February 26th, 2025 | 07:00 CET

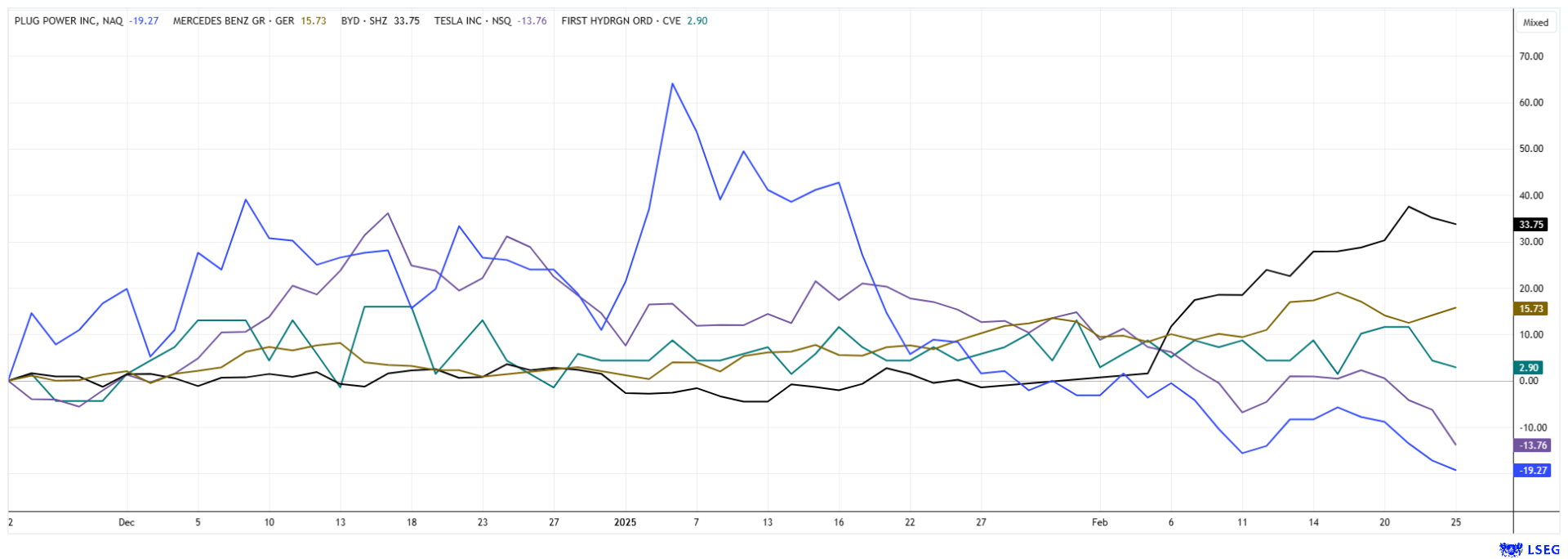

Elon Musk is losing, now comes hydrogen! Watch out for BYD, Plug Power, First Hydrogen, and Mercedes

Tesla has already lost its leading role to BYD, but there are other winners from the Texan crash. Mercedes is one of the profiteers. First Hydrogen is ready to roll out its innovative solutions. Since nuclear power plants are almost emission-free during operation, the carbon footprint of green hydrogen from nuclear energy is comparable to that from renewable sources such as wind and solar. Unlike wind or solar energy, nuclear power can produce electricity around the clock because it is not dependent on weather conditions. In countries such as France, Finland, and Japan, nuclear energy is already being considered as an option for hydrogen production to drive the decarbonization of industry. Which stocks are coming to the fore as a result?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , PLUG POWER INC. DL-_01 | US72919P2020 , First Hydrogen Corp. | CA32057N1042 , MERCEDES-BENZ GROUP AG | DE0007100000

Table of contents:

"[...] The VERRA certification adds credibility to dynaCERT's emission reduction technologies by demonstrating compliance with internationally recognized standards for carbon emissions reductions and sustainable development. [...]" Jim Payne, CEO, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Plug Power – The moment of truth

The big losers in 2024 will be in the hydrogen sector. In addition to the public investment crunch, private entrepreneurs are also becoming increasingly hesitant. This leads to a constant decline in orders, which the ailing balance sheets would now sorely need. Money is running out and will likely necessitate a few more capital increases. This is now the case with Plug Power. After an absolute buying frenzy in 2020/21, the share price fell by 95% from its high. CEO Andy Marsh has been unable to convince his investors much in recent years, and false statements about future developments compounded this. With the inauguration of Donald Trump, the entire greentech sector was once again punished, with PLUG shares losing a further 40% overall to around USD 1.60 since November 2024. Due to a decline in public sector orders, the Company has recently undergone a restructuring, and last week, a major capital increase of USD 1 billion was announced. The annual figures for 2024 are now scheduled for February 27, and the stock market is currently taking a long view. It will, therefore, be interesting to hear what CEO Marsh has to say. If the share price holds up after the annual results press conference, this would be a signal for traders, although fundamentally, Plug Power does not yet offer any incentives to buy.

First Hydrogen – Only those who innovate can score

When thinking about hydrogen, one should especially consider nuclear energy as a transmitter. While large reactors only make sense on vessels like ships, a flexible stationary nuclear power plant can ensure decarbonization in many regions of the world. So-called small modular reactors (SMRs) are being closely examined in the US. According to the International Atomic Energy Agency (IAEA), SMR plants will help reduce greenhouse gas emissions in the future as a reliable and affordable energy source. The unique properties of SMRs in terms of efficiency, flexibility, and cost-effectiveness can enable the technology to play a key role in the clean energy transition. According to the IAEA, 84 such reactors are currently being developed or constructed in 18 countries worldwide. The US, Canada, Great Britain, France, Russia, China, and Japan are mentioned in particular. These countries want to operate SMRs in the future as a "low-emission transitional solution" to achieve their climate protection goals. The unique properties of SMRs in terms of efficiency, flexibility, and cost-effectiveness could enable the technology to play a key role in the clean energy transition. According to the IAEA, 84 such reactors are currently in development or under construction in 18 countries worldwide. The main countries mentioned include the US, Canada, the UK, France, Russia, China, and Japan. These countries aim to operate SMRs as a "low-emission transitional solution" to achieve their climate protection goals.

Hydrogen from nuclear energy could become popular in the coming years. Many countries are stepping up their nuclear energy commitment under the "NetZero" environmental flag. The Canadian innovator First Hydrogen also wants to use the "Hydrogen-as-a-Service" model to supply customers in the Montreal-Québec City region with clean, green hydrogen as a fuel for the first time in the next few years. Several projects are currently being evaluated to move forward on this topic. The high-tech companies from Silicon Valley are leading the way. With billions of dollars in investments, they want to meet their gigantic power consumption in the large data centers with their own small reactors.

First Hydrogen aims to be a first mover in this area and would like to install these SMRs in areas where the grid power supply is limited or non-existent, in order to produce storable hydrogen for filling stations. Once again, First Hydrogen is demonstrating its strong focus on innovative and sustainable energy solutions to accelerate the global energy transition. First Hydrogen's stock (FHYD) is still trading quietly in the CAD 0.35 to 0.40 range. With the first 100 days in office, Donald Trump could push the nuclear sector to new heights. First Hydrogen is in pole position because Quebec is combining "NetZero" targets with a local solution that could set a precedent nationwide. Very exciting!

BYD and Mercedes – The shakeout has begun

After political interference, is this the consequence? Tesla is struggling with weak sales in the EU, with new registrations halving in January. Overall, only 9,945 Tesla vehicles were newly registered in Europe, a significant drop from the 18,161 units in the previous year. At the same time, EU registrations of electric vehicles have increased by a third. Overall, however, the auto market in the European Union had a sluggish start to the new year. In January, 831,201 new passenger vehicles were registered, 2.6% fewer than in the same period last year. By contrast, electric vehicles made a significant leap forward. However, a year earlier, subsidies had expired or been cut in several European countries, causing sales to slump.

According to data from Deutsche Bank Research, the global market for electric vehicles is growing rapidly again. According to this, around 1.2 million electric vehicles were sold worldwide in January 2025. Chinese manufacturers such as BYD and Geely dominate the global market, while Tesla and European brands are trailing behind. BYD alone sold over 310,000 vehicles in January, a year-on-year increase of 44.9%. Such figures would be a dream for Mercedes. In 2024, the Stuttgart-based company achieved annual sales of 1,983,400 units thanks to a strong performance in Germany, China and the US, but the forecasts for the current year are modest. A cost-cutting program has now been set up, which also includes a partial relocation to Hungary. BYD has set a good example there. With a production facility in the neighboring Eastern European country, European import duties will be avoided from 2026. It is no coincidence that Tesla shares have been falling drastically in recent days to below USD 300, while BYD has reached a new all-time high of EUR 49. The annual figures of Mercedes-Benz only pushed the shares below EUR 60 for a short time, and the turnaround at around EUR 52 appears to have been successful. We expect the current trends to continue, as Tesla is still valued five times as high as BYD and Mercedes combined.

The much-discussed energy transition will show new facets. While e-mobility is making a fresh attempt with new political support, the EU market, with its high consumer potential, is being discovered by China. It will be difficult for the first mover, Tesla, to maintain its leading position in the premium segment. Local suppliers such as Mercedes will become stronger again. Alternative energy concepts are also directing investors' attention to specialized niche suppliers such as First Hydrogen.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.