February 17th, 2026 | 08:00 CET

From CAD 0.10 to CAD 0.81? Why Desert Gold is now poised for revaluation

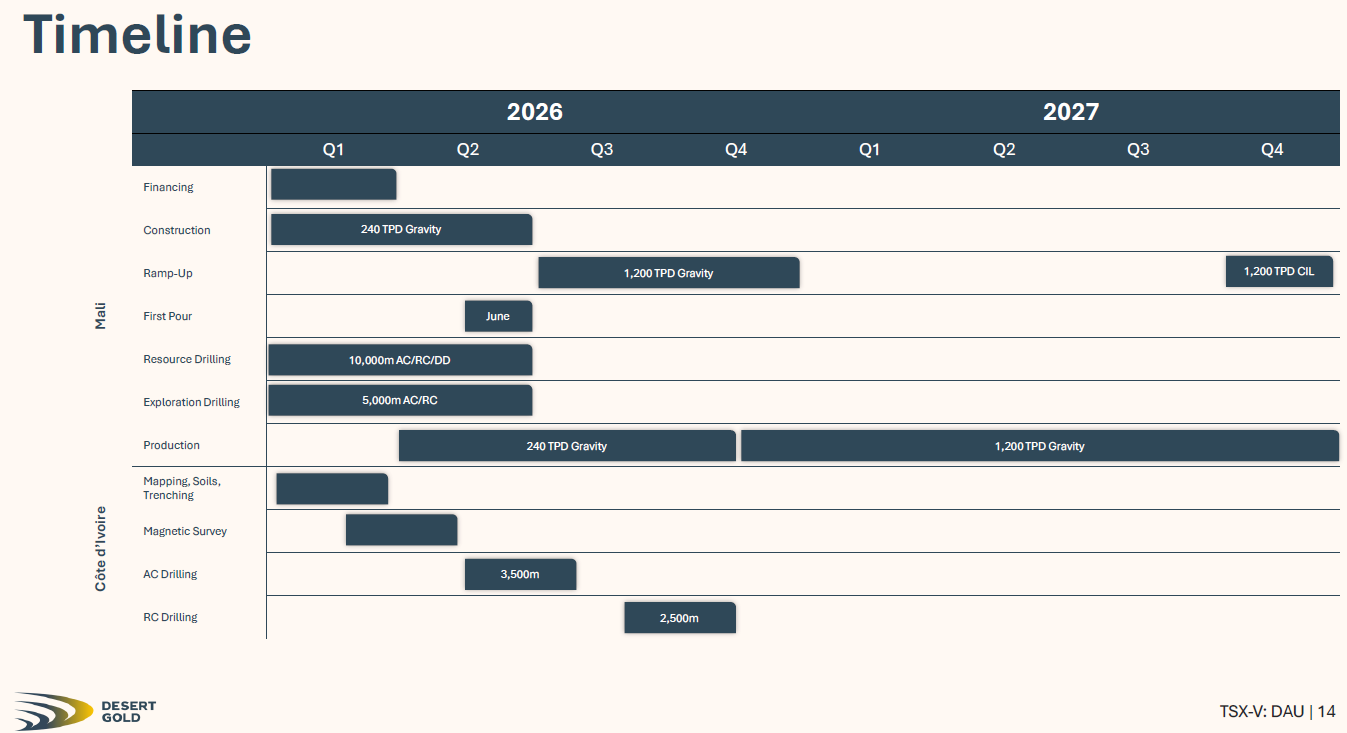

The lines between hope and substance are often blurred in the commodities sector. However, a clear turning point is emerging at Desert Gold Ventures. The company, which has projects in Mali and Côte d'Ivoire, has moved beyond the phase of pure speculation. While the market still considers the stock to be in the exploration segment, preparations for gold production at the fully approved SMSZ project in Mali are already in full swing. With oversubscribed financing, solid profitability figures, and a clear timeline, the course is set for production. Investors who want to recognize the transition from explorer to producer in good time would do well to take a closer look now.

time to read: 5 minutes

|

Author:

Armin Schulz

ISIN:

DESERT GOLD VENTURES | CA25039N4084

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

The transformation has long since begun

There are companies that talk about plans. And there are companies that implement them. Desert Gold clearly belongs to the second category. In January, the company secured approximately CAD 7.2 million in a significantly oversubscribed financing round, a clear vote of confidence from professional investors who recognize the value of the story. The capital will flow directly into the crucial next steps: commissioning the first processing plant at the Barani East project in Mali and further developing the Tiegba Gold project in Côte d'Ivoire.

This financing is more than just fresh money. It is a vote of confidence and, at the same time, the starting signal for the operational phase. CEO Jared Scharf sums up the strategy: "Our main goal is to advance the development schedule as quickly as possible to commercial production." And this schedule is ambitious, but now within reach.

SMSZ project in Mali: From paper to practice

The heart of the investment story is and remains the Senegal Mali Shear Zone (SMSZ) project in western Mali. Anyone looking at the map will immediately understand the geological potential. The 440 sq km area is in a prime location, neighboring heavyweights such as Barrick's Loulo mine (9.8 million ounces), B2Gold's Fekola (7.6 million ounces) and Allied Gold's Sadiola (7.3 million ounces). The fact that Chinese mining giant Zijin Mining acquired its neighbor Allied Gold for USD 5.5 billion in early 2026 impressively underscores the strategic value of this region.

But Desert Gold is pursuing its own smart path. Instead of getting bogged down in expensive feasibility studies for a mega-mine, the company is taking a phased, capital-efficient approach.

The initial focus is on the near-surface oxide deposits at the Barani East and Gourbassi deposits. These zones offer the ideal entry point for initial production.

Gold production in 2026: Not a pipe dream, but a roadmap

The preliminary economic assessment (PEA) presented in November 2025 and finalized in January 2026 provides the figures that underpin the plan. And they are more than impressive:

• At a conservative gold price of USD 2,850/ounce: After-tax net present value (NPV10) of USD 61 million, internal rate of return (IRR) of 57%, payback period of only 2.5 years.

• At the current gold price of over USD 4,000/oz: NPV10 of USD 124 million, IRR of a fantastic 101%.

The total costs (AISC) are comfortably below the current gold price at a projected USD 1,137 per ounce. Every dollar that the gold price rises above this mark flows directly into profit, which is a huge operational lever.

More importantly, this is not just theory, because implementation is already underway. Site preparation at the Barani East location has begun. Clearing, earthworks, the construction of access roads, and the preparation of the platform for the processing plant are underway. The first modular processing plant, with an initial capacity of 10 tons per hour, is already in production. Once it has been delivered and installed, production will be ramped up. Everything is geared towards producing the first gold this year.

This step is the decisive turning point. Once the first ounce of gold is sold and cash flow starts flowing, Desert Gold will finally leave the high-risk exploration phase and enter the producer arena. The market fundamentally values companies in this phase differently – a revaluation is then no longer a question of if, but of how quickly.

The icing on the cake: Tiegba in Côte d'Ivoire

While the Mali project will provide short-term cash flow, the second pillar in Ivory Coast offers long-term growth leverage. The Tiegba Gold project comprises a 297 sq km concession in one of West Africa's most mining-friendly countries.

What makes Tiegba so special? A contiguous gold-in-soil anomaly that extends for several kilometers and has geological parallels to well-known large deposits such as Bonikro. This area has never been systematically drilled. It is a blank spot on the exploration map and thus the stuff of which discoveries are made.

Côte d'Ivoire has become significantly more attractive in recent years. A reliable legal framework, well-developed infrastructure, and a mining ministry that promotes exploration investment make the country one of the hotspots in the region. Desert Gold has begun a structured exploration program here that includes mapping, geophysical surveys, and initial drilling. If economically viable gold is found in the bedrock, it would be a classic price driver that could lead to a revaluation.

Untapped potential and strong partners behind it

An often overlooked detail is that the current PEA for the SMSZ project is based on less than 10% of the total known gold resources. Over 1 million ounces are currently outside the mine plan, either at depth or in adjacent structures. Any further drilling that brings these resources into the economically viable range directly increases the project value. Management has already announced new programs to leverage this potential.

Added to this is a shareholder structure that inspires confidence. Management and the board hold around 10% of the shares, which puts them in the same boat as the shareholders. California-based fund company Merk Investments is on board with around 7%, while mining legend Ross Beaty holds around 3%. These are not short-term day traders, but experienced investors with staying power.

Analysts at GBC see a price target of CAD 0.81. The stock is currently trading at CAD 0.10.

Desert Gold has set the decisive course. While many juniors are still dreaming of a future, Desert Gold is building one. The SMSZ project in Mali is fully approved, financed, and in the implementation phase. Gold production this year is not a promise, but a clearly communicated goal. At the same time, Tiegba in Côte d'Ivoire offers the potential for a real discovery. The combination of imminent cash flow, solid PEA figures, a clear roadmap, and a strong shareholder base makes the company one of the most promising stocks in the segment. The transition from explorer to producer has begun. Those who get in early could benefit significantly from a potential revaluation.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.