December 28th, 2023 | 07:00 CET

Fireworks for the 2024 energy transition: Siemens Energy, Almonty Industries, Siemens and Nordex in your New Year's Eve portfolio?

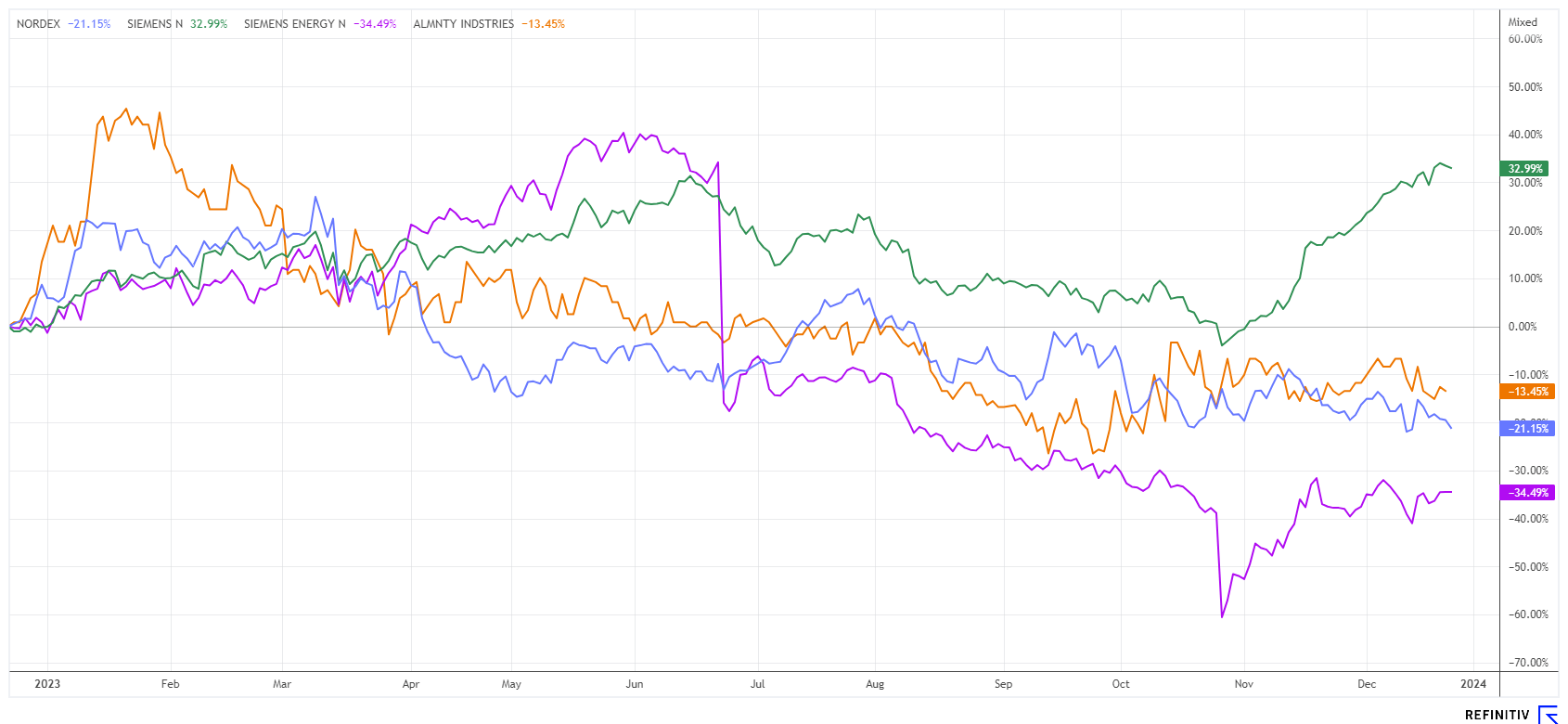

Supporters of GreenTech shares came away empty-handed in terms of performance in 2023. Despite repetitive messaging from Berlin, Brussels, and Washington, alternative energy projects have yet to really take off. There is a lack of private investors willing to finance the less profitable billion-dollar projects. However, after the conclusion of the Climate Conference in Dubai, a new force of anti-fossil fuel world improvers might emerge, initiating the new year with fresh debt-funded projects. Yield hunters should, therefore, briefly bet on the losers from 2023 at the start of the year in order to ride the euphoric New Year wave. Here are a few suggestions.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0 , ALMONTY INDUSTRIES INC. | CA0203981034 , SIEMENS AG NA O.N. | DE0007236101 , NORDEX SE O.N. | DE000A0D6554

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Siemens Energy - The parent company is selling shares

With a 12-month loss of 34%, Siemens Energy is one of the weakest stocks in the DAX 40 index. The poor performance of the Spanish wind subsidiary Gamesa caused the balance sheet to falter in the middle of the year. In order to still be able to process the good order situation, the former energy division of Siemens took advantage of a federal and bank guarantee of EUR 15 billion. The Spanish company is now trying to overcome the quality problems.

Meanwhile, the former parent company is pursuing the consistent separation of its energy shareholding. Siemens is transferring a further 8% share package of the remaining 25.1% stake to its pension fund. Not entirely risk-free, as any losses incurred by the pension fund would have to be offset by Siemens. Siemens Energy was spun off from Siemens on July 9, 2020, when Siemens was gradually divesting its shares. The pension fund currently holds 14.8% of Siemens Energy's shares. The step is irrelevant for the pensioners; only the former parent company cannot escape any risks but has merely postponed them to the future. Not surprisingly, Siemens CFO Ralf Thomas resigned from the Supervisory Board of Siemens Energy as of February 26, 2024.

Siemens Energy shares have lost around two-thirds of their value since their highs in 2020; at the end of 2022, the Company acquired a majority stake in the faltering wind turbine manufacturer Gamesa. On the Refinitiv Eikon platform, 10 out of 22 analysts are nevertheless optimistic and expect an average 12-month price target of EUR 14.65. This gives the Munich-based company a potential upside of 30% - but investors should be prepared for some negative news. Those who entered well below EUR 10 should hedge existing profits at around EUR 9.50.

Almonty Industries - Strategic metals make a splash

A brute rally can be observed in strategic metals at the end of the year. The rare earth stocks Neotech Metals and Defense Metals, for example, gained between 100 and 300% within a few trading days. Investors obviously have the ongoing conflicts in Ukraine, the Middle East and the renewed problems in the Suez Canal in mind. It is clear that the issue of supply chains and difficult access to important metals could turn into a showstopper for commodity-dependent industrialized nations at any time. Investors have, therefore, been eyeing safe jurisdictions that can compensate for the emerging supply gaps for the foreseeable future. Green and high-tech companies, in particular, depend on a stable supply of important metals, as the production of batteries and alternative energy solutions such as hydroelectric turbines, wind turbines and photovoltaic systems consumes considerable quantities of these raw materials. Last but not least, the AI wave is also based on a high level of technologization that has yet to be achieved in many countries.

The Canadian company Almonty Industries owns four properties of the rare metal tungsten. The Company has been working hard for several years to revitalize the Sangdong mine in South Korea, with production scheduled to start in 2024. In addition to the existing debt financing of USD 75.1 million from KfW, the Company is still looking for suitable equity providers at the project level, as shareholders should not be further diluted by the raising of new funds. With a view to 2024, the properties in Spain should also be able to produce again and provide further cash flow for the development work in South Korea.

In the medium term, Almonty Industries is developing into a tungsten supplier with a 5% global market share, which should soon make industrial customers and potential strategic partners sit up and take notice. In the days leading up to Christmas, the share price rose to around CAD 0.51 or EUR 0.37 on German stock exchanges. Risk-conscious investors can confidently add the supplier of strategic metals to their 2024 shortlist, as price gains of several 100% are on the cards. The "Tax Loss Season" in Canada could not harm the share price, which is a positive sign.

Nordex - What the analysts say

Nordex has not performed well in 2023 so far, losing 22% in the past 12 months, while the TecDAX has managed to gain 14%. Whether the coming year will be better depends on several factors. The biggest problem is the high costs, and it seems that there may be some headwinds in the wage negotiations as well. With a second warning strike in Rostock, the IG Metall trade union has given its demands in the collective bargaining talks considerable emphasis. Between 250 and 300 Nordex employees gathered at the production site in mid-December. Although trade unionist Stefan Schad was satisfied with the turnout, there would probably be no further job security for the German site. No wonder, because in addition to the already high wage costs, other input factors such as electricity, gas and important raw materials have developed into a nationwide cost problem for the industry since the traffic light government in Berlin took office.

Despite this, Nordex management wants to return to the black in the coming year. Analysts on the Refinitiv Eikon platform expect earnings per share of EUR 0.13, and this is even expected to skyrocket to EUR 0.70 in 2025. There are certainly positive voices: The experts at investment bank Jefferies and Deutsche Bank expect 12-month price targets of EUR 17 and EUR 16, respectively. The first buy signals on the chart are already above the EUR 11 mark. However, the final annual figures will not be available until March 26, 2024. Until then, the share price is likely to fluctuate wildly. Traders are setting limits in the corridor of EUR 8 to 9.

Strategic metals have been a hot topic on the stock market for several days now. This could quickly translate into several 100% price gains in 2024. Siemens Energy and Nordex are rehearsing the turnaround, while Almonty has already achieved the medium-term technical turnaround.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.