January 3rd, 2024 | 07:00 CET

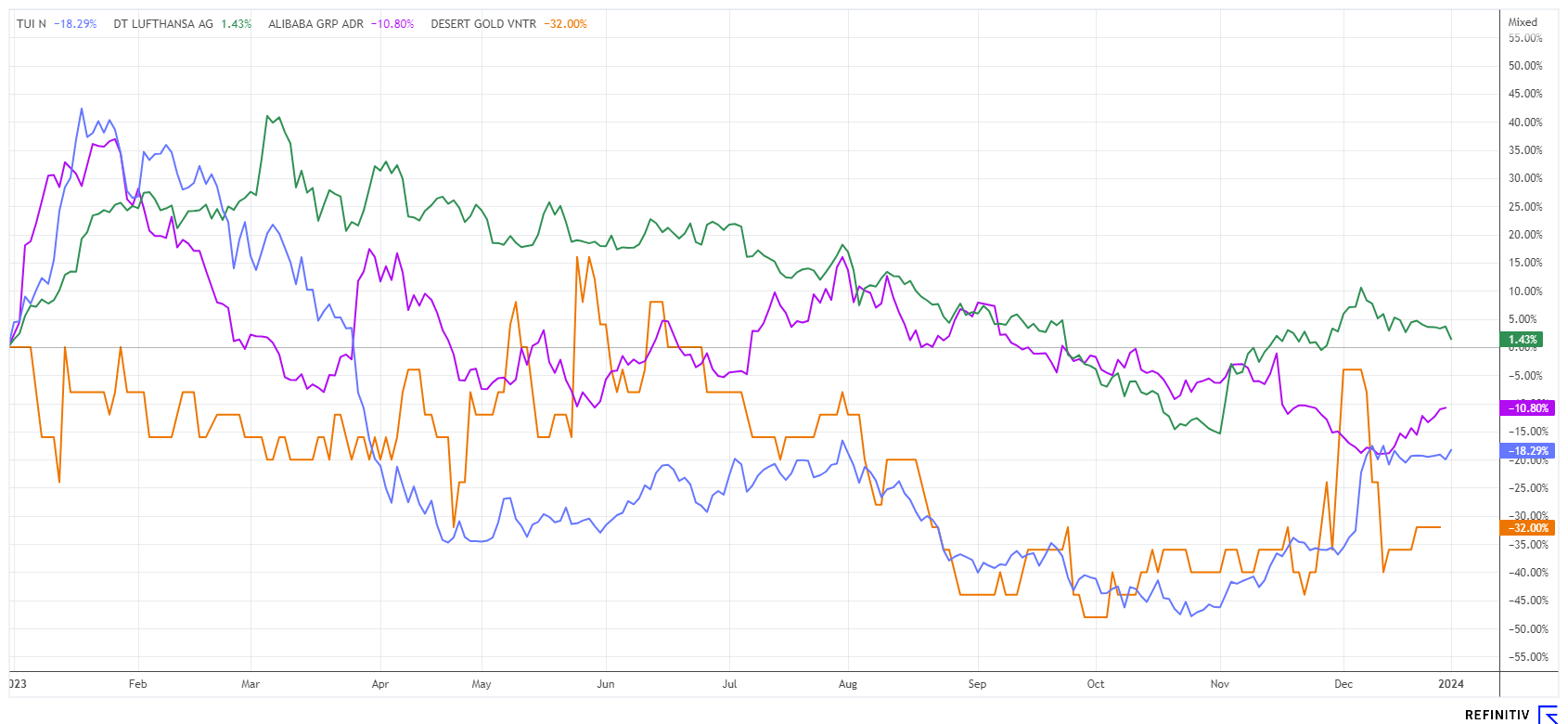

Donald Trump turns 2024 into a false start - This is where the action is: TUI, Lufthansa, Desert Gold and Alibaba

"If I do not become president, the stock market is in for a bigger crash than the Great Depression of 1929," proclaimed Donald Trump, the former president and Republican aspirant, at the end of the year. The assessment makes for amusing and entertaining reading and contains an important message. The economy is sluggish, war is raging in many places, and inflation is galloping. Why are stocks still trading near their all-time highs? It is the interest rate fantasy because between 4 and 7 interest rate cuts by the ECB and the Fed are expected in 2024. This will allow countries to continue their bloated and debt-financed budgets, but it will not create prosperity in the long run. Despite Trump's gloomy forecast, we look at some interesting turnaround stocks.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

TUI AG NA O.N. | DE000TUAG505 , LUFTHANSA AG VNA O.N. | DE0008232125 , DESERT GOLD VENTURES | CA25039N4084 , ALIBABA GR.HLDG SP.ADR 8 | US01609W1027

Table of contents:

"[...] Our district-scale 104,000-hectare land package already hosts the Barsele deposit (2.4Moz Au) and multiple new gold anomalies identified through modern exploration techniques. [...]" Taj Singh, CEO & Director, First Nordic Metals Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Alibaba - When will the e-commerce giant turn around?

2023 was not a good year for the online retailer Alibaba, with its share price down 17% in the last 12 months, making it one of the worst-performing technology stocks on the NASDAQ. Exactly 3 years ago, the share was 200% higher. Nevertheless, from a purely fundamental point of view, it now seems worth a look, as sales of the well-known platform continue to rise at an annual rate of 10 to 15%, and profits are growing disproportionately high. In the meantime, the 2024 P/E ratio of the debt-free company is only a low 9.8.

There are 48 analyses of the Alibaba share on the Refinitiv Eikon platform with an average target price of USD 125.80. The current price of around USD 77 represents a potential upside of over 60%. The catch: There is not a single "Sell" recommendation! This is rarely seen. **The Chinese internet giant bought back its own shares for the equivalent of USD 9.5 billion in 2023, yet its market capitalization remains below USD 200 billion. Thus, Alibaba is a clear long-term buy! Collect boldly!

Desert Gold - The fuse is burning

Gold has already performed very well in 2023 with a 13% price increase. On average, the annual appreciation of the precious metal is roughly equal to the actual measurable inflation rate. In Central Europe, it amounted to around 15 to 20% last year without taking official statistics into account. This means that there is still considerable catch-up potential for gold in 2024. The actual measurable inflation forms a basket of essential everyday items and includes services. The price of food and energy has risen by 50% since the coronavirus pandemic, while craft and tourism services have also increased dramatically in price, especially since geopolitical conflicts got out of hand. A change in trend is not foreseeable in any of these areas. This means there is plenty of fuel for precious metal investors. After all, gold and silver function as both value preservation and crisis protection. Then, there is the permanent expansion of government debt in euro- and USD-dominated economic areas. The capital requirements of Western governments are leading to an unavoidable debt cycle due to a multitude of burdens, which are likely to continue in the coming years. We should be mentally prepared for further geo-conflicts besides Ukraine and Israel to emerge in 2024.

Africa is increasingly coming into focus internationally as a raw materials continent. Huge potential lies dormant there in essential metals and minerals. Traditionally, the connection to Western investors is good, as they also bring important development services to the country. The Canadian explorer Desert Gold Ventures is focusing on the Senegal Mali Shear Zone (SMSZ). Here, 1 million ounces of gold have already been identified close to the surface. The highlight: well-known gold prospectors such as Barrick, B2 Gold and Allied Gold are located in the immediate vicinity with their current mining operations. They are looking for operational expansions and new properties for the coming years. In Mali, gold can be sustainably extracted from the ground at USD 850, making the area increasingly relevant as the price per ounce rises. Desert Gold is at the forefront on-site and is valued at only EUR 7.3 million. Rumor has it that there are already major interested parties. Keep collecting!

TUI and Lufthansa - What will the new tourism year be like?

It is still completely unclear how the 2024 tourism year will go. On the one hand, the coronavirus catch-up effects are waning, while on the other hand, high ticket prices and constant geopolitical conflicts are curbing people's desire to travel. Nevertheless, TUI and Lufthansa are talking about bookings that are only just below the pre-coronavirus figures in terms of volume, but the absolute number of trips sold is likely to be lower than in the years before 2019 due to the high price increases.

For Lufthansa, the experts at Citigroup see a rather bleak outlook, as there was a significant downgrade just at the beginning of the year. Analyst Sathish Sivakumar lowered his rating to "Sell". He believes that the industry's recovery from the pandemic is ending and that both domestic and international business is set to decline. In addition, competition from low-cost airlines is fierce; Ryanair, for example, is extremely profitable with significantly lower ticket prices. UBS is of a different opinion: it votes "Buy" and has raised its 12-month price target from EUR 14 to EUR 15.

Opinions are also divided on the TUI share. The experts at the investment banks see price targets of between EUR 6.50 and EUR 10.50, while Deutsche Bank is very positive. The chart and the fundamental data are now interesting. In addition to a 2024 P/E ratio of 6.8, according to consensus data, debt will be around zero by 2027, and sales will be around EUR 25 billion. With a share price loss of 15% in the past year, things went better than expected in the end. The all-time low of EUR 4.40 in October 2023 should, in any case, be history. Technically, a strong upward movement could begin if the share price can break through the EUR 7.50 mark.

The stock market remains volatile and challenging. It is not yet certain whether tourism stocks will perform as well in 2024 as they did last year. Inflationary pressure remains high due in part to rising levies and taxes paid to the government. This brings gold back into focus. Among our selected stocks, Desert Gold remains very promising! The internet giant Alibaba is now an exciting story for the next 3 years.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.