November 24th, 2025 | 09:25 CET

DAX up, NASDAQ down! Automotive sector back in focus with Mercedes-Benz, WashTec, BYD, and VW

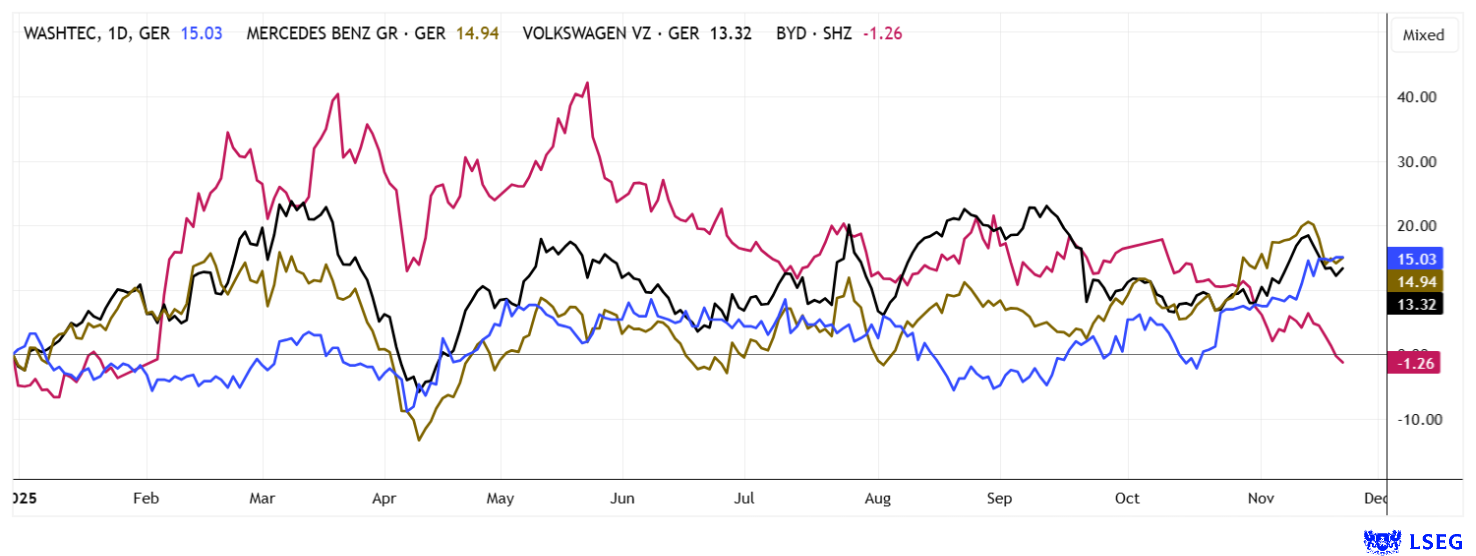

The correction in the growth markets continues. Even crypto investors, who are used to success, are now complaining about the pronounced market weakness. November and December are usually good months for the stock market. However, because September and October performed so exorbitantly well, profits are now apparently being taken across the board. For German blue chips, the whole thing has been mild so far, and according to general valuation rules, they also have more room for upward movement. We are diving into the world of electric vehicles and combustion engines, where P/E ratios between 4 and 12 are the norm and real, tangible goods are traded. It is time to put away the AI toys and start the machines.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

WASHTEC AG O.N. | DE0007507501 , MERCEDES-BENZ GROUP AG | DE0007100000 , BYD CO. LTD H YC 1 | CNE100000296 , VOLKSWAGEN AG VZO O.N. | DE0007664039

Table of contents:

"[...] We know exactly what we are doing and are implementing what we consider to be a proven technology in an industrially applicable and scalable way. [...]" Uwe Ahrens, Director, Altech Advanced Materials AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD – Operationally successful, yet still affordable

Who would have thought? Much faster than expected, BYD Motors is heading for the luxury segment of electric mobility. To this end, it is launching the luxury brand Yangwang, which was founded in 2023 and is already attracting a lot of attention in China. With Yangwang, BYD aims to compete in the ultra-luxury segment with leading names such as Bentley, Rolls-Royce, and Porsche, and prepare for entry into the European market from 2026. The models sold in China, including the Yangwang U8 SUV and sporty sedans such as the U7, offer up to 1,305 hp and accelerate from 0 to 100 km/h in around 3.6 seconds. The U9 Xtreme in particular sets new standards with up to 3,000 hp and has already set a world speed record. Sales prices in China start at around EUR 80,000 to EUR 140,000, with prices for the European market expected to exceed EUR 200,000.

In addition to luxury vehicles, BYD is also continuing to expand its model range and infrastructure in Europe. With the Sealion 8 SUV and the "Super e" platform, which offers over 800 volts and megawatt fast charging with up to 1,000 kW charging power, BYD is breaking new ground in battery technology and charging speed. Next year, BYD also plans to install numerous megawatt charging stations across Europe to make the most of the advantages of the new generation of vehicles. With the new plant in Hungary, the Chinese company will also enter the EU era in 2026, when the first jobs will be created and import duties will be eliminated. This is likely to lead to a rapid increase in acceptance among European buyers. In terms of brand awareness, BYD has achieved 46% awareness among the target group of 20- to 60-year-olds within three years. The Company is already one of the three best-known new electric vehicle brands in many European markets. Internationally successful in the UK, Italy, and Indonesia, BYD ranks among the top three emerging manufacturers. The rollout in Europe is proceeding according to plan, even though the nine-month sales figures are still below management expectations. Next year, the market share is expected to rise well above 1%.

BYD shares have been in a correction phase for twelve months and are currently even trading in the red. However, the estimated P/E ratio for 2026 is only 11.1, and 28 out of 30 experts on the LSEG platform recommend buying the stock. With prices around EUR 10.30, analysts see upside potential of 45% to EUR 15. Growth is likely to pick up again soon, as many EU countries are launching new e-mobility subsidy programs starting in Q1 2026. Now is the time to buy!

WashTec AG – Strong growth with clean car bodies

WashTec is also part of the expanded automotive peer group. The Augsburg-based company is the world's leading provider of solutions for professional vehicle washing and combines the sale of car wash systems with a growing, high-margin service and digital business. The business model is based on the sale of innovative car washes and gantry systems, an after-sales business with a wide range of services, and a variety of digitally networked offerings that make the operation of the systems more efficient, profitable, and increasingly automated. By connecting the washing systems to the Company headquarters, WashTec enables its customers to optimize the management of maintenance, chemical consumption, and digital payment processes, allowing operators to significantly reduce personnel costs while generating additional revenue.

This combination of physical product business, recurring revenues, and scalable digital services ensures high cash flows, rising margins, and a robust competitive position in Europe, North America, and other international markets. WashTec is the world's leading provider of solutions for professional vehicle washing. In the first nine months of 2025, the Company increased its revenue by 7.2% to EUR 358.2 million. EBIT developed particularly dynamically, rising by 17.4% to EUR 32.4 million, while the margin also improved to 9.0% from 8.2%. In the third quarter, WashTec achieved the highest margin growth of the year at 11.8%, confirming the noticeable improvement in operating momentum.

Analysts on the LSEG platform emphasize that the structural expansion of the business model in recent years will lead to sustainably increasing margins. Four out of four experts recommend "Buy" and calculate an average target price of EUR 54.25 for the next 12 months. For long-term investors, the SDAX stock pays a solid 2.5% dividend. Given the expected growth, a 2026 P/E ratio of 15 is not too expensive! With the recently launched share buyback program of up to EUR 5 million, management is sending another signal of confidence in long-term value development. The Company will be presenting itself at the Equity Forum in Frankfurt on November 25. A well-rounded proposition for investors!

Mercedes and VW – Will 2026 bring a turnaround?

It is hard to believe the harsh treatment the German automotive industry has had to endure in recent years. First, the EU-wide ban on combustion engines by 2035 was imposed, forcing German consumers to rethink their choices. As a result, revenue from combustion engines in Europe plummeted dramatically, and companies had to forego billions in profits. Now, EU officials have retroactively approved the continued operation of combustion engines from 2035 onwards, subject to technological requirements. Premium manufacturers can therefore breathe a sigh of relief. The constant back and forth naturally led to the entire industry investing too little in e-mobility and now having to watch as Chinese manufacturers gain market share point by point.

Brussels now aims to turn the tide with a mammoth package of investment subsidies and new e-subsidies. The scolded shareholders of Mercedes-Benz and VW are looking at three years of ruin, with share prices falling by an average of 10 to 35%. At times, the two companies together are currently worth only about EUR 110 billion, just EUR 15 billion more than their main competitor, BYD from China. However, investors in Mercedes-Benz receive a dividend of 5.4%, and the 2026 P/E ratio is a low 8.3. At VW, the payout in relation to the share price of EUR 94.7 is already more than 6%, and the 2026 P/E ratio is a low 4.4. Now that both German companies have undergone extensive restructuring, international investors should sit up and take notice. BYD's technological lead is likely to be gone by 2026, which means the valuation gap could quickly close again!

The automotive sector is poised to recover significantly from the sell-off at the beginning of the year. In contrast, Chinese high-flyer BYD is in a pronounced consolidation phase. If you are looking for solid growth and technological prospects in the sector, WashTec shares are a good choice. Stable dividends of over 2.5% and an upward-trending long-term chart. This makes investing fun!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.