August 29th, 2023 | 07:00 CEST

DAX consolidates, Artificial Intelligence stutters and Hydrogen in rebound? Plug Power, First Hydrogen and Nel ASA in focus

The summer has so far not brought much joy to the bulls on the international markets. After a strong NASDAQ performance of plus 30% at the beginning of the year, the tech index is increasingly facing rough waters. Not even the solid earnings of the AI giant NVIDIA could prevent the 1,500-point correction since early July. The German benchmark index DAX 40 also plunged from 16,529 at its high to below 15,800 points. Chart technicians point to the critical zone of 15,450 to 15,650, which the market could approach in the next few days. This is where the continuation of the bull market since September 2022 will be decided. A brief look at the hydrogen sector provides clarity.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , NEL ASA NK-_20 | NO0010081235 , First Hydrogen Corp. | CA32057N1042

Table of contents:

"[...] We are committed to stay as the number one Canadian and global leader in the Hydrogen-On-Demand diesel technology [...]" Jim Payne, CEO, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Plug Power - Halved again

The Plug Power share was finally able to stabilize after a 2-year sell-out in May and, after a price loss of over 85%, achieved an impressive turnaround of plus 100%. All this against the background of smoldering shareholder lawsuits against CEO Andy Marsh, who published far too good outlooks, especially in 2022, but which could never be backed up with figures. The consequence: another drop in the share price to below EUR 8.

Last week there was a big shareholder meeting at the new hydrogen plant in Georgia. Marsh referred in his speech to the promising opportunities in the H2 sector, Joe Biden's IRA pot and the growing international tendencies to finally push green hydrogen as an alternative energy source. Shareholders recognized that Plug Power is poised to benefit from all these pots in the medium term and pushed the price back up after the recent halving. In the meantime, however, suspicions are growing that the entire sector will have to contend with regular stock market valuations. And with that, it is a call to exit!

Based on double-digit price-to-sales ratios and non-existent P/E ratios, billion-dollar valuations are simply not sustainable in a market normalization, even though global ESG funds are steadily increasing their ratios. Plug Power could also see another halving if the NASDAQ changes direction at some point. However, as a short-term momentum trade, the Plug share is always interesting because of its high liquidity.

First Hydrogen - Hydrogen for the last mile

Canadian company First Hydrogen Corp. (FHYD) is still undervalued despite showcasing remarkable innovation. Management is focused on establishing hydrogen as an energy source in the transportation sector. To this end, the Company has clearly positioned itself in the market with its "Hydrogen-as-a-Service" model. It intends to cover the entire value chain in the future via the development of emission-free vehicles and the production and sale of green hydrogen. In order to achieve this, the Company has recently acquired properties and entered cooperation agreements in Quebec.

In the last week, the Company surprised with more good news. FHYD is stepping up fleet trials of its hydrogen-powered fuel cell vehicle (FCEV) to help parcel delivery companies with their express deliveries. H2 propulsion technology is highly efficient, especially in short-haul applications, as the vehicles can be refueled quite quickly back at the collection point after delivering their cargo. Following successful initial road trials with fleet operators in the UK, further demonstration vehicles from the Company have now been parked for operational trials with several parcel delivery companies. Parcel delivery operators plan to complete their trials in the third and fourth quarters.

According to experts, the parcel delivery logistics market will reach over USD 210 billion by 2032. This is because the e-commerce boom continues to drive growth in the delivery market. There are over 9 million online retailers worldwide, trading through their own internet platforms, and the need for green logistics solutions is constantly increasing. First Hydrogen engineers emphasize that while the vehicles are designed for longer trips, they are equipped with advanced E/H2 hybrid engines best suited for shorter trips in urban and suburban areas. Regenerative braking helps recharge the battery, especially on trips with many starts and stops. First Hydrogen's (FHYD) stock is likely to hit the gas very quickly after the initial commercialization of its products. The share, valued at EUR 122 million, is also 10 times cheaper than the green-dazzling truck startup Nikola Motors from the US.

Nel ASA - Back on track

The Norwegian hydrogen electrolysis pioneer is entering an important chart-technical phase. Because despite a fundamentally sound order situation, the share price keeps coming dangerously close to the last bastion in the chart at around NOK 10. In European trading, the stock has now tested the EUR 1.00 mark several times and has so far also been able to maintain it by a narrow margin.

In addition to electrolysers, Nel also offers various refueling solutions. With certification in hand, the Scandinavian company has attracted customers in South Korea and the US state of California. The Company recently received worldwide certification from the independent organization Underwriters Laboratories of Canada (ULC) for its hydrogen refueling station. A historic milestone for the further internationalization of the business.

However, it is questionable when confidence in the share will return. The correction from the all-time high of around EUR 3.45 in January 2021 has already wiped out 72% of shareholder assets. With a market capitalization of EUR 1.67 billion, however, investors still pay 10 times the annual revenues of 2023 for entry. Nel is thus still considered too expensive!

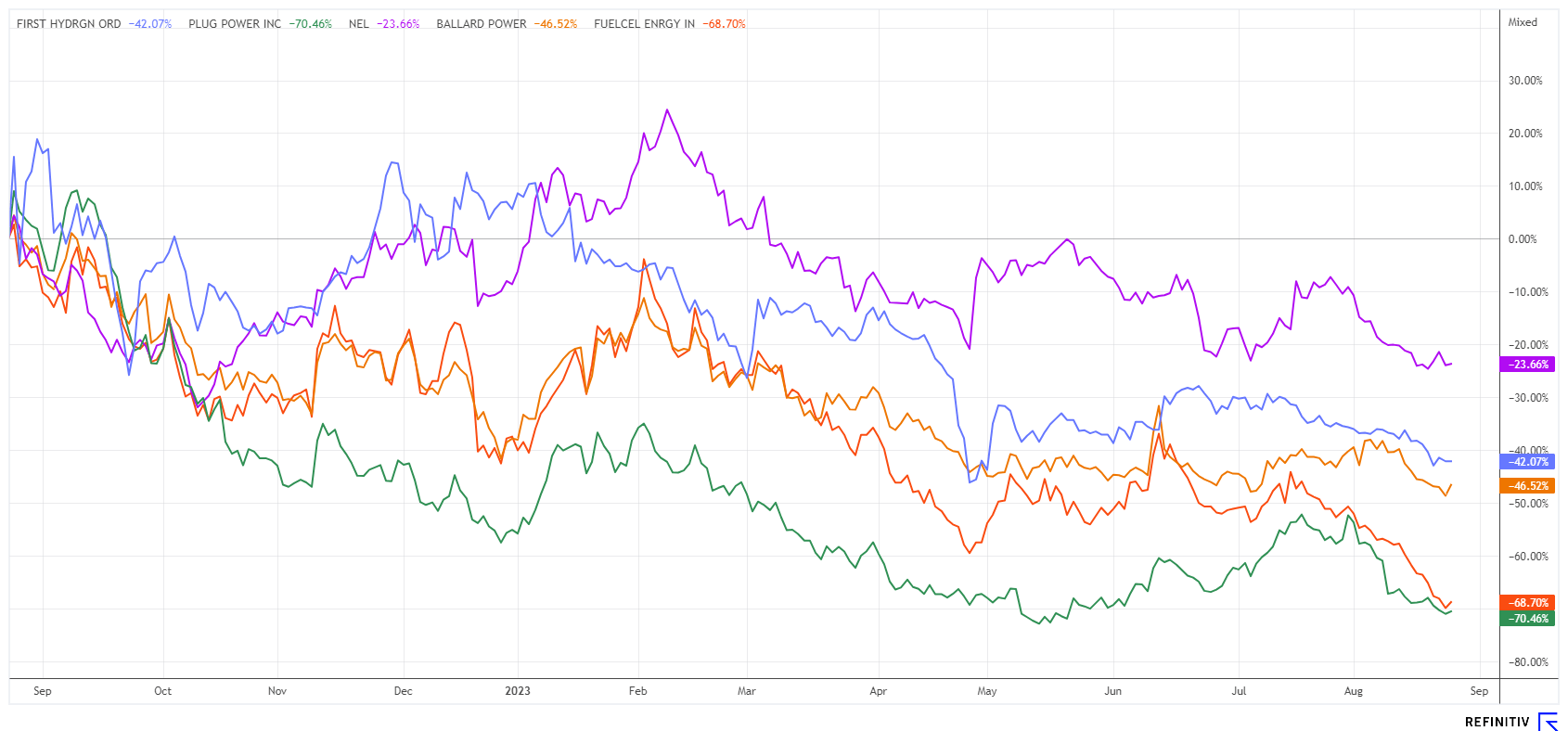

The hydrogen sector has again gone into correction mode. Because of their high valuations, the protagonists Nel, Plug Power, Ballard Power and FuelCell Energy are still at risk. The Canadian company First Hydrogen now offers solutions for the last mile in the delivery business and is not expensive in a sector comparison. Selection remains the trump card!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.