October 17th, 2025 | 07:10 CEST

E-mobility and hydrogen take off – BYD, Nio, Graphano Energy, and Plug Power in focus!

The German government is resolutely driving forward the transition to e-mobility by 2035 - a clear signal at a time when climate targets and energy dependence are the subject of intense debate. The market for electric vehicles is benefiting from innovations in battery technologies and a growing charging infrastructure. Advances in solid-state batteries, silicon anodes, and new cathode materials are significantly increasing range, performance, and safety. Faster charging times and longer service life are making the switch increasingly attractive for consumers. At the same time, recycling processes and the circular economy are gaining in importance to conserve resources and promote sustainability. With government support and growing competition, enormous opportunities are emerging for manufacturers and investors. But while electromobility is booming, hydrogen is also increasingly becoming the focus of the energy transition as a complementary technology. Investors are free to decide where to invest for the best returns.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , NIO INC.A S.ADR DL-_00025 | US62914V1061 , Graphano Energy Ltd. | CA38867G2053 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD and NIO – Chinese manufacturers on the rise

The European vehicle market is undergoing massive change as Chinese manufacturers such as BYD and NIO grab market share. In recent months, BYD has established itself as a serious competitor to Tesla and has achieved higher sales figures for the first time in several European markets. The Company is pursuing a clear expansion strategy with a local focus. A new production facility in Hungary is scheduled to go into operation in 2025, with further plants planned in Turkey and possibly Spain. These locations are intended not only to circumvent customs duties but also to shorten supply chains and strengthen competitiveness in the EU. BYD scores with a broad model portfolio, ranging from compact city cars to premium SUVs. So far, BYD has impressed with a visible technological lead in batteries and drive systems. The blade battery in particular is considered the benchmark for efficiency and safety in industry.

NIO also has ambitious plans for the European market, albeit with a slightly different strategy. The Company is focusing more on service, brand, and user experience, for example, through innovative battery exchange stations and digital customer networks. With its new sub-brand Firefly, NIO is also entering the high-volume mid-range segment. The first Firefly models were delivered in Norway and the Netherlands in the summer of 2025 and are expected to be available in seven other European countries in the medium term. The asking price of less than EUR 30,000 is a slap in the face for German manufacturers and opens up new customer segments. Despite initial delays in its market entry, the Company is considered one of the most exciting Chinese players with premium aspirations.

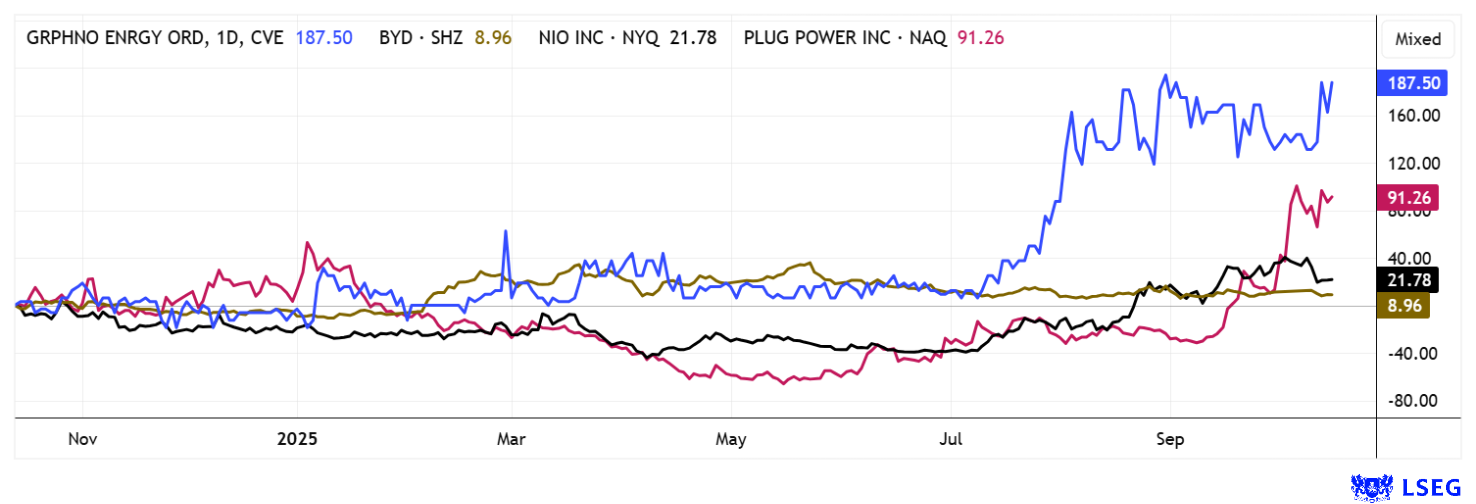

BYD shares have undergone a sharp 40% correction from EUR 17.50 to EUR 11.50 - so far with little sign of a rebound. NIO, on the other hand, has seen its share price double since July from around EUR 3 to EUR 6.50. Analysts on the LSEG platform have differing opinions. While BYD is assigned a 12-month price target of EUR 14.95, experts are more skeptical about NIO, with an average target slightly below the current price. The reason likely lies in profitability: BYD has increased sales for 16 consecutive quarters and is generating decent margins, whereas the start-up NIO is not expected to reach profitability before 2030.

Graphano Energy – Canada's new hope for sustainable battery materials

Graphano Energy is rapidly developing a strong project pipeline for graphite in the Canadian province of Québec, positioning itself as a key future supplier for the strategically important battery industry. The Company's flagship Lac Aux Bouleaux (LAB) project lies directly adjacent to Northern Graphite's Lac des Îles mine and benefits from an agreement to share processing facilities. This collaboration could secure Graphano significant cost advantages in the transition to production and unlock additional synergies in processing. In addition to LAB, the Company also holds a second high-grade deposit, the Standard Mine project, which has already proven successful in metallurgical tests.

In October 2025, Graphano reported promising initial drill results from its new Black Pearl exploration area, located immediately east of the Standard Mine and consisting of 84 claims covering 4,149 hectares. Drilling carried out last month confirmed significant near-surface mineralization with up to 11.3% graphitic carbon over 8.61 meters (drill hole BP25-01). Further drilling returned up to 7.95% Cg over 3.75 meters and 7.37% Cg over 4.70 meters, underscoring the strong potential of the discovery. According to CEO Luisa Moreno, these initial results confirm the exploration model and demonstrate the potential for Black Pearl to become a significant addition to Graphano's portfolio.

Just one week later, Graphano released the final assay results from its drill program, which indeed confirm the project's large-scale and resource expansion potential. Drill hole BP25-06 stood out in particular, returning 4.81% Cg over 12.25 meters, including 6.63% Cg over 7.07 meters at a depth of only 25 meters. This identified several conductive trends as being directly associated with graphite mineralization, significantly strengthening the district-scale potential of both the Black Pearl and Standard Mine areas. Overall, all nine drill holes indicate that graphite mineralization extends over several hundred meters and remains open in all directions, suggesting an even larger deposit. The adjacent Standard Mine project already hosts an indicated resource of 950,000 tonnes grading 6.27% Cg and an inferred resource of 980,000 tonnes grading 7.16% Cg. According to CEO Luisa Moreno, the successful completion of the Black Pearl drilling program marks an important milestone in expanding the resource base and strengthening graphite production in Québec.

Graphano benefits not only from Québec's excellent infrastructure, but also from tax incentives and access to clean hydroelectric power. With its LAB, Standard Mine, and Black Pearl projects, the Company is well-positioned to serve the growing needs of the battery and energy industries in North America. Graphite has long been considered a key raw material for lithium-ion batteries, a cornerstone of the energy transition. Graphano's development schedule coincides precisely with the industrial ramp-up of new battery production. With a still manageable market capitalization of around CAD 3.2 million, Graphano shares offer an interesting entry point into Canada's next emerging graphite success story.

Listen to CEO Dr. Luisa Moreno at the latest International Investment Forum on October 8: here

Plug Power – The turnaround is behind us

The US "hydrogen miracle" Plug Power is showing remarkable strength. After a 95% drop to USD 0.75 at the beginning of 2025, CEO Andy Marsh needed three major capital increases worth billions and a bond commitment from the US Department of Energy to get the Company back on track. Recently, however, a series of strong operational updates has boosted confidence, prompting analysts to start raising their price targets again. Plug Power is now back on the buy list for 6 out of 22 experts, although the average price target still lingers at USD 2.88 - a relic from the correction period. Earlier this week, the stock reached the USD 4.50 mark on record trading volumes, a sixfold increase from the lows. For those still skeptical, it may be worth waiting for Q3 figures on November 11, when the Company is expected to provide an updated outlook. A hot one to watch!

While many automakers remain stuck in the slow lane during the current super bull market, tariffs, environmental regulations, and a noticeable consumer reluctance to buy are weighing on margins and filling up dealer inventories. The picture is quite different for Graphano Energy: the global race for better batteries is driving demand for graphite to record levels. Whoever can deliver wins! And Plug Power? It has managed to turn the tide explosively. It will be exciting to see how things develop here.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.