August 15th, 2023 | 05:40 CEST

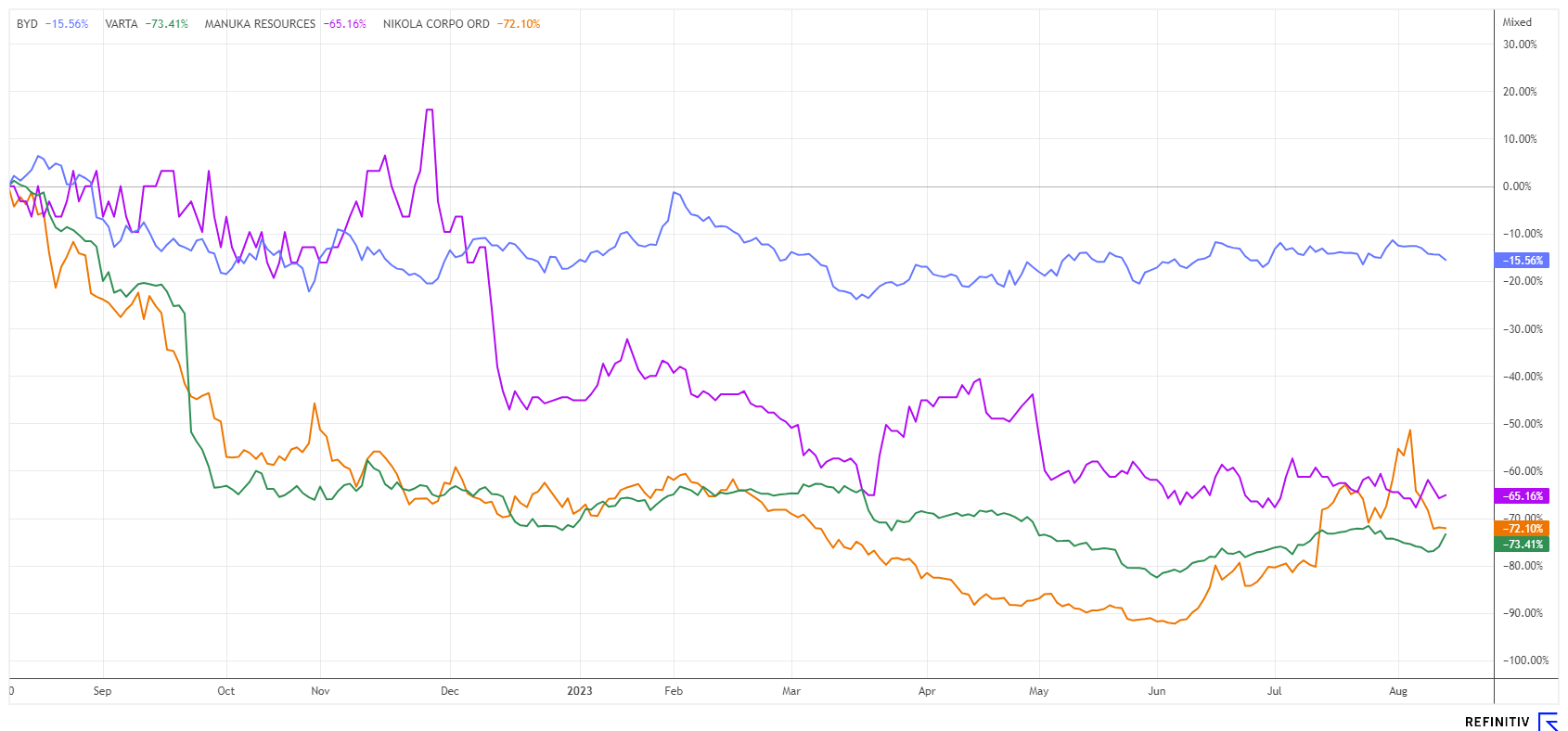

E-mobility 2.0 - Better batteries, longer ranges: BYD, Nikola, Manuka Resources, and Varta in the spotlight!

The fact that the e-mobility wave will continue in the medium term depends greatly on the performance components and public subsidies. Government subsidies for buying a Stromer or hydrogen-powered vehicle are falling. In order to encourage rapid uptake, there are subsidies from the government and manufacturers, known as the environmental bonus. But the total budget for the federal support for the bonus is limited. In 2023, only EUR 2.1 billion was initially planned, but Economics Minister Habeck has since announced an increase to EUR 2.5 billion. In 2024, only EUR 1.3 billion is currently planned, which is a cut of 50%. So the race against time has begun. Which shares are particularly interesting now?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , NIKOLA CORP. | US6541101050 , Manuka Resources Limited | AU0000090292 , VARTA AG O.N. | DE000A0TGJ55

Table of contents:

"[...] We will trigger indirect creation of 1,665 new jobs nationwide, while directly employing 300 staff - 270 operational and 30 administrative. [...]" Dennis Karp, Executive Chairman, Manuka Resources Limited

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Varta - Breathing a sigh of relief after the figures

Varta AG has had a difficult few months. Three profit warnings in a row and an "emergency restructuring" with the loss of 800 jobs worldwide. The so-called voluntary program to take advantage of natural fluctuation opportunities at the Ellwangen site will be completed before the end of August. With the half-year figures, however, the Group is now spreading hope. The cost reductions are on target and have already been exceeded in some areas. Despite the still challenging overall economic situation, the Company is therefore optimistic.

The energy storage business is doing very well, with several customer projects starting up and demand traditionally rising seasonally in the second half of the year. After 6 months, sales fell by 10% to EUR 339 million, and EBITDA remained in the red at EUR -6.8 million. The highlight is the "Energy Storage Systems" division. Here, revenues almost doubled to EUR 81.5 million, and the division is even profitable with an EBITDA of EUR 8.8 million.

Order intake is rising again, and the Company is currently in the process of building a gigawatt factory for energy storage systems. The first battery modules will be manufactured there at the end of the year. For the coming year, sales of "significantly more than EUR 900 million" are already being targeted again, according to CEO Dr. Markus Hackstein. The share jubilated last week with 15% plus from EUR 21.50. From a chart perspective, the EUR 18 mark should now be history. Continue to build up!

Manuka Resources - This could revolutionize the battery market

Those looking for modern battery solutions should take a look at Australia. Australian mining and exploration company Manuka Resources Ltd (MKR) has significant gold and silver assets in the Cobar Basin in mid-western New South Wales. Following the acquisition of Trans-Tasman Resources Limited, Manuka became the owner of the Taranaki vanadium-titanium-magnetite (VTM) project.

The active Mt Boppy gold mine hosts an open pit mineral resource as well as material from tailings and processing residues. The Company has recently commenced a screening and gold recovery project, with the prospecting products being processed at its Wonawinta operating facility. Manuka expects to produce 350 to 450 ounces of gold per week here, which should add about USD 2 million in cash flow to its coffers. The Company is also confident that it will soon be operating an active mine again, following a further exploration program in addition to processing the tailings. There are several promising base metal exploration targets on Manuka's approximately 1,150 sq km package of concessions in the Cobar Basin.The existing silver will only be mined again once market prices are significantly higher.

For the e-mobility market, the VTM Taranaki iron sands project is highly attractive. Recently, the first promising vanadium resource was published. As a result, the property is one of the largest vanadium deposits in the world. With a mining license granted, the Company is still awaiting the new environmental permit before starting work on a bankable feasibility study. Vanadium is among the most promising follow-on metals for the construction of new, long-lasting and safe batteries. MKR's 541 million shares currently embody a market value of EUR 17 million. Far too low for an active gold mine with great growth prospects in battery metals.

BYD and Nikola - Lots of movement, trending downward

Clear turnover leaders recently were the shares of BYD and Nikola. Two representatives of the e-mobility sector with very different business approaches. BYD has risen to become the largest producer of motor vehicles in China, surpassing Volkswagen and Tesla. The technology group also produces the successful blade battery in the fully vertically integrated group. This allows the Company to remain independent in procurement and calculate good margins all the way through to the end product. The BYD share has already passed VW in terms of valuation and is preparing to exceed the EUR 100 billion mark. After quickly exceeding the EUR 32 mark, the share price entered a consolidation. BYD remains an interesting long-term standard stock.

Nikola Motors rose from the dead about 8 weeks ago. After over 97% share price loss and many inconsistencies around founder and former chief executive Trevor Milton, the stock market knew only one direction: south. At some point, the short ratio in the share also reached the sound barrier of 25% - then came the turn. Social media traders went on the attack and catapulted the value from EUR 0.60 to 3.00. The start-up can currently only report further losses. However, glimmers of hope remain in the existing e-truck orders, which are expected to lead to the first deliveries as early as September. In the coming years, the Company also plans to offer fuel cell trucks. One can be curious to see what the dazzling company will really achieve. Investors quickly cashed out again at USD 3.40, sending the highly volatile stock down nearly 50% in just 3 days. With a market capitalization of around USD 700 million, it is still a hefty price to pay for a start-up. Casino at its best!

The e-mobility market hinges on many components. Ultimately, however, electric vehicles will only be purchased if they offer unbeatable advantages over combustion engines. This is currently not the case. Battery companies are technologically very exciting, but car manufacturers will have to wait for the proof of concept when governments cut back their subsidies.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.