December 1st, 2022 | 13:09 CET

First Hydrogen, Tesla, Volkswagen - Hydrogen or battery drive, who makes the race?

The German Federal Ministry of Research and Education has big plans: the natural gas network is to be converted as a supply structure for hydrogen so that Germany is well equipped for the future. The Canadian company First Hydrogen is betting on hydrogen propulsion, launching its first production facility in Quebec. A call for leadership is being heard regarding Elon Musk and his car company Tesla. It seems that a blue bird and the desire for freedom of expression are taking up so much of his time that the share price is wobbling. The competition is not sleeping: Volkswagen is currently number one in Europe with its EV models. Who will make the race?

time to read: 5 minutes

|

Author:

Juliane Zielonka

ISIN:

First Hydrogen Corp. | CA32057N1042 , TESLA INC. DL -_001 | US88160R1014 , VOLKSWAGEN AG VZO O.N. | DE0007664039

Table of contents:

"[...] The VERRA certification adds credibility to dynaCERT's emission reduction technologies by demonstrating compliance with internationally recognized standards for carbon emissions reductions and sustainable development. [...]" Jim Payne, CEO, dynaCERT Inc.

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

First Hydrogen: Quebec secured as a site for hydrogen LCV production, stock rallies

Germany will start buying liquefied natural gas (LNG) from Qatar in 2026 for energy supply. Over a period of fifteen years. Qatar will also supply China for the next 27 years. Qatar will sell the gas to the US company ConocoPhillips, which will then deliver it to the LNG terminal in Brunsbüttel. From a technical and economic point of view, hydrogen can also flow through the existing German natural gas network in the future. The research project "TransHyDE" started in 2021 on behalf of the BMBF. The hydrogen network structure is an elementary component in preparing Germany for hydrogen technology. After all, no country wants to be permanently dependent on energy supply.

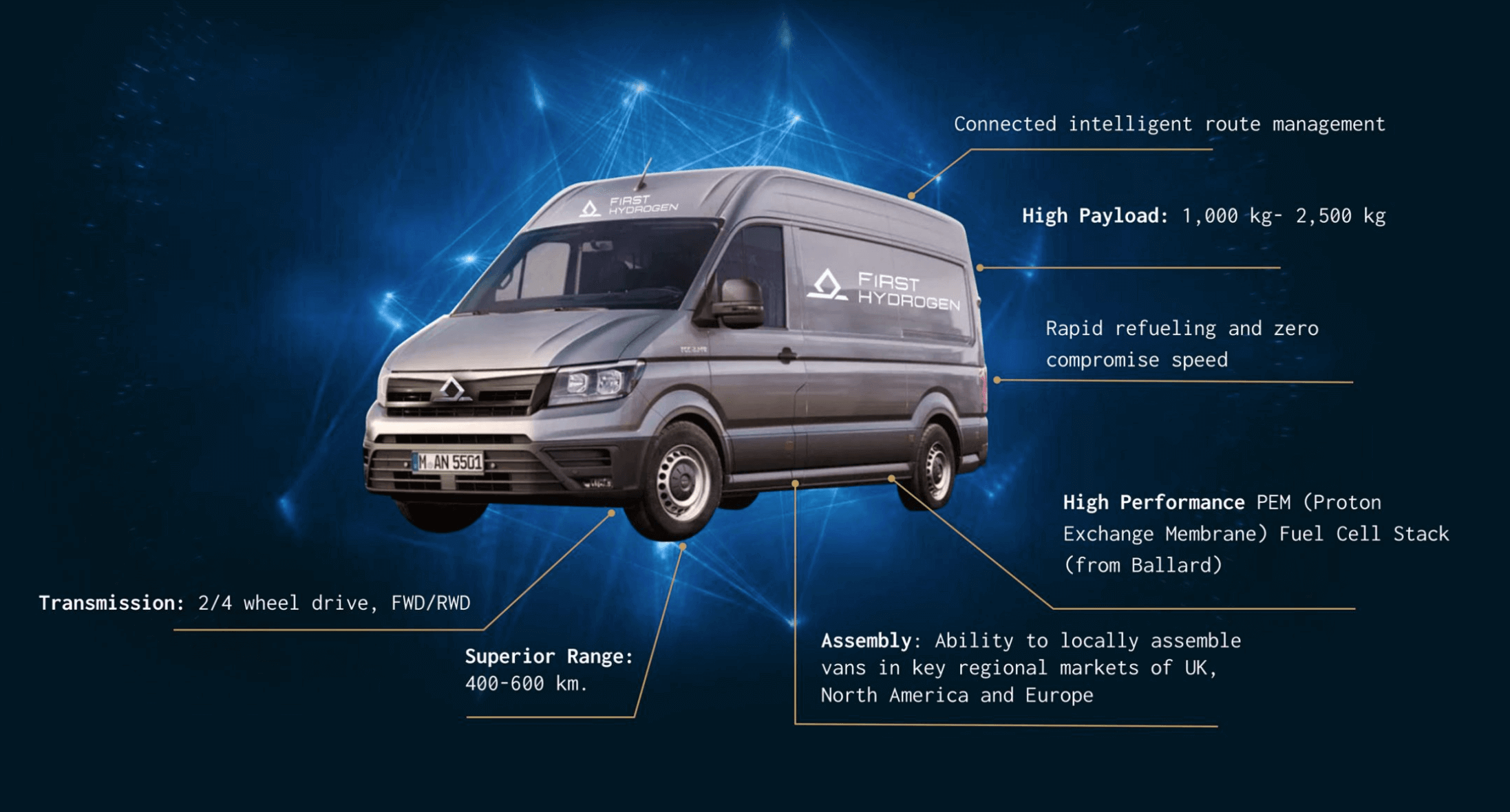

The Canadian company First Hydrogen is one step ahead. In the future, a zero-emission strategy will prevail on the mobility axes of this world. First Hydrogen provides the appropriate hydrogen-powered transporters for this purpose.

First Hydrogen trucks will be assembled in Quebec for distribution throughout North America in combination with the Company's "Hydrogen as a Service" product offering. The assembly plant will be designed for an annual capacity of 25,000 vehicles at full capacity and will contribute to green technology job creation in the region.

First Hydrogen's strategy fits well with the "Plan for a Green Economy1" and the "2030 Quebec Green Hydrogen and BioEnergy Strategy1", both of which aim to reduce dependence on fossil fuels and achieve energy autonomy through the use of green hydrogen for decarbonization. In addition, the province of Quebec provides a stable and supportive environment for our project thanks to its economic, innovation-friendly policies. First Hydrogen's project fits well with recent announcements by the Canadian government to support green hydrogen and low-carbon fuel initiatives. The stock is trading at EUR 3.60, up 19.60% in the last 5 days. For those who would like to meet First Hydrogen first-hand, there will be a presentation, including live Q&A, at the 5th International Investment Forum on December 7 at 10 am CET. register here.

Tesla - Massive competitive pressure on models under USD 50K

The investment bank Morgan Stanley asked institutional investors whether Elon Musk's Twitter acquisition affected Tesla stock. 73% of investors affirmed the purchase significantly impacted Tesla's performance. In another question, 40% of respondents were convinced the move was driving most of Tesla's underperformance, and 40% said it was responsible for more than half of Tesla's underperformance.

Electric cars are growing in popularity with the masses, so models under USD 50,000 are in high demand - an area where Tesla "is not yet truly competitive," S&P Global Mobility said in a report released on Tuesday.

S&P Global Mobility predicts that the number of battery-powered electric models will grow from the current 48 to 159 by the end of 2025, faster than Tesla will be able to build new factories. In addition, the gigafactory in Brandenburg is characterized by a great deal of ignorance in the prevailing occupational health and safety and German bureaucratic jungle.

Tesla CEO Elon Musk reconfirmed in a recent conference call that the Company is working on a vehicle priced below the Model 3, though the timing of the launch is unclear. Tesla competes with models such as General Motors' Bolt and Bolt EUV, Hyundai's Ioniq 5, Kia's EV6, Volkswagen AG's ID.4 and Nissan's Leaf. Investors should also keep an eye on BYD. The Company has several irons in the fire.

Volkswagen - Alyssa Milano swaps Tesla for ID.4, VW leads with BEV sales in Europe

One prominent new car ID.4 owner is US actress Alyssa Milano. She opted for Volkswagen's model in exchange for her Tesla, writing on her Twitter account "I returned my Tesla. I bought the VW ev. I love it. I am not sure how advertisers can buy space on Twitter. A publicly traded company's products associated with hate and white supremacy do not seem like a successful business model."

Actors are good at what they do but not necessarily good at history. So the historical clarification surrounding the VW Group was not long in coming, either, and parts of the past surrounding World War II came up. The production of the car was started by the National Socialist organization "Strength Through Joy" on May 28, 1937, in Berlin under the name "Gesellschaft zur Vorbereitung des Deutschen Volkswagens mbH (GeZuVor)". Under the Allied forces, it was largely British Major and engineer Ivan Hirst who transformed Volkswagen from a single factory in Wolfsburg, Germany, into a major postwar automaker and, thus, an international brand. There are parallels here with Tesla, as Musk also acquired the Tesla company.

The VW ID.4 is the best-selling BEV in Europe in October 2022, with 6,069 e-cars, according to Jato. The European new car market increased by 14% in October, registering 903,533 new vehicles, the third consecutive month of growth compared to last year. October's growth is partly explained by the strong performance of the Volkswagen Group. The German manufacturer registered 230,115 units - a 40% increase in volume, driven mainly by Audi, Skoda and Cupra. However, this is significantly lower than the 281,700 units registered in October 2020 and the 302,000 units registered in October 2019. The stock is currently trading at EUR 139.80.

Currently, Volkswagen leads the list of best-selling BEV models in Europe, closely followed by FIAT. But the battery business is looking rather poor for the Wolfsburg-based company. The group warns that rising energy costs are making its own planned battery plant unprofitable. Long-term investors should look closely at the hydrogen sector and First Hydrogen. Hydrogen can become the driving force behind the energy transition on the roads. First Hydrogen secures Quebec as a production site for its zero-emission vans, and Tesla is waiting for its boss to retake the lead.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.