February 16th, 2023 | 22:05 CET

Encavis, Globex Mining, Freeport-McMoRan - Like in a fairy tale

Germany still has 22 years to achieve its goal of climate neutrality. By then, electricity will be generated purely from the sun and wind, and buildings will be so perfectly insulated that they will no longer need to be heated. Cars will only be fueled by electricity or green hydrogen. On paper, the energy mix transformation reads simple, but the implementation seems almost impossible, given current developments. Massive problems are likely to arise in procuring critical raw materials, as global demand is already outstripping supply for many metals.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

ENCAVIS AG INH. O.N. | DE0006095003 , GLOBEX MINING ENTPRS INC. | CA3799005093 , FREEPORT-MCMORAN INC. | US35671D8570

Table of contents:

"[...] We have a clear strategy for neutralizing sovereign risk in Papua New Guinea. [...]" Matthew Salthouse, CEO, Kainantu Resources

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

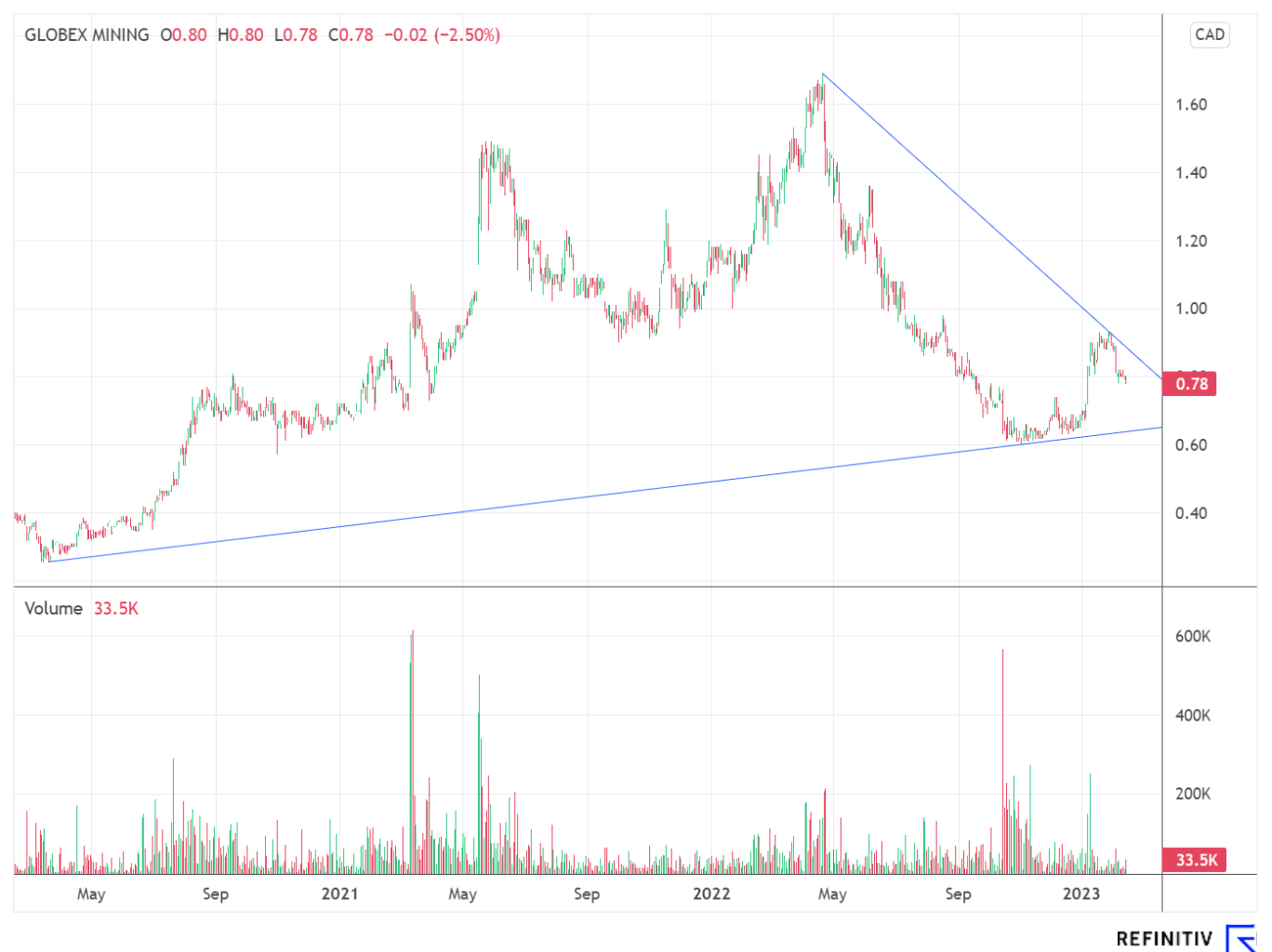

Globex Mining - The share for the commodity boom

The shift from fossil fuels to renewable energy sources is bringing much-needed metals more and more to the forefront. For example, the main components in technologies for generating or storing green energy are made of copper, nickel, cobalt or lithium. It is well known that these raw materials are already in short supply today. On the other hand, the geopolitical risks mean that there is a danger of even greater dependence than we have already experienced with Russia in the case of oil and natural gas.

To ensure that the Western world is supplied with the materials it needs, policymakers support the mining sector with billions in subsidies. However, the increasing demand due to climate change is far outstripping supply for many critical metals, and experts say it takes an average of 7-10 years to build new mining projects. But how can the average private investor profit from the expected rising prices without taking the risk of a total loss on an individual investment?

Globex Mining, listed with a market capitalization of CAD 43.42 million, offers an alternative where every investor should sleep easy because the portfolio diversification is unique. The Company, which Jack Stoch has successfully managed for decades, offers a total of 217 holdings, divided into various asset classes such as gold, silver, platinum and palladium, via the industrial metals copper, zinc, iron and nickel, as well as rare earths and energy metals such as lithium, uranium and cobalt. With 44 projects, Globex Mining participates directly in the energy transition, as critical metals and minerals such as iron, rare earths, uranium, lithium and cobalt are stored here. A total of 55 projects have historical or NI 43-101 compliant resource estimates.

Globex Mining generates revenue by optioning land packages from its inventory for cash and shares. As a result, the Company receives recurring royalties, and the partner assumes the exploration risk. In addition to acquiring and licensing properties, the Company also invests approximately CAD 1.5 per year to explore its properties. With a cash balance of EUR 7.7 million and over CAD 10 million in resilient investments, Globex Mining is very well secured.

Freeport-McMoRan - Forecasts conceded

One of the largest mining companies in the world is Freeport-McMoRan, based in Phoenix, Arizona. Its portfolio includes the Grasberg area in Indonesia, one of the world's largest copper and gold deposits. Grasberg, located on the island of Papua in the Sudirman mountain range, is controlled mainly by the Indonesian government, and Freeport acts as a mine operator there. The mining giant also has significant operations in North and South America, including the extensive Morenci mining district in North America and the Cerro Verde operation in South America.

Due to heavy landslides and rainfall, work on the flagship Grasberg project had to be suspended. The world's largest gold mine and second-largest copper mine was paralyzed by mudslides which damaged the concentrate processing plant and part of the road. Freeport McMoRan expects to restart the mine at the end of the current month.

As a result, forecasts for the first quarter have been capped. The US company now expects lower sales than forecast in January. About four weeks ago, 900 million pounds of copper and 300,000 ounces of gold were expected. At optimal operation, the mine produces nearly 5 million pounds of copper and 5,000 ounces of gold daily.

Encavis - Surprisingly strong

With a 14% increase in electricity production from renewable sources to 3,133 GWh, wind and solar farm operator Encavis has outperformed even its own forecasts. In addition to total output, all key performance indicators also exceeded expectations. As the MDAX-listed group announced, revenues grew by around a third YOY to EUR 455 million, while analysts were forecasting sales in the region of EUR 432 million.

Operating earnings before interest, taxes, depreciation and amortization Ebitda also grew by over 30% to EUR 340 million, with a high margin of 75%. This results in operating earnings per share of EUR 0.58, compared to earnings per share of EUR 0.48 in 2021. At EUR 320 million, operating cash flow grew particularly strongly, exceeding the forecast of EUR 280 million by around 14%.

With the achievement of an operating EBIT of approximately EUR 195 million, the producer of electricity from renewable energies is already close to the target values of the established growth strategy "Fast Forward 2025", which announced a target value of EUR 198 million.

Insiders seem convinced of further business development. Thus, Supervisory Board member Albert Büll bought Encavis shares at a price of EUR 18 and a total volume of EUR 216,000.

The shift to wind and solar energy and the electrification of transport requires many critical metals. Globex Mining has a unique portfolio in this regard. Freeport-McMoRan announced a temporary shutdown of its operations at the Grasberg mine. In contrast, Encavis was convincing on all counts in its full-year 2022 figures.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.