February 20th, 2025 | 07:50 CET

DAX makes a decent correction – Gold sets its sights on the USD 3,000 mark! Caution advised with Palantir, Barrick, Desert Gold, Lufthansa, and TUI

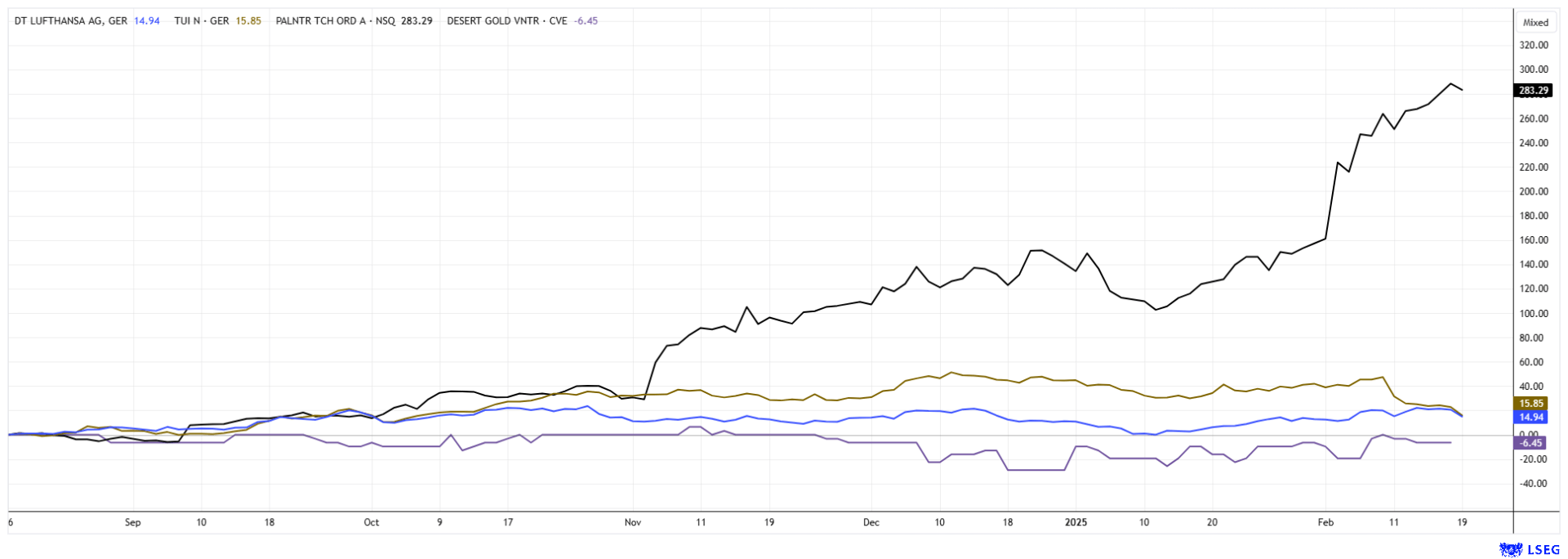

After weeks of gains, the DAX 40 index saw its first noticeable correction yesterday. It rose to 22,935 in the morning, but by the evening, it had fallen to just 22,450. Hardly anyone had considered that the one-way street of rising valuations would eventually come to an end. Will the correction continue and perhaps go really deep? The opposite is currently true for gold. The inflation figures from the UK of a smooth 3% in January are causing the central bank to break out in a cold sweat. Adieu interest rate cuts – instead, gold is appreciating again and reached a new all-time high of USD 2,945. We look at the winners and losers. It is time to position yourself correctly.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

PALANTIR TECHNOLOGIES INC | US69608A1088 , BARRICK GOLD CORP. | CA0679011084 , DESERT GOLD VENTURES | CA25039N4084 , LUFTHANSA AG VNA O.N. | DE0008232125 , TUI AG NA O.N. | DE000TUAG505

Table of contents:

"[...] We quickly learned that the tailings are high-grade, often as high as 20 grams of gold per tonne; because they are produced by artisanal miners, local miners who use outdated technology for gold production. [...]" Ryan Jackson, CEO, Newlox Gold Ventures Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Palantir Technologies – A wild ride

One of the top performers on the NASDAQ 100 is Palantir Technologies. Initially seen as a big data stock in the software industry, the Company now has the status of a key defense stock. This is because its sophisticated espionage software can be used to collect and evaluate important movement data on troops in war zones. The British government has already used the software from Denver to prevent the spread of COVID-19. The Company is now also working for the Ukrainian army to reconnoitre enemy territory and predict and simulate the course of the war.

Those wondering about the valuation may be perplexed, as Palantir is listed with an estimated revenue of around USD 3.75 billion in 2025 and a market capitalization of USD 285 billion. This results in a remarkable price-to-sales ratio of 76 for the current year, and a P/E ratio can be calculated at 233. What investors see and expect in this stock remains a mystery. Perhaps it is the media presence of CEO Alexander Karp, who publicly embraces Donald Trump and Elon Musk and calls for sweeping "paradigm shifts" in politics.

Desert Gold – The bright spot

Gold has been able to show its strength again in recent months. With the latest inflation reports, the gold price cleared the hurdle of USD 2,750 and surged to USD 2,945. When the return over the last 25 years is calculated, the mathematical value is 9.2% per annum. For gold owners, this is a good hedge against losses in purchasing power. The fact that central banks are once again showing interest in gold is reflected in transactions from 2024. A total of 1,000 tons were added to the balance, mainly by central banks in the BRICS countries. They are reducing their holdings of US government bonds and buying physical precious metals. This is not a good sign of confidence in the US.

The Canadian explorer Desert Gold Ventures has had its sights set on the Senegal-Mali Shear Zone (SMSZ) for several years. 1.1 million ounces of gold have already been identified near surface. CEO Jared Scharf and his team of geologists are confident that they will be able to report a higher figure in the upcoming Preliminary Economic Assessment (PEA). Currently, Barrick Gold's dispute with the military government of Mali over tax payments is overshadowing the mood on the ground. While the government of Mali insists on a one-time fee, Barrick proposes a staggered payment plan over a period not yet determined. The new mining legislation could give Mali a larger share and higher royalties from Barrick's largest property, the Loulo-Gounkoto complex. Observers expect an amicable settlement in the first quarter of 2025 because the largest mine in the country is currently at a standstill, with all the negative effects on the country's GDP and employment.

CEO Scharf speaks publicly about the significant potential for a major player if the Desert Gold properties are integrated. If the gold price continues to rise, a quick response from competitors is likely. After all, the neighbors are none other than the well-known names such as Barrick, B2 Gold, and Allied Gold. Desert Gold is, therefore, in pole position for a quick takeover deal with its SMSZ project. With a market capitalization of around CAD 15.6 million, the junior is currently dramatically undervalued. The timing for an entry is optimal.

Desert Gold will be represented by CEO Jared Scharf at the next International Investment Forum on February 25. The story is a hot topic. Free registration here.

TUI and Lufthansa – Eurowings with its own tour operator

When looking at the prices of tourism providers, one will discover further correction waves at the European market leader TUI as of yesterday. Disappointing figures for Q4-2024 and a gloomy outlook for 2025 are weighing on the stock. Lufthansa, after about 20% price gains since August 2024, now has its sights set on the EUR 7 mark. The news about Eurowings, which was published last week, appears important for the industry. The Lufthansa subsidiary is setting up its own tour operator, transforming the Eurowings Holidays brand into a separate entity. This GmbH will also take over the personnel and IT systems of media and tourism entrepreneur Karlheinz Kögel. His HLX group has long been a partner of Eurowings. The management of Eurowings is thus capitalizing on a new trend and can serve around 20 million customers with combination bookings. Airlines have recently started expanding their offerings to include other vacation elements, such as hotels or activities. One advantage of this strategy is that the margins on such packages are generally higher. In addition, vacations are often booked well in advance, which ensures that aircraft are fully utilized. AI is also used to put together customized packages. What sounds good for Lufthansa could lead to some outflows at TUI. It is worth keeping the stocks of TUI and Lufthansa on the watchlist. It could be that Lufthansa has now consolidated its position.

High-tech stocks and the DAX 40 index seem to have run a bit hot at the moment. Yesterday, for example, the popular German standard index corrected by 2.5% after reaching a new all-time high that morning. One-day reversals like this often have a pioneering character, which is why investors should now hedge their portfolios accordingly. It is also getting exciting with gold. Higher prices are still expected here. The junior explorer Desert Gold is valued at around USD 10 per ounce of gold in the ground, which is historically low.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.