August 1st, 2025 | 07:10 CEST

Evotec's turnaround, Veganz Group's record year, Puma's relaunch: Your profit roadmap through the market shift!

Germany's stock market is highly polarized in July 2025. While some heavyweights are struggling, others are shining with record results. This volatility is fueled by interest rate fears, disruptive changes, and the growing pressure of the sustainability transformation. In this complex environment, three stocks offer striking contrasts: A biotech pioneer is fighting its way back after painful setbacks through strategic realignments. A vegan food manufacturer is celebrating a record year with skyrocketing share prices and new profits. A sporting goods giant, on the other hand, is deep in a repositioning process after disappointing forecasts and management changes. Discover the opportunities and risks at Evotec, Veganz, and Puma.

time to read: 5 minutes

|

Author:

Armin Schulz

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , VEGANZ GROUP AG | DE000A3E5ED2 , PUMA SE | DE0006969603

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

Evotec – Strategic sale as part of turnaround plan

Evotec is consistently pushing ahead with its strategic realignment. The Hamburg-based drug discovery specialist has reached a basic agreement to sell its Toulouse biologics site to long-standing partner Sandoz. Evotec will transfer the modern production platform for approximately USD 300 million in cash, as well as future license revenues and milestone payments. This move significantly reduces capital commitment and is in line with the announced focus on a leaner, technology-based business model. For Evotec, the deal not only represents an immediate cash injection but also a long-term source of income through the agreed follow-up payments.

Under CEO Christian Wojczewski, Evotec is currently undergoing a fundamental restructuring. In addition to the sale of Toulouse, other sites have already been closed or sold, including a plant in Halle, Westphalia. The portfolio is to be streamlined by around 30%, with a focus on high-quality services in selected therapeutic areas and the use of AI and automation. At the same time, the Company has begun to exit the gene therapy business. These measures are aimed at reducing costs and increasing efficiency, even though it was recently necessary to lower the revenue forecast for 2025. However, the Company is maintaining its EBITDA target.

The turnaround at Evotec is a marathon, not a sprint. The current realignment, with less in-house production and more technology licenses and services, appears to be the right way to address the ongoing losses. It remains to be seen whether the extremely ambitious target of an EBITDA margin of over 20% by 2028 is realistic. It will require not only the successful implementation of the cost-cutting plans, but also strong growth in the highly profitable new business areas. The partnership with Sandoz and the technology transfer demonstrate that Evotec possesses valuable expertise. The share is currently available for EUR 7.196.

Veganz Group - Mililk: How drying technology is revolutionizing the beverage industry

The Veganz Group recently merged five business areas. Veganz provides snacks, Happy Cheeze specializes in vegan cheese, Peace on Earth offers meat alternatives, and OrbiFarm does indoor farming. The latter was sold at the end of June for around EUR 30 million. With its new Mililk business unit, the Company has developed a real game-changer for the B2B market with its Mililk technology. At its core is a patented 2D printing process that transforms liquid products such as milk alternatives into dry sheets. This innovation brings tangible benefits: up to 50% lower production costs, less packaging material, around 85% less weight and, as a result, significantly reduced CO2 emissions and ultimately up to 90% cost savings through optimized logistics and packaging costs. The shelf life is significantly extended, and all without a cold chain. Organic and barista-grade quality is also guaranteed. This gives large-scale buyers such as restaurant chains a clear competitive advantage.

Instead of serving end customers, the Company is fully focused on multipliers. With partners such as Develey, the supplier to McDonald's and Burger King, and Jindilli Beverages in the US, which supplies Starbucks among others, the technology is being fed into established distribution networks. Six production sites are already planned in Europe, and a 60 million litre plant is to be built in the US by 2026. The sale of OrbiFarm and the successful capital increase of EUR 7.1 million provide sufficient funds for the expansion of production. The new holding structure with the spin-off of Mililk FoodTech GmbH creates transparency and enables targeted investments. The focus is clearly on licensing and scaling this core innovation, as this is where significant growth opportunities lie.

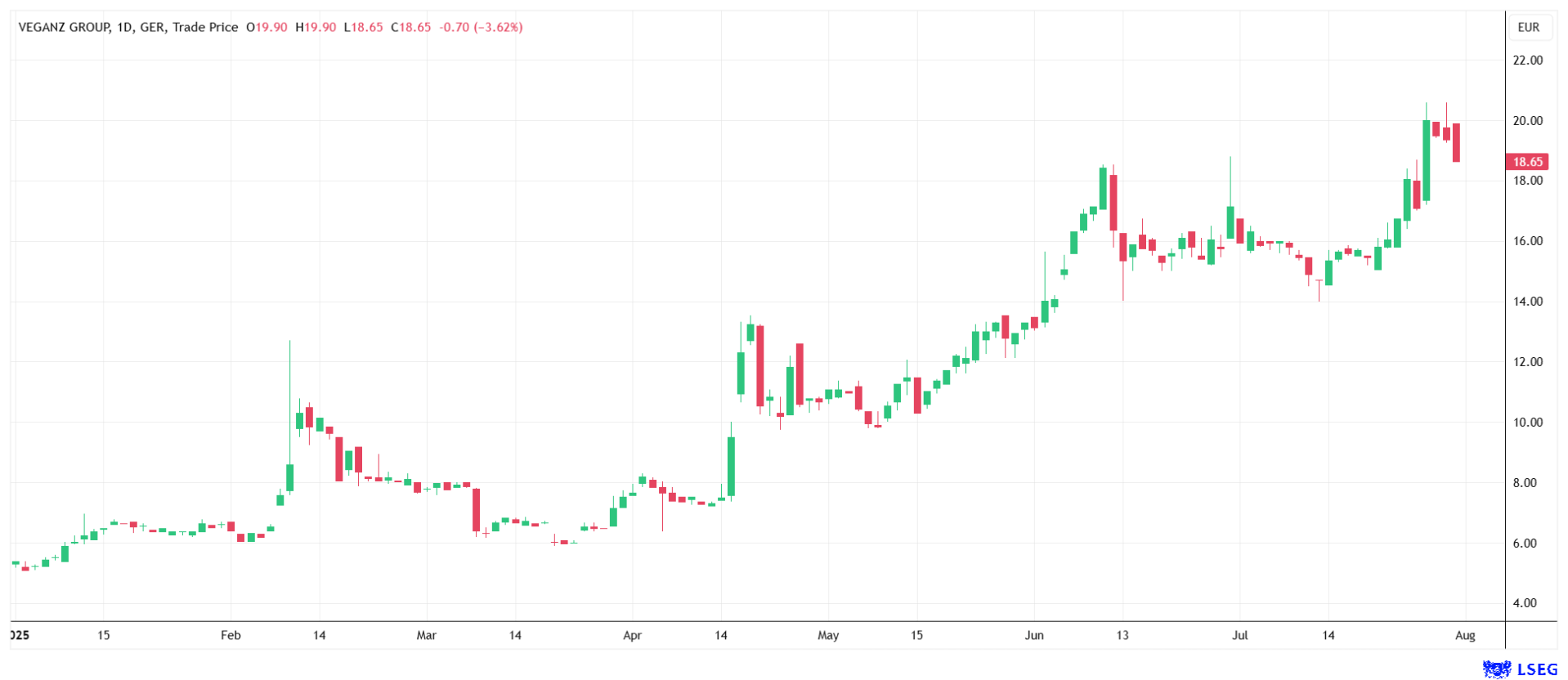

The technology has long since passed laboratory testing. Listings in stores, partnerships with dairies, and entry into the US market prove its practical suitability. The Company's own machine design and comprehensive patents protect its know-how. With the spin-off of Mililk FoodTech GmbH, capital is now being raised specifically for capacity expansion, with the parent company retaining a clear majority stake. The latest preliminary half-year results underscore the growth trajectory. EBITDA of EUR 25.33 million shows that the realignment is working. In the previous year, the figure was a loss of EUR 4.26 million. The complete half-year report will be presented on September 25. Since the beginning of the year, the share price has risen by more than 300% at its peak and is currently trading at EUR 18.65.

Puma – Revises its expectations

The big cat is showing its claws, but in the wrong direction. Puma's preliminary figures for the second quarter are clearly disappointing. Adjusted for currency effects, revenue fell by 2% to EUR 1.94 billion, and in real terms the decline was as much as 8.3%. The core markets were particularly hard hit, with North America down 9.1%, Europe down 3.9% and China down 3.9%. The bright spots are Latin America, with growth of 16.1%, and direct sales via e-commerce, which rose strongly. While shoes grew slightly, textiles and accessories slumped.

Margins are suffering noticeably. The gross profit margin fell by 0.7 percentage points to 46.1%, driven by discounts and unfavorable exchange rates. Logistics optimizations and growing direct sales were only able to offset this partially. Adjusted EBIT excluding special items slipped deep into the red at EUR -13.2 million. This was compounded by one-off costs of EUR 84.6 million and high tax expenses, resulting in a consolidated loss of EUR 247 million. Currency-adjusted inventories rose by a worrying 18.3%.

Given the ongoing weakness, Puma is pulling the emergency brake and significantly lowering its annual forecast. Instead of slight growth, the Company now expects currency-adjusted sales to decline in the low double-digit percentage range. EBIT is now also forecast to be a loss instead of the hoped-for profit. In addition to weak demand, currency effects and high inventories, the main drivers are US tariffs, which are expected to reduce gross profit by around EUR 80 million in 2025. In response, capital expenditure will be cut by EUR 50 million to EUR 250 million and inventory reduction will be accelerated. The new Puma CEO, Arthur Hoeld, has a lot on his plate. The share price is currently EUR 19.07.

The market polarization is clearly reflected in these three companies. Evotec is consistently pushing ahead with its painful but necessary turnaround by streamlining its portfolio, focusing on core technologies, and making strategic sales, such as its factory in Toulouse. Veganz is shining with its disruptive Mililk process, which is laying the foundation for scalable, profitable B2B growth through massive cost advantages and sustainability gains. Puma, on the other hand, is in the midst of a deep crisis, struggling with weak demand, margin pressure, and currency effects, which led to a drastic forecast correction and an expected annual loss.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.