August 30th, 2024 | 06:45 CEST

Desert Gold, Occidental Petroleum, Vonovia SE - Gold, oil, and real estate markets in focus

After a phase of stabilization above the USD 2,300 mark, the price of gold has managed to surpass its previous highs and reach a new record high. This upward trend is also reflected in the rising value of gold explorers like Desert Gold, as recent drilling in Mali, West Africa, has yielded promising results. Established commodity companies such as Occidental Petroleum, on the other hand, are reducing their high levels of debt, which have arisen through the acquisition of assets. The latest figures from real estate company Vonovia SE indicate an easing in the European real estate market, a trend also reflected by major online real estate platforms. The wait-and-see phase seems to be over for both buyers and sellers, with increases in inquiries for both property and financing. Rental housing remains a highly traded commodity. Where is an investment worthwhile? Three companies in focus.

time to read: 6 minutes

|

Author:

Juliane Zielonka

ISIN:

DESERT GOLD VENTURES | CA25039N4084 , OCCIDENTAL PET. DL-_20 | US6745991058 , VONOVIA SE NA O.N. | DE000A1ML7J1

Table of contents:

"[...] Troilus has the potential to be an entire gold belt. All of our work to date points to this, and each drill hole makes the picture we have of the Troilus project much clearer. [...]" Justin Reid, President and CEO, Troilus Gold Corp.

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

Desert Gold: Promising drilling results and growth potential in Mali's emerging gold market

Investors see gold as a safe haven in times of economic and geopolitical uncertainty. Given ongoing global challenges such as inflation, geopolitical tensions, and market volatility, the precious metal continues to gain in importance as an investment. Its limited availability makes it a popular instrument for portfolio diversification. Analysts see a favorable environment for rising gold prices in the current economic climate, making investments in gold mining explorer stocks such as Desert Gold more attractive.

Gold may have intrinsic value, but Desert Gold, as a company specializing in the exploration and mining of gold, is in a position to increase its enterprise value. It owns the 440 sq km SMSZ project in Mali, Western Africa. The project has considerable gold deposits: Proven and probable reserves total approximately 1.08 million ounces of gold. These are spread across roughly 29 million tons of rock, with an average gold content of 1.15 g/t.

According to data from GlobalData, Mali will rank 16th among the world's largest gold producers in 2023. Growth of around 3% per year is expected for the period from 2023 to 2027 - good prospects for Desert Gold.

Recent drill results return promising gold grades, including 54 g/t gold over 10.15 meters at Barani East and 6.62 g/t gold over 12 meters at Gourbassi West. Further details on the drilling can be found in the associated press release. Some drill holes show higher grades than expected, especially in the Barani East Zone.

A resource estimate is now being prepared for the first time for the 1.6 km long Gourbassi West North Zone. To this end, three bulk samples weighing around 220 kg have been sent to a laboratory in South Africa for metallurgical testing. The results are expected in around three months and are crucial for planning the open-cast pits and processing plants.

A drone flight provided precise topographical data and detailed photomosaics of the three deposit areas. This also puts the documentation in a good position to inform the planning of potential mining infrastructure such as buildings, crushing plants, and leach fields.

*Desert Gold CEO Jared Scharf is pleased with the progress: "I am very pleased with the progress of our PEA. The metallurgical drill holes have pleasantly surprised us with several unexpected zone extensions and higher than expected grades in some parts of the Barani East Zone.* The potential addition of a new resource at Gourbassi West North could further improve the economics of the project as we work to complete the PEA as soon as possible."

Occidental Petroleum makes progress on debt reduction and asset expansion

The US oil and gas company Occidental Petroleum (NYSE: OXY) can report a significant reduction in its controlled debt. In the third quarter of 2024, the Company managed to reduce its debt by USD 3 billion.

In the commodities industry, loans are often used to finance further acquisitions that increase the value of the Company. This is exactly what Occidental did with the acquisition of mineral rights company CrownRock. The Company has been in the mineral rights and royalty business in Texas' Permian Basin for over three decades. OXY President and Chief Executive Officer Vicki Hollub explains that by completing this transaction, Occidental is adding assets that further strengthen and broaden its existing portfolio.

In addition to acquisitions, divestitures are also boosting Occidental's balance sheet. For example, the sale of a stake in Western Midstream Partners generated USD 700 million. In total, Occidental has already generated around USD 1.7 billion through disposals this year. With the imminent completion of the sale of assets in the Delaware Basin, the Company expects to reduce its total debt by more than USD 3.8 billion in the current year.

Hollub emphasizes that with the measures taken so far, almost 85% of the short-term debt reduction target of USD 4.5 billion has been achieved.

Vonovia reports robust business results in the first half of 2024

Concrete gold is another popular form of investment alongside physical gold. The German real estate group Vonovia SE reports solid operating results for the first half of 2024 and confirms its annual forecast at the upper end of expectations.

The revaluation of Vonovia's portfolio results in a value of EUR 82.5 billion, which is slightly below the level at the end of 2023, confirming expectations of a market recovery. CEO Rolf Buch emphasizes that Vonovia has overcome the crisis and is now once again delivering a robust performance in a challenging environment.

Chief Capital Markets Officer Oschrie Massatschi from competitor Aroundtown SA sees the market situation somewhat more critically. "We have definitely moved away from the trough. Devaluations in the residential segment are likely to remain fairly stable for the rest of the year," Massatschi told Reuters. "I do not think everything is behind us," Massatschi said, pointing to the still high interest rates and the struggling German economy.

The Company's sales program for 2024 is well on track with a target of EUR 3 billion. Properties worth EUR 1.5 billion had already been sold by the middle of the year, including a portfolio of 1,970 apartments in the greater Frankfurt area and the Rhine-Main region for around EUR 300 million.

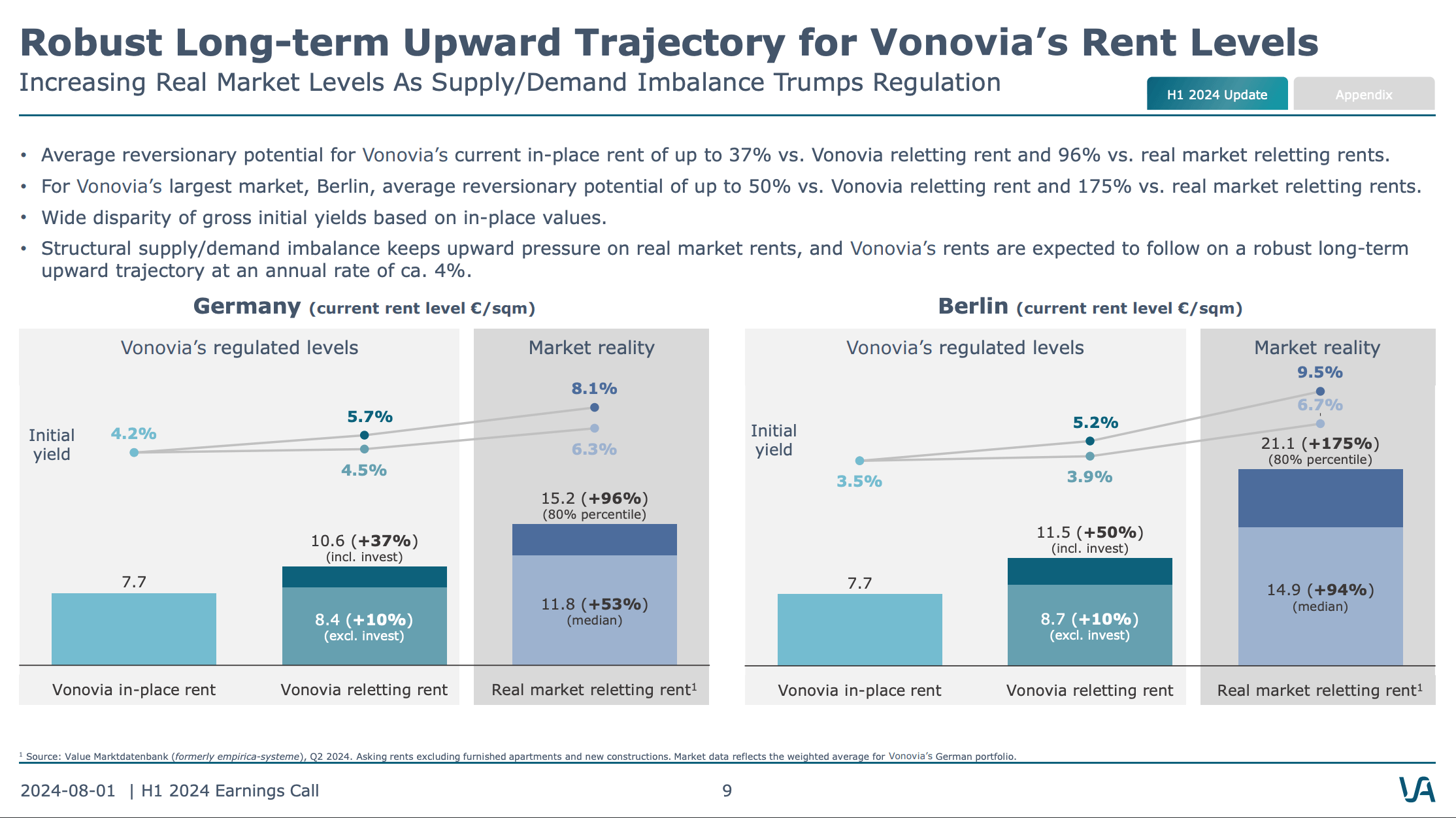

Rental income at Vonovia SE increased by 3.8%, with the average effective monthly rent in the Group amounting to EUR 7.86/m2. In Germany, this figure amounted to EUR 7.73/m2. These prices do not include popular major cities such as Munich, Hamburg, Berlin, and Frankfurt, where the rent per square meter is now around EUR 21/m2 - EUR 24/m2 and more for new builds, even in peripheral areas. (see infographic below Vonovia SE Earnings Call presentation). One possible reason for the increase in rental income is contracts with index-linked rents. With this form of rent, the rent is linked to the consumer price index and adjusted annually. Tenants benefit from the transparency and predictability of rent increases as well as protection against arbitrary adjustments. However, a high inflation rate can lead to significantly higher rent increases than in times of low inflation, representing a considerable financial burden for tenants.

Vonovia invested a total of EUR 673.8 million in existing properties and new builds in the first half of the year, with 1,655 apartments being completed. The share is currently trading at EUR 31.30 and has risen by 11.55% since the beginning of the year.

Desert Gold is benefiting both from the expected growth of the gold market in Mali and from the latest drill results with high gold grades. The upcoming resource estimate for the Gourbassi West North Zone also indicates significant potential. The Company is adding value by expanding its proven gold resources and advancing the development of the SMSZ project. Occidental Petroleum announces considerable progress in debt reduction and strategic portfolio optimization. The significant debt reduction of USD 3 billion in the third quarter of 2024, with the prospect of a further reduction totaling USD 3.8 billion by the end of the year, is well under control through acquisitions and disposals. Vonovia SE presents itself as a solid investment opportunity in the real estate sector, with strong operating results and an optimistic forecast for the year. Rising rental income and investments in existing and new buildings promise further growth. Despite social issues due to rising rents, Vonovia offers an attractive combination of stability and growth potential in a recovering real estate market. Three investment opportunities, three companies with solid consolidation, and growth prospects.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.