June 23rd, 2020 | 07:54 CEST

Desert Gold Ventures, First Majestic Silver, K+S - Resources with potential

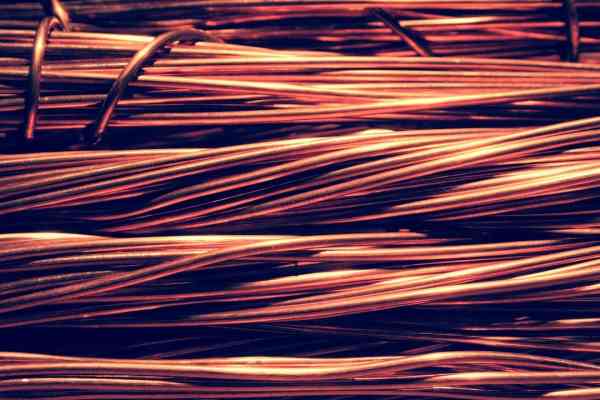

Many commodities are currently experiencing a price increase. The precious metals gold and silver are in demand above all because central banks and governments are increasing the money supply with their stability actions, thus creating the need for inflation protection. While gold is largely an independent currency, silver is not only an investment object, but is also used industrially. The energy sector has also calmed down and the price of oil is rising. Copper has recovered from its lows in March 2020. Rising prices mean higher margins, now timing is key.

time to read: 2 minutes

|

Author:

Mario Hose

ISIN:

CA25039N4084 , CA32076V1031 , DE000KSAG888

Table of contents:

Author

Mario Hose

Born and raised in Hannover, Lower Saxony follows social and economic developments around the globe. As a passionate entrepreneur and columnist he explains and compares the most diverse business models as well as markets for interested stock traders.

Tag cloud

Shares cloud

In the centre of West Africa

The price of gold has been rising continuously since summer 2019. In the meantime, the troy ounce of the precious metal already costs more than USD 1,750.00. At the beginning of September 2018, the price per ounce was still quoted at less than USD 1,200.00. For the coming year Goldman Sachs sees a price potential up to USD 2,000.00 and Bank of America even considers a rise to up to USD 3,000.00 possible.

Investors who are interested in value creation and would like to be involved in the early stages should take a look at Desert Gold Ventures. The company has projects with a size of about 400 square kilometers and is surrounded by renowned gold producers as well as mines with more than five million ounces of gold reserves each. The management has acquired the large portfolio over the past ten years and can expand the amount of gold discoveries with planned drilling programs.

An exploration company can usually be expected to be taken over by a major producer. The market value of Desert Gold Ventures is approximately CAD 21 million. In 2018, acquisitions in Africa were paid around USD 200.00 per ounce in ground and Desert Gold Ventures' management is targeting the discovery of up to six million ounces.

Focus on silver production

The price of silver has also been extremely volatile in recent weeks. Thus an ounce of gold still cost around USD 18.00 at the beginning of the year and then plummeted to almost USD 14.00 in March. Meanwhile, the price is once again trading in the region of the year's highs, which is playing into the hands of companies such as First Majestic Silver. The higher the price, the more the company can earn. The market value is currently around CAD 2.5 billion and experts believe that silver will catch up in the shade of gold.

German Global Player

At K+S, potash (Kali) and salt (Salz) are not only behind the name, but are the focus of corporate development. Over the past three years, the market capitalization has fallen by more than 75% to EUR 1.15 billion. As stock market wisdom has it, the tide is lifting all boats, and this was also the case with the K+S share over the past few weeks. The share rose from EUR 5.20 to over EUR 7.30. In the meantime, the shares are changing hands again at about EUR 6.00.

It is currently unclear how management will deal with the expected market changes. Conversely, the extent of the cuts in social life will have consequences for the economy. Now it depends on how well K+S can adapt.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may in the future hold shares or other financial instruments of the mentioned companies or will bet on rising or falling on rising or falling prices and therefore a conflict of interest may arise in the future. conflict of interest may arise in the future. The Relevant Persons reserve the shares or other financial instruments of the company at any time (hereinafter referred to as the company at any time (hereinafter referred to as a "Transaction"). "Transaction"). Transactions may under certain circumstances influence the respective price of the shares or other financial instruments of the of the Company.

Furthermore, Apaton Finance GmbH reserves the right to enter into future relationships with the company or with third parties in relation to reports on the company. with regard to reports on the company, which are published within the scope of the Apaton Finance GmbH as well as in the social media, on partner sites or in e-mails, on partner sites or in e-mails. The above references to existing conflicts of interest apply apply to all types and forms of publication used by Apaton Finance GmbH uses for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and etc. on news.financial. These contents serve information for readers and does not constitute a call to action or recommendations, neither explicitly nor implicitly. implicitly, they are to be understood as an assurance of possible price be understood. The contents do not replace individual professional investment advice and do not constitute an offer to sell the share(s) offer to sell the share(s) or other financial instrument(s) in question, nor is it an nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but rather financial analysis, but rather journalistic or advertising texts. Readers or users who make investment decisions or carry out transactions on the basis decisions or transactions on the basis of the information provided here act completely at their own risk. There is no contractual relationship between between Apaton Finance GmbH and its readers or the users of its offers. users of its offers, as our information only refers to the company and not to the company, but not to the investment decision of the reader or user. or user.

The acquisition of financial instruments entails high risks that can lead to the total loss of the capital invested. The information published by Apaton Finance GmbH and its authors are based on careful research on careful research, nevertheless no liability for financial losses financial losses or a content guarantee for topicality, correctness, adequacy and completeness of the contents offered here. contents offered here. Please also note our Terms of use.