January 16th, 2024 | 07:15 CET

E-mobility boom 2024, when will the German vehicle market take off? BYD, Edison Lithium, VW, BMW

The last word in e-mobility has not yet been spoken. While BYD is leading the sales list worldwide, Tesla is struggling with important supplier parts and has had to halt production temporarily. German manufacturers have used the last two years to catch up on technical backlogs and are preparing to score points in the "electric world", too. Last year, buyers were offered a state environmental bonus on top, but this was cancelled before Christmas. Now, the market has to prove that it can survive with fewer subsidies. Where are the opportunities for investors?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , Edison Lithium Corp | CA28103Q2080 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , BAY.MOTOREN WERKE AG ST | DE0005190003

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD - The global market leader in alternative drives

The Chinese conglomerate BYD announced at the beginning of the year that it had produced over 3 million vehicles with alternative drive systems in 2023. Tesla, on the other hand, reported an output of 1.84 million purely electric vehicles. This puts BYD ahead in the overall view, but Tesla remains number one on the e-stage.

However, the market weighting could soon shift, as the Chinese company has big plans for entering the European market. CEO Wang Chuanfu said at the IAA Mobility in Munich in September 2023 that a total of 6 models are to be launched by mid-2025. The first European car plant is to be built in Hungary in the city of Szeged. BYD recently announced on its WeChat channel that several thousand jobs will be created there by 2026. The Company already operates a factory in north-western Hungary where electric buses are manufactured. In order to get the market launch off to a good start, the price of the current models has already been reduced by up to EUR 7,000. The BYD Atto 3 Comfort now costs EUR 37,990. It seems that the price reduction applies not only to private customers but also to commercial buyers.

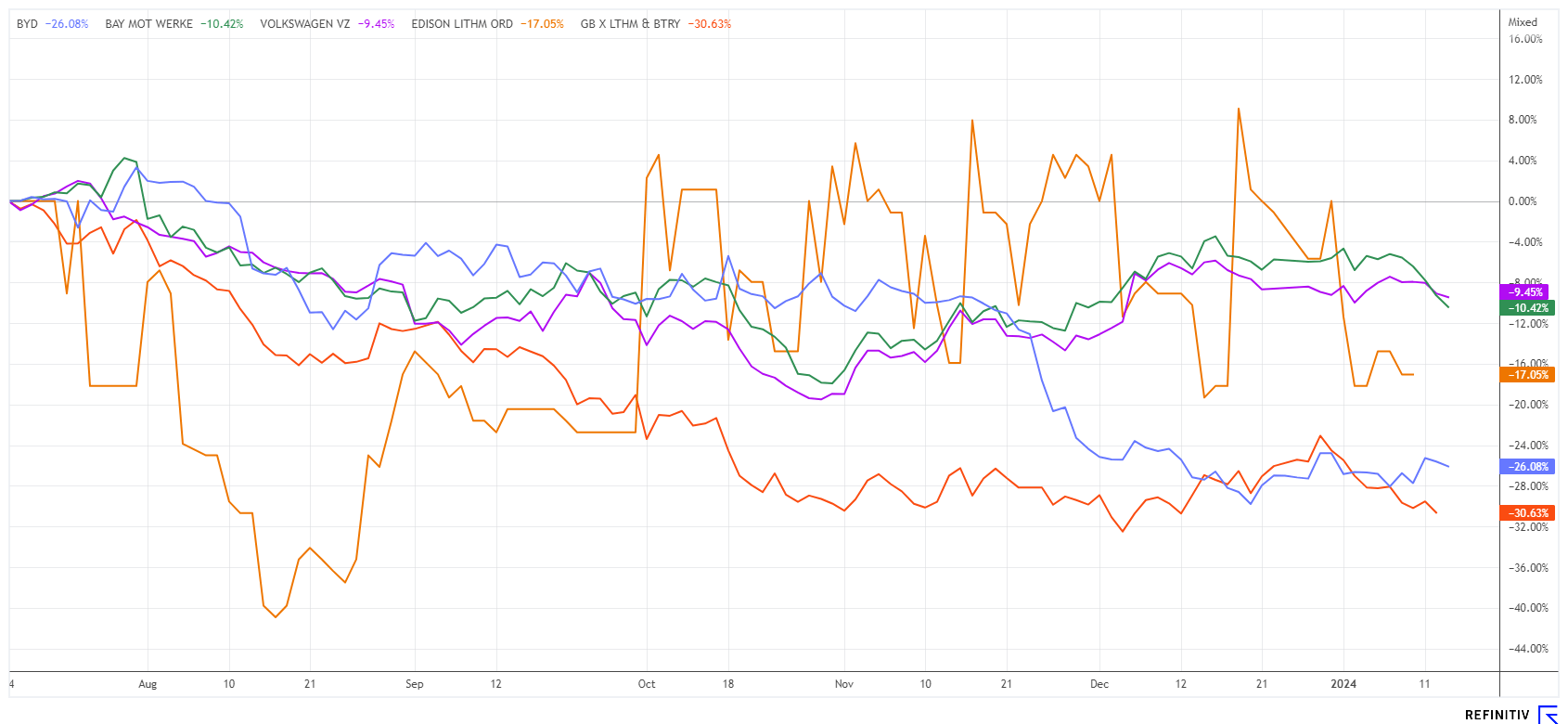

BYD registered 4,135 new electric vehicles in Germany last year, 90% of which were the Atto 3. The Romanian manufacturer Dacia also wants to start the year with discounts of up to EUR 10,000. The competitive field is, therefore, becoming increasingly difficult. Foreign manufacturers still have significant cost advantages on the German market and are leading the discount battle. BYD shares have lost around 10% in the last 12 months and are currently struggling to reach the EUR 24 mark. The share is not cheap, but analysts expect BYD to achieve a sales growth of just under 20% annually until 2026. But beware: the Asian e-vehicles have yet to prove their clout in Europe.

Edison Lithium - Reorientation creates many opportunities

Despite the global shortage of lithium, the current market supply is likely sufficient to put further pressure on the price of the battery metal. The global Lithium & Battery ETF is down 30% since mid-2023, while the Canadian battery metal explorer Edison Lithium is doing slightly better.

Shortly before Christmas, the Company delivered some important news. On December 18, 2023, Edison Lithium signed a letter of intent (LOI) with the Texan energy company Meteor Energy to sell its stake in the Argentinian subsidiary Resource Ventures (ReVe) for USD 5 million. Prior to the sale, ReVe will first spin off the Pipanaco claims, and one of the Lexi claims into a new company and continue to manage them independently. The parties intend to take approximately 60 days to review the deal thoroughly.

Edison will focus its Argentinean efforts on 8 mining concessions covering approximately 28,766 hectares in an area in the Argentinean province of Catamarca, which are not subject to the sale and represent approximately 20% of the claims currently held by ReVe. The coveted lithium comes from salt pans or salt lakes and is extracted using evaporation and purification equipment. A young raw materials company also needs good asset management. Only two and a half years ago, Edison paid USD 1.25 million for the entire ReVe property. The stock market has so far paid little attention to the good deal; the valuation of the entire Edison Lithium is currently just under CAD 2.8 million. This could change dramatically upon the realization of the LOI.

VW versus BMW - With different philosophies to success

The German automotive market has to cope with another setback, as the state environmental bonus surprisingly expired last year. With the landmark ruling of the Federal Constitutional Court in November 2023, the free Corona funds may not be spent on the Climate Transformation Fund. Volkswagen reacted immediately and took over the financial disadvantages for its customers for vehicles already ordered, but the vehicle must be delivered by the end of March. BMW only clarifies the facts of the discontinuation on its website but does not cover the costs. However, individual negotiations at the local dealer are likely to follow. Ultimately, the environmental margin will also have to be waived here in order to retain loyal customers.

It is not good news for owners of VW and BMW shares. Since December, these stocks have lost between 6 and 9%, and now there is also the price reduction from the Chinese newcomer BYD. Fundamentally, VW and BMW are available at a 2024 P/E ratio of 3.8 and 6.1, respectively. On top of this, dividend yields of 7.7% and 5.6% beckon. With this valuation, the charts should gradually start to turn around.

The German government cancelled the environmental bonus just before Christmas 2023. Now, representatives of the e-mobility industry need to have a rethink. It is no longer a tax-subsidized self-runner. VW and BMW are taking different paths, while BYD is reducing prices for now. Edison Lithium should soon receive USD 5 million in cash and can thus take advantage of new opportunities in the raw materials market.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.