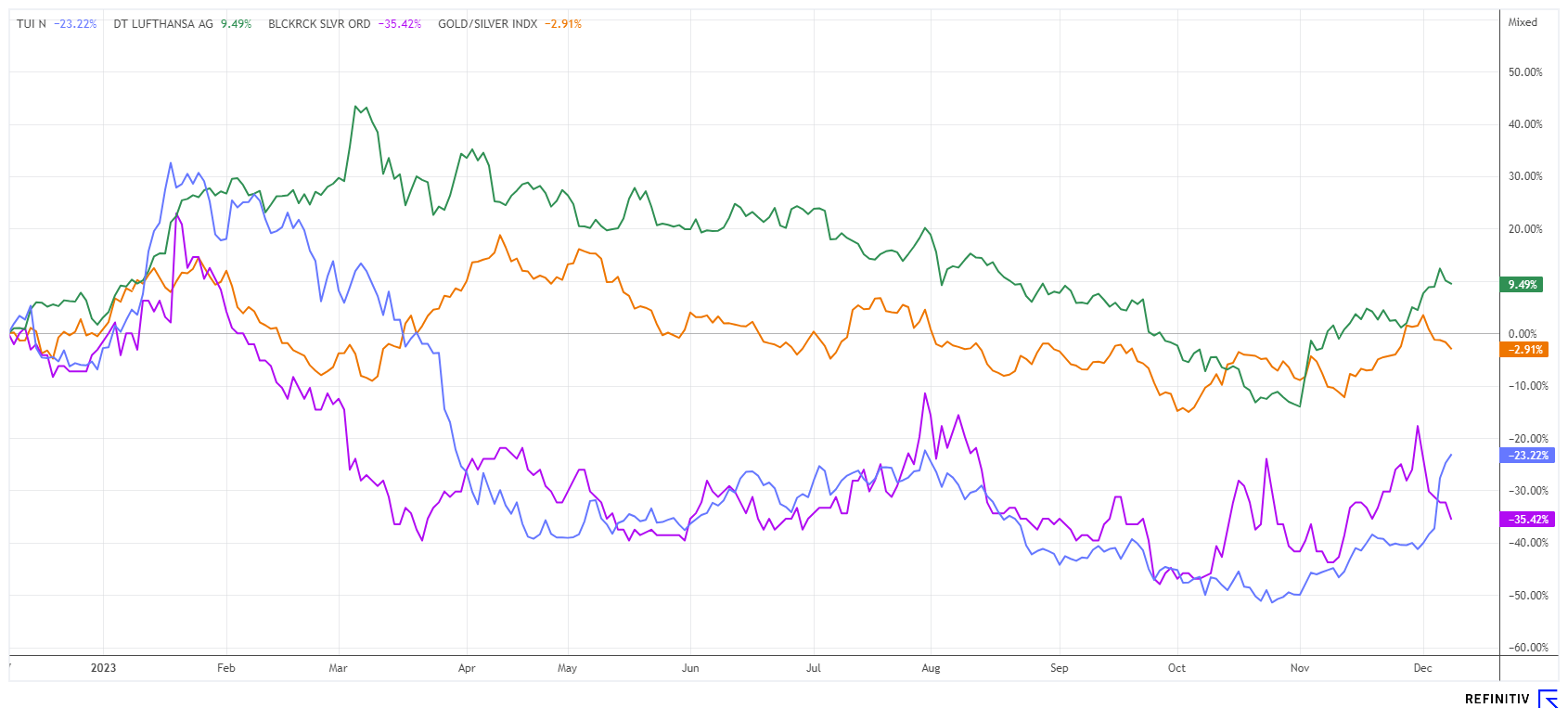

A new record high for the DAX at 16,782 - who would have thought it? The stock market is anything but boring at the moment. Gold started the week at a new all-time high of USD 2,147 in Asian trading, then sold off and even fell below the USD 2,000 mark again over the course of the week. Although the central banks are currently absorbing 30% of production, the price is unable to hold steady at the top. This is likely due to the lower-than-expected inflation at the beginning of the last quarter of the year. All in all, lower inflation also means lower interest rates. This is actually a bullish signal for gold and silver, but things often turn out differently than expected. On the consumption side, the tourism market should also be considered due to higher household budgets. Is this where the top yields for the coming year are hiding?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

Blackrock Silver | CA09261Q1072 , TUI AG NA O.N. | DE000TUAG505 , LUFTHANSA AG VNA O.N. | DE0008232125

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Gold and silver - First the spark, then the sell-off

Gold and silver are the playthings of the central banks. Long-term investors rejoiced at the beginning of last week when the troy ounce of gold suddenly went through the roof. Unfortunately, it was a bull trap in Asian trading because by the time it reached Europe, the precious metal was already USD 100 lower again, and gold and silver continued to lose significant ground as the week progressed. At the end of the trading week, the coveted metals even marked new monthly lows, thus canceling any attempt to break out. Technically, the USD 1,995 to USD 2,000 zone for gold marks an important consolidation and resistance zone that has been in place since May 2023. It should definitely turn around at this point and attempt a new breakout to USD 2,070.

However, with the good US labor market report on Friday, this is no easy task. This was later followed by a completely surprising consumer confidence index from the University of Michigan with a value of 69.4 instead of the expected 62.0. This sets the sails for an economic recovery in the US and further confirms expectations of an imminent interest rate cut by the Fed. For precious metals, this means that they are currently unable to play the "safe haven" card. Even geopolitical conflicts worldwide seem to have become more of a norm, with international investors not perceiving them as a threat to the financial system.

Blackrock Silver - One of the best silver deposits in the world

Like any other asset, precious metals run in specific cycles, and after three terrible years, the next wave of appreciation is likely to be imminent. However, the scenario for mining companies has changed since Covid. More regulation, safety and sustainability have been imposed by the authorities, so costs continue to rise, partly due to the increase in energy and transportation costs. However, if the average costs for a mining operation continue to rise and refinancing also means more interest expense, mining production will decline worldwide.

Projects with large deposits with good exploration status that can go into production immediately when metal prices rise are currently at an advantage. This is precisely the case with Blackrock Silver's silver property in Nevada. In November, the Company submitted its most recently updated Mineral Resource Estimate (MRE) totaling 570,000 ounces of gold and 47.74 million ounces (MOZ) of silver or 100.04 MOZ silver equivalent (AgEq) in the form of a NI 43-101 report to the Securities and Exchange Commission. Compared to the old report, the resource has increased by a full 135%, and a surface mine can already be operated highly profitably at a cut-off grade of 200 grams of silver per tonne (AgEq).

According to the Fraser Institute, Nevada was the most attractive mining country in the world in terms of investment in 2022. Known as the "Queen of the Silver Camps," the Tonopah district historically produced more than 174 million ounces of silver and 1.8 million ounces of gold from just 7.5 million tons of rock, making it one of North America's highest-grade primary silver districts. With the recent lithium discovery in Tonopah North, Blackrock stands to gain some additional income from an option contract in the future. In addition to precious metals, the search for recoverable lithium in North America could one day become a blockbuster story. 193 million shares are listed in Canada under the symbol BRC, and there are also 37 million options and warrants. 59% of all shares are held by institutional investors such as Sprott and Crescat, as well as some wealthy private individuals. The silver giant First Majestic Silver also owns shares. With a market capitalization of around CAD 60 million, the share is only quoted at a fraction of the calculated mine potential. Collect now!

TUI and Lufthansa - Beneficiaries of falling inflation

In an environment of falling inflation and interest rates, free budgets in private households are increasing. In addition, there is a catch-up effect from the unfortunate pandemic years, which made traveling to distant countries almost impossible. The two tourism-dependent companies, TUI and Lufthansa, experienced a crisis between 2019 and 2021 that threatened their very existence and could only be overcome with government aid. Supported by an exceptional year in travel activity, TUI and Lufthansa have been able to repay their remaining obligations to the saviour in need in recent months. As the all-important equity is slowly building up again through profits, share prices are not yet far from their painful lows.

TUI was able to gain an incredible 20% last week, as the turnaround has been achieved with the annual figures presented. CEO Sebastian Ebel had recently spoken of uncertainties in the winter business, but now the tourism giant shone in the final quarter. Revenue increased by 25% to EUR 20.7 billion for the year as a whole, returning to the pre-crisis level of 2019. The bottom line is an adjusted EBIT of just under EUR 456 million; the current booking momentum promises sales growth of around 10% for the coming financial year and a return of the EBIT margin of 7 to 10% in the medium term. It is also important to look at the net debt - it has been reduced to EUR 2.1 billion. The expected 2024 P/E ratio is attractive, with values below 7. This means that the Hanoverians have almost closed the valuation gap to Lufthansa, as the airline's P/E ratio is only a low 5.5, and there is also a dividend payout of 2.6%. With current prices of EUR 7.25 and EUR 8.35, respectively, both TUI and Lufthansa could become the top picks for the new investment year 2024. Keep buying!

Gold and silver have been put on the back burner again for the time being due to the failed technical breakout. For many reasons, the shares of Blackrock Silver from Nevada are highly attractively valued, as are the two tourism giants TUI and Lufthansa.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.