August 23rd, 2023 | 09:10 CEST

Disappointments and surprises: Nikola, Plug Power, First Hydrogen

Hydrogen and electromobility are megatrends. But not all shares from these sectors deliver what they promise. Nikola has recently disappointed. After the share price multiplied in June and July, it halved in August. And now Nikola has shocked shareholders again. Investors have also been unhappy with Plug Power in recent months. The hydrogen specialist just cannot get a handle on its margins. Is there hope for both again after the recent sell-offs? In contrast, First Hydrogen has surprised on the upside. A customer is enthusiastic about the test of the hydrogen fuel cell vehicle. Will a major order follow now, along with a rediscovery of the stock?

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

NIKOLA CORP. | US6541101050 , PLUG POWER INC. DL-_01 | US72919P2020 , First Hydrogen Corp. | CA32057N1042

Table of contents:

"[...] Why should a modular electrolyzer cost more than a motorcycle? [...]" Sebastian-Justus Schmidt, CEO and Founder, Enapter AG

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

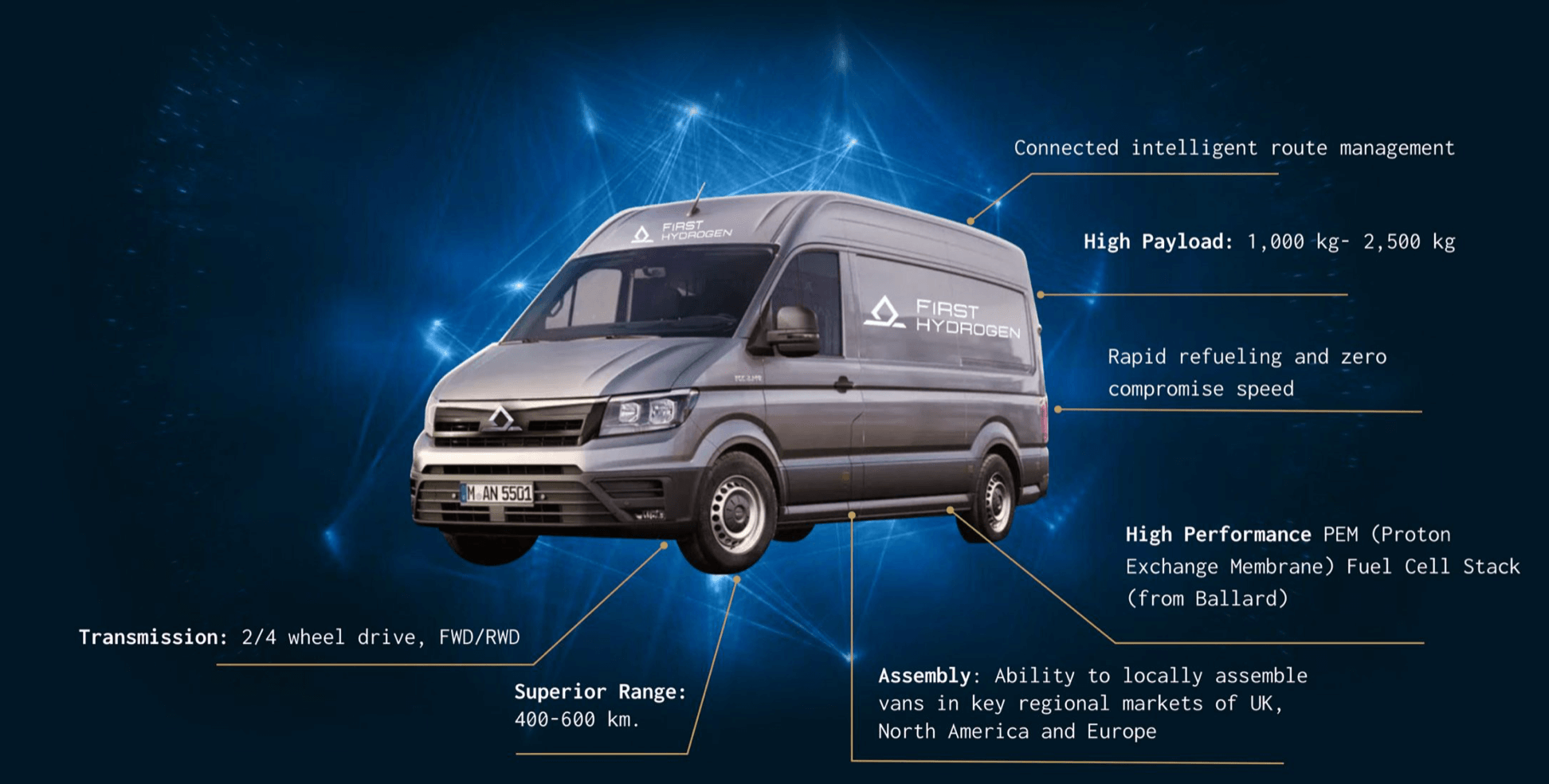

First Hydrogen: The hydrogen newcomer inspires

The poor sentiment in the hydrogen sector is evident from the lack of response to First Hydrogen's recent success story. This went unnoticed, although the Canadian hydrogen fuel cell commercial vehicle impressed during test drives with a fleet operator in the UK. In regular times, this news would likely have led to a double-digit jump in the share price. Does this offer an exciting entry opportunity?

Yes, say the experts from researchanalyst.com. After the extremely successful test drives of the prototypes under real road conditions, entry into the mass market should occur soon. This will open up a sales volume of around EUR 1 billion for the Canadians. With a market capitalization of around EUR 90 million, First Hydrogen is not overvalued compared to other companies in the sector.

Rivus has recently expressed enthusiasm for road tests with First Hydrogen's commercial vehicles. The range was deemed unbeatable - more than double that of electric-powered vehicles - and refueling is quick at less than 5 minutes. It is important to note that Rivus is far from being a small fleet provider. The Company operates around 120,000 vehicles in the UK. Gemma Horne, Warranty Controller at Rivus, accompanied the tests and said, "The main advantage of the First Hydrogen vehicle is that the refueling times are shorter than the charging times of battery-powered vehicles. And of course, unlike internal combustion engines, hydrogen vehicles produce zero emissions."

First Hydrogen Automotive CEO Steve Gill was also pleased, saying, "*We are pleased that Rivus was able to prove that this technology can be a viable alternative for many fleets. The trial also demonstrated that the vehicle can achieve a range of more than 500 km on a single tank*, exceeding initial expectations for the vehicle's performance in real-world use. We have long believed that our vehicle will be beneficial to fleets, and this first trial proves just that."

Plug Power: Shareholders are concerned

While First Hydrogen is receiving virtually no advance praise in terms of valuation and market potential, Plug Power is a very different story. The hydrogen specialist from the US is valued at more than USD 5 billion even after the recent share price declines. After another set of weak quarterly figures with high losses and a threatened capital measure, investors sent the share below EUR 8 and thus close to the multi-year low at around EUR 7. Around a year ago, the share was trading at over EUR 20.

The business is simply in a tough spot. Although Plug Power was able to increase sales by 72% to USD 260.2 million in the second quarter, thus exceeding analysts' estimates, the loss estimates were also exceeded. Plug Power posted a loss of USD 236.4 million in the second quarter. This, in turn, suggests that the US company will likely require a substantial amount of capital until reaching the break-even point.

Nikola: Convertible bond shocks shareholders

Nikola is already one step ahead. On Monday, a capital measure was announced, causing the electric truck developer's stock to drop by double digits again, closing at USD 1.51. Around USD 325 million is to be collected via a convertible bond. This will mean a significant dilution for existing shareholders. Even more urgently than at Plug Power, the capital is needed to break even "at some point" - when is still written in the stars. Because previously, there was a halt to sales of electric trucks due to a battery fire. The previously delivered vehicles were recalled to modify the battery pack. Perhaps partly because of these problems, Nikola has already announced it will focus on fuel-cell trucks.

As with Plug Power, Nikola's market capitalization should not be underestimated despite the plunge in its share price. Nikola still weighs in at over USD 1.4 billion. Plug Power will not likely see a sustained upward trend until the financing is clear.

Investors would be well advised to pay attention not only to the old pure plays such as Nel, Plug Power and Nikola. First Hydrogen is without doubt one of the exciting newcomers.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.