September 11th, 2024 | 07:15 CEST

Caution: The next commodity rally boosts Globex but brings higher costs for VW, BMW, and BYD!

The price of copper exceeded the USD 9,000 mark again in September, and future prices remain stable above the USD 9,400 mark. This makes it clear to high-tech manufacturers and producers of alternative energies that the desired electrification will cause significantly higher costs than anticipated. Despite the global economic stagnation, commodity prices remain high. This is mainly due to the general increase in operating costs in mining operations. Energy, material, and personnel costs have seen the most significant increases in over 30 years since 2020. Major consumers of industrial metals, in particular, are now having to dig deeper into their pockets. For some, this is feasible, but for mass producers such as Volkswagen or BYD, this means increased pressure on margins. Where are the opportunities for investors?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

GLOBEX MINING ENTPRS INC. | CA3799005093 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , BAY.MOTOREN WERKE AG ST | DE0005190003 , BYD CO. LTD H YC 1 | CNE100000296

Table of contents:

"[...] We quickly learned that the tailings are high-grade, often as high as 20 grams of gold per tonne; because they are produced by artisanal miners, local miners who use outdated technology for gold production. [...]" Ryan Jackson, CEO, Newlox Gold Ventures Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD - Conquering Europe in its sights

The Chinese technology and automotive group BYD is aggressively pushing into international markets, with Europe playing a major role. However, the challenge is proving tougher than anticipated. In January 2024, the Company already had to significantly reduce its prices for electric vehicles in Germany, as competition for electricity customers had become extremely fierce following the abolition of the environmental bonus. The crux of the matter: many potential buyers are adopting a wait-and-see attitude, curious about how Europe's political climate will evolve. After the significant shift to the right in the European elections, many consumers are expecting the ban on combustion engines to be postponed or removed. In Germany, BYD currently offers five purely electric models: Atto 3, Dolphin, Seal, Tang, and Han. With this range, the Company even recorded a decline in sales for the first time in August 2024 from 240 to 218 units. As a newcomer, BYD has achieved a European market share of 0.1%.

BYD announced in August 2024 that it would take over the German distributor Hedin Electric Mobility in order to expand its local sales network; the new plant in Hungary is due to be launched in 2026. The list price for the entry-level Atto 3 model in Germany is currently EUR 36,394; it is available in China for around half the price. The surcharge for BYD vehicles is 17.4% under the new EU import rules. Fundamentally, a closer look should be taken at the BYD share, as the Chinese stock is trading at an impressive 14.5 compared to VW's 2025 P/E ratio of 3.5. In chart terms, the stock has been trading in a narrow range of EUR 24 to 28 for the past 6 months. The massive 500% rally since 2019 seems to have ended. Caution at the platform edge!

Globex Mining - Commodities in abundance

Whether precious metals or industrial metals, Globex Mining (GMX) has the right answer. The Canadian explorer and asset manager from Quebec has over 250 projects in its portfolio. Although the focus is clearly on gold properties, Globex can support international efforts to secure strategic metals. Several industry representatives have already made representations to CEO Jack Stoch. Time and again, the Company succeeds in optioning one of its numerous claims to an explorer and participating in the subsequent mining success. The Company, including its predecessor companies, has more than 40 years of growth and development behind it, but it continues to expand its portfolio and conclude occasional sales deals. This ensures that Globex always has liquidity and a high level of financial strength and does not have to constantly refinance like other commodity companies.

Those familiar with CEO and founder Jack Stoch know that more success stories will likely be announced in the coming weeks. In early August, there was news from the Crater Lake area, where partner Scandium Canada Ltd. had carried out logistically remote drilling work and encountered mineralization in all holes. Numerous deposits of scandium and rare earths are located on the Globex property, which is in the immediate vicinity of Schefferville. Currently, there are approximately 57.7 million fully diluted GMX shares, trading actively between CAD 0.80 and CAD 0.90. Compared to the 2023 lows of CAD 0.68, this is already a premium of 25%. If gold continues its momentum above USD 2,500 as expected in the near future, Globex shares should set off on the next sprint upward.

BMW and Volkswagen - It is all about the supply chains

The Supply Chain Act, officially known as the "Corporate Due Diligence in Supply Chains Act", has a significant impact on the automotive industry as it requires companies and suppliers to respect human rights and environmental standards along their entire supply chain. The new law requires them to monitor their production processes and all upstream and downstream stages of the value chain - from raw material extraction to completion. This requires detailed insights into the origin of raw materials such as copper, nickel, cobalt, lithium, and rare earths, which are particularly important for the production of electric vehicles and batteries. Companies not fulfilling their due diligence obligations can be fined or excluded from public tenders. However, paying close attention to the same should lead to a competitive advantage as consumers increasingly look for more environmentally friendly and ethically produced products.

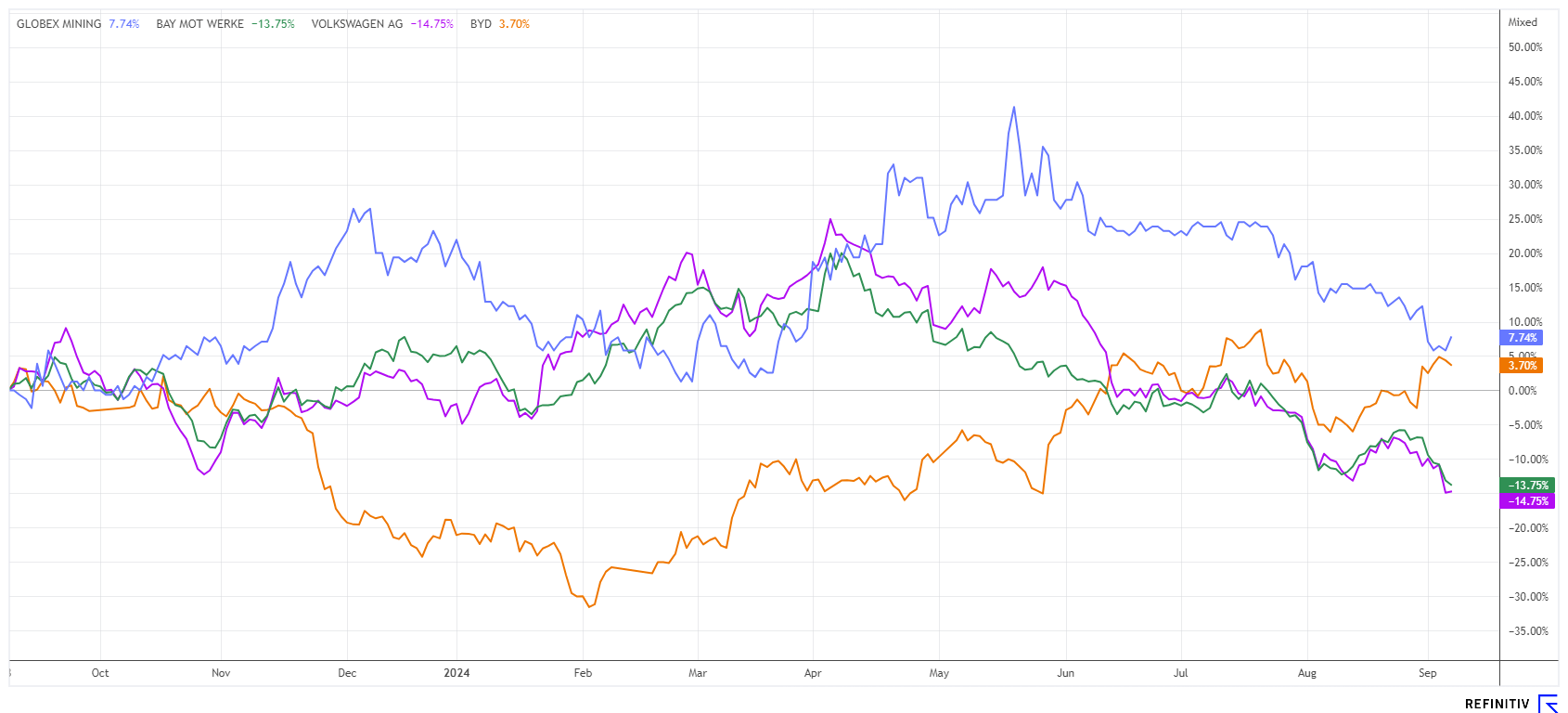

Volkswagen and BMW have already established comprehensive ESG principles and are constantly reviewing their supply chains. During the COVID-19 pandemic, deficits resulting from international outsourcing activities at the turn of the millennium also became apparent. Even though both companies have their sights set on switching to environmentally friendly drive systems, it is not yet clear whether the consumer will help to finance the increase in product prices or whether the manufacturers' margins will continue to fall. The charts of German car manufacturer shares are under significant pressure in 2024 because, in addition to high energy prices, German industrial policy is also putting pressure on business success. There are many indications that the major correction in the automotive sector is not yet over.

The stock market is currently taking no prisoners. While commodity stocks like Globex Mining remain in demand due to high commodity prices and strong gold performance, automotive stocks are increasingly consolidating. Rising costs, margin pressure, falling sales, and an unsettled consumer create an unfavorable environment for significant growth. The DAX 40 index is also likely to feel the weakness of the major industrial stocks soon.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.