November 11th, 2025 | 07:15 CET

Finding true value in the stock market! DroneShield, Palantir, and Globex Mining in Focus

Irrationality has become the new norm on the capital markets. While global economic growth has been stuttering for years, tech stocks on the NASDAQ are celebrating daily. Cautious voices are often ridiculed because, according to statistics, they are only proven right every 5 to 7 years. The penultimate sharp correction occurred 7 years ago in the fall of 2018, followed by two more, in 2020 and 2022, triggered by the pandemic and war. Since then, markets have been climbing almost relentlessly. The highly regarded DAX and NASDAQ indices have more than doubled since those corrections. Meanwhile, the Shiller P/E ratio has risen from 18 to 37 – incidentally, it peaked at 40 two weeks ago. Since then, volatility indicators have been reluctant to fall. The nervousness is palpable! We are using this most challenging of investment periods to reflect on what true value really means.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

DRONESHIELD LTD | AU000000DRO2 , PALANTIR TECHNOLOGIES INC | US69608A1088 , GLOBEX MINING ENTPRS INC. | CA3799005093

Table of contents:

"[...] We can make a big increase in value with little capital. [...]" David Mason, Managing Director, CEO, NewPeak Metals Ltd.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

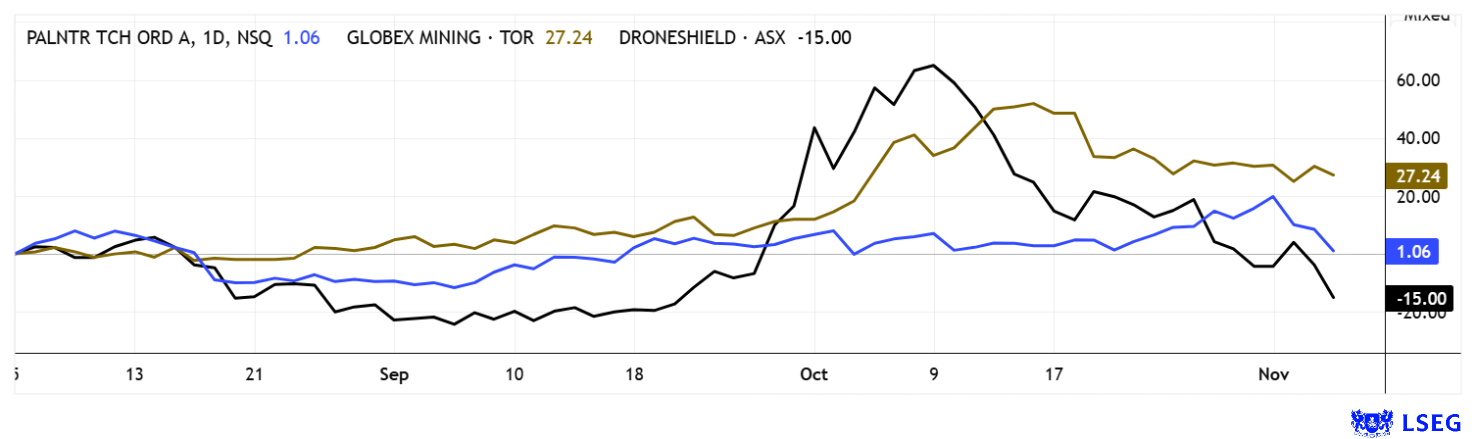

Palantir Technologies amazes trading at 100x revenue or 250x earnings

Big data specialist Palantir Technologies continues on its steep growth trajectory: With its Q3 figures, the Denver-based company has once again exceeded analysts' already ambitious targets. The AI and software specialist offers analysis tools for large corporations and government agencies, generating USD 1.18 billion in revenue (up from USD 725.5 million) and earning 21 cents per share (up from USD 0.06) in the last quarter. Analysts had expected only USD 1.09 billion and 17 cents. As expected, the Company has issued an optimistic forecast for the fourth quarter and estimates total revenue of around USD 4.40 billion for 2025, while Wall Street had only expected USD 4.17 billion. After the announcement, the stock initially rose by another 7% in after-hours trading to a new all-time high of around USD 222, but fell 12% on the next trading day. "Buy the rumor, sell the fact" was the sentiment in the trading rooms.

Since then, the daily parties have come to an end, with the share price already down USD 50 or USD 120 billion in market value from its last high. Technicians point to a necessary correction of the steep upward trend, while pessimists see the approaching trend reversal of the exceptional AI story of recent years. Analysts are largely out of the game, as P/S ratios of 100 and P/E ratios of 250 have historically only been seen during the tech bubble of the 2000s. It is astonishing that this valuation phenomenon is actually repeating itself. But after the foreseeable price correction in the coming months, many investors will say, "Actually, it was all obvious!"

Globex Mining – A gold treasure with over 260 opportunities

Globex Mining (GMX) has been operating a successful business model since the 1970s. It consists of securing properties, which are then optioned to partners for development and later generate royalty fees. In recent years, this role as a diversified owner of mineral rights with a focus on strategic projects in Canada and the US has been consolidated. In an environment of geopolitical uncertainty and disrupted supply chains, securing North American resource flows is becoming increasingly important. The Québec-based company currently manages over 260 projects, including more than 50 with historical or current NI 43-101 resource estimates, and has no debt. With cash and securities of approximately CAD 30 million, Globex remains financially flexible and can take advantage of opportunities without dilution. The Canadian environment offers stable legal and infrastructural conditions as well as constructive cooperation with indigenous partners, a key locational advantage for long-term development. By combining precious metal assets and interests in critical metal projects, Globex is strengthening the resilience of regional supply chains and the solidity of its own balance sheet.

A current example of operational momentum is the Duquesne West Gold Project in Québec, in which Globex has an indirect 50% interest. Project partner Emperor Metals has resumed the drilling program, which is expected to cover between 10,000 and 15,000 meters. The goal is to expand the open-pit footprint and define additional ounces of gold in adjacent rock zones. The 120,000 meters drilled so far cover only a fraction of the deposit, which is conceptually estimated at 1.46 million ounces of gold. Exploration on site is focused on confirming and expanding high-grade lenses and re-testing historical drill holes to strengthen the database for a reliable resource estimate.

In parallel, Globex reports further significant progress with the Bald Hill antimony project in New Brunswick. Following the acquisition option by Antimony Resources Corp., an NI 43-101 technical report was published describing a potential deposit of 2.7 million tonnes with a grade of 3 to 4% antimony. This corresponds to up to 108,000 tonnes of contained antimony, doubling previous estimates from 2014. Antimony Resources is currently conducting an additional 6,000-meter drill program to further extend the mineralized zone and establish the basis for an initial official resource estimate.

GMX shares can look back on a golden few months, with the share price rising 50% from CAD 1.30 to over CAD 2.00. The first step in a long-needed revaluation has been taken, and the overall market is currently consolidating somewhat. Flexible investors are using the setback as an opportunity to invest in a well-balanced portfolio of metals for the future!

As part of the International Investment Forum (www.ii-forum.com), Lyndsay Malchuk interviewed COO and President David Christie about the latest progress. Click here for the video!

DroneShield – Employee options cashed in, share price plummets

Since Ursula von der Leyen declared a "European defense emergency" in the EU Parliament, Australian drone defense specialist DroneShield has been on a steep upward trajectory. When the first foreign high-flyers were spotted in the Baltic States and Poland, the stock experienced another upward surge. Between April and October, it achieved an incredible 600% growth, but since then, we have seen it halve again. Rational investors quickly calculated that at prices around AUD 6.50 (EUR 3.65), the expected 2025 revenue of approximately AUD 215 million was being priced at about 32 times. To make matters worse, reaching the AUD 200 million revenue threshold for the current year triggered 44 million performance-linked employee options, which were immediately exercised. This brought 5% of the outstanding capital onto the market just as buyers were fleeing due to the high valuation. The result: halved in three weeks! It is questionable whether the share price will ever recover from this, as DroneShield is still overvalued. CEO Oleg Vornik also announced that the next option revenue hurdles will be reached at AUD 300, 400, and 500 million. Then there will be more shares for the workforce. Investors should be cautious: the market value remains AUD 3.5 billion, meaning a revenue factor of 16. For comparison: Rheinmetall, which is also growing, is trading at a P/S ratio of 4.5! Some stock market stories these days are almost like a comedy!

Until October, the stock market was willing to pay almost any price for defense stocks, but the tide has turned. Expensive stocks will therefore have to consolidate somewhat before new investors return in force. Investors are slowly shifting their focus to the supply chains of those strategic metals without which modern defense would not be possible. Those who rebalance their portfolios now can make a good profit when the next upturn in the sector comes.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.