October 13th, 2025 | 07:30 CEST

Drone boom and multiplication: Following DroneShield, RENK, and Standard Lithium, NEO Battery Materials shares are taking off!

Missed out on the multiplication of shares such as DroneShield, RENK, and Standard Lithium? Investors can still get in early with NEO Battery Materials. The Company is benefiting from the drone boom and the raw materials conflict between the US and China. NEO Battery Materials has developed advanced battery technology. The first manufacturer of drone batteries has already placed an order. In the future, the Company also plans to offer complete batteries itself. To save time in commercialization, a factory has been leased. This will allow for rapidly increasing sales and profits. The tariff and raw materials conflict between the US and China is likely to give NEO an additional boost. When will the stock take off?

time to read: 4 minutes

|

Author:

Fabian Lorenz

ISIN:

DRONESHIELD LTD | AU000000DRO2 , RENK AG O.N. | DE000RENK730 , STANDARD LITHIUM LTD | CA8536061010 , NEO BATTERY MATERIALS LTD | CA62908A1003

Table of contents:

"[...] Boron is one of the most versatile elements in the whole world! Everyone reading this text regularly uses hundreds of products that depend on boron. [...]" Tim Daniels, CEO, Erin Ventures

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

NEO receives order: Performance of drone batteries to increase

NEO Battery Materials is benefiting from the trend toward drones, robotics, and electromobility. After all, nothing works without batteries. At the same time, progress in terms of costs and efficiency is urgently needed. In addition, dependence on China along the value chain must be reduced so that drones, robots, and the like in the West are not left without power in the future. NEO shares combine all of these factors. They are still largely unknown on the capital market, but rising trading volumes - including on Tradegate in Germany - show that this is currently changing. Considering its market capitalization, buying in could prove worthwhile.

The most recent announcement highlights the potential. The Company is cooperating with a battery manufacturer that specializes in power-intensive special applications such as unmanned aerial systems (UAS), drones, and defense-related mobile systems. The agreement stipulates that the partner will purchase a total of 50 tons of silicon anode materials from NEO for its batteries over the next four years. However, the partnership goes much further than that. The two companies intend to work together in practical tests to improve the performance of lithium-ion and lithium-polymer battery cells using NEO's technology.

NEO CEO Spencer Huh commented: "This purchase agreement and JDA represent another important milestone in the commercialization of NEO's silicon battery technology. By partnering with a North American battery company, we are advancing our mission to build a robust and high-quality North American battery supply chain."

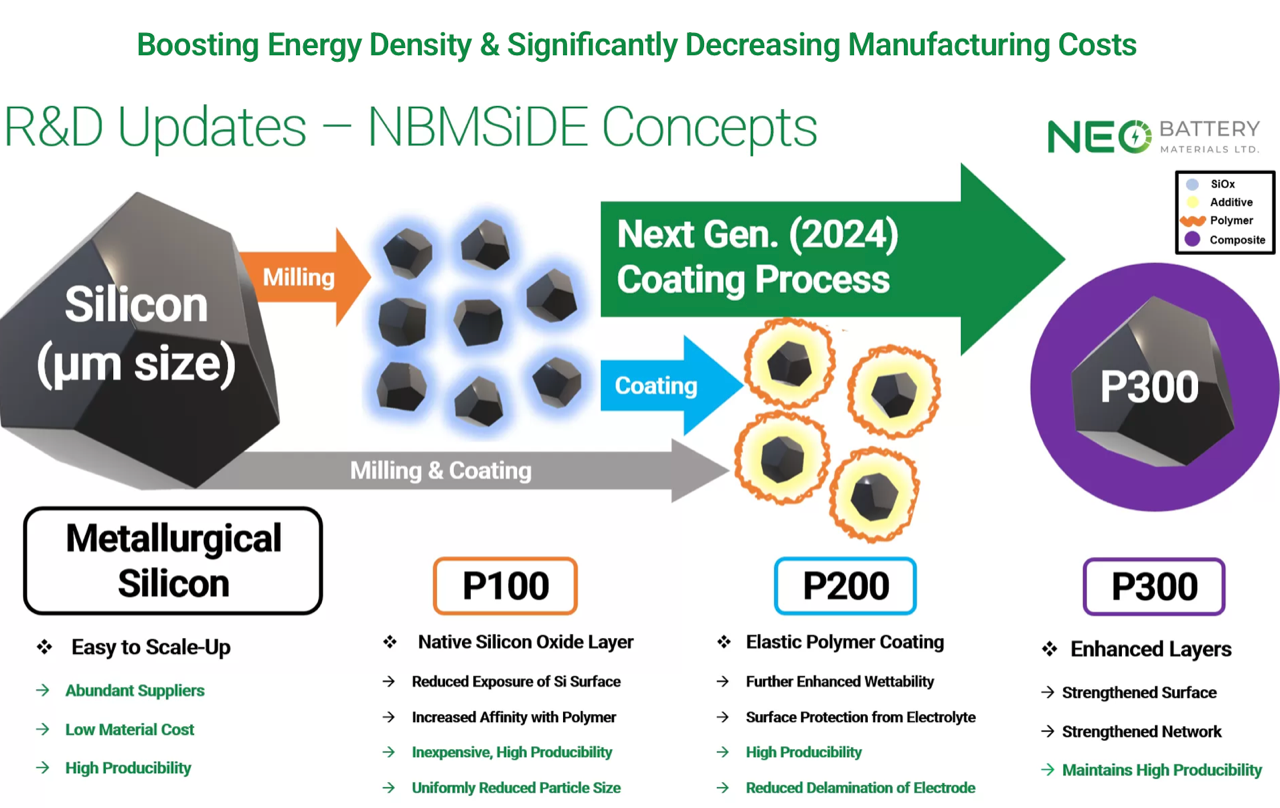

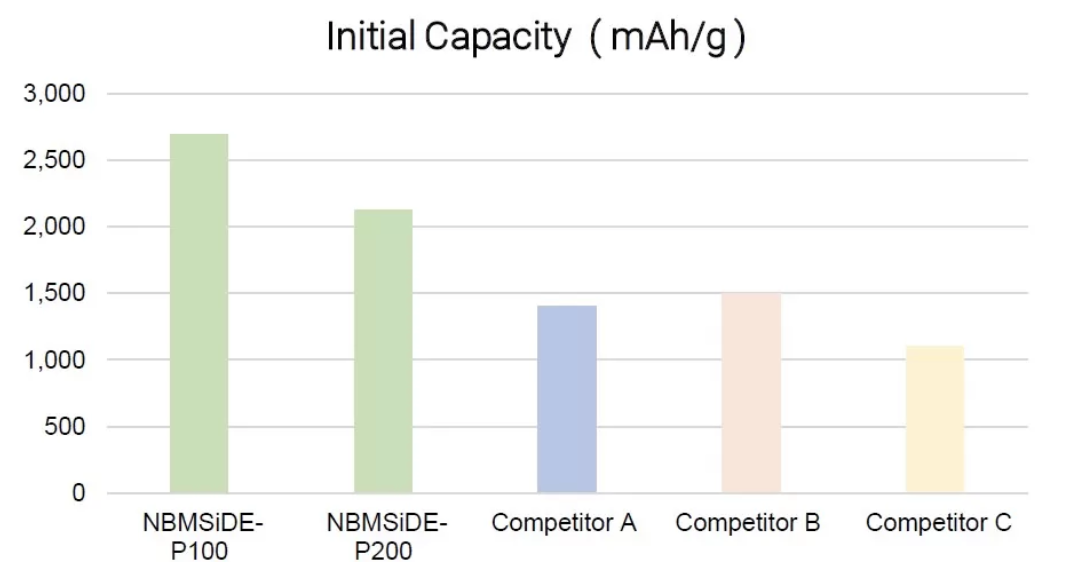

New generation of high-performance batteries

NEO Battery Materials is positioning itself as a pioneer of a new generation of high-performance batteries. With its NBMSiDE® technology, the Canadian company is developing a silicon anode solution to replace traditional graphite anodes in lithium-ion batteries. The advantage: the process is energy-efficient, scalable, and over 60% more cost-effective than conventional manufacturing processes. At the same time, it delivers up to 70% higher energy density. This would be a quantum leap for aviation applications, robots, electric vehicles, and stationary storage. Thanks to an innovative polymer coating, the structure of the silicon particles remains stable, significantly increasing cycle stability and service life. NEO is pursuing a phased commercialization plan that covers the entire value chain. Production capacity has already been increased to 4 tons per year and is expected to reach 20 tons by the end of 2025. At the same time, a 240-ton facility is being built in Windsor, Ontario - Canada's first silicon anode factory. In the longer term, the Company plans to expand into South Korea, Europe, and the US with the goal of becoming one of the top 10 global anode suppliers.

Key role in the global electrification wave

NEO's vision is clear: batteries should run longer, charge faster, and cost less. In doing so, the Company aims to play a key role in the global wave of electrification – and bring silicon anodes from the laboratory to series production. Anyone who believes in the future of electromobility should keep an eye on this Company. Collaborations with Fortune 500 partners, including Rockwell Automation and Linde Korea, ensure industrial integration.

Commercialization and the resulting growth in sales and earnings could come faster than expected. NEO Battery Materials has secured a strategically important expansion site in South Korea to significantly expand its production capacity for battery cells and silicon anodes. The site, featuring six industrial buildings, is directly adjacent to the previously announced electrode factory and has been leased, eliminating the need for construction from scratch. NEO will thus cover all three common battery formats – pouch, cylindrical, and prismatic cells – enabling the production of customized high-performance batteries for drones, robotics, AI electronics, energy storage, and e-mobility. At the same time, silicon material production will increase to 20 tons per year. With this vertical integration from materials to finished batteries, the Company is laying the foundation for its own "Battery Innovation Platform" and positioning itself as a future full-service battery provider in the Western market.

Trump's tariff war with China plays into NEO's hands

The escalating trade conflict between the US and China could turn into a strategic advantage for NEO Battery Materials. China has again restricted exports of rare earths, while Trump has threatened 100% tariffs. In recent months, it has become clear that Washington is increasingly focusing on localized and secure value chains in key industries. Investments in MP Materials and the Canadian company Lithium Americas underscore this strategy. The focus on lithium highlights the US government's recognition of batteries as a future-critical technology. However, lithium mining in the US only makes sense if the raw material is also processed locally. Consequently, battery supply chains that operate outside China and serve modern technologies are likely to gain strategic importance. In addition, higher tariffs on Chinese battery materials and components could further enhance the cost advantage of NEO's lower-cost, silicon-based technology. This would not only put the Company in a stronger geopolitical position but also make it an attractive partner for US automakers and drone manufacturers seeking to reduce their dependence on Chinese supply chains.

With a new generation of high-performance batteries, NEO has arrived at just the right time: the drone boom is expected to drive demand for efficient batteries. In addition, the trends toward robotics and electromobility continue unabated. Even the Trump administration, not usually a fan of renewable energy, has recognized the strategic importance of lithium and batteries. Leasing the prime site in South Korea appears strategically smart, as it enables the Company to generate revenue and profits quickly.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.