June 25th, 2025 | 07:10 CEST

Geopolitical wild card: Almonty on track for another price surge, overtaking Rheinmetall, Hensoldt, and RENK

Almonty Industries (TSX: AII; WKN: A1JSSD; ISIN: CA0203981034; CAD 3.23) remains in the spotlight, and rightly so! The tungsten resource stock has been one of the absolute top performers so far in 2025 and has the potential to move into a completely new league. All signs point to a revaluation. What is developing here is more than just a mining project; it is a geopolitically highly relevant raw materials offensive with billion-dollar potential. Amid escalating trade conflicts, China is sending a strategic counter-signal and restricting exports of key metals. Tungsten is thus becoming a critical element for high-tech, aviation, and defense and is now at the top of governments' procurement lists. This is precisely where Almonty comes in. With the Sangdong mine in South Korea, the largest Western tungsten supplier outside China will be established by 2025. US defense companies are already securing the coveted resources – long-term, exclusively, and strategically. The confidence is huge, and the timing is perfect. Those who get in now could ride the next wave of growth. A surge in valuation is more than just likely; it is inevitable!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , HENSOLDT AG INH O.N. | DE000HAG0005 , RENK AG O.N. | DE000RENK730 , ALMONTY INDUSTRIES INC. | CA0203981034

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Geopolitical significance on the rise

CEO Lewis Black has been pursuing a clear security strategy vision for years: Almonty Industries is to become an indispensable key player in the global race for critical metals. Now, this master plan is beginning to pay off, both for the Company and its shareholders. With its upcoming US status, Almonty is opening the door to highly profitable military contracts previously reserved for only a few. Add to this the growing demand for raw materials from European and international defense organizations, and one thing becomes clear: demand far exceeds production capacity. Future production has effectively been allocated long before it even starts! Sangdong is thus developing into a critical infrastructure for the West, politically as well. The US government has already recognized Almonty in writing for its strategic relevance in competition with China. In the future, the mine could not only supply the defense industry, but also contribute to the US's national raw material reserves.

Textbook scarcity

The high proportion of tungsten deliveries to the defense sector is decisive. Currently, this accounts for around 85% of production. Customers include companies such as Rheinmetall, which uses the material for hardening ammunition. With its recently approved investment target of 5% by 2030, NATO is sending further signals in the direction of rearmament. This is keeping the production lines running hot and making industrial metal procurers sweat, because what is lacking are goods and future capacity. Anyone who wants to build high-tech equipment in three years' time can already start working on their order list for the necessary materials.

In an interview with CNBC, CEO Black confirmed that the decision to relocate the Company's headquarters to the US had already been made under the Biden administration. The aim is to be closer to customers in the defense sector. Particularly important: price floors in supply contracts give the Company planning security, while there are no upper limits. This preserves the upside for shareholders. Sounds like a lot of blue sky!

CEO Lewis Black on SQUAWK BOX (CNBC)

Analysts respond with multiple upgrades

Analysts at GBC Research recently upgraded their "Buy" rating for Almonty to CAD 5.50 from CAD 4.20. They cite the rapid progress of mine construction in Sangdong as the main reason for this upgrade. The processing plant is almost complete, and the final tranche of the USD 75.1 million loan from KfW IPEX-Bank has already been disbursed. Initial ore processing is now scheduled for the second half of the year. Together with the Company's other mines, revenue is expected to double to around CAD 60 million by 2025. Analysts expect revenues of CAD 153 million and CAD 314 million for 2026 and 2027, respectively. By 2027, net profit is expected to reach over CAD 200 million. This will lift earnings per share from CAD 0.09 in 2025 to CAD 0.74 in 2027. With prices around CAD 3.22, the 2027 P/E ratio stands at 4.4 – an impressive margin of just under 68%. Analysts at Sphene Capital recently raised their price target twice to CAD 5.40, which would value the 285.92 million shares at around CAD 1.54 billion.

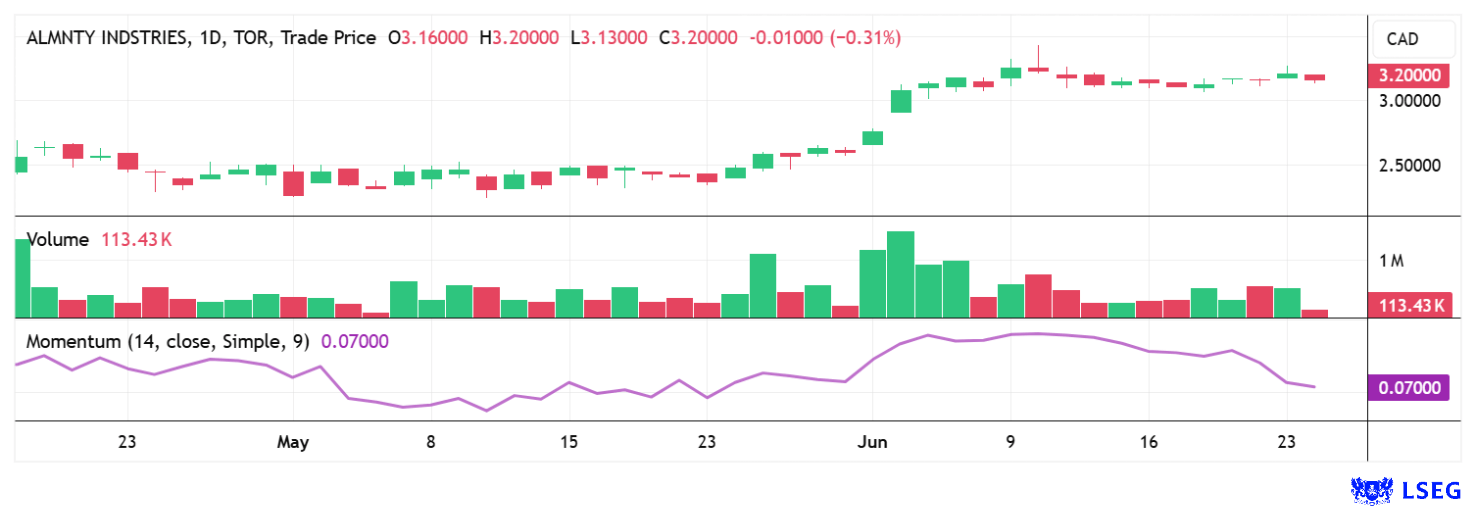

Momentum is building – An explosive upward surge is in the air

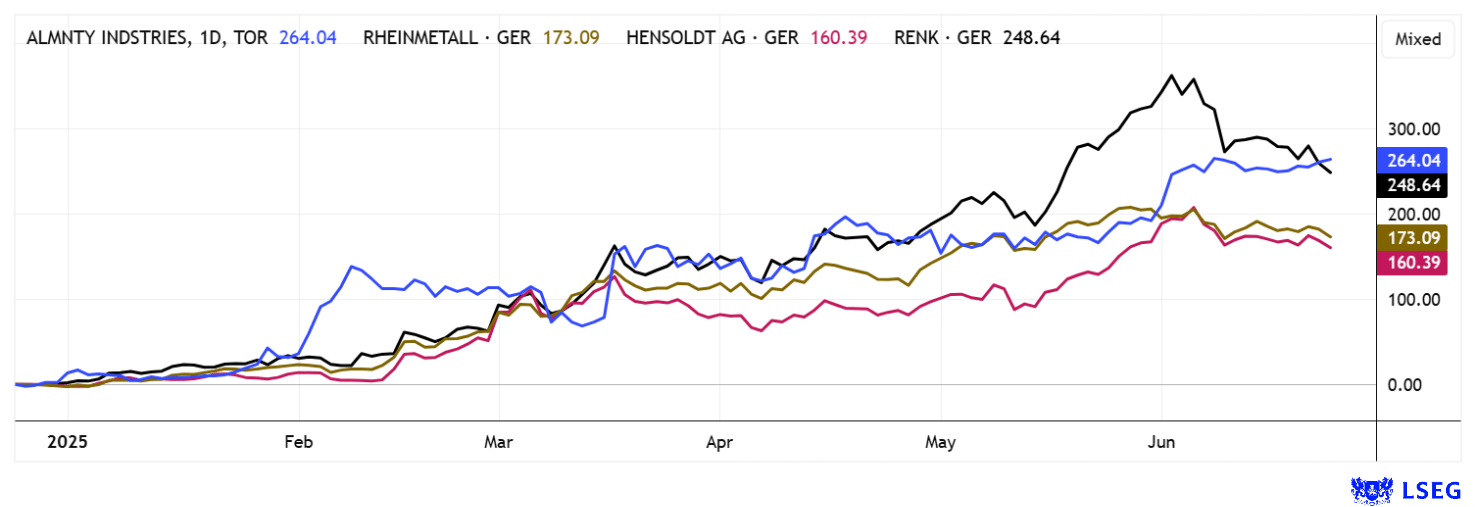

Given its low valuation compared to industry, the stock remains attractive, especially given the expected NASDAQ listing. Interest from institutional investors in the US is likely to skyrocket. For US investors, it is precisely this factor – strategic scarcity – that reveals the true value. In security-sensitive markets, it is not only quality that counts but also political reliability. No wonder, then, that Almonty Industries' share price has been rising almost in a straight line since the beginning of the year, with even minor market corrections having little effect on the momentum.

Almonty also performs well in comparison to the frequently cited peer group of defense stocks. German investors should, therefore, definitely take a closer look at the tungsten specialist alongside Rheinmetall, Hensoldt, and RENK. The CEOs of these prominent defense companies are very likely already familiar with CEO Lewis Black.

**The new world order is in search of secure sources of raw materials, and Almonty delivers precisely that. The fact that CEO Black dared to invest in a disused tungsten mine in South Korea back in 2015 – at a time when disarmament was still the political model – is now proving to be a stroke of strategic genius. In retrospect, a bullseye with foresight. Looking ahead, there is still plenty of room for significantly more upside!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.