September 24th, 2024 | 07:00 CEST

Environmental funding is back, now 100% with e-mobility stocks! VW, Mercedes, Prismo Metals, BYD and NIO

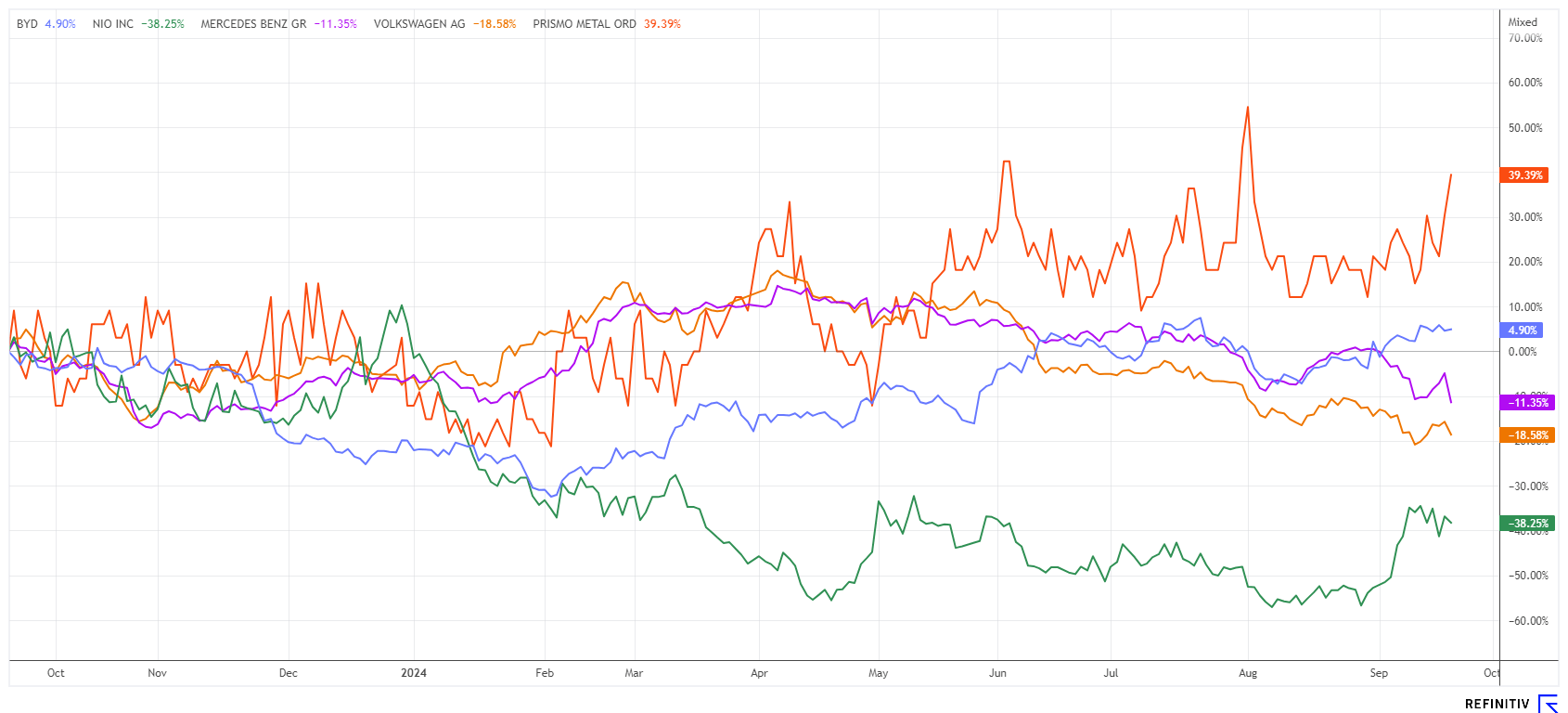

E-mobility has become a political issue in Europe because, despite the punitive tariffs imposed, thousands of new vehicles reach the ports of Rotterdam, Antwerp, and Hamburg every week. Prices are up to 30% lower than comparable EU models. Due to the current sales crisis, the German Federal Minister for Economic Affairs visited the crisis-ridden VW Group. There, he assured that he wanted to help and promised new funding for electric vehicles. However, it is not that simple because subsidies require the approval of the EU. This week, Habeck has been invited to the crisis summit of the automotive industry. This could represent the turning point for the struggling automotive industry. Valuations in the sector are at their lowest in years. Where are the opportunities for investors?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

VOLKSWAGEN AG VZO O.N. | DE0007664039 , MERCEDES-BENZ GROUP AG | DE0007100000 , PRISMO METALS INC | CA74275P1071 , BYD CO. LTD H YC 1 | CNE100000296 , NIO INC.A S.ADR DL-_00025 | US62914V1061

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD and NIO – China conquers Europe

Above all, the slowdown in China is weakening the international automotive business. But what cannot be sold in China itself quickly reaches Europe by ship. That is because Far Eastern producers can enter the market here with significantly higher selling prices, in some model groups, by up to 100%. For German manufacturers, sales of premium vehicles in Asia are increasingly being hit by the weakness of the local economy, but there is no plan B here.

Four out of ten imported electric vehicles most recently came from China. The People's Republic has thus significantly expanded its position as the most important importer, even though the absolute unit numbers have declined slightly due to the weak market since the summer. Nevertheless, China's share of total imports of pure electric vehicles to Germany rose significantly to almost 41%. Last year, this share was still at 29%; in 2020, it was only 12%.

While BYD will start production in Hungary from 2026, thus avoiding the EU punitive tariffs, NIO is apparently interested in taking over the Audi plant in Brussels. Sure, the infrastructure is already in place here; one just has to change the Company signs. According to rumors, a purchase offer has already been prepared. BYD, for its part, is taking over its German sales partner, Hedin Electric Mobility. This is how quickly Asian suppliers can gain a foothold in Europe. In terms of growth, the shares of BYD and NIO are certainly interesting, but BYD remains sufficiently valued, and NIO's cash flow is likely to remain negative until 2027 due to high investments. Very speculative!

Prismo Metals – The copper price lifts explorers' spirits

After months of consolidation, the copper price climbed back above the USD 9,400 mark last week, an important resistance level on the way up. After rallying to USD 10,850 in May, the important industrial metal consolidated to USD 8,600. However, the high momentum in renewable energies and the acceleration in the e-mobility sector are once again making the most important metal for electrification a sought-after commodity. In addition, inventories at the futures exchanges have fallen to a three-year low.

These are good conditions for the Canadian exploration company Prismo Metals. The junior has an attractive copper property called "Hot Breccia" in Arizona. The property consists of 1,420 hectares with a total of 227 contiguous mining claims located in the world-class copper belt between the well-known copper mines Morenci, Pinto Valley, Ray, and Resolution. The extensive historical exploration data of the former Bear Creek Mining Company has now been updated, and work on the project is progressing rapidly.

With a current silver price of USD 31, the second property, Palo Verdes in Mexico, should now also come into focus. The drilling program has been announced for September and will start soon. Financing should not be an issue as Prismo is working closely with the anchor shareholder Vizsla Silver Corp. The two properties border each other directly and can be developed together in a meaningful way. In previous drilling, 102 g/t gold and 3,100 g/t silver were discovered. It is worth bringing more drill rigs into position. After the election, Mexico has now become a sought-after mining location again.

The Company's 54.18 million shares are currently trading at CAD 0.23. This is already at the upper end of the range of the last 12 months, but the capitalization is still manageable at CAD 10.3 million. A further buy argument would be provided by overcoming the CAD 0.26 mark. The soaring copper and silver prices and upcoming news could soon send the title through the roof.

VW and Mercedes – Now we are in for a bumpy ride

Two profit warnings in September took a toll on the prices of Volkswagen and Mercedes. While VW announced plans to cut up to 30,000 jobs and even close some plants, the Stuttgart-based company suddenly saw its margins collapse. The blame for the plight of the German premium carmakers lies with the sharp decline in sales in the Far East, where German premium vehicles were once in demand. Now, however, e-mobility dominates the market, and sales of combustion engines are declining faster than expected.

According to the latest reports, declining sales in China are causing Wolfsburg's management to rethink its investments there. Volkswagen has been working with its Chinese partner, SAIC Motor Corp, in China for almost four decades. By the end of 2023, VW had employed more than 90,000 people in its Chinese factories. Now, as early as next year, the plant in Nanjing may be closed, as anonymous sources report to Bloomberg.

Mercedes-Benz is also concerned about the current fiscal year. Last week, the Stuttgart-based company again lowered its already revised profit forecast. The main reasons for this are the deteriorating economic situation and the decline in business in the Far East. EBIT is expected to be well below the previous year's level, with Mercedes-Benz's passenger car division in particular weighing on the forecast. A margin between 7.5 and 8.5% is now expected for 2024, while the previous outlook was 10 to 11%.

Nevertheless, with share price losses of between 12 and 18% in the last 12 months, some of this has already been priced in. The restructuring costs are not yet reflected in the balance sheet, but the substance of both companies is high. This means that P/E ratios of 3.5 to 4.8 and dividend yields of over 6 to 7% are slowly becoming attractive. If the economics minister reacts quickly, this could soon get prices out of the basement. Buy a few VW shares at EUR 91 and Mercedes at EUR 55, but a horizon of 2 to 3 years is necessary.

The course for e-mobility could now be set anew in Berlin and Brussels, which should help the struggling stocks in the automotive sector to recover. These stocks have underperformed the DAX 40 index by more than 25% in recent months. Prismo Metals is advancing faster than expected, and copper and silver prices are rising simultaneously. This makes the stock a speculative top pick among the smaller explorers.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.