September 22nd, 2025 | 07:30 CEST

E-mobility poised for the next boost! Focus now on Mercedes-Benz, Geely, BASF, and Graphano Energy!

The market for electric vehicles is heavily influenced by current battery technology. Advances in high-performance materials and solid-state batteries are significantly improving range, performance, and safety. Faster charging times and longer battery life are leading to greater consumer acceptance. The development of silicon anodes and new cathode materials is enabling more efficient and cost-effective batteries. Sustainable recycling methods are also important, as they strengthen the circular economy and reduce environmental impact. With the expansion of charging infrastructure, range anxiety is decreasing, and EV usage is becoming more convenient. This highly innovative environment opens up opportunities for both manufacturers and investors alike. Those who understand the key players in the space can achieve substantial returns.

time to read: 6 minutes

|

Author:

André Will-Laudien

ISIN:

MERCEDES-BENZ GROUP AG | DE0007100000 , GEELY AUTO. HLDGS HD-_02 | KYG3777B1032 , BASF SE NA O.N. | DE000BASF111 , Graphano Energy Ltd. | CA38867G2053

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BASF – Battery innovation with new high-performance materials

In the current e-mobility environment, the battery, its charging time, and durability are at the center of discussions. Consumers are also keeping a close eye on current developments in order to make a sound decision for their next car purchase. BASF is currently setting new standards in battery materials and is now supplying mass-produced high-nickel NCM cathode materials for semi-solid-state batteries to WELION in China for the first time. The cooperation was established in a record time of just 12 months. The special composite coating improves the capacity, safety, and service life of the batteries, with BASF currently shaping the market as the technology leader.

At the same time, strategic alliances such as the one with CATL secure the Ludwigshafen-based company a key role in the development of pioneering high-nickel, LFP, and manganese-rich battery materials. These partnerships and the broad portfolio enable the targeted supply of customized solutions to global OEMs and cell manufacturers in Asia, Europe, and America. The Company's commitment to recycling, for example, through new black mass capacities in Germany, rounds off the value chain and puts the focus on sustainability. BASF is not only consistently expanding its market position internationally, but also marking an important milestone for investors as a full-service provider and innovator in industry. The next generation of electromobility has already been ushered in, with rising registration figures illustrating its acceptance among buyers.

BASF shares have not performed particularly well over the last three years. Despite new DAX highs, the share price has fluctuated unspectacularly between EUR 38 and EUR 52. Currently still a loser in the German energy crisis, this could change in the medium term, as Berlin aims to remedy the situation and bring Germany back to the forefront. New entrants to BASF currently pay a 2027 P/E ratio of 10.7 and a P/S ratio of 0.6. On top of that, there is a dividend yield of 5.3%.

Graphano Energy – The next graphite supplier from Canada

Graphano Energy is also strongly positioned in the same segment. The Company is rapidly developing a comprehensive graphite project pipeline in Québec, Canada, and is positioning itself as a new key supplier for the strategically important battery industry. The focus is on the flagship Lac Aux Bouleaux ("LAB") project, which is located in the immediate vicinity of Northern Graphite's Lac des Îles Mine and benefits from a cooperation agreement on the joint use of the processing plant. This partnership could secure Graphano significant cost advantages in the transition to production and allow it to leverage synergies in development and processing. On top of that, there are tax incentives from the Québec government.

In addition to LAB, Graphano owns a second high-grade deposit, the Standard Mine project, which scores highly for the battery industry with positive resource figures and successful metallurgical tests. The Company plans to present a resource estimate and continue drilling activities this year, followed by a feasibility study in 2026. In a regulatory environment dominated by US tariffs on Chinese graphite, Québec's domestic production offers a strategic location advantage. This is because the 163% tariffs imposed by the US on Chinese imports are increasing interest in local suppliers. Donald Trump still has some work to do in his relationship with Canada, but the chances of a technology and resource partnership are high. At the same time, Graphano reported promising drill results with exceptionally high graphite grades at its latest discovery, Black Pearl. The first drilling campaign aims to define the extent of the mineralization and significantly broaden the resource spectrum. The project is conveniently located and benefits from access to a skilled workforce and clean hydropower. The geological environment is similar to the large deposits in the region, which promises further resource potential.

Graphite remains a key raw material for lithium-ion batteries, for example, and is a cornerstone of the energy transition. With the planned ramp-up phase of new battery production in Europe, Graphano's development schedule is perfectly timed for industrial implementation. The Company presents itself as a technology metal developer with a clear growth strategy, supported by local infrastructure and expertise. Graphano's share price (GEL) has already made a leap, but its current capitalization of CAD 3.6 million is still very manageable. Collect!

Mercedes versus Geely – In the race for the megawatt future

The hunt for the best charging system is in full swing. Mercedes-Benz recently reached a milestone with its AMG GT XX concept car. For the first time, the 1 MW charging power mark was exceeded at a prototype charging station from Mercedes and Alpitronic. Specifically, the peak reached 1,041 kW, with up to 1,176 amps flowing through a liquid-cooled CCS cable. Within one minute, the system was able to transfer 17.3 kWh, which corresponds to a WLTP range of around 125 kilometers. This is made possible by a newly developed high-performance battery with an energy density of over 300 Wh/kg, based on cylindrical NCMA cells and direct oil cooling. The first test clearly shows that Mercedes aims to be at the forefront of fast charging. From 2026, the findings will be incorporated into its own charging parks in Europe and North America, offering premium customers an exclusive charging experience.

While Mercedes is still working on the practical implementation, its Chinese competitors have long been active. Geely has already announced the launch of a 1.2 MW DC fast-charging station for 2025 through its Zeekr brand and is simultaneously building a network of over 12,000 charging points. Added to this is the so-called "Golden Battery" with a charging rate of up to 5.5C, which enables a charge from 10 to 80% in about 10 minutes, a value that Mercedes currently only achieves in a test environment. At the same time, Geely is focusing on scaling. In addition to high-end models such as Zeekr, the Company also serves price-sensitive markets with vehicles such as the EX5, thus securing a broad customer base and volume at an early stage.

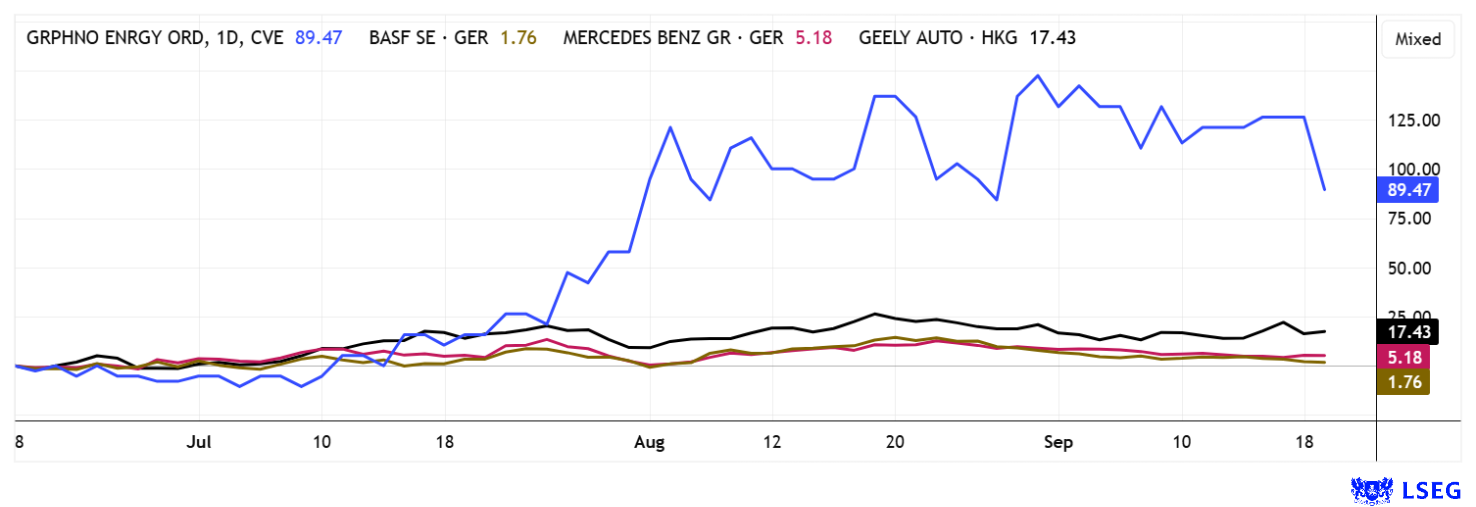

Mercedes is pursuing the path of a premium technology leader with high development expenditure, clear differentiation, and long-term return potential. On the LSEG platform, 10 out of 27 analysts give it a thumbs up, with an average price target of EUR 58.30 – a 13% premium on the current price of EUR 51.60. Geely is focusing on speed, volume and diversification, which promises rapid market share gains. Geely shares have gained over 90% in the last 12 months, while Mercedes-Benz shares are down 10%. At least there is a dividend yield of almost 8% at this level. Geely trumps with a 2026 P/E ratio of 9.5, while the Stuttgart-based company only manages a factor of 7.4. Both stocks have their medium-term appeal if e-mobility finally takes off.

The automotive sector is one of the weakest industries in the current super bull market. Strict requirements in the tariff dispute, ever-changing environmental laws, and consumer reluctance are putting pressure on margins and filling dealer parking lots. The situation is different at Graphano Energy: The pressure to innovate in battery development is so high that graphite ranks at the top of the industry's procurement list.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.