June 14th, 2023 | 07:20 CEST

Despite the heat pump - uranium is in demand as never before! Rheinmetall, GoviEx Uranium, Palantir, C3.ai

Like a prayer wheel, green political ideas are raining down on the German industrial landscape - no more nuclear energy, but instead coal and gas. Historically high energy prices are to be accepted, even though wholesale prices are already below pre-war levels again and the energy mix is supposedly fed by more than 50% renewable energy. Because no one knows what the future holds for all this, major investment decisions by industry are now going against Germany. VW is investing EUR 10 billion in Spain, and BASF is doing the same in China. Valuable jobs that will no longer exist in Germany in the foreseeable future. What should investors keep an eye on to create at least sunny prospects in their portfolios?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , GOVIEX URANIUM INC A | CA3837981057 , PALANTIR TECHNOLOGIES INC | US69608A1088 , C3.AI INC | US12468P1049

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

GoviEx Uranium - Facing big jump in Africa

Once again, another monthly gain in the uranium spot price. Starting from around USD 25 in 2020, prices in the commodity markets have been gradually rising. Currently, it does not look as if this trend will change any time soon. Many uranium deposits are under the political influence of Russia. However, given the global sanctions against the aggressor, the leadership in Moscow has no great desire to continue supplying the West with critical metals. On the contrary, Kazakhstan, as one of the leading producers, is under Moscow's supervision and is struggling to meet its contractual obligations.

China has announced a dramatic expansion of its nuclear technologies. There are also currently 47 nuclear reactors in the Chinese pipeline that are expected to come on stream within the next eight to ten years. Germany may be out of the loop on this one, but France, the UK, Poland and the Czech Republic are taking their place, as is Ukraine, which is hoping for trillions in investment from the EU once the war is over. 57 million pounds, or the equivalent of about 32% of total annual demand, global uranium production fell short of demand in 2020. By 2025, a total shortfall of 200 million pounds is projected. The Canadian company GoviEx Uranium is moving forward with its property in Niger, Africa. It is in the immediate vicinity of Global Atomic's and Areva's mining sites. The GoviEx projects named Madaouela in Niger and Mutanga in Zambia are in focus. The third property, Falea in Mali, was to be sold to African Energy Metals Inc. However, this deal was recently cancelled.

For the upcoming projects, GoviEx has issued 85.71 million shares at CAD 0.16 in a private placement, with the same number of warrants at a strike price of CAD 0.19. The shares have already seen lows at around CAD 0.13 and have been trending upwards again for a few days. The almost 786 million shares add up to a market value of CAD 126 million. Uranium properties in Africa offer a good investor base. A further upward valuation is evident in the current environment.

Rheinmetall - Analysts are very positive

The Rheinmetall share is truly a phenomenon. Although the business figures are only gradually increasing, investors likely sense the big bonanza in the medium term. The initial spark was the 100 billion in special funds for the Bundeswehr, which the German government enshrined in the Basic Law in 2022. Analysts now assume that Rheinmetall will be able to book a large chunk of these investments as sales. It is not surprising that the analysts' estimates are somewhat at the upper end and show an increase from EUR 6.4 billion in 2022 to EUR 7.8 billion in 2023 and almost EUR 11 billion in 2025. Growth is thus assumed to be around 15% to 20% per year. Profitability measured by the EBIT margin is expected to develop disproportionately from about 11% to 14%. High R&D expenditures are expected.

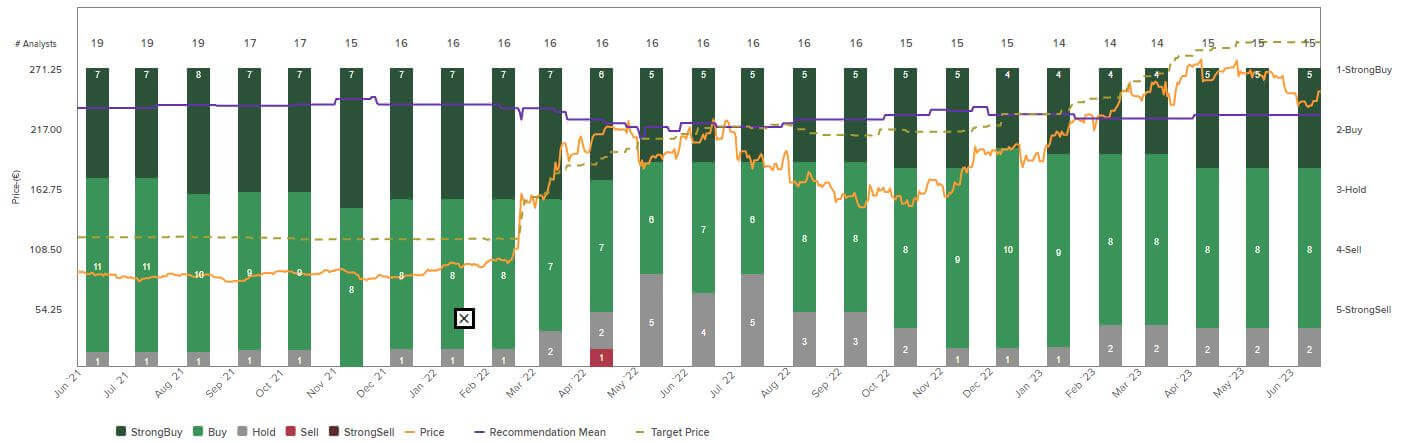

Should the aid for Ukraine be significantly expanded, there should indeed be very large jumps at Rheinmetall because Rheinmetall profits only moderately from the orders of the German armed forces with many other contractors. On the Refinitv Eikon platform, analysts are unanimous. Of 15 experts surveyed, 13 issued a buy recommendation, and the median 12-month price target is EUR 296.40 - just under 20% above the current quotation. The share is currently consolidating at a high level but has already reached an annual high of EUR 281 and should not fall below EUR 233. Set a suitable stop at approximately EUR 238 for profit protection, as the share is technically battered at EUR 248.

Palantir and C3.ai - Military technologies in demand

Those who think of artificial intelligence quickly end up with the currently popular NASDAQ stocks Nvidia, Palantir or C3.ai. What they all have in common is investors' fantasy that in the next few decades, large areas of our lives will be influenced by learning machines. Since media and telecommunications companies, in particular, have a lot of data on their users, Big Data has become a buzzword for people who believe in technology. Supposedly, all collected and aggregated data can be used to create a perfect forecast of how consumers and decision-makers will react in certain decision-making constellations. So if you have a lot of past data, with the appropriate computing power and good data analytics software, you can anticipate future actions with high probabilities.

With its public contracts in the field of military intelligence, Palantir has recently also been able to cause a corresponding stir in Ukraine. C3.ai is a competitor in the private sector and empowers companies with its service for the use of artificial intelligence and helps to advance the level of digitalization. Both stocks are well-positioned in the current environment of disruptive change. Palantir is making small profits. The P/E ratio is close to 70 based on 2023 estimates. C3.ai will not be in the black until 2026 - maybe. With over 100% share price increases in 6 weeks, decent momentum has already been processed with prices of USD 15.80 and USD 37.50, respectively. Tighten your trailing stop with a 10% profit protection line in the upward trend and enjoy the gold rush.

Digitalization is advancing. Globally, this is causing energy consumption to go up rather than down. This requires new energy sources, and nuclear energy is being considered again by many countries despite the Fukushima incident. As a result, the uranium stock of GoviEx remains in focus. Defence and highly specialized IT companies also benefit from this environment.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.