April 11th, 2023 | 09:41 CEST

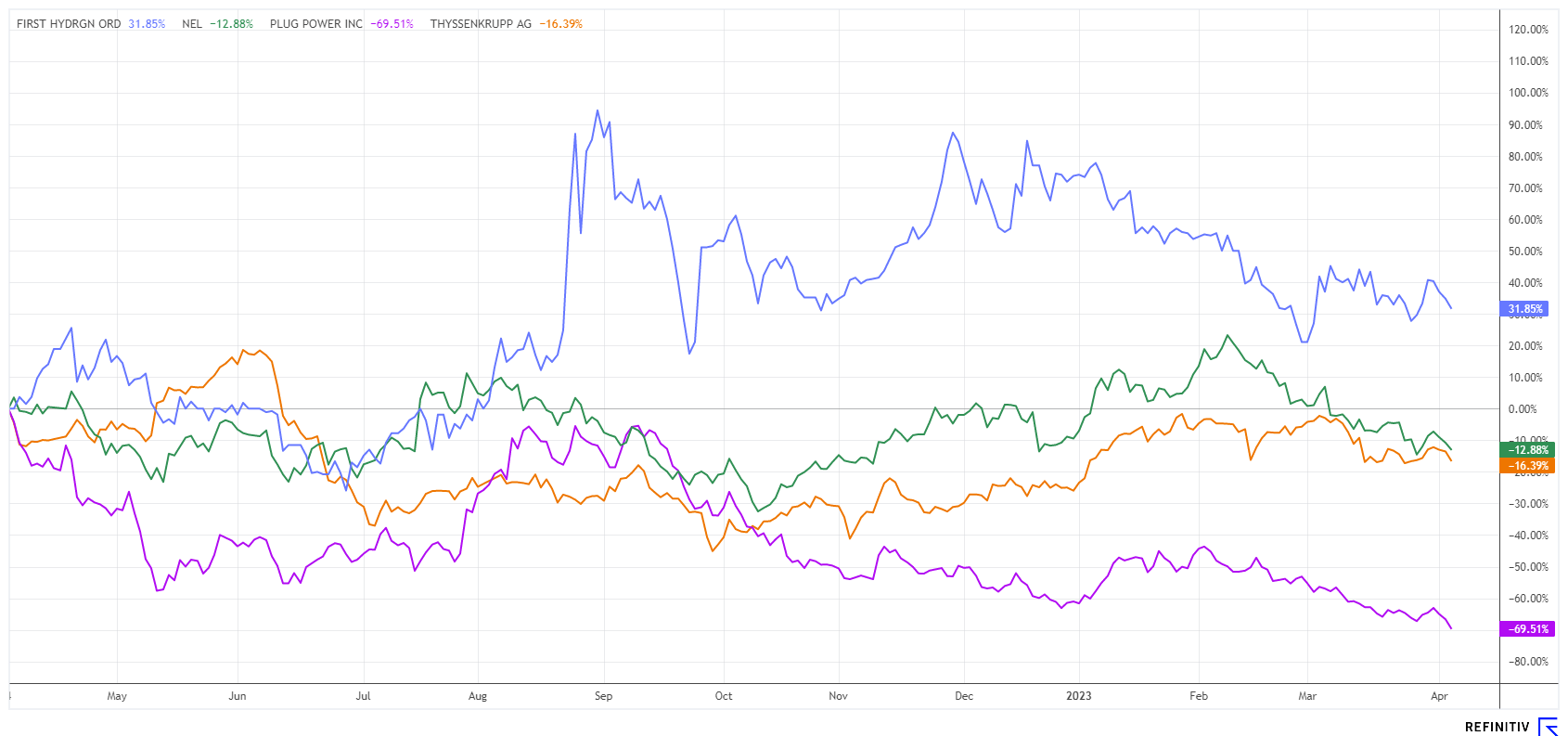

DAX in the Easter rally! Plug Power, First Hydrogen, Nel, Thyssenkrupp - Buy hydrogen selectively

The 3 Cs are currently doing the rounds: conflict, crisis and climate change. We cannot influence the war, but there seem to be many vested interests that can exploit the geopolitical uncertainty for their own benefit. With Credit Suisse, the potential crisis took shape again for the first time since 2008, but it has been averted for the time being. Then there is climate change, which we do feel from time to time. It is not only through the actions of the Last Generation that many measures have been taken, and more are being taken every day. In the discussion on sustainable energy production, there is a lot of confidence in hydrogen that the industrial breakthrough is imminent. What values should investors keep their eyes on?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , First Hydrogen Corp. | CA32057N1042 , NEL ASA NK-_20 | NO0010081235 , THYSSENKRUPP AG O.N. | DE0007500001

Table of contents:

"[...] Why should a modular electrolyzer cost more than a motorcycle? [...]" Sebastian-Justus Schmidt, CEO and Founder, Enapter AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA - Back in the downward spiral

Since the end of the last hype around hydrogen stocks at the beginning of 2021, things have been quiet again around Nel ASA, Plug Power & Co. The once bubbling sales expectations have cooled noticeably, and analysts recently adjusted their growth forecasts for the sector sharply downwards. The Nel ASA share has also suffered recently. The shares have been on a downward trend since the beginning of February. Nel pushed ahead strongly with its hydrogen projects in the first quarter and landed one major order after another. The capital increase of 108 million new shares at a price of NOK 14.90, carried out at the beginning of March, was somewhat bumpy. The funds will be used for further expansion, especially to create new production capacities in Europe and the US.

The major project with the German HH2E for 120 megawatts of electrolyser equipment is finally signed and sealed. HH2E plans to build scalable hydrogen projects across Germany. Recent measures by the EU also provided some optimism. A pilot programme for the EU's announced hydrogen bank is to start in autumn 2023. Producers like Nel will then receive a fixed premium per kilogram of hydrogen produced over a period of 10 years. Despite all the positive operational successes, the stock market seems to act according to the motto "Buy the Rumour, Sell the News". Quarterly figures will be published on 27 April, about a week after the annual general meeting. At EUR 1.19, Nel has slipped close to its long-term support zone between EUR 1.10-1.20. The share is anything but cheap, but traders have been keeping an eye on Nel's trading range of EUR 1.05 to 1.75 for some time!

First Hydrogen - The second generation of emission-free vehicles has arrived

One company that has had the switch to green hydrogen on its radar for a long time is First Hydrogen, a Canadian provider of zero-emission logistics solutions. The Company has clearly positioned itself with its "Hydrogen-as-a-Service" model and wants to cover the entire value chain in the future by constructing zero-emission vehicles and producing and distributing green hydrogen. The Company has now presented the concept for its revolutionary next-generation zero-emission vehicle. The light commercial vehicle (LCV) was developed with global mobility expert EDAG Group. Models with hydrogen-powered fuel cell electric drive (FCEV) and battery electric powertrain are planned. The Generation II concepts are already in development, while First Hydrogen is still road-testing the first-generation vehicles with members of the UK Aggregated Hydrogen Freight Consortium (AHFC).

The proof of the feasibility of hydrogen as a fuel in the commercial vehicle sector should have already been provided. The commercial start is being made by Rivus, a vehicle management provider, which will enable potentially interested parties to experience the benefits of hydrogen propulsion. The vehicles will be tested in various industries, including parcel delivery, food delivery, utilities, healthcare and roadside assistance, allowing First Hydrogen to test the vehicles in different real-world operating environments.

The global light-duty vehicle market is expected to reach USD 752 billion by 2030, with zero-emission vehicle growth expected to accelerate further as the EU's zero-emission target dates approach. At a share price of CAD 3.56, First Hydrogen is valued at only EUR 166 million. The innovative driving force from the EU will soon turn much fantasy into political reality.

Energy Division CEO Robert Campbell will be on hand to answer questions on the latest developments at the upcoming International Investment Forum on 10 May 2023. Participation in the online event is free of charge. Click here to register.

Plug Power - The high-flyer goes under the wheels

Once a celebrated high-flyer among hydrogen stocks, the Plug Power share is now one of the big losers. It is surprising because the sales leaps are real, and the business is flourishing. Looking at the operating performance, Plug Power can certainly report some significant successes. The start of production of the joint venture with Renault is worth mentioning, and the billion-euro contract with Amazon, the smooth start of production at the Gigafactory in Richmond, the launch of the Acciona joint venture in Spain and the expansion of the hydrogen infrastructure in the US. Most recently, a 100 MW contract was secured with Germany's Uniper, with further expansion plans to 500 MW.

The list could go on, but the figures for 2022 once again missed expectations, and the forecasts for the following years obviously could neither reconcile nor convince, as the industry momentum is pointing downwards. This also marks the time for investors to take their lush gains since 2019, as first-time shareholders are still up over 250%. However, those who jumped on the bandwagon late have had to endure a full 66% in losses over the past 12 months. But with a price-to-sales ratio of 4 on estimated sales in 2023, the stock is still expensive. First-quarter figures are due on 10 May, and there is no reason to invest at the moment.

Thyssenkrupp - The Nucera IPO is coming

The timetable is set. According to CFO Klaus Keysberg, the only thing that matters for the realisation of the planned IPO of Nucera is the right stock market environment; the listing process is already fully prepared. This is important for ThyssenKrupp and Germany as a business location because considerable investments in technology and research are needed here, which must also be financed via the capital markets.

According to Reuters, this could be as early as June. There are many speculations about the valuation of Nucera, ranging from EUR 2 to 5 billion. Analysts take a positive view of the fact that Thyssenkrupp will retain a majority stake after the IPO. Proceeds of up to EUR 1.2 billion are expected from the issue of new shares. The analysts of Baader expect the issue of the shares to be somewhat favourable because the market sentiment is not currently geared for mega demand.

With the end of the IPO discussions, Thyssenkrupp and its subsidiary Nucera could focus more on the operating business again. A positive aspect of the IPO is the media attention and the new way for future refinancing via equity and debt capital. German investors are also given the opportunity to invest in a major hydrogen player for the first time. Thyssenkrupp is repositioning itself for the long term and is relatively inexpensive at the moment.

The hydrogen industry takes a fresh start in 2023. The recently criticised public budgets will now be successively placed in the economy. We should expect the first industrial successes on a larger scale as early as 2025. Private investors can also invest in the stock market and jump on the bandwagon. But as described, not every share is cheap. Nel and Plug Power remain expensive, but First Hydrogen and ThyssenKrupp look very promising.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.