December 29th, 2020 | 09:13 CET

Glencore, Almonty, Aurubis - Scarcity drives share price

If you have listened to the old master of the stock market André Kostolany, then you have thought about aluminum in the past, and that's a good thing. If you bet on companies that focus on industrial metals or strategic metals, you should see a good performance next year. Rising demand in the wake of electromobility is driving up the price of copper. But so-called strategic metals, such as tungsten, are also used in various ways and are difficult to substitute. The availability of strategic metals is more limited than that of industrial metals. At times, there can be a large gap between supply and demand. Investors then profit from scarcity prices. We reveal where opportunities are tempting.

time to read: 2 minutes

|

Author:

Carsten Mainitz

ISIN:

CA0203981034 , JE00B4T3BW64 , DE0006766504

Table of contents:

Author

Carsten Mainitz

The native Rhineland-Palatinate has been a passionate market participant for more than 25 years. After studying business administration in Mannheim, he worked as a journalist, in equity sales and many years in equity research.

Tag cloud

Shares cloud

GLENCORE PLC - strongly diversified

Glencore is one of the world's largest and most diversified commodity companies. The Group's roots date back to the 1970s. Started as a trading Company, Glencore is now a major producer and marketer of commodities and employs 160,000 people. The Group owns 150 mining projects in more than 35 countries. With a stock market value of almost EUR 40 billion, the Company is a heavyweight.

Glencore's business activities are divided into two parts. As a producer, the Group distinguishes between "Metals & Minerals" with copper, zinc, nickel, cobalt, aluminum, etc. and "Energy Products" with coal and oil. As a marketer, Glencore physically procures raw materials and products from its global supplier base and sells the raw materials to its customers. This whole process includes processing, storage and transportation of raw materials.

By positioning itself as a producer and marketer, the Company differentiates itself from competitors. Investors can thus invest in an established player in terms of business activities and raw materials.

ALMONTY INDUSTRIES INC - on the way to becoming a significant tungsten producer

Almonty focuses its business on tungsten, which belongs to the group of strategic metals. Tungsten has an extremely high thermal toughness and density. It has the highest melting point of all metals, as well as the most remarkable mechanical strength. Tungsten is often used as an alloy.

Currently, Almonty's activities are predominantly in Europe with mining, processing and shipping of tungsten concentrate from its Los Santos mine in western Spain and its Panasqueira mine in Portugal. In addition, the Company is developing the tin and tungsten project at Valtreixal, in northwestern Spain.

However, central to Almonty's growth is the development of the Sangdong tungsten mine in Gangwon Province, South Korea. Here, the foundation was laid in December to provide financing to become the largest tungsten producer outside China. In the future, it aims to meet around 30% of demand outside China and approximately 7% to 10% of global demand. Plans call for ramping up production starting in 2021. The mine is expected to have an operating life of 30 years or more.

Given rising tungsten prices, extremely favourable financing, low-cost structure and long mine life, analysts at First Berlin confirm their buy recommendation with a price target of CAD 1.45. The share can thus easily double. Given the current market capitalization of around CAD 120 million, the potential of such a large mine of a critical commodity is still far from being priced in.

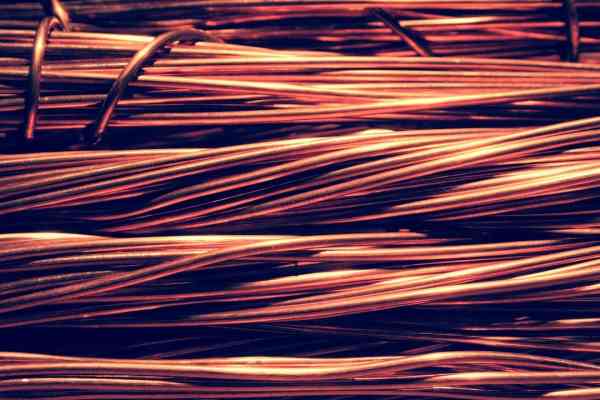

AURUBIS AG - the world's largest copper recycler

Aurubis produces copper from copper concentrates and recycling materials and processes them further into primary products. Copper scrap and many other recycling materials are therefore returned to the economic cycle. Precious metals such as gold and silver are produced as by-products of recycling. Aurubis has production sites in Europe and the USA and a global sales network.

The MDAX-listed Group is already the world's largest copper recycler and strengthened its position in recent months with the acquisition of the Belgian-Spanish metal recycler Metallo, significantly expanding Aurubis' ability to recycle metals from old electrical appliances. Also, the Group established a joint venture with TSR Recycling for cable recycling in November.

Aurubis presented its figures for the past fiscal year in December. Operating earnings before taxes (EBT) increased by 15% to EUR 221 million. An EBT of between EUR 210 and EUR 270 million is forecast for the current financial year.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may in the future hold shares or other financial instruments of the mentioned companies or will bet on rising or falling on rising or falling prices and therefore a conflict of interest may arise in the future. conflict of interest may arise in the future. The Relevant Persons reserve the shares or other financial instruments of the company at any time (hereinafter referred to as the company at any time (hereinafter referred to as a "Transaction"). "Transaction"). Transactions may under certain circumstances influence the respective price of the shares or other financial instruments of the of the Company.

Furthermore, Apaton Finance GmbH reserves the right to enter into future relationships with the company or with third parties in relation to reports on the company. with regard to reports on the company, which are published within the scope of the Apaton Finance GmbH as well as in the social media, on partner sites or in e-mails, on partner sites or in e-mails. The above references to existing conflicts of interest apply apply to all types and forms of publication used by Apaton Finance GmbH uses for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and etc. on news.financial. These contents serve information for readers and does not constitute a call to action or recommendations, neither explicitly nor implicitly. implicitly, they are to be understood as an assurance of possible price be understood. The contents do not replace individual professional investment advice and do not constitute an offer to sell the share(s) offer to sell the share(s) or other financial instrument(s) in question, nor is it an nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but rather financial analysis, but rather journalistic or advertising texts. Readers or users who make investment decisions or carry out transactions on the basis decisions or transactions on the basis of the information provided here act completely at their own risk. There is no contractual relationship between between Apaton Finance GmbH and its readers or the users of its offers. users of its offers, as our information only refers to the company and not to the company, but not to the investment decision of the reader or user. or user.

The acquisition of financial instruments entails high risks that can lead to the total loss of the capital invested. The information published by Apaton Finance GmbH and its authors are based on careful research on careful research, nevertheless no liability for financial losses financial losses or a content guarantee for topicality, correctness, adequacy and completeness of the contents offered here. contents offered here. Please also note our Terms of use.