April 17th, 2024 | 06:30 CEST

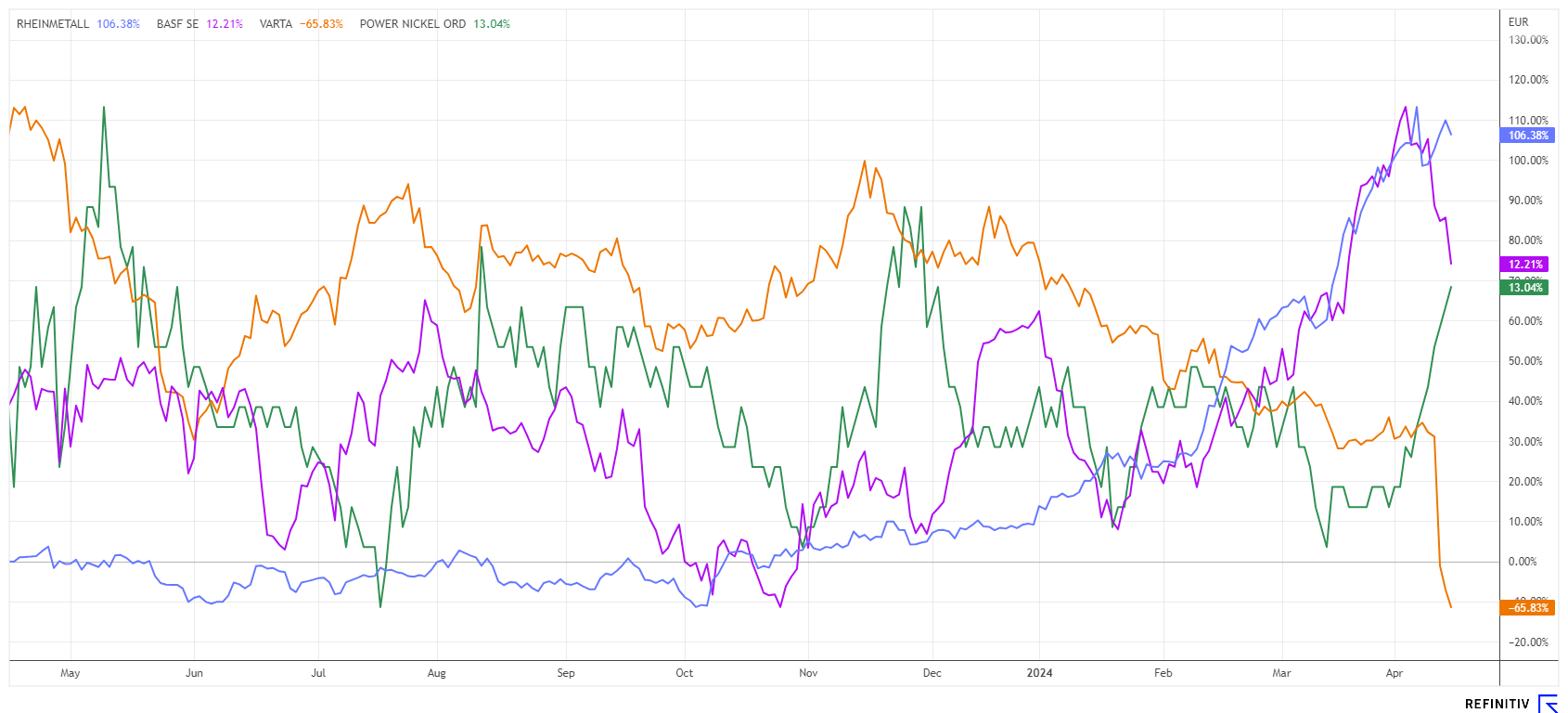

Discount battle over: Commodities on the counter-offensive! Rheinmetall, Power Nickel, BASF and Varta in focus

Since the bombing of Israel by Iran, the clocks are ticking differently in the Middle East. The next stage of escalation has been reached. If Israel now uses the right to defense as an opportunity to initiate something bigger, it is here: the conflagration. Gold and silver are shining as safe-haven currencies and pulling long-neglected commodity shares through the roof. Now is the time to keep the sails in the wind and ride the long-awaited upward momentum. In the energy transition, strategically safer jurisdictions that can safely serve the growing hunger for commodities are still in demand. We highlight a few opportunities.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , Power Nickel Inc. | CA7393011092 , BASF SE NA O.N. | DE000BASF111 , VARTA AG O.N. | DE000A0TGJ55

Table of contents:

"[...] China has become the manufacturing capital of the World, and because of its infrastructure, expertise and capabilities, Silkroad Nickel has strategically positioned itself to partner with Chinese companies in the Stainless Steel and EV industries [...]" Jerre Foo, Corporate Development Executive, Silkroad Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BASF - Dividend beats skepticism

BASF AG from Ludwigshafen is one of the losers in the current mix of German industrial policy: rising wages and energy costs combined with shrinking economic growth. During the DAX rally in the first quarter, the share was able to shine with 20% growth despite the gloomy outlook. Now, shortly before the Annual General Meeting, the upswing is beginning to tremble, and a correction is pushing the share price down again by almost 10%. Investors who want to collect the dividend in 8 days are losing out even before the ex-date. Unusual but typical of a consolidation at a high level. Now, even those not wanting a taxable distribution want to sell.

Fundamentally, after achieving EUR 68.9 billion in revenue in 2023, analysts expect a slight increase of 2% for BASF this year. Net profit is projected to rise to EUR 2.88 billion, following significant write-downs on subsidiary DEA Wintershall last year that negatively impacted the balance sheet. Overall, the share is currently valued at a 2024 P/E ratio of 14.7; the announced dividend of EUR 3.35 remains a consolation. On the Refinitiv Eikon platform, 13 out of 25 experts still recommend buying the share. However, the average expected price target of EUR 53.50 was already reached in early April. Long-term, BASF is a good standard stock, but short-term economic dips could pose challenges.

Power Nickel - A poly deposit causes a sensation

Those keeping an eye on the energy transition should look for safe jurisdictions because the world is in the age of de-globalization due to numerous geopolitical conflicts. Industrial manufacturers are again pursuing local sourcing as their main strategy. Western government representatives are currently in the process of agreeing on supply alliances for the coming decades. New suppliers with good deposits are increasingly being targeted. If we take global nickel production for electrification as a benchmark, a full 3.6 million tons were produced in 2023, around 50% of which came from Indonesia, well ahead of the Philippines and Russia. But can the Western world rely on stability from these suppliers?

Canadian explorer Power Nickel has made good progress so far with its premium Nisk deposit in Quebec. The most recently published drilling results indicate a further expansion of the resource. In addition to nickel, important technical metals such as copper, cobalt, palladium, and platinum are also in the ground. This is an excellent setup for future supply to the high-tech industry with the advantages of a secure jurisdiction. The recently released report for hole PN-24-044 highlights 24.3 g gold over 0.6 meters, 5.7 g silver, 5.29% copper, 3.26 g palladium, 0.29 g platinum and 3.31% nickel.

CEO Terry Lynch comments: "If you were to ask a miner what a perfect mine is, the answer would be: a substantial, high-grade, near-surface discovery of polymetallic mineralization in a safe area with excellent existing infrastructure. Today, 1 gram of gold is worth about USD 75. A one million-ounce ore body with an average grade of 1 gram would be considered a good deposit. The grades we are seeing suggest that we could have yields in the rock between USD 1,000 and USD 2,000. That is exciting. That is exactly what we want!"

The Power Nickel share is taking the momentum from the current bottom analysis and has risen by 28% in the last 5 trading days alone. If the mineralization grades are also confirmed in the next drill holes, Power Nickel will likely only be at the beginning of a major value adjustment. The refinancing of the last few months, which was well above the share price, is now benefiting the operational progress. The price adjustment for raw materials alone should massively increase the value of the high-grade NISK project. Buy more!

Today, LIVE at 13:00 CET, CEO Terry Lynch will appear in front of the camera at the 11th International Investment Forum and will report on the Company's latest developments. Click here to register.

Rheinmetall bullish, Varta bearish

In recent weeks, one DAX stock has been on all fund managers' buy lists: Rheinmetall. It feels like a one-way street, but beware: there have already been two days of so-called flash crashes, with intraday falls of more than 10% on high volume. Some investors here are already poised to take profits on a large scale. Recovering from setbacks has still been possible, but the share is no longer fundamentally cheap. With a market capitalization of EUR 23.5 billion, investors are currently paying 2.5 times annual revenue, and the P/E ratio for 2024 of 25.4 is impressively high for a mechanical engineering company with a technology touch. Perhaps the EUR 570 to 600 zone will be triggered again quickly, but then the shares should fly! To protect profits on the downside, place a smart stop at EUR 515.

What Rheinmetall will accomplish in 2023/24, the Varta share did in 2020/21. An endless belief in total electrification had driven the battery manufacturer to price/sales ratios of 10 and P/E ratios of over 50. After several profit warnings, an emergency capital increase by the major shareholder and a restructuring program, the Ellwangen-based company has now arrived in the real world - a 93% share price loss from the top and shrinkage instead of growth. Last week, Varta announced that its restructuring concept was no longer sufficient. The parameters from last summer are "no longer adequate" to return to a profitable growth path by the end of 2026 as planned. The coffers are empty, and the Management Board is negotiating a solution with the financiers. Completely unattractive - hands off!

The quiet period in the capital markets is history. War, inflation and growing debt characterize the volatile investment business. In the first quarter, the stars aligned for artificial intelligence and high-tech. However, chart technicians are now pointing their thumbs down. The situation is quite different for defense stocks and commodities, which first have to price in the current global climate and are now celebrating a proper spring break!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.