May 11th, 2023 | 12:30 CEST

Financial crisis - which financial crisis? Spring bull market ahead: Mercedes-Benz, Blackrock Silver, Nel ASA, Plug Power - Still getting in now?

The stock markets are jumping from one high to the next. If it even comes, the long-anticipated recession has already been mentally filed away. That is because the GFK consumer climate index has been rising for 8 months, and the ifo index is once again close to the 100 mark at 96.5, which is considered an expansion signal among economists. Uncertainty in the financial sector could not be greater due to overnight takeovers. But after 8 consecutive US interest rate hikes, some market participants now believe the hawkish period is over. Since the ECB has been reluctant to get into the inflation fight, only 5 rate hikes have been registered here. Gold, silver, and even lithium are sensing the arrival of spring once again. We will now focus on three interesting stocks.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

MERCEDES-BENZ GROUP AG | DE0007100000 , Blackrock Silver | CA09261Q1072 , NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Mercedes-Benz - Things are not going quite right with the EQ models

According to Mercedes CEO Ola Källenius, instead of getting stuck on the road and obstructing traffic, climate activists should rather work as engineers in his company, where they can actively shape the future. At the same time, Källenius rejected environmentalists' criticism of heavy SUVs: *"From my point of view, it is not about individual vehicle shapes, but about making cars sustainable overall. At Mercedes, all cars are becoming greener." Mercedes-Benz wanted half of the cars sold to be electric by 2025, although not always fully electric.** Ola Källenius has pushed the target back by at least one year (i.e. 2026). There are several reasons for this, one decisive factor being the current slump in plug-in hybrids, which are no longer subsidized. Such a decline was actually to be expected, yet the Stuttgart-based company had probably expected a higher "climate dynamic" among the population.

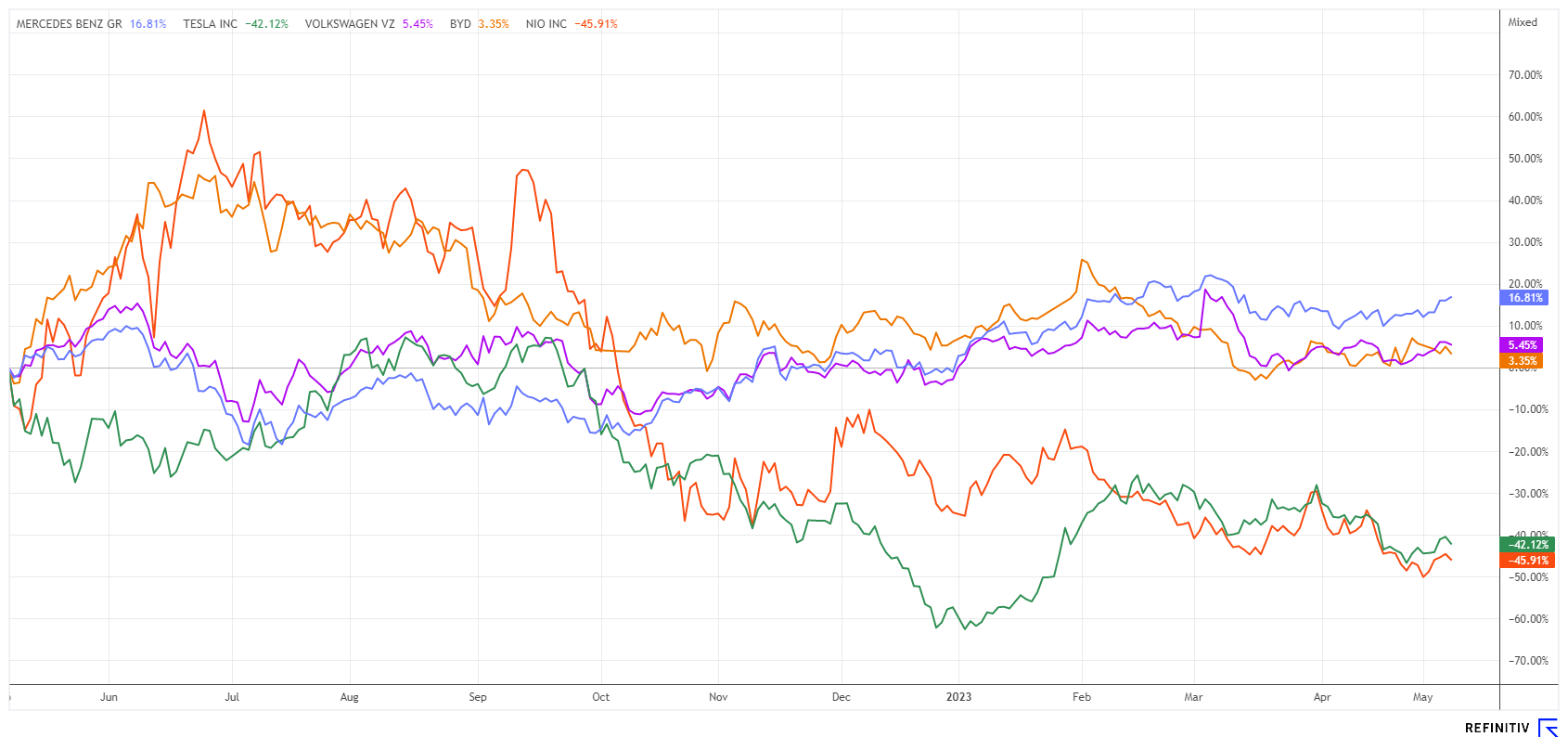

The in-house EQ models are not doing quite as well as expected and Mercedes is also struggling in the world's most important market, China. There, prices have already been adjusted downwards for the still-fresh EQE and EQS. Not only has Tesla become a competitor in this new market, but there are also more and more competitors from China, such as Nio and BYD. Not only can they keep up with Mercedes, but they are also 25% cheaper on average. Nevertheless, the shareholders were satisfied at the AGM and gladly accepted the dividend of EUR 5.20.

The share price is now some distance from its high of EUR 75.90, but the 25 analysts on the Refinitiv Eikon platform are all positive and calculate a median price target of EUR 90.20, a smooth 35% above the current price.

Blackrock Silver - The lithium deposit could become interesting

For e-mobility, the availability of lithium is of utmost importance because, although there are already many alternative technologies, so far no approach has made it to the industrial world. So if we think in terms of model cycles for the automotive industry, the Li-ion battery will undoubtedly continue to dominate the market for another 5 to 10 years.

Canadian explorer Blackrock Silver (BRC) focuses on developing gold and silver projects in Nevada. Now, however, there has been a significant discovery on the Company's own Gabriel property. The exploration program from 2022 has revealed lithium mineralization. To take advantage of further expertise, Blackrock is working with Tearlach Resources Ltd. on this one through an option agreement. There have been results for 3 more drill holes from a Phase I core drilling program at the Tonopah North lithium project (Gabriel). In doing so, Tearlach continued to encounter significant grades and widths. Results from these 3 core holes have higher than expected lithium values than the original discovery drilling and have demonstrated an expanded mineralized area measuring 2.0 by 2.75 km.

Andrew Pollard, President and CEO of Blackrock Silver commented: "We are very encouraged by the recent drill results from Tearlach, which indicate that the lithium-bearing system at the Gabriel Project continues to be more extensive and higher grade than originally anticipated. With a maiden resource estimate planned for later this year, we see the potential to unlock significant value for our shareholders as this discovery is advanced."

Blackrock Silver shares are currently trading at CAD 0.33. In addition to the recent discovery of lithium, precious metals could also make a comeback in the current environment and create opportunities.

Nel ASA - Negative pull from plug power

The share of the Norwegian hydrogen company Nel, after a slight recovery, has once again taken a downward turn. The sell-off at industry competitor Plug Power is likely to blame. Here there is a major shareholder class action lawsuit because of false information on growth, and even the latest figures have not been able to bring the market out of the selling mood.

Plug Power Inc. posted revenue of USD 210 million in the first quarter of 2023, up 49% from a year earlier. However, the gross margin for the same period was minus 33%. EBIT reached minus USD 209.8 million, in line with the negative sales performance. On a net basis, a bitter loss of USD 0.35 per share remains. The renewed setback was due to the increased cost of producing hydrogen molecules combined with historically higher natural gas prices.

Nel ASA had recently announced plans to build a giga-factory for electrolysis in the US state of Michigan. The production facility is expected to be the largest of its kind in the world. The total cost is estimated at USD 400 million. For CEO Håkon Volldal, proximity to Detroit US automaker General Motors was very important, as GM is a key cooperation partner for the industrial production of hydrogen. In November, the two companies decided to expand their existing partnership.

The Nel share has fluctuated strongly in the corridor of EUR 1.05 to EUR 1.30 in recent months. At EUR 1.23, it seems quite close to the upper turning point again. With a 2023 P/S ratio of 12, it still commands a high entry price into the H2 sector. But with permanent losses, the sector remains unattractive for private investors. We had already advised against an investment at an early stage.

The course for stopping global warming is not yet clear-cut. Many technologies can make an active contribution, but most solutions are initially counterproductive in their implementation. This is especially true for e-mobility. Investors should keep a healthy mix of standard stocks and high-opportunity investments in the Greentech sector to reduce portfolio risk.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.