May 23rd, 2023 | 08:00 CEST

DAX on a record chase, and hydrogen is making a comeback! VW, Daimler Truck, First Hydrogen, Traton. Who can convince?

The EU wants to invest about EUR 25 billion in hydrogen over the next 10 years. To this end, the Commission has drafted the concept of a "Hydrogen Accelerator" to promote the use of renewable hydrogen. The "REPowerEU plan" launched for this purpose aims to produce 10 million tons of renewable hydrogen within the EU by 2030 and to import a further 10 million tons. It is hoped that this will provide an important building block for saving the climate. The private sector is also involved. We take a look at some of the key players.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

VOLKSWAGEN AG VZO O.N. | DE0007664039 , Daimler Truck Holding AG | DE000DTR0013 , First Hydrogen Corp. | CA32057N1042 , TRATON SE INH O.N. | DE000TRAT0N7

Table of contents:

"[...] Why should a modular electrolyzer cost more than a motorcycle? [...]" Sebastian-Justus Schmidt, CEO and Founder, Enapter AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

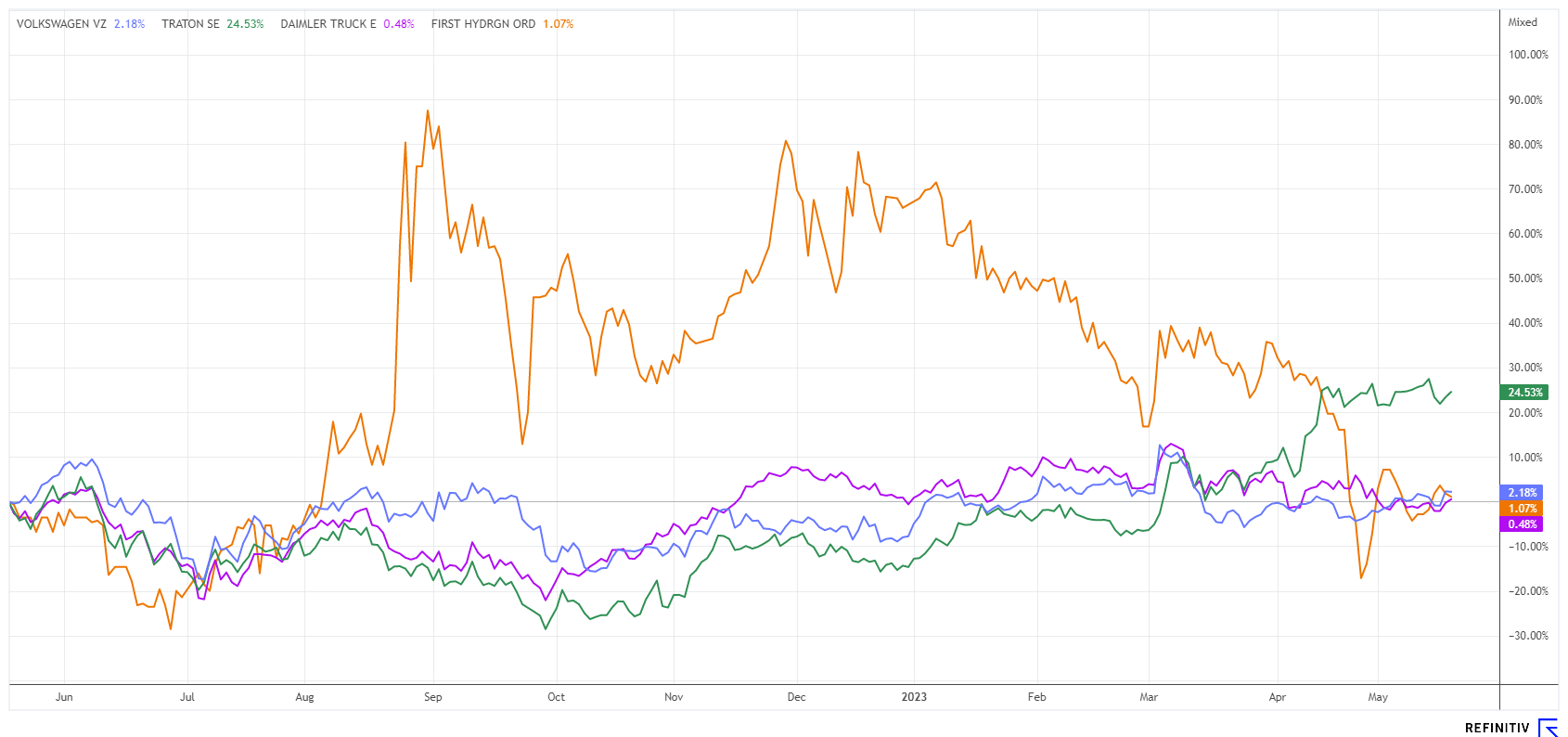

Hydrogen stocks on the sidelines - 12 months of price losses

Despite all the public approaches to promoting renewable energy sources, a very challenging environment has been established for investors for about 2 years. Those who have been able to tap the industry's momentum have been able to earn 50 to 100% with the standard stocks Nel ASA, Plug Power, Fuelcell Energy or Ballard Power. However, those who hold the stocks in the portfolio for longer remain in the loss zone. All four shares have lost between 5% and 57% in the past 12 months. Nel ASA is still in a maintained sideways trend, Fuelcell and Ballard are losing over 40%, and the sector leader Plug Power is already offside with a class action lawsuit on its neck with a loss of over 50%. But opportunities in the sector remain.

Hydrogen in transport - Daimler Truck 'Yes', Traton clear rejection

When it comes to hydrogen, it is important to focus on its practical application. Which companies are turning the legislative requirements into tangible results? Who is making the most of existing subsidies? In the German transport sector, there are two large listed companies, each of which spun off from the large automotive groups. Traton has been the listed truck & bus holding company since 2018, combining all VW truck units such as MAN, Scania and Navistar. Daimler Truck, on the other hand, represents the coveted Mercedes trucks Actros & Co, Fuso, as well as the US companies Western Star and Freightliner. Daimler Truck has been listed in the DAX 40 index since 2022.

In the implementation of H2 technology, the newly listed companies are taking different paths. It was announced from Wolfsburg that hydrogen would not play a technological role at Traton for the time being. The strategy for the drive of the future is clearly geared towards the battery-electric drive. An analysis by the Fraunhofer Institute also supported this decision; clear advantages are seen in electric battery operation compared to the fuel cell.

In a practical comparison, Daimler Truck came to a different conclusion. Two CO2-neutral trucks from Daimler Truck with electric drive and H2 fuel cells were tested. With both vehicles, Daimler Truck shows that they can fulfil different applications of logistics customers. The Company has, therefore, logically opted for a dual strategy in 2022. The electrification of the Daimler portfolio will focus on both batteries and hydrogen-based drives. Both shares are currently on an upward trend and are similarly positioned in the market; Traton is only 2.5 times smaller than Daimler Truck.

First Hydrogen - First road test results are convincing

The Canadian company First Hydrogen was founded with the purpose of establishing hydrogen as an energy source in the transport sector. The Company has positioned itself in the market with its "Hydrogen-as-a-Service" model and wants to cover the complete value chain in the future through the development of emission-free vehicles and the production and distribution of green hydrogen.

Currently, the solutions for light commercial vehicles (LCVs) are being tested in Great Britain. LCVs powered by hydrogen fuel cells are performing even better than predicted. In the first phase of commissioning, the vehicles covered 6,000 km, including on the M25 motorway in London. OnBoard data recording supports the simulations of the vehicle range, which currently exceeds even the promised 500 km. The test vehicles perform with excellent efficiency, both in urban and extra-urban driving at higher speeds. The fuel consumption of First Hydrogen's LCV is less than 2 kg per 100 km in various driving scenarios and as low as 1.5 kg in urban traffic. The result demonstrates that First Hydrogen can offer fleet managers zero-emission vehicles with the required range, payload and short refuelling times.

Continuous operation with a 100 KW cell can be carried out at any permissible maximum speed. Evaluation continues in operational trials with fleet management provider Rivus. Rivus drivers are testing the vehicle's performance with different payloads on roads in Birmingham, the West Midlands and South Yorkshire. The tests also involve direct comparisons between battery electric and diesel or petrol-powered vehicles. Vehicle data is uploaded to the cloud via onboard telematics and a GPS tracker, allowing First Hydrogen engineers to conduct further analysis in real-time. First Hydrogen's (FHYD) stock has quickly headed north after a brief consolidation. With a market capitalization of only EUR 130 million, the stock is significantly cheaper than many other H2 stocks.

Energy division CEO Robert Campbell will be on hand to answer questions on the latest developments at the upcoming "IIF Hydrogen Day" on June 15, 2023. Participation in the online event is free of charge.

VW - Open to technology into the future

In contrast to its former subsidiary Traton SE, the Volkswagen Group has opted for an openness to technology for its passenger car division. Although the former CEO, Herbert Diess, may have had a different official stance, the VW Group has already filed a patent for a special fuel cell in collaboration with the Saxon company Kraftwerk Tubes in 2022. The patent identifies VW as an adopter of the technology and indicates active involvement in its development. The fuel cell in question can be produced at a significantly lower cost with the ceramic membrane mentioned in the patent, eliminating the need for expensive platinum.

This means that hydrogen cars could become cheaper in the future, which are still much more expensive than battery vehicles today. The range can also be significantly increased to up to 2000 km with the new cell type. The technology is almost the same as solid-state batteries, on which manufacturers worldwide are working at full speed. Solid-state batteries use a solid material to store energy, whereas the fuel cell uses H2 gas. So, in the long run, hydrogen will be considered by VW as an energy carrier for electrically powered vehicles. The first prototypes could come to light as early as 2026. At around EUR 120, the VW share is currently the cheapest in the DAX 40 index, with a 2023 P/E ratio of 3.9.

The hydrogen sector is currently taking a new run on the stock market. The old protagonists, such as Nel, Plug Power and Fuelcell, still appear to be at risk of fluctuations in their stock prices. In the truck sector, Traton and Daimler Truck are established standard stocks. The Canadian company First Hydrogen has developed a fully functional LCV prototype with a hydrogen drive in a very short time. Hats off to them!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.