November 26th, 2025 | 06:50 CET

Exploding commodity prices meet NASDAQ hysteria! Nordex, European Lithium, Siemens Energy, and Standard Lithium in focus

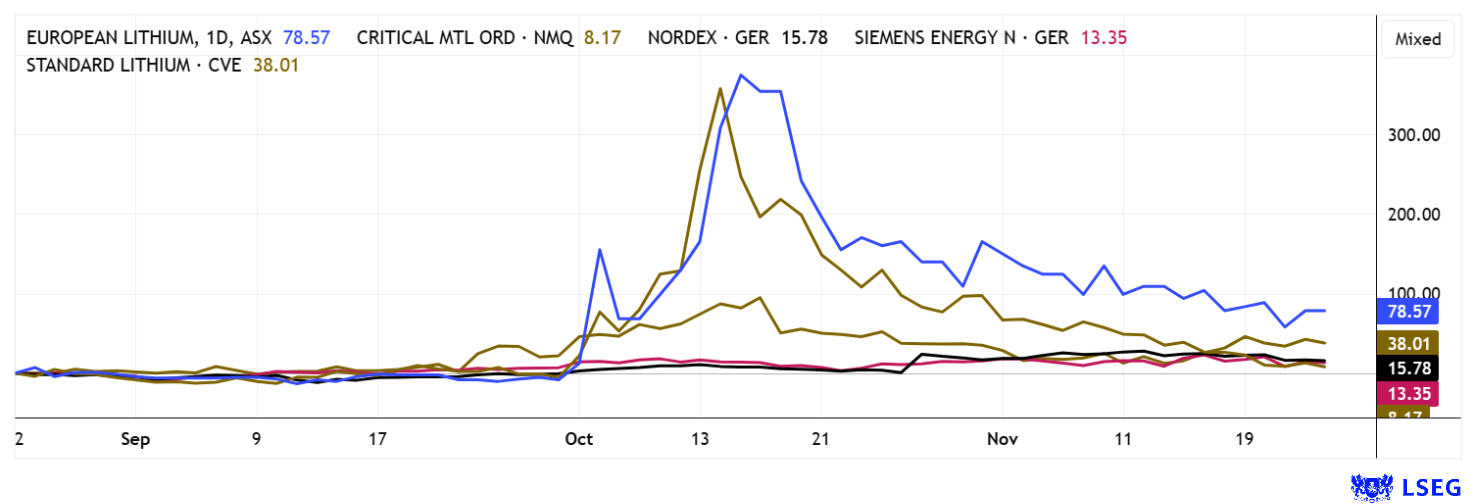

Metals, hi-tech, and defense - an explosive mix! All three of these industrial sectors are facing serious challenges. The scarcity of critical raw materials from a limited number of sources is leading to sharp price increases and jeopardizing important supply chains. Europe is responding with a collective rethink, as dependence on rare metals such as lithium and rare earths is increasingly becoming a strategic and political risk. A disruption in supply could abruptly halt the market penetration of electric vehicles. The recent extreme rise in raw material prices is driving companies such as European Lithium and Standard Lithium through the roof, while buyers of critical metals such as Nordex and Siemens Energy are finding themselves in difficulty. We shed some light on the situation!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NORDEX SE O.N. | DE000A0D6554 , EUROPEAN LITHIUM LTD | AU000000EUR7 , SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0 , STANDARD LITHIUM LTD | CA8536061010

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

European Lithium – Recipes for the looming critical metal emergency

It took a long time, but European Lithium's program has now been announced for several months and is finding its valuation ratios. It is about securing Western industries with scarce and rare metals. The Australian company is positioning itself in a rapidly changing raw materials environment as a broadly diversified supplier of critical metals, with Greenland playing a key role due to its growing geopolitical importance. At the same time, there are some land rights in Ukraine that could come back into focus after successful peace negotiations. Alongside this, the Wolfsberg project in Austria remains a central component of the European battery value chain. As Europe's first fully approved lithium mine, it is set to supply BMW from 2027, thereby contributing to the diversification of the German automotive industry's dependencies. With the addition of the Leinster project in Ireland, European Lithium is further expanding its strategic raw material reach within the EU.

There is no doubt that the Arctic island of Greenland is increasingly becoming the focus of Western industrial policy due to its enormous resource base of rare earths and strategic metals. The Tanbreez project, held through the US subsidiary Critical Metals Corp. (just over 50% stake), is considered one of the world's most significant deposits of heavy rare earths outside Asia. Current drilling campaigns confirm exceptionally consistent HREO and gallium grades, while low uranium and thorium values significantly favor approval. Despite all the tough political negotiations, the economic attractiveness is increasing almost daily, as model calculations show a net present value of up to USD 3 billion and an internal rate of return in the triple-digit percentage range.

As the majority shareholder of Critical Metals, European Lithium benefits directly from this value dynamic, as its stake in NASDAQ-listed CRML currently has a calculated value that significantly exceeds European Lithium's market capitalization. Strategic partial sales of CRML shares also generated over AUD 180 million for the Company, increasing the group's cash reserves to around AUD 325 million. This capital base not only enables project progress, but also a generous share buyback program to reduce the valuation discrepancy. European Lithium's share price has been on a sustained upward trend for a year, benefiting from increased attention in the German-speaking D-A-CH region. With a current market capitalization of around EUR 168 million, the medium-term appreciation is far from over! Collect!

CEO Tony Sage provides a strategic update in an interview with IIF correspondent Lyndsay Malchuk.

Standard Lithium – Back on track?

Standard Lithium is also one of the great hopes of the US supply chain for critical metals. The Company is currently focusing on three main areas: progressing toward completion of the Definitive Feasibility Study (DFS) for the South West Arkansas (SWA) project, raising USD 130 million in capital to finance the construction of the plant, and developing new lithium sulfide products for solid-state batteries. Losses also rose in Q3 due to expansion investments, most recently to USD 6.1 million. Nevertheless, as of September 30, 2025, there was still around USD 30 million in the coffers, and now the proceeds from the capital increase will be added to this. Technologically, an innovative solution for the future of batteries is currently being advanced with the new method for converting lithium hydroxide into lithium sulfide, particularly in collaboration with partner Telescope Innovations. Standard Lithium plans to start production at the SWA project in 2028 and is one of the few players to deliver a tangible start to production. The stock experienced a sharp rally of 500% over nine months, rising from EUR 0.90 to EUR 5.40, before pulling back to EUR 3.45 following the capital raise at EUR 4.35. With a market capitalization of roughly EUR 680 million, Standard Lithium is no longer particularly cheap!

Nordex and Siemens Energy – Far beyond the horizon

Nordex and Siemens Energy were able to leverage their GreenTech aura fully in 2025. Both stocks adorn the CDAX universe's leaderboards, with gains of 115% and 111%, respectively, over the last 12 months. But what happens next? Good advice seems to be hard to come by, as both stocks have benefited greatly from the megatrend of the energy transition. Analysts meet on the LSEG platform to review the companies' fundamental data. For Nordex, they arrive at a revenue estimate for 2025/26 of EUR 7.5 billion and EUR 8.3 billion, respectively, with an EBITDA margin estimated at around 7%. Nordex itself has set a medium-term margin target of 8%. That does not leave much room for upward movement, which has prompted 7 out of 16 analysts to put the brakes on. Overall, the average price target is only EUR 27.60, but that still represents a potential return of just under 8%. The same calculation applies to Siemens Energy: 10% estimated revenue growth in 2026 with a current P/E ratio of 30 for 2025/26. Some firms find this a little ambitious. The median price target has fallen from EUR 122 to EUR 115.7 in the last four weeks. It is questionable how long profits can still be taken calmly, as the technical peak between EUR 102 and EUR 116 has now lasted a good six weeks. Exit at the right time or set stops at EUR 23.75 or EUR 99.50.

The capital markets are prone to sharp corrections. Over the summer, investors' portfolios accumulated significant gains. With the icing on the cake of the super bull market in October, there are now sell-offs at the end of the year. European Lithium and Critical Metals are also falling back somewhat, but once consolidation is complete, they could quickly head north again.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.